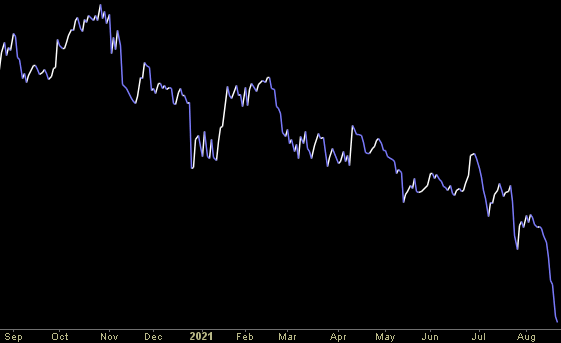

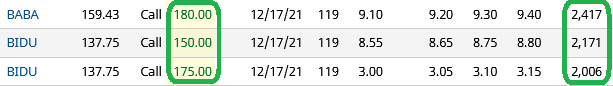

Unusual Options Activity – BIDU BABA

Where is money flowing today?

Quote of the Day…

Be in the know. 15 key reads for Friday…

- China passes major data protection law as regulatory scrutiny on tech sector intensifies (CNBC)

- AstraZeneca Seeks Approval of Landmark Antibody Drug Preventing Covid Symptoms (Barron’s)

- The Delta variant has derailed the speed of the economic recovery and will prompt the Fed to delay tapering plans, Guggenheim’s Minerd says (Business Insider)

- 4 Healthcare Stocks That Analysts Love (Barron’s)

- BlackRock calls for investors to lift allocations to China’s markets (Financial Times)

- Chinese regulators meet with developer Evergrande as scrutiny on real estate grows (CNBC)

- Here’s why the ultra-wealthy like Bill Gates and Thomas Petterfy are investing in U.S. farmland (CNBC)

- Ark’s Cathie Wood Says the Stock Market ‘Couldn’t Be Further Away From a Bubble.’ Here’s Why. (Barron’s)

- Intel CEO Calls Chip Maker ‘Willing Buyer’ as Semiconductor Industry Consolidates (Wall Street Journal)

- CVS, Walgreens Look for Sales Bump From Covid-19 Boosters (Wall Street Journal)

- China Passes One of the World’s Strictest Data-Privacy Laws (Wall Street Journal)

- The Dream Cars of the Car Designers (New York Times)

- Exclusive-China eyes pushing U.S. IPO-bound firms to hand over data control-sources (Yahoo! Finance)

- Billionaire John Paulson Goes Big on These 2 High-Yield Dividend Stocks (Yahoo! Finance)

- Biggest Tax Hike on Wealthy Since ‘93 Is Bogged Down in U.S. Congress (Bloomberg)

Unusual Options Activity – Alibaba Group Holding Limited (BABA)

Data Source: barchart

Today some institution/fund purchased 4,910 contracts of Jan 2023 $170 strike calls (or the right to buy 491,000 shares of Alibaba Group Holding Limited (BABA) at $170). The open interest was just 856 prior to this purchase. Continue reading “Unusual Options Activity – Alibaba Group Holding Limited (BABA)”

