Be in the know. 20 key reads for Thursday…

- 5 Undervalued Healthcare Stocks (Barron’s)

- Opendoor Can Succeed in a Housing Market Downturn, CFO Says (Barron’s)

- Why Yield-Hungry Investors Are Looking to Energy Stocks (Barron’s)

- The Fed Is Optimistic About the Recovery—and Unsure What That Means for Rates (Barron’s)

- Judge Blocks Biden Oil Lease Plan. Why the Market Has Shrugged It Off. (Barron’s)

- Biogen’s FDA Win Marks a Mini-Rally in Biotech Stocks (Barron’s)

- China’s Economic Growth Moderates as Consumers Stay Cautious (Wall Street Journal)

- Americans Welcomed Back to Europe as Covid-19 Restrictions Ease (Wall Street Journal)

- Boeing, Airbus Gear Up for Post-Tariff Fight for Orders (Wall Street Journal)

- Fed keeps key rate near zero but moves up forecasts for initial rate hikes to 2023 amid upbeat outlook, stronger inflation (USA Today)

- S. Jobless Claims Rose Last Week for First Time Since April (Bloomberg)

- David Tepper Says Oil Stocks Are Cheapest Because People Hate Them (Bloomberg)

- European Stocks Are Coming In From the Cold (Bloomberg)

- Why inflation could create a ‘giant wealth transfer’ from lenders to borrowers (MarketWatch)

- 23andMe Successfully Closes its Business Combination with VG Acquisition Corp. (VGAC) (Street Insider)

- Walt Disney (DIS) PT Raised to $215 at Guggenheim on Faster Recovery with Higher Spending Levels (Street Insider)

- Netflix (NFLX) Could Have Its Strongest 6-Month Slate Ever in 2nd-Half – JPMorgan (Street Insider)

- Oil Continues to Explode Higher: 4 Goldman Sachs Conviction List Picks to Buy Now (24/7 Wall Street)

- AT&T: back to basics after four decades of botched dealmaking (Yahoo! Finance)

- Happy to Shun Showrooms, Millennials Storm the Car Market (New York Times)

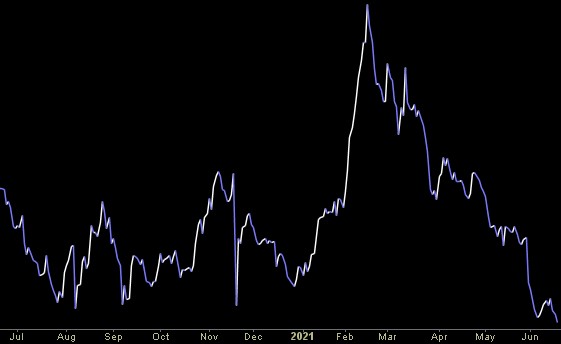

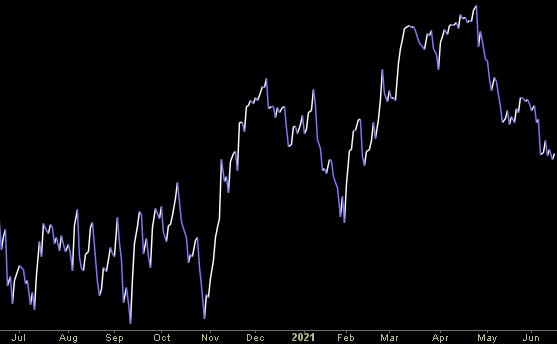

The Prince “When Doves Cry” Stock Market (and Sentiment Results)…

In 1984 Prince released “When Doves Cry” on his Purple Rain album. It was his first Billboard 100 hit and held the #1 spot for five weeks. We thought we would refer to some of his famous lyrics to wrap our arms around the Federal Reserve decision this week: Continue reading “The Prince “When Doves Cry” Stock Market (and Sentiment Results)…”

Where is money flowing today?

Be in the know. 20 key reads for Wednesday…

- China Tackles Commodity Prices. Mining Stocks Fall. (Barron’s)

- Watch for Taper Talk, Rate Views, and Inflation Outlook at Today’s Fed Meeting (Barron’s)

- Supply and Demand Are Coming Back Into Balance. These 9 Charts Show How. (Barron’s)

- How Talk of Tapering Could Affect Stocks (Barron’s)

- Exxon Could Rise 40%, With Big Dividend Growth (Barron’s)

- Oil Price Hits Pandemic High as Investors Bet on Green Energy (Wall Street Journal)

- Is Higher Inflation Here to Stay? Fund Managers Don’t Think So (Institutional Investor)

