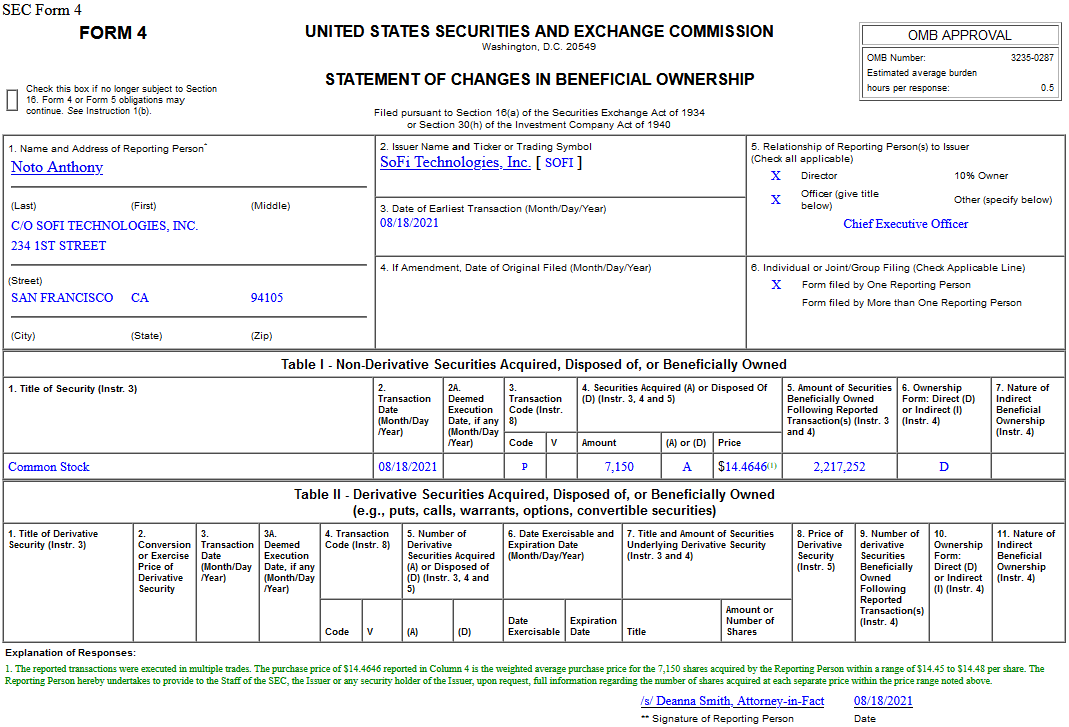

Hedge Fund Tips (PCN) – Position Completion Notification

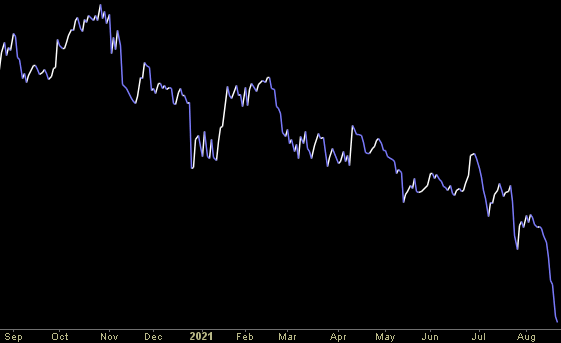

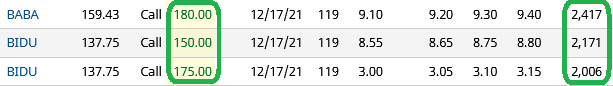

Unusual Options Activity – BIDU BABA

Where is money flowing today?

Quote of the Day…

Be in the know. 15 key reads for Friday…

- China passes major data protection law as regulatory scrutiny on tech sector intensifies (CNBC)

- AstraZeneca Seeks Approval of Landmark Antibody Drug Preventing Covid Symptoms (Barron’s)

- The Delta variant has derailed the speed of the economic recovery and will prompt the Fed to delay tapering plans, Guggenheim’s Minerd says (Business Insider)

- 4 Healthcare Stocks That Analysts Love (Barron’s)

- BlackRock calls for investors to lift allocations to China’s markets (Financial Times)

- Chinese regulators meet with developer Evergrande as scrutiny on real estate grows (CNBC)

- Here’s why the ultra-wealthy like Bill Gates and Thomas Petterfy are investing in U.S. farmland (CNBC)

- Ark’s Cathie Wood Says the Stock Market ‘Couldn’t Be Further Away From a Bubble.’ Here’s Why. (Barron’s)

- Intel CEO Calls Chip Maker ‘Willing Buyer’ as Semiconductor Industry Consolidates (Wall Street Journal)

- CVS, Walgreens Look for Sales Bump From Covid-19 Boosters (Wall Street Journal)

- China Passes One of the World’s Strictest Data-Privacy Laws (Wall Street Journal)

- The Dream Cars of the Car Designers (New York Times)

- Exclusive-China eyes pushing U.S. IPO-bound firms to hand over data control-sources (Yahoo! Finance)

- Billionaire John Paulson Goes Big on These 2 High-Yield Dividend Stocks (Yahoo! Finance)

- Biggest Tax Hike on Wealthy Since ‘93 Is Bogged Down in U.S. Congress (Bloomberg)

Unusual Options Activity – Alibaba Group Holding Limited (BABA)

Data Source: barchart

Today some institution/fund purchased 4,910 contracts of Jan 2023 $170 strike calls (or the right to buy 491,000 shares of Alibaba Group Holding Limited (BABA) at $170). The open interest was just 856 prior to this purchase. Continue reading “Unusual Options Activity – Alibaba Group Holding Limited (BABA)”