This week I chose the 1966 Italian Spaghetti Western (The Good, the Bad, and the Ugly) as the theme for our article – and it has nothing to do with Mario Draghi becoming the new Prime Minister of Italy.

As a box-office success grossing $25M in 1966 (~$200M in today’s dollars), this film is credited with launching Clint Eastwood into stardom.

The film is known for its iconic “Mexican Standoff” where all three characters are seen as anti-heroes, killing for their personal gain. It parallels the scene we saw play out with GameStop this past week:

-The Reddit Rebellion/Robinhood “Retail Traders” were portrayed as “The Good.”

-The Hedge Fund shorts were labeled “The Bad.”

-The Robinhood platform was coined “The Ugly” after restricting traders from purchasing shares of GME and continuing the “short squeeze.”

Like all good Mexican Standoffs – where no strategy exists that allows any party to achieve victory – in turning the guns inward, they all effectively got hurt.

-The “Diamond Handed” Redditors stayed at the punch bowl too long leaving the late-comers holding the bag.

-The Hedge Funds suffered a self-inflicted blow by not managing risk in a short that had 140% Short Interest.

-The Robinhood platform (either by design or by necessity) wound up taking from the poor to give to the rich!

When Robinhood restrict buying – due to their short term inability to meet capital requirements – GME fell from almost $500 down to ~$200 giving Hedge Funds the much needed window to cover their shorts at a much better price and live another day.

By the time Robinhood “partially” restored the ability to purchase GME, the short interest had collapsed from 140% down to 53% and then into the mid-30s. They snatched DEFEAT from the jaws of VICTORY for their retail customers. Had that restriction not been imposed, there’s no telling how high GME would have rocketed in the short-term before finally reversing.

This is why I stated in last week’s note on Jan 28th (when GME traded up to $483),

Quote 1:

“The retail traders had a huge short term win and mopped the floor with the dealers and the short-sellers, but as the old saying goes, “bulls make money, bears make money, pigs get slaughtered.”

Quote 2

“To the Reddit folks “In Da Club”, you crushed some big names in the game. Make sure you walk away with some chips and live to play another day…

You identified the vulnerability that “sophisticated players” missed – and you deserve to harvest the spoils…

Now take some chips off the table while you can and, “go sip Bacardi like it’s your birthday…”

To those of you who heeded this suggestion, congratulations.

To those that stayed at the trough a little too long, a picture is worth a thousand words:

On Tuesday, I was on Fox Business – with Liz Claman – on the Claman Countdown. Thanks to Liz and Jacqueline D’Ambrosi Scales for having me on.

In this segment we covered the unwinding of the GME trade, Economic Outlook, and where to find value moving forward:

The WSB/Reddit trade is now a crowded rush through a narrow exit. “Diamond Hands” have become “Cubic Zirconias.” CME raised margin requirements on Silver Monday night and Short Interest on GME collapsed.

The market was rallying on the unwinding of the Reddit/Robinhood trade because the expectation of further de-risking of Hedge Funds (who were short) is perceived to be behind us.

Last week AAPL and other “winners” were under pressure (despite strong earnings) as they became a “source of funds” for hedge funds that had to sell their winners (longs) to pay for their “losers” (shorts). Hedge funds haven’t taken down exposure this quickly since 2009 (which was also at the beginning of a new cycle).

Now that the squeeze is dying down, they (Hedge Funds) have to quickly restore exposure. Few managers want to be short/flat with earnings coming in much stronger than anticipated.

Market participants are seeing certainty around more stimulus (either through cooperation or reconciliation).

The non-partisan CBO (Congressional Budget Office) put out their projections this week, which found:

- U.S. Economy will recover to new highs in economic activity by mid-year (3.7% annualized rate).

- Unemployment will fall to 5.3% this year.

- Inflation will remain low (1.5%).

These projections from the CBO assume that current laws on taxes and spending remain in place, and that no meaningful additional stimulus is provided.

