Where is money flowing today?

Be in the know. 30 key reads for Thursday…

- Jack Ma’s Ant in Talks to Share Data Trove With State Firms (Wall Street Journal)

- Lilly’s (LLY) donanemab receives U.S. FDA’s Breakthrough Therapy designation for treatment of Alzheimer’s disease (Street Insider)

- General Electric (GE) Approaching a Free Cash Flow Inflection Driven By Aviation – UBS (Street Insider)

- Vertex Pharma (VRTX) Approves $1.5B Buyback Program (Street Insider)

- SEC’s planned new ‘woke’ rules creating cost concerns for business leaders (FoxBusiness)

- Rates Are Still Low. Here Are 8 Large-Cap Stocks That Offer Income. (Barron’s)

- The Fed’s Stress Test Results Are Coming. All Eyes Are on Bank Stocks. (Barron’s)

- Berkshire Hathaway Appears to Have Bought Back $6 Billion of Stock in Quarter (Barron’s)

- India Warns About Delta Plus Covid-19 Variant (Barron’s)

- Economies Need Central Bank Digital Currencies More Than Bitcoin, Says Global Banking Watchdog (Barron’s)

- ViacomCBS, Roku Stock Jump on Report of Comcast M&A Speculation (Barron’s)

- Canadian Stocks Look Cheap, BofA Says. Why They Could Be Cyclical Superstars. (Barron’s)

- Prime Day Is Over. These 12 Stocks Are Still Good Deals. (Barron’s)

- The clearest evidence that Wall Street has no clue where Treasury yields are headed (MarketWatch)

- 5 BofA Securities US 1 List Stocks to Buy Now That Also Pay Very Dependable Dividends (24/7wallst)

- Biden and Senators Close In on Bipartisan Infrastructure Deal (New York Times)

- Emergency Landing for China’s Flying Pig Prices (Wall Street Journal)

- S. economy grew 6.4% in year’s first quarter, Commerce Department reiterates (MarketWatch)

- Jobless claims slip, but remain at elevated pandemic levels (Fox Business)

- Durable goods jump as transportation rebounds (Fox Business)

- OPEC+ Weighs Cautious Supply Hike as Oil Market Begs for Barrels (Bloomberg)

- How Home Builders Are Contributing to Housing Frenzy (Wall Street Journal)

- Big Win for Property Rights (Wall Street Journal)

- Xpeng (XPEV) Leaps After Receiving a Green Light From Regulators to Raise Up To $2 Billion in Hong Kong IPO (Street Insider)

- com (AMZN) Prime Day Sales Increase 7% Generating New Record – Morgan Stanley (Street Insider)

- Goldman Sachs Sees S&P 500 Dividend Growth Much Higher Than Market is Pricing (Street Insider)

- Lumber continues to skid below $900 with the commodity in free-fall from May highs (Business Insider)

- Tencent takes quiet path through China’s tech turbulence (Financial Times)

- Russian supply curbs exacerbate squeeze on European gas market (Financial Times)

- Carnival expects second-quarter losses of $2 billion, teases additional cruise restarts (MarketWatch)

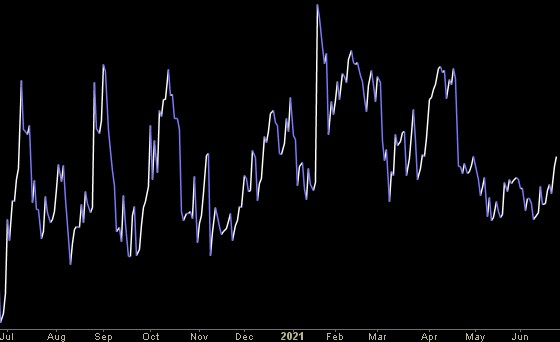

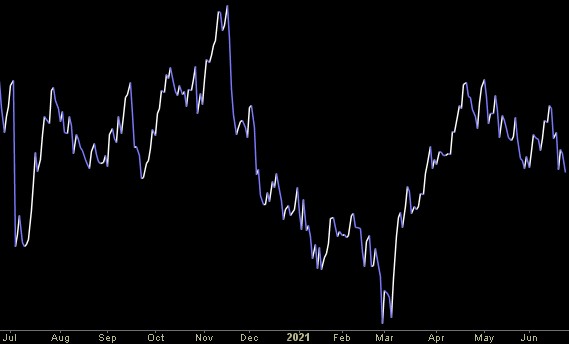

The Sam Hunt, “Breaking Up Was Easy In The 90’s” Stock Market (and Sentiment Results)…

I had to look hard for a song to describe this week’s stock market sentiment, but I think I found the one in Sam Hunt’s recent country hit, “Breaking Up Was Easy In The 90’s”: Continue reading “The Sam Hunt, “Breaking Up Was Easy In The 90’s” Stock Market (and Sentiment Results)…”

Tom Hayes – Bloomberg Radio Appearance – 6/23/2021

Bloomberg Radio Appearance – Thomas Hayes – Chairman of Great Hill Capital – June 23, 2021

Listen Directly on Bloomberg (shorter commercial free version)

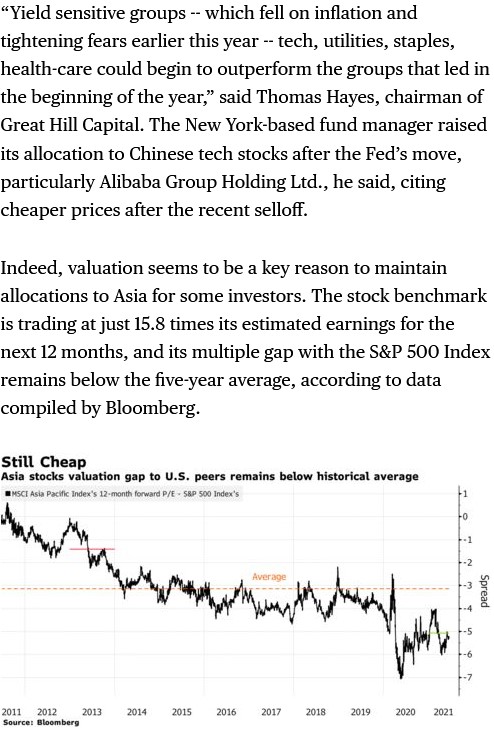

Tom Hayes – Quoted in Bloomberg article – 6/18/2021

Thanks to Ishika Mookerjee and Moxy Ying for including me in their article on Bloomberg. You can find it here:

Thanks to Ishika Mookerjee and Moxy Ying for including me in their article on Bloomberg. You can find it here:

Click Here to View The Full Article on Bloomberg

Hedge Fund Tips (PCN) – Position Completion Notification

Unusual Options Activity – Alibaba Group Holding Limited (BABA)

Data Source: barchart

Today some institution/fund purchased 1,471 contracts of Jan 2023 $310 strike calls (or the right to buy 147,100 shares of Alibaba Group Holding Limited (BABA) at $310). The open interest was just 378 prior to this purchase. Continue reading “Unusual Options Activity – Alibaba Group Holding Limited (BABA)”