- Global Banks Tally Up Potential Costs Linked to U.S. Client (Barron’s)

- US companies sound inflation alarm (Financial Times)

- 25 Undervalued European Stocks Set to Beat Post-Pandemic Earnings (Barron’s)

- Bluebird Shares Jump as FDA Approves Cancer Therapy (Barron’s)

- A Windfall Is Coming for Banks. Here’s How They Should Use It. (Barron’s)

- The Parable of the Suez Canal (Barron’s)

- New Trade Representative Says U.S. Isn’t Ready to Lift China Tariffs (Wall Street Journal)

- Bond Bulls Charge Ahead, Challenging Consensus on Rising Yields Wall Street Journal)

- The Two Tiger Cubs at the Center of Friday’s $35 Billion Meltdown (institutionalinvestor)

- Gen X emerging from pandemic with firmer grip on America’s wallet (Reuters)

- Boeing Nabs Southwest Airlines Order for 100 737 Max Jets, 155 Added Options (24/7 Wall Street)

- Contentious Union Vote at Amazon Heads to a Count (New York Times)

- Billions in Secretive Derivatives at Center of Hedge Fund Blowup (Bloomberg)

- CFDs – The Dirty Little Secret Behind The Collapse Of Archegos (ZeroHedge)

- ‘What the hell’s an NFT?’ — ‘SNL’ explains in an amazing rap parody (MarketWatch)

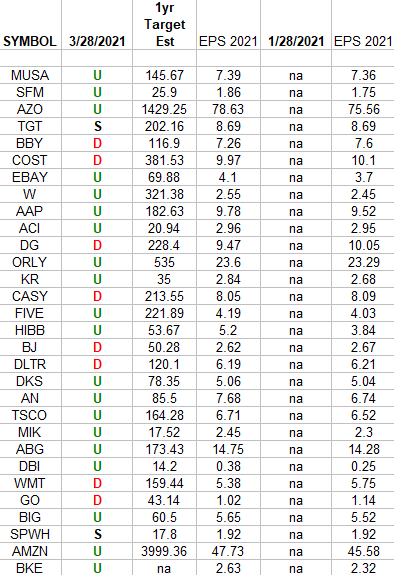

Retail Earnings Estimates/Revisions

In the spreadsheet above I have tracked the earnings estimates for the Retail Sector ETF (XRT) top 30 weighted stocks. Continue reading “Retail Earnings Estimates/Revisions”

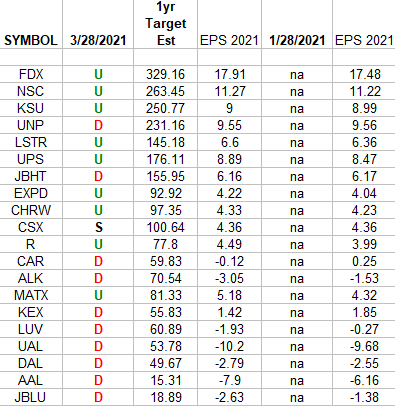

Transports Earnings Estimates/Revisions

In the spreadsheet above I have tracked the earnings estimates for the Transportation Sector ETF (IYT) holdings. Continue reading “Transports Earnings Estimates/Revisions”

Be in the know. 11 key reads for Sunday…

- Episode 21-13 The Birth of CRISPR (Tech Nation)

- Mean Reversion After Biggest 1-Year Spike Since 1949? (Almanac Trader)

- Democrats confident they can pass $3tn infrastructure bill (Financial Times)

- The Economy Doesn’t Need The Fed’s Easy Monetary Policy To Keep Booming, BofA Says (Forbes)

- Are we heading for a post-pandemic ‘Roaring 2020s,’ with parties and excess? (Washington Post)

- Amazon could get its first unionised workforce in America (The Economist)

- Electric Air Taxis Must Be Just as Safe as Commercial Planes, VTOL Exec Says (robbreport)