With additional stimulus a near certainty now, their estimates will likely be conservative. Vaccinations are rising and cases are dropping. The market is sniffing this out.

Our Suggestion to Liz Was: Ignore the noise and find opportunity where there is still value. We think (Defense & Aerospace) sub-sector is a remaining laggard from last year – that can lead this year – as we see a meaningful recovery in commercial aviation in 2H. Investors can get exposure through ETFs like ITA (and others), or buy several of the biggest holdings like: RTX, NOC, LMT, GD.

On Wednesday Morning I was able to elaborate on this theme with Jill Wagner on Cheddar. Thanks to Jill and Ally Thompson for having me on – as well as Taylor Garre for coordinating the segment.

Jill asks a great question at the end of the interview regarding advice I would give to new investors. I recommend my favorite book. Find out the title here:

Here were some additional topics/questions of key importance at this juncture. These were not covered in the interview above as we ran out of time:

Where are we in the earnings: do you like what you’ve seen so far?

(Data Source: Factset)

Earnings are coming in better than expected on both Top and Bottom lines. On December 31, Q4 earnings were expected to be -9.7%. Now they are at -2.3% (with less than 1/2 the S&P having reported) and will likely end POSITIVE year on year (in the middle of a pandemic – which had meaningful regional shutdowns in Q4). 82% of companies have reported positive EPS surprise and 76% beat on revenues.

The Financials sector (+28.9%) sector is reporting the largest positive (aggregate) difference between actual earnings and estimated earnings. This will only improve as they continue to release reserves in coming quarters.

As of today, the S&P 500 is reporting year-over-year growth in revenues of 1.7%. If 1.7% is the actual growth rate for the quarter, it will mark the first time the index has reported year-over-year revenue growth since Q1 2020.

In aggregate, companies are reporting earnings that are 13.6% above the estimates.

For Calendar Year 2021, analysts are projecting earnings growth of 23.6% and revenue growth of 8.7%

The most important point is that 2021 and 2022 estimates continue to be revised up each week (now at $172.05 for 2021 and $198.54 for 2022). This means we ate trading at ~19.4x next year’s earnings (which is higher than 17.6x 10 year average – but somewhat justified with rates low and estimates rising).

Energy, Industrials, Cons. Disc, Materials and Financials will all grow EPS> 20% in 2021 while Tech and com Services will grow slower (16.3% and 12.3% respectively) than the S&P 500 (and are trading at a higher multiple).

What concerns you? And what’s the next catalyst here for stocks once we get through earnings?

-In the short term I am watching the US Dollar as it has been showing strength in recent weeks. Hedge Funds are record short $USD and “Commercial Hedgers” have been buying. Commercials are usually right at extremes. This would be a short term headwind for earnings and stocks if it persists.

-Inflation is likely to come sooner than anticipated – forcing the Fed to act more quickly than expected. It will come from wage inflation [employers competing for labor as “pent up” demand returns and private wages will have to meet or exceed extended unemployment benefit pay (up to ~$40,000 per year at the top end)]. Commodities (Oil) “gas prices at the pump” will continue to rise as domestic drilling is curtailed on Federal Land. This impacts ~30-40% of shale drilling. IF rates have to go up sooner than expected, multiples are too high.

-Bad news: Taxes are going up for corporations. Good news: It takes on average 15 months to pass a comprehensive tax bill. When does the market begin to discount the reduction in earnings (from the Corp Tax Rate potentially moving up to 28% before the mid-term elections)?

-What also concerns me is that comps are going to be tough for Tech in Q1 and Q2 2021 because they pulled forward a lot of demand at this time last year.

-The thing that could set us back is if new strains become resistant to the current vaccines and it takes a couple of months to modify what we have (low probability).

-With the aggressive de-risking of Hedge Funds Last week, redemptions will be imminent. Are there “aftershocks” after the initial earthquake? It usually takes more than a few days to work through the system.

