I had to look hard for a song to describe this week’s stock market sentiment, but I think I found the one in Sam Hunt’s recent country hit, “Breaking Up Was Easy In The 90’s”:

Chairman Powell was consistent in his message both on Wednesday of last week and Tuesday of this week. He will keep the pedal to the metal as long as it takes to achieve full employment.

For those who are trying to “Break up with the Market” – it was much “Easier in the 90’s” when there wasn’t $120B/mo. in Bond Purchases and unlimited liquidity to save the day. The market continues to climb the “wall of worry” supported by ample and unprecedented liquidity.

On Tuesday I was on Fox Business – the Claman Countdown – with Liz Claman. Thanks to Liz and Ellie Terrett for having me on.

In this segment, I parsed the Fed’s communications and how they translate into positioning:

KEY POINTS of POWELL’S TESTIMONY:

- The unemployment rate remained elevated in May at 5.8 percent, and this figure understates the shortfall in employment, particularly as participation in the labor market has not moved up from the low rates that have prevailed for most of the past year.

- The economic downturn has not fallen equally on all Americans, and those least able to shoulder the burden have been the hardest hit. In particular, despite progress, joblessness continues to fall disproportionately on lower-wage workers in the service sector and on African Americans and Hispanics.

- The Fed pursues monetary policy aimed at fostering a strong, stable economy that can improve economic outcomes for all Americans. Those who have historically been left behind stand the best chance of prospering in a strong economy with plentiful job opportunities.

- Inflation has increased notably in recent months. This reflects, in part, the very low readings from early in the pandemic falling out of the calculation; the pass-through of past increases in oil prices to consumer energy prices; the rebound in spending as the economy continues to reopen; and the exacerbating factor of supply bottlenecks, which have limited how quickly production in some sectors can respond in the near term. As these transitory supply effects abate, inflation is expected to drop back toward our longer-run goal.

- We at the Fed will do everything we can to support the economy for as long as it takes to complete the recovery.

IMPLICATIONS:

Unemployment rate Feb 2020: 3.5% with 5.7M unemployed

Unemployment rate June 2021: 5.8% with 9.3M unemployed

While Bullard’s hawkishness (along with quad witching) created a tailspin on Friday, Chair Powell is still driving the Bus.

I was also on standby to join the end of the Claman Countdown on Friday if the market started tanking, but it held relatively steady into the close (after the midday flush).

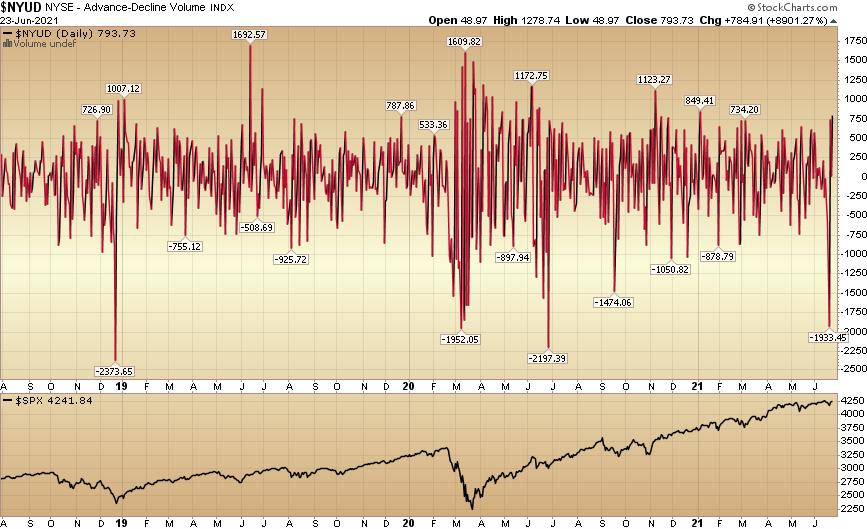

The one measure I was going to point to was the fact that the combination of Quadruple Witching Friday and Bullard’s Comments may be overdone – as NYSE Advancing Volume – Declining Volume was at a low only seen 4x in the past 2 years (and all instances were coincident with lows). As such we added to BABA (major position) and bought VIAC, TAK, FOX (minor positions) on the weakness.

Pedal to the Metal: Powell has stated that he will let the economy run as hot as needed to avoid the LONG TERM structural unemployment we had following the 2008 GFC. This means: No taper until 2022, and no rate rises until 2023.