- Watch this $1.2M supercar EV drift on ice like a ballerina (thenextweb)

- F1 live stream: how to watch every 2021 Grand Prix online from anywhere (techradar)

- Boats And Bull Markets: Indicators Of The Week (NPR Planet Money)

- Succession Season 3: Everything We Know So Far (Town & Country)

Be in the know. 15 key reads for Saturday…

- Block-Trade Bevy Wipes $35 Billion Off Stock Values in a Day (Bloomberg)

- GSK and Vir Submit Covid-19 Drug for FDA Authorization (Barron’s)

- Gilded Age or Roaring Twenties? (investoramnesia)

- The Value Stock Rotation Isn’t Over—Not by a Long Shot (Barron’s)

- Higher Taxes? Deficit Spending? Why the Stock Market Isn’t Worried. (Barron’s)

- European Stocks Look Tempting. No, Really. (Barron’s)

- Here’s what tax hikes could mean for the stock market as Biden pushes infrastructure plan (MarketWatch)

- China Signs 25-Year Deal With Iran in Challenge to the U.S. (Bloomberg)

- ‘It’s crazy. There is no inventory.’ Housing industry veteran marvels at real estate boom (CNN Business)

- US fears China is flirting with seizing control of Taiwan (Financial Times)

- Big Oil lobbyist throws weight behind carbon pricing (Financial Times)

- What Discord Is, and Why Microsoft Covets It (Bloomberg)

- John Stuart Mill’s Philosophy of Equality (Farnam Street)

- Influencers with Andy Serwer: Ray Dalio (Yahoo! Finance)

- Payday Might Be Coming for U.S. Bank Investors (Wall Street Journal)

Hedge Fund Tips with Tom Hayes – VideoCast – Episode 75

Article referenced in podcast above:

The Bruno Mars, “Leave The Door Open” Stock Market (and Sentiment Results)…

Hedge Fund Tips with Tom Hayes – Podcast – Episode 65

Article referenced in podcast above:

The Bruno Mars, “Leave The Door Open” Stock Market (and Sentiment Results)…

Hedge Fund Trade Tip (PIN) – Position Idea Notification

Where is money flowing today?

Be in the know. 15 key reads for Friday…

- Fed lifts curbs on US banks’ share buybacks and dividends (Financial Times)

- Aston Martin bets on a Formula One comeback to revive the brand (Financial Times)

- Earnings Forecasts Are Low. What That Means for Stocks (Barron’s)

- Merck’s Little Brown Pill Could Transform the Fight Against Covid (Bloomberg)

Jefferies Upgrades Altria (MO) to Buy; ‘Underappreciated RRP, Cannabis and ESG Optionality’ (Street Insider) - 5 High-Yielding Dividend Aristocrat Stocks Are Perfect Now for Worried Investors (24/7 Wall Street)

- Race to dislodge Suez blockage as shipping rates surge, tankers diverted away (Reuters)

- Global money market funds get highest inflows in 13 weeks, Lipper data show (Reuters)

- The Pandemic Has Hurt Rite Aid and Walgreens. Here’s Why That Might Change. (Barron’s)

- Yes, You Can Retire on Dividends. 10 Stocks to Build an Income Stream for the Long Haul. (Barron’s)

- Andrew Left Channels GameStop, Naming Heavily-Shorted Root as Best Stock Pick of 2021 (Institutional Investor)

- Companies raise record $140bn in US junk bond market in first quarter (Financial Times)

- Powell Says Now Is Not the Time to Focus on Reducing Federal Debt (Wall Street Journal)

- Berkshire Hathaway Offers to Spend $8.3 Billion on Emergency Power Plants in Texas Wall Street Journal)

- With Negative Rates, Homeowners in Europe Are Paid to Borrow (Wall Street Journal)

- Powell says Fed will ‘gradually’ cut its bond-market footprint — some think this year (MarketWatch)