What is the next catalyst for the Stock Market?

The next catalyst is stimulus – which will be achieved either through bi-partisan cooperation or more likely budget reconciliation.

What does it all suggest going forward?

In the absence of further catalysts, historically low institutional cash levels, pockets of froth (record call buying, SPAC frenzy, retail participation) and a lot of good news already priced in, we could see a continued consolidation of the gains in coming weeks before resuming the uptrend and closing the year out higher.

Now onto the shorter term view for the General Market:

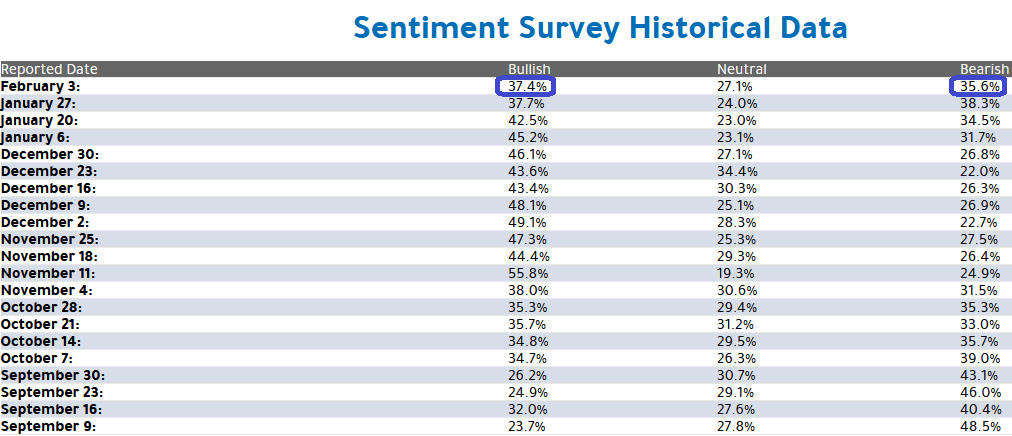

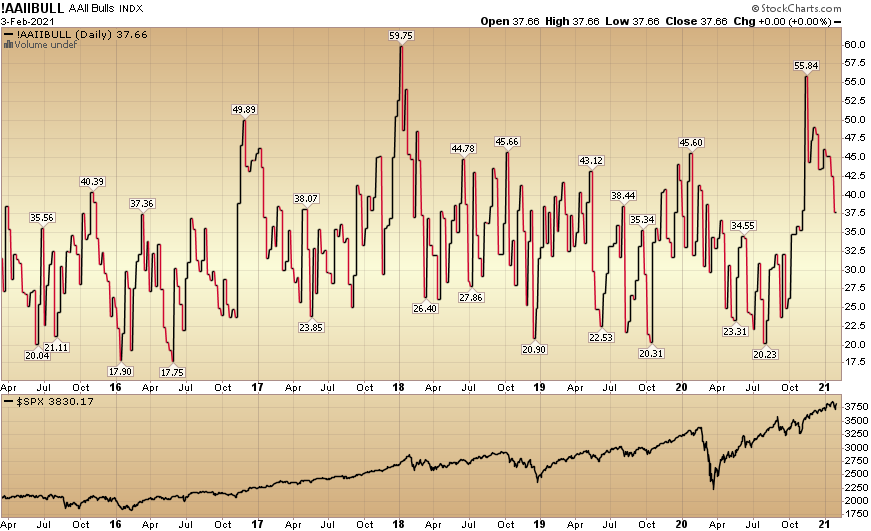

In this week’s AAII Sentiment Survey result, Bullish Percent (Video Explanation) flat-lined to 37.4% from 37.7% last week. Bearish Percent moderated to 35.6% from 38.3% last week. Euphoria is coming off the boil a bit.