Couple that with recent softness in commodities (ex-energy) and a large supply of labor not returning until Sept (following Ext. Unemployment benefits expiry), the Fed has cover to stay dovish.

This means those “yield sensitive” groups (Tech, Utilities, Pharma, Staples) that were hit hard earlier this year on inflation/tightening fears will have some seasonal strength over summertime.

FAANGM (well over 20% weight in S&P) will have to step up after 12 months of going sideways in order for the market to push to new highs this summer.

The names we have been suggesting on the show in the last few weeks are starting to benefit from this Fed posture: SPLK (up ~20% in a few weeks), AMZN, NFLX and BABA (we added more on last week’s weakness). We think Chinese Tech will start to follow US tech in this new leg up.

We expect the “reopening trade” Banks, Energy (cyclicals) to take a breather and resume its strength before year-end as we are still only 1 year into a new business cycle. Their recovery will continue for several years to come as we are still “early cycle.”

Chinese Stocks

I had the pleasure to be included in Ishika Mookerjee and Moxy Ying’s article on Bloomberg regarding the opportunity in Chinese stocks.

In their article they included a chart that shows the relative undervaluation of Chinese Stocks to US Stocks:

Last night I was able to join Bryan Curtis and Paul Allen on Bloomberg radio to elaborate on the China thesis and Alibaba (as well as comment on US conditions). I also discussed a possible “black swan” lurking around the corner for cyclicals.

Thanks to Jung Soo Maeng and Yang Yang for having me on. You can listen below (and fast forward through commercials in the middle of the segment) or:

Listen Directly on Bloomberg (shorter commercial free version)

Now onto the shorter term view for the General Market:

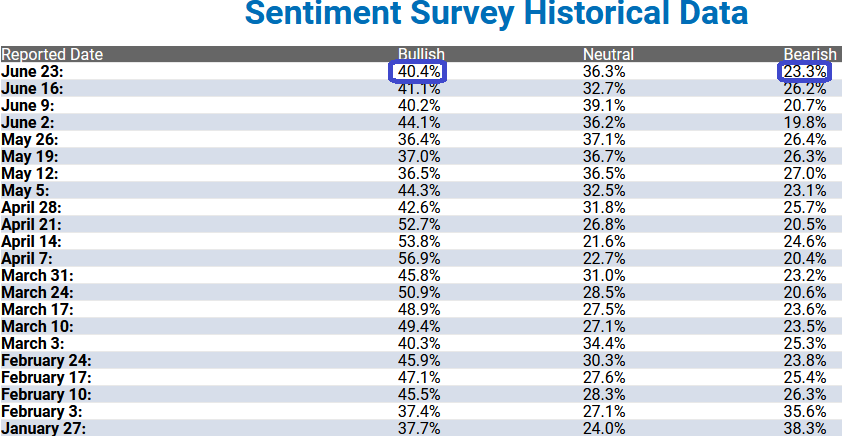

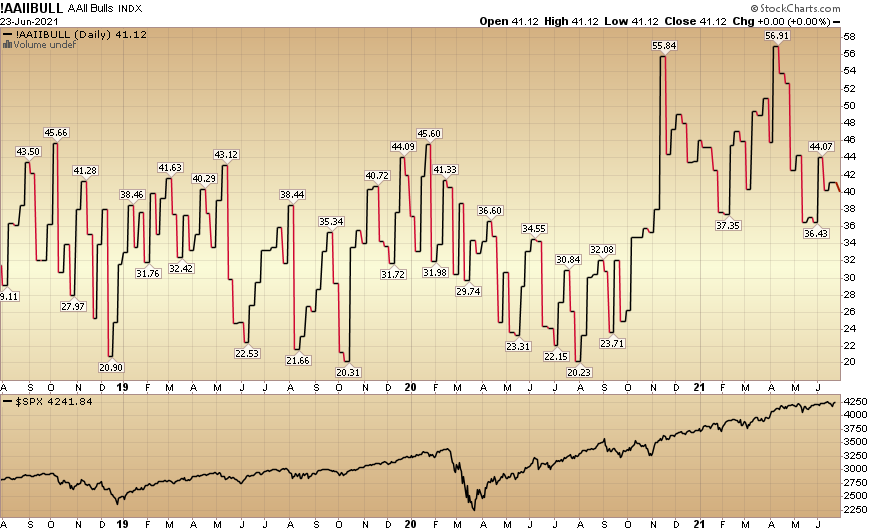

In this week’s AAII Sentiment Survey result, Bullish Percent (Video Explanation) flat-lined to 40.4% from 41.1% last week. Bearish Percent decreased to 23.3% from 26.2% last week.

