Where is money flowing today?

Be in the know. 17 key reads for Wednesday…

- Manchin privately tells WH he’ll back $1T of Biden’s budget resolution: report (Fox Business)

- Wall Street sees as much as 56% upside for its 20 favorite stocks (MarketWatch)

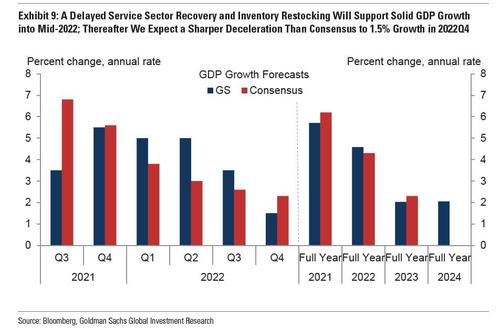

- Goldman Sachs Expects Less GDP Growth This Year. Blame Delta and Consumer Spending. (Barron’s)

- 5 Utility Stocks for Investors Chasing Yield (Barron’s)

- BlackRock responds to Soros’ criticism of its China investments (Fox Business)

- Intel’s Salvation Lies in Europe—but Not With Fabs (Wall Street Journal)

- Wells Fargo Isn’t Missing the Party Yet (Wall Street Journal)

- Intel to Invest Up to $95 Billion in European Chip-Making Amid U.S. Expansion (Wall Street Journal)

- Elliott Management Has a More Than $1 Billion Stake in Citrix Systems (Wall Street Journal)

- Wall Street Can’t Get Enough Fixer-Upper Houses (Wall Street Journal)

- Apple Likely Has More App Store Deals to Make (Wall Street Journal)

- SEC needs to find a way to curb payment for order flow (Financial Times)

- Japan upgrades Q2 GDP on stronger business spending (Reuters)

- 5 reasons why UBS just boosted its year-end S&P 500 forecast to among the highest on Wall Street (Business Insider)

- China’s central bank keeps the brakes on economic stimulus (CNBC)

- Investment Banks Turn Sour on U.S. Equity Outlook (Bloomberg)

- Ray Dalio Says China Opportunities Can’t Be Neglected (Bloomberg)

Tom Hayes – Yahoo! Finance Appearance – 9/7/2021

Yahoo! Finance Appearance – Thomas Hayes – Chairman of Great Hill Capital – September 7, 2021

Click Here to Watch HD Version Directly on Yahoo! Finance

Unusual Options Activity – Alibaba Group Holding Limited (BABA)

Data Source: barchart

Today some institution/fund purchased 3,919 contracts of June 2022 $185 strike calls (or the right to buy 391,900 shares of Alibaba Group Holding Limited (BABA) at $185). The open interest was 1,040 prior to this purchase. Continue reading “Unusual Options Activity – Alibaba Group Holding Limited (BABA)”

Hedge Fund Tips (PCN) – Position Completion Notification

Where is money flowing today?

Quote of the Day…

Be in the know. 22 key reads for Tuesday…

- Multiplying Crackdowns Haven’t Stopped Cash Pouring Into China (Bloomberg)

- Millions of Americans Travel Over Holiday Weekend Despite Covid Outbreaks (Barron’s)

- Tired of Losing Yet? The Energy Report 09/07/2021 (Phil Flynn)

- China’s economy gets welcome boost from surprisingly strong Aug exports (Reuters)

- COLUMN-Hedge funds in historic double-down on higher U.S. yields: Jamie McGeever (Reuters)

- Goldman Cuts Its US GDP Forecast For The Third Time In The Past Month (ZeroHedge)

- From Cradle to Grave, Democrats Move to Expand Social Safety Net (New York Times)

- China and Big Tech: Xi’s blueprint for a digital dictatorship (Financial Times)

- Famed Wharton professor says the next inflation reading is more important than the monthly jobs report. (Business Insider)

- Taper your pessimism — Fed’s actions won’t derail U.S. stocks, Barclays strategists say (MarketWatch)

- Boeing Now Has an Airbus Problem to Add to the List (Barron’s)

- Disney’s ‘Shang-Chi’ Flies to a Record Labor Day at the Box Office (Wall Street Journal)

- China’s Industrial Planning Evolves, Stirring U.S. Concerns (Wall Street Journal)

- Warning of Income Gap, Xi Tells China’s Tycoons to Share Wealth (New York Times)

- Consumers and Companies Are Buying In on Paying Later (New York Times)

- Xi Jinping May Be Leading China Into a Trap (Bloomberg)

- Chinese Technology Stocks Jump After Tencent Buys Back Shares (Bloomberg)

- Hong Kong Move to Reopen China Border Boosts Retail Stocks (Bloomberg)

- China’s ‘Mr. Income Distribution’ Explains Common Prosperity (Bloomberg)

- Xi’s Common Prosperity Drive Triggers a Rare Debate in China (Bloomberg)

- China Freezes Tutoring Firms’ Fees, Enrollment Pending Approvals (Bloomberg)

- Goldilocks Has Equity Investors In a Headlock (Bloomberg)

Be in the know. 8 key reads for Labor Day…

- Business Travel Rebound Stifled by Covid Resurgence (Wall Street Journal)

- China Says Government to Set Prices for After-School Classes (Bloomberg)

- Tech giants are rushing to develop their own chips – here’s why (CNBC)

- Some Chinese stocks briefly surge 30% as investors bet on a new Beijing exchange opening (CNBC)

- JD.com appoints new president as founder steps back from day-to-day operations (CNBC)

- Didi’s ride hailing rival Cao Cao raises $600 mln to expand (Reuters)

- China will improve opening up of capital market – securities regulator (Reuters)

- Dollar store chains are leading retail store openings in US: report (FoxBusiness)