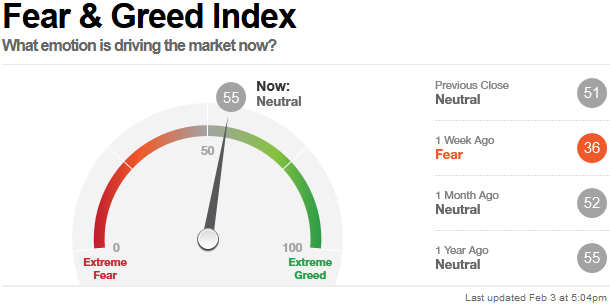

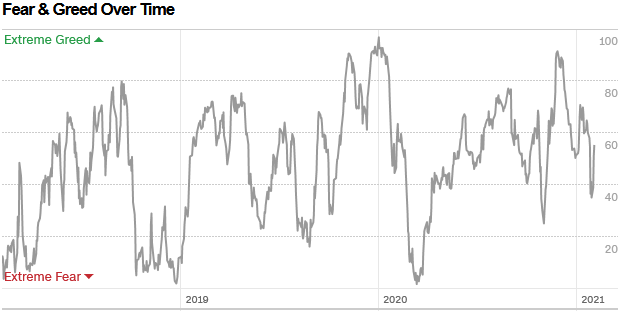

The CNN “Fear and Greed” Index rose from 40 last week to 55 this week. This is a neutral read. You can learn how this indicator is calculated and how it works here: (Video Explanation)

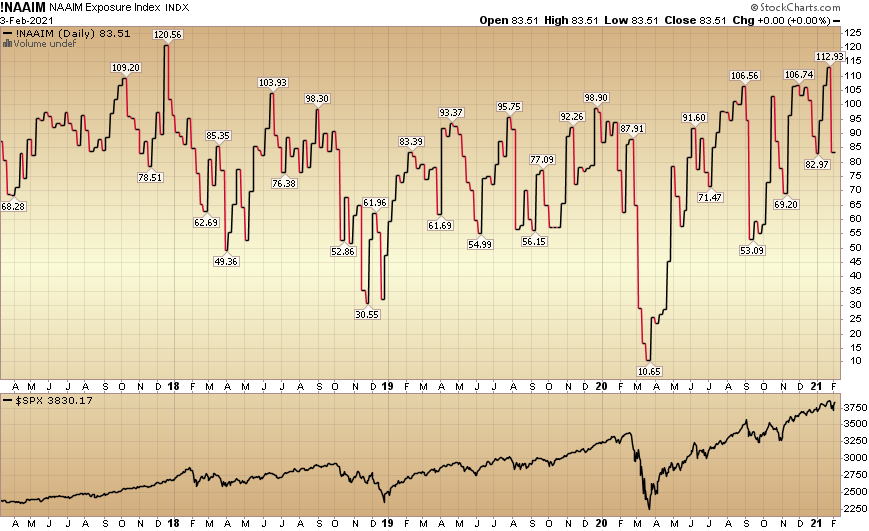

And finally, this week the NAAIM (National Association of Active Investment Managers Index) (Video Explanation) dropped to 83.51% this week from 112.93% equity exposure last week.

Our message for this week:

We got a 3.7% pullback last week. Was that it? It’s too early to tell. If it follows our post-election 2017 model – there were no pullbacks that exceeded that range (3-4%) for the full 12 months.

However, with the largest de-grossing amongst Hedge Funds since 2009 last week, it rarely resolves itself in a couple of days. After an earthquake, there are usually tremors (redemptions) that could keep pressure on market “winners” as they are sold down to pay out withdrawals. Watch AAPL for a clue.

One theme we have been pressing in recent weeks’ podcasts/videocasts is the concept of “rallies under the surface.” This means that even if the market were to consolidate sideways for some period (to digest the ~75% gains off the March lows), certain sectors and stocks could have monster up moves – even if the general indices are subdued for some time.

We will continue add to Defense and Aerospace (on the 2H Commercial Aviation recovery), and hold (and possibly add to) Banks and Energy in coming weeks (if they come down any further).