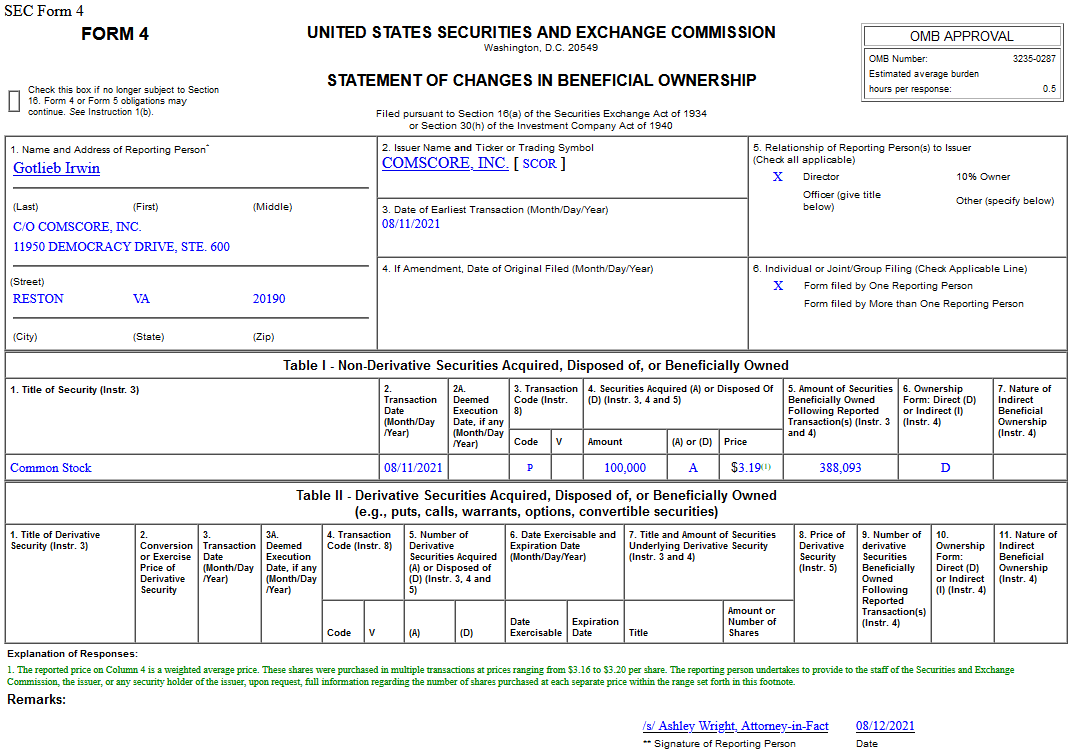

Insider Buying in comScore, Inc. (SCOR)

Hedge Fund Tips (PCN) – Position Completion Notification

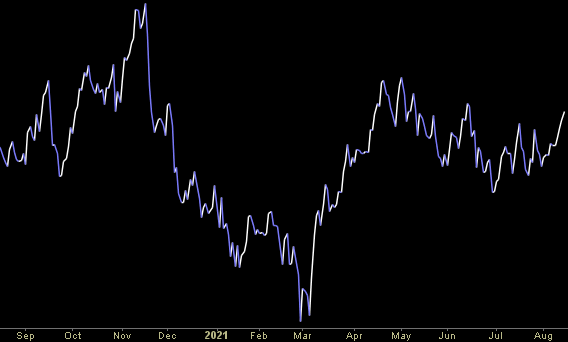

Where is money flowing today?

Be in the know. 10 key reads for Friday…

- Productivity Will Battle Inflation an Send Stocks Higher, Says Ed Yardeni (Barron’s)

- Rocket Earnings Fell Short, but the Company Expects Mortgage Demand to Remain Strong (Barron’s)

- Ways to Gear Up Your Portfolio for Inflation Concerns (Barron’s)

- Disney Posts a Rebound as Tourists Returned to Its Theme Parks (Wall Street Journal)

- Home Prices Jumped Across the U.S. in Second Quarter (Wall Street Journal)

- S. consumers suffered a ‘stunning loss of confidence’ in early August, University of Michigan survey finds (MarketWatch)

- ‘Memory – Winter is Coming’: Morgan Stanley Downgrades Micron (MU) to EW as Supply is Catching Up To Demand, Prefers Samsung (SSNLF) (Street Insider)

- Dan Loeb’s Third Point Gets a Taste of Its Own Activist Medicine (Wall Street Journal)

- Disney+ reaches 116 million subscribers, and its parks division returns to profitability. (New York Times)

- Yardeni Says ‘Roaring 2020s’ to Continue, and Stock Bulls Agree (Bloomberg)

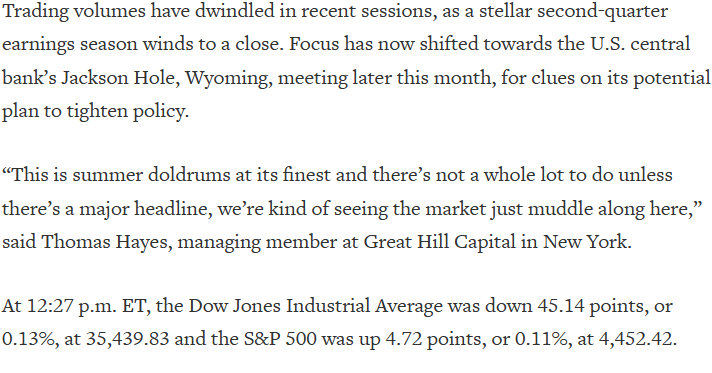

Tom Hayes – Quoted in Reuters article – 8/12/2021

Thanks to Devik Jain and Ambar Warrick for including me in their article on Reuters today. You can find it here:

Thanks to Devik Jain and Ambar Warrick for including me in their article on Reuters today. You can find it here:

Click Here to View The Full Article on Reuters

Unusual Options Activity – Activision Blizzard, Inc. (ATVI)

Data Source: barchart

Today some institution/fund purchased 9,810 contracts of Jan $90 strike calls (or the right to buy 981,000 shares of Activision Blizzard, Inc. (ATVI) at $90). The open interest was just 2,836 prior to this purchase. Continue reading “Unusual Options Activity – Activision Blizzard, Inc. (ATVI)”

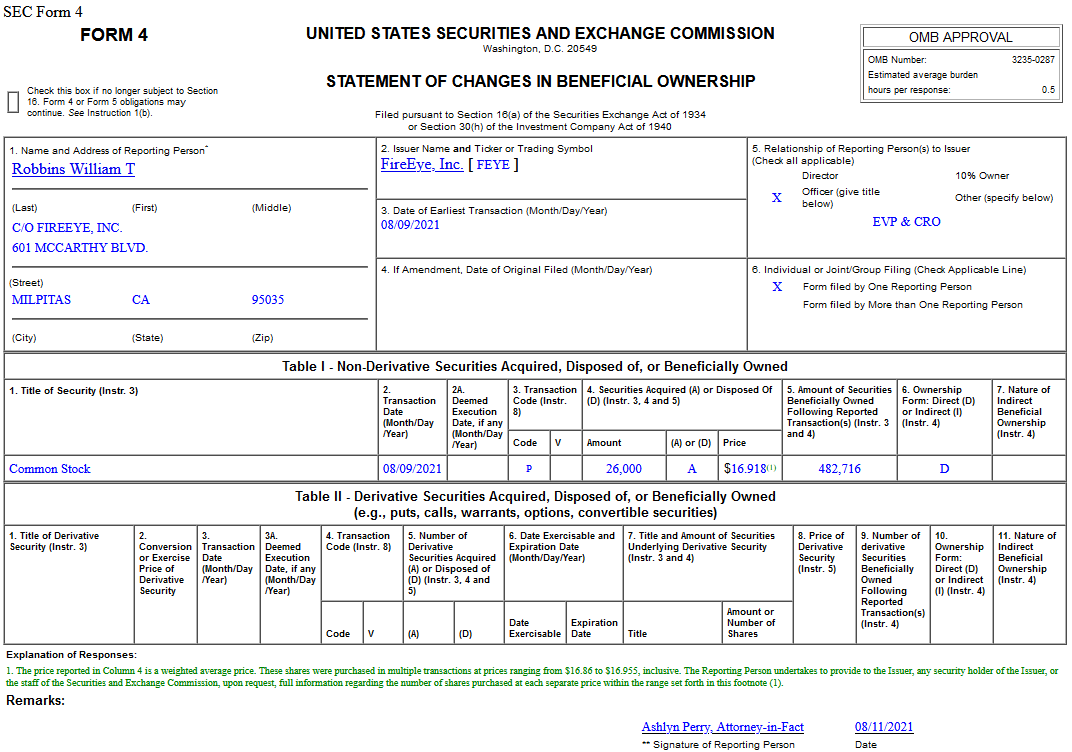

Insider Buying in FireEye, Inc. (FEYE)

Where is money flowing today?

Be in the know. 20 key reads for Thursday…

- How A Retail Maverick Turned Boot Barn Stores Into Pure Gold (IBD)

- Just Eat Takeaway (GRUB) Gains as Seth Klarman Hedge Fund Buys a $645 Million Stake, Shareholders Says Stock ‘Deeply Undervalued’ (StreetInsider)

- App Store Competition Targeted by Bipartisan Senate Bill (Wall Street Journal)

- How Millennial Investors Lost Millions on Bill Ackman’s SPAC (institutionalinvestor)

- Manchin warns of ‘grave consequences’ if Democrats pass $3.5 trillion package (MarketWatch)

- Feeling the Inflation Heat. The Energy Report 08/12/2021 (Phil Flynn)

- Crypto wars: Biden administration at war with itself over regulation (Fox Business)

- Bumble, Match Have Love Left to Give (Wall Street Journal)

- Banks Are a Good Bet if Interest Rates Spike (Barron’s)

- Merck Spinoff Organon Is Supercheap and It Just Set a 3.7% Dividend Yield (Barron’s)

- China unveils five-year plan to strengthen control of economy (Financial Times)

- Baidu Earnings Beat Expectations. Why Its Stock Is Dropping. (Barron’s)

- Fannie Mae Aims to Make Home Loans More Accessible (Wall Street Journal)

- One Number to Gauge Where the Economy Is Headed (New York Times)

- Liquidity Is Evaporating Even Before Fed Taper Hits Markets (Bloomberg)

- S. Initial Unemployment Claims Drop for Third Week in a Row (Bloomberg)

- Palantir revenue jumps 49% in second quarter (CNBC)

- Labor shortage gives retail and restaurant workers the upper hand—for now (CNBC)

- Billionaire ‘Bond King’ Jeff Gundlach warns inflation is worryingly high — and official readings are understating the problem (Business Insider)

- How Do Baidu’s Q2 Numbers Stack Up Against Google? (Benzinga)