image source: Reddit

Chair Powell came to play yesterday and the market liked it. Is this the bottom in the short term 3-8% pullback we started calling for in Q1 on our podcast|videocast(s)?

We don’t know, but what we can tell you is that our last hedge (Semi’s put spread) came off on Wednesday – on the back of AMD collapsing after earnings. We took the money and ran – even if we kept a few shekels on the table (2.2-2.4x). The only publicly disclosed hedge still on – which is much longer dated – is the TLT call spread (long bonds).

With all of the hedging and “tactical shorts” in the last couple of months, at the end of the day “quick wins” are nice, but not the core of what we do. We buy high quality businesses (with moats) – when they are temporarily impaired (on the operating table) – but leaving the hospital walking on their feet versus lying their backs! That is our knitting, but I would say this campaign was successful and allowed us to stay ~98% long through the volatility.

We’ll let the TLT (long-bond) call spread run for a while as they have the highest EV (expected value). If the others flush further (which is better than a coin-flip chance), so be it, but I’m not going to get in the way of an additional $35B/month of new liquidity coming into the market over the intermediate term. The moves we made served their purpose, now we redeploy the cash.