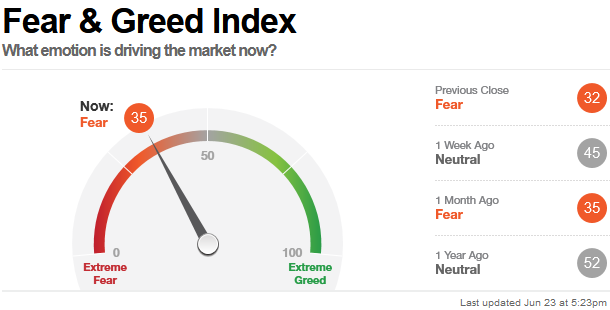

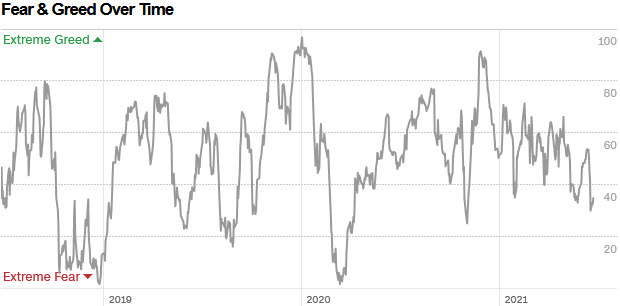

The CNN “Fear and Greed” Index declined from 45 last week to 35 this week. Fear is back and the market is trying to climb the “wall of worry.” You can learn how this indicator is calculated and how it works here: (Video Explanation)

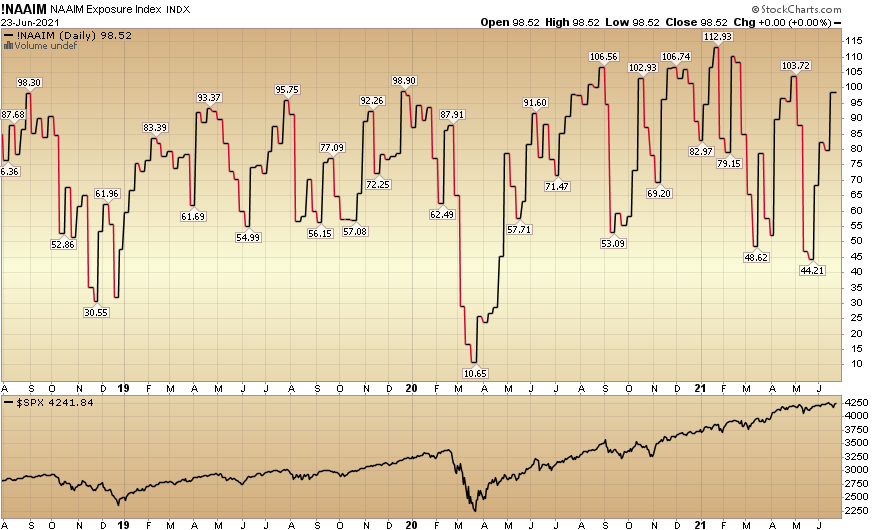

And finally, this week the NAAIM (National Association of Active Investment Managers Index) (Video Explanation) jumped to 98.52% this week from 79.65% equity exposure last week.

Our message for this week:

Selective Tech (BABA, SPLK, NFLX, AMZN) and Defensives (Selective Utilities, Staples and Pharma) is where we believe opportunity is right now (for Summer) as cyclicals will likely shake out some of the “late money” in coming months – before resuming their uptrend/new highs later in the year (we are still in the early stages of a new business cycle).

We have modestly trimmed (taken profits) on some of our cyclicals from last year in recent weeks (kept core positions) and will potentially add back to them in coming months on weakness.

When you’re ready to throw in the towel on the next pullback, remember Sam Hunt’s soothing words, “Breaking Up Was Easy In The 90’s” – at the end of a business cycle. It is much harder to bail just one year into a new business cycle – coupled with unparalleled money supply growth.

***THE PODCAST/VIDEOCAST WILL BE OUT ON FRIDAY THIS WEEK.