- Wall Street firms paid almost $3bn last year for retail brokers’ trades (Financial Times)

- A Piggly Wiggly warning for the Reddit investor rebels (Financial Times)

- Nordstrom brothers confident of overcoming trouble in store (Financial Times)

- Hindenburg Research Goes After ‘Wall Street Celebrity Promoter’ Chamath Palihapitiya (Institutional Investor)

- Clover Health Investments (CLOV) Issues Response to Short Seller Hindenburg Research (StreetInsider.com)

- Goldman Sachs Has 3 Contrarian Stocks to Buy Now That All Pay Big Dividends (24/7 Wall Street)

- GameStop’s meteoric gains have almost entirely disappeared — here’s advice for those who didn’t get out in time (MarketWatch)

- Opinion: Bucs, not Chiefs, will win one for the bulls if the Super Bowl Indicator is right (MarketWatch)

- More companies than usual are beating earnings estimates — and sales numbers are just as bullish for the stock market (MarketWatch)

- All of President Biden’s key executive orders — in one chart (MarketWatch)

- 5 Stocks That Are Most Sensitive to a Change in Oil Prices (MarketWatch)

- Feb. 16 is the next big day for Biden’s economic plan (MarketWatch)

- Here’s where the jobs are — in one chart (CNBC)

- Klobuchar Introduces Antitrust Bill Raising Bar for Technology Deals (Wall Street Journal)

- Biogen’s Alzheimer’s Drug Faces a Big Test (Barron’s)

- Bonds Send Message: Inflation Is Coming (Barron’s)

- Money Is Pouring Into Emerging Markets, and Out of the U.S. (Barron’s)

- Beijing lays down a marker in South China Sea (Financial Times)

- US-China investment flows belie geopolitical tensions (Financial Times)

- Biden Urges Fast Virus Relief as Minimum-Wage Hike Hopes Fade (Bloomberg)

- ‘Big Short’ investor Michael Burry paved the way for the GameStop frenzy when he bought a stake in 2019. Here’s the story of Burry’s game-changing bet. (Business Insider)

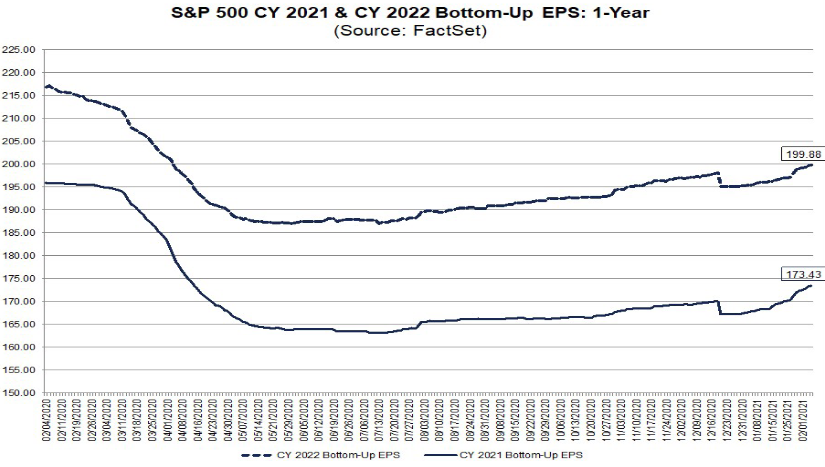

- Fiscal stimulus prospects and strong earnings tailwind may propel stocks in the week ahead (CNBC)

- Marc Randolph on Building Netflix, Battling Blockbuster, Negotiating with Amazon/Bezos, and Scraping the Barnacles Off the Hull (#496) (TimFerriss)

- As ‘Low Quality’ Stages a Comeback, This Utility Looks Set to Break Out (Barron’s)

- New Amazon CEO Can Either Help Workers and Sellers—or Automate Them Away (Wall Street Journal)

- Speculation & The Underdog (investoramnesia)

- The Best-Case Outcomes Are Statistical Outliers (Farnam Street)

- Fundamentals Still Matter (valuestockgeek)

- Stanley Druckenmiller, Chairman and CEO of Duquesne Family Office (Talks at GS)

- Amazon Union Election to Proceed as Labor Board Denies Delay Request (Wall Street Journal)

Hedge Fund Tips with Tom Hayes – VideoCast – Episode 68

Article referenced in VideoCast above:

The Good, the Bad, and the Ugly Stock Market (and Sentiment Results)…

Hedge Fund Tips with Tom Hayes – Podcast – Episode 58

Article referenced in podcast above:

The Good, the Bad, and the Ugly Stock Market (and Sentiment Results)…

Unusual Options Activity – Itaú Unibanco Holding S.A. (ITUB)

Data Source: barchart

Today some institution/fund purchased 31,102 contracts of Sept. $6 strike calls (or the right to buy 3,110,200 shares of Itaú Unibanco Holding S.A. (ITUB) at $6). The open interest was just 259 prior to this purchase. Continue reading “Unusual Options Activity – Itaú Unibanco Holding S.A. (ITUB)”

Where is money flowing today?

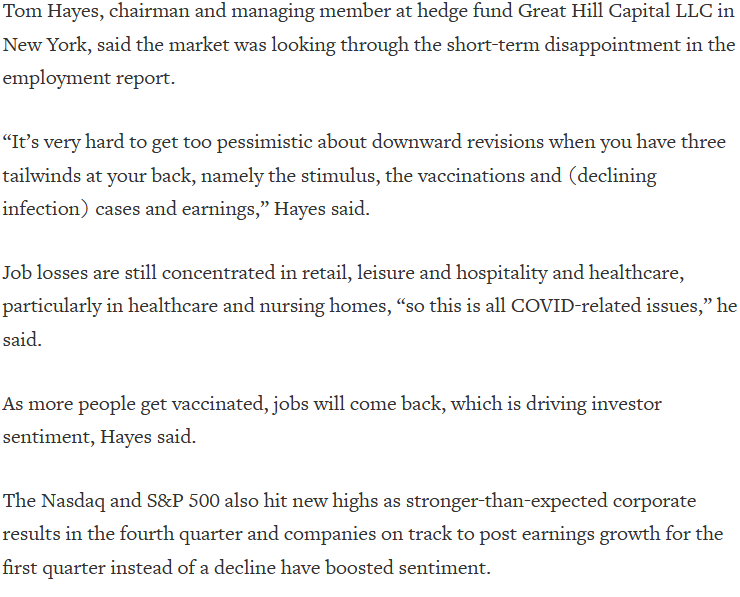

Tom Hayes – Quoted in Reuters article – 2/5/2021

Thanks to Herb Lash for including me in his article on Reuters today. You can find it here:

Be in the know. 10 key reads for Friday…

- Regeneron Earnings Easily Beat; REGN Stock Rises (Investor’s Business Daily)

- Johnson & Johnson Seeks Emergency Authorization for Covid Vaccine (Barron’s)

- Nokia Stock Falls After Earnings. Look Out for ‘Atypical Volatility.’ (Barron’s)

- What the Super Bowl Means for Stocks (Barron’s)

- Gilead Says Covid Treatment Remdesivir Is Needed for Another Year (Barron’s)

- Energy stocks and bonds shine after brutal slump, even as Biden moves to curb fossil fuels (MarketWatch)

- Biden Signals Break With Trump Foreign Policy in a Wide-Ranging State Dept. Speech (New York Times)

- Quest for Hollywood Fame Splits Redditors at Heart of Market Frenzy (New York Times)

- U.S. Payrolls Miss Estimates After Bigger December Decrease (Bloomberg)

- White House Adviser Says Jobs Report Underscores Need for Aid (Bloomberg)