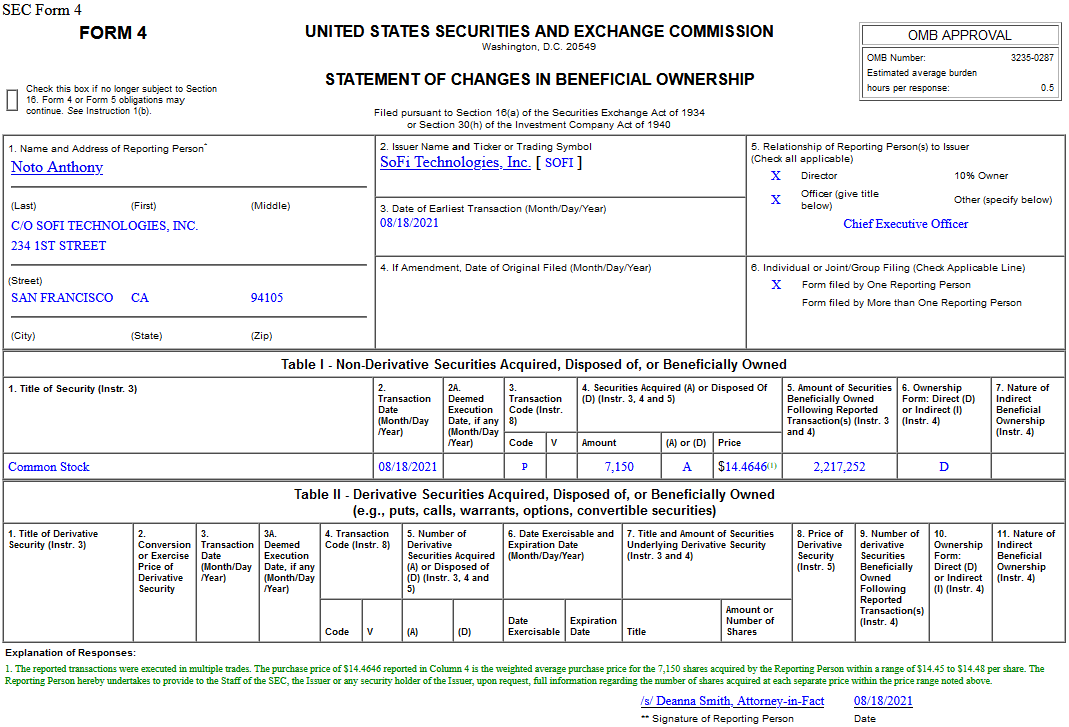

Insider Buying in SoFi Technologies, Inc. (SOFI)

Where is money flowing today?

Hedge Fund Trade Tip (PIN) – Position Idea Notification

Be in the know. 20 key reads for Thursday…

- Baidu’s $1bn bond draws strong demand despite China tech crackdown (Financial Times)

- Tencent Earnings Good Enough to Forget Regulatory Woes for One Day (Barron’s)

- Dogecoin Alone Accounted For 62% Of Crypto Revenue For Robinhood In Q2 (Benzinga)

- Fed would make ‘very serious mistake’ tapering this year, analyst says (Fox Business)

- Most Fed officials believe stimulus could start winding down this year (Financial Times)

- 5 Raymond James Analyst Favorite Stocks Look Safe and Pay Big, Dependable Dividends (24/7 Wall Street)

- US consumers flock to the shops despite spread of Delta variant (Financial Times)

- Why Jim Cramer Is Bullish On Disney At Current Levels: ‘The Greatest Story Ever Told’ (Benzinga)

- Philly Fed factory index falls in July to lowest since December (Reuters)

- Ray Dalio, Al Gore, and 8 other Alibaba investors may have seen $1.4 billion wiped off their stakes this quarter. Ken Fisher, Jeremy Grantham, Bill Miller, and Steve Cohen were also shareholders as of June 30. (Business Insider)

- Soaring demand for the world’s least-liked commodity sees coal prices jump 106% this year (CNBC)

- Anxiety Ripples Through Markets Worried About China and Covid (Bloomberg)

- Contrarian Investors Should Love Emerging Markets (Bloomberg)

- China Tech Rout Deepens as New Regulations Mulled; Alibaba Dives (Bloomberg)

- Bilibili Beats Views, But Long Stock Slide Continues (Investor’s Business Daily)

- Rowe Price CEO Leads With His Top 10 List (Investor’s Business Daily)

- XPeng Is Quadrupling Capacity. It Expects to Sell More Electric Vehicles. (Barron’s)

- Tencent to Work With Chinese Regulators to Limit Minors’ Online Game Time (Wall Street Journal)

- Officials debated timing, mechanics of plans to reduce $120 billion in monthly bond purchases at July meeting, minutes show (Wall Street Journal)

- Amazon Plans to Open Large Retail Locations Akin to Department Stores (Wall Street Journal)