- Watch the ‘dot plot’ at the Fed meeting today (Financial Times)

- Regeneron antiviral treatment saves lives of Covid patients in hospital (Financial Times)

- Amazon (AMZN) Prime Members Now Valued at Around $1,000/Year Each, Sees ~240M by Year-End – JPMorgan (Street Insider)

- States to end unemployment benefits for more than 400,000 people this weekend (CNBC)

- Lumber Prices Are Falling Fast, Turning Hoarders Into Sellers (Wall Street Journal)

- Solid Power, QuantumScape, and the Battle for Next-Generation Batteries (Wall Street Journal)

- Meet the New Chinese Economy, Same as the Old Chinese Economy (Wall Street Journal)

- WTI Bounces On Big Crude Draw, Gasoline Demand Pick-Up (ZeroHedge)

- Netflix (NFLX) Could Have Its Strongest 6-Month Slate Ever in 2nd-Half – JPMorgan (Street Insider)

- Exxon (XOM) and Chevron (CVX) Have Further Upside to Q2 Consensus Earnings and FCF Estimates – Morgan Stanley (Street Insider)

- U.S. mortgage applications rise as purchases rebound (Street Insider)

- Oil Supercycle Could Hinge on Drilling Lag, Saudi Minister Says (Bloomberg)

- Homebuilding bounces back as lumber prices cool (Fox Business)

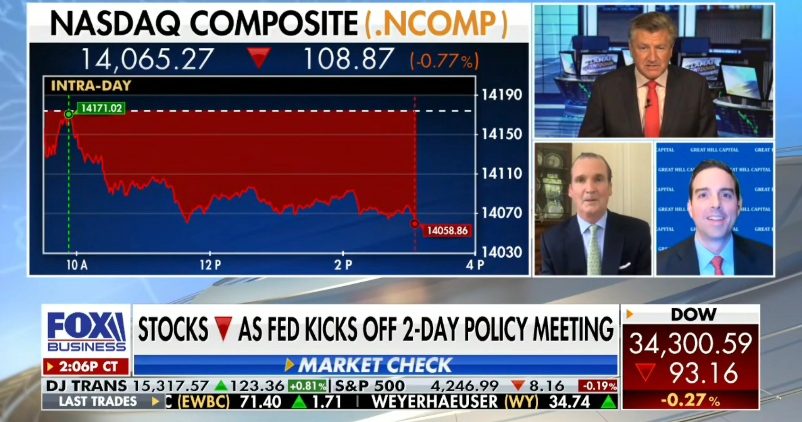

Tom Hayes – The Claman Countdown – Fox Business Appearance – 6/15/2021

Where is money flowing today?

Quote of the Day…

Hedge Fund Trade Tip (PIN) – Position Idea Notification

Be in the know. 17 key reads for Tuesday…

- The Bond Market Is Acting Strange. An Economic Slowdown Could Be Ahead (Barron’s)

- AstraZeneca, Pfizer Vaccines Offer Strong Protection From Delta Variant (Barron’s)

- Here are 7 reasons to stay bullish on stocks and why the S&P is headed to 4,600, from Credit Suisse (MarketWatch)

- Here’s what the market wants — and doesn’t want — to hear from Powell on inflation at Fed meeting (MarketWatch)

- U.S. and Europe Set to Call Truce Over 17-Year Airbus and Boeing Feud (Barron’s)

- Jamie Dimon says JPMorgan is sitting on about $500 billion in cash, waiting to invest in higher rates (MarketWatch)

- ‘Do not read too much into this month’s bond rally’: it doesn’t mean markets see inflation receding, says JPMorgan (MarketWatch)

- ‘Fastest production car you can buy’: Jay Leno impressed by Tesla’s Model S Plaid (New York Post)

- U.S. Retail Sales Drop, Hinting at Shift to Spending on Services (Bloomberg)

- NBC Says Olympics May Be Most Profitable Ever Despite Pandemic (Bloomberg)

- A full rundown of what to expect from the Federal Reserve on Wednesday (CNBC)

- Here’s what you need to know about Biden and Putin’s high-stakes meeting (CNBC)

- Jaguar Land Rover is developing a hydrogen-powered vehicle and plans to test it out this year (CNBC)

- One corner of health care could lead Nasdaq’s next record rally, Oppenheimer analyst predicts (CNBC)

- Copper Falls to Eight-Week Low on Fear China Might Release Stockpiles (Wall Street Journal)

- Walgreens offers same-day delivery service through Uber Eats (MarketWatch)

- Wells Fargo (WFC) Likely to Announce a Material Dividend Increase, PT Raised to $52 at Raymond James (Street Insider)