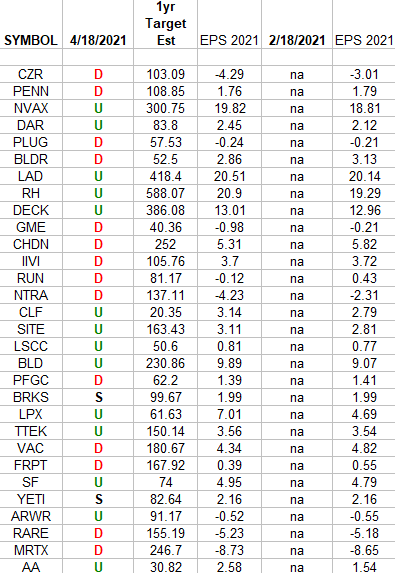

In the spreadsheet above I have tracked the earnings estimates for the top weighted Russell 2000 small cap stocks. I have columns for what the 2021 estimates were on 2/18/2021 and today. Continue reading “Russell 2000 (top weights) Earnings Estimates”

Be in the know. 10 key reads for Sunday…

- America Is Short of Home Builders as Well as Homes (Wall Street Journal)

- Robert Arnott on Global Asset Management (Podcast) (Bloomberg)

- Sell in May??? Post-Election-Year “Worst Months” Mixed (Almanac Trader)

- How Pfizer Became the Status Vax (Slate)

- Billionaire Reveals His ‘Secret’ To Beating China At Manufacturing (Forbes)

- How spooks are turning to superforecasting in the Cosmic Bazaar (The Economist)

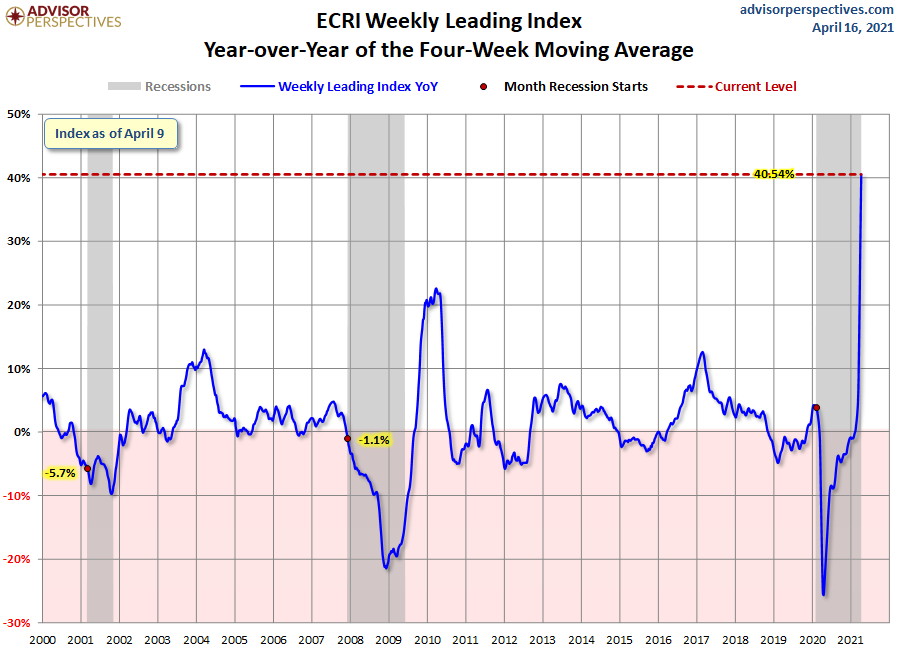

- ECRI Weekly Leading Index Update (advisorperspectives)

- The Transcript 04.12.21: Reopening euphoria (The Weekly Transcript)

- Formula 1 Is Heading to Miami (Road and Track)

- Historic Oil Glut Amassed During the Pandemic Has Almost Gone (Bloomberg)

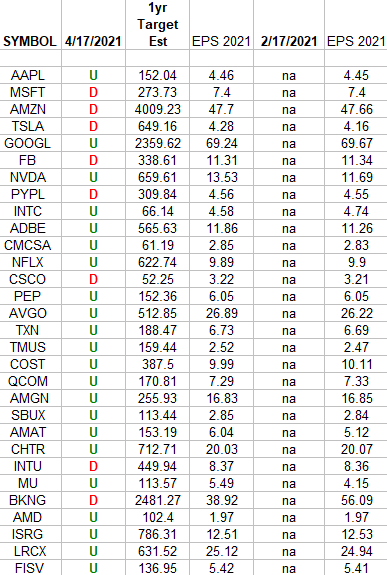

NASDAQ (top 30 weights) Earnings Estimates/Revisions

In the spreadsheet above I have tracked the earnings estimates for the top 30 weighted Nasdaq stocks. I have columns for what the 2021 estimates were on 2/17/2021 and today. Continue reading “NASDAQ (top 30 weights) Earnings Estimates/Revisions”

Be in the know. 28 key reads for Saturday…

- 10 reasons why the value-stock resurgence has further to run, according to BofA (Business Insider)

- 10 Solid Dividend-Paying Stocks on Sale (Morningstar)

- Tech Stocks Are Mired in Unfamiliar Territory as Market Laggards (Bloomberg)

- Li Lu: Value Investing in China, Full Transcript (latticeworkinvesting)

- Activist Investors Are Rattling Cages Again (Barron’s)

- Last winter saw larger-than-average U.S. natural gas withdrawals from storage (EIA)

- Home Building Picked Up in March. What It Could Mean for Skyrocketing Prices. (Barron’s)

- 3 Big Banks Had Huge Bond Sales This Week. What It Means for Markets. (Barron’s)

- Mark Rothko’s ‘Untitled’ From 1970 Could Fetch US$40 Million at Christie’s (Barron’s)

- What It Would Take for the S&P 500 to Hit 4500 by Year End (Barron’s)

- How People Get Rich Now (paulgraham)

- 4 Electric-Vehicle Charging Stocks at Fire-Sale Prices (Barron’s)

- Mexican Stocks Look Ready to Rally. Here’s Why. (Barron’s)

- Jane Fraser’s Debut as Citi’s CEO Hits All the Right Notes (Barron’s)

- The Stock Market Climbed Because Tumbling Bond Yields Don’t Mean What They Used To (Barron’s)

- Here’s how the ‘pause’ on J&J’s COVID-19 shot may or may not affect the company’s earnings (MarketWatch)

- Bill Miller 1Q 2021 Market Letter (millervalue)

- No Causal Link Found So Far Between J&J’s Covid-19 Vaccine and Blood-Clot Cases, Company Researchers Say (Wall Street Journal)

- Oakmark’s Bill Nygren on his expectations for the economic recovery (CNBC)

- The Bull Case for a $100 Million New Jersey Deli (Wall Street Journal)

- The Most Important Number of the Week Is 9.8% (Bloomberg)

- Boom Times Are Coming, If Only You Can Wait (Bloomberg)

- Hedge Funds Are Ready to Get Out of New York and Move to Florida (Bloomberg)

- SpaceX wins $2.9bn Nasa contract to land Americans on the moon (Financial Times)

- The labor market is the strongest it’s been since the pandemic started — and setting up a huge boost to America’s most crucial economic engine (Business Insider)

- 3 reasons the stock market is poised for a near-term correction, according to LPL (Business Insider)

- Pipeline pressure and Elliott’s stake have GSK in a spin (Financial Times)

- Netscape 2.0: Coinbase stock debut rekindles memories of web breakthrough (Financial Times)

Tom Hayes – CGTN Global Business Appearance – 4/16/2021

Hedge Fund Trade Tip (PCN) – Position Completion Notification

Unusual Options Activity – Valero Energy Corporation (VLO)

Data Source: barchart

Today some institution/fund purchased 22,713 contracts of June $80 strike calls (or the right to buy 2,271,300 shares of Valero Energy Corporation (VLO) at $80). The open interest was just 4,657 prior to this purchase. Continue reading “Unusual Options Activity – Valero Energy Corporation (VLO)”

Hedge Fund Tips (PCN) – Position Completion Notification

Where is money flowing today?

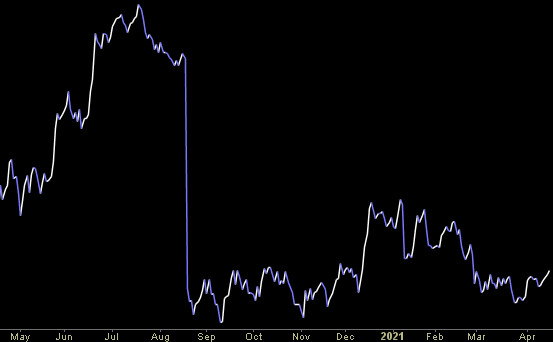

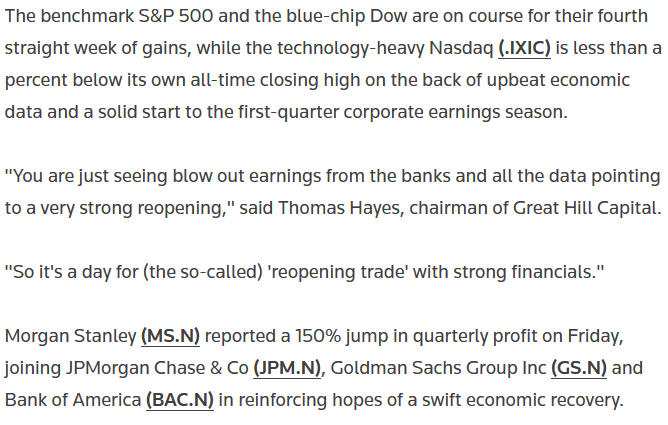

Tom Hayes – Quoted in Reuters article – 4/16/2021

Thanks to Shivani Kumaresan for including me in her article on Reuters today. You can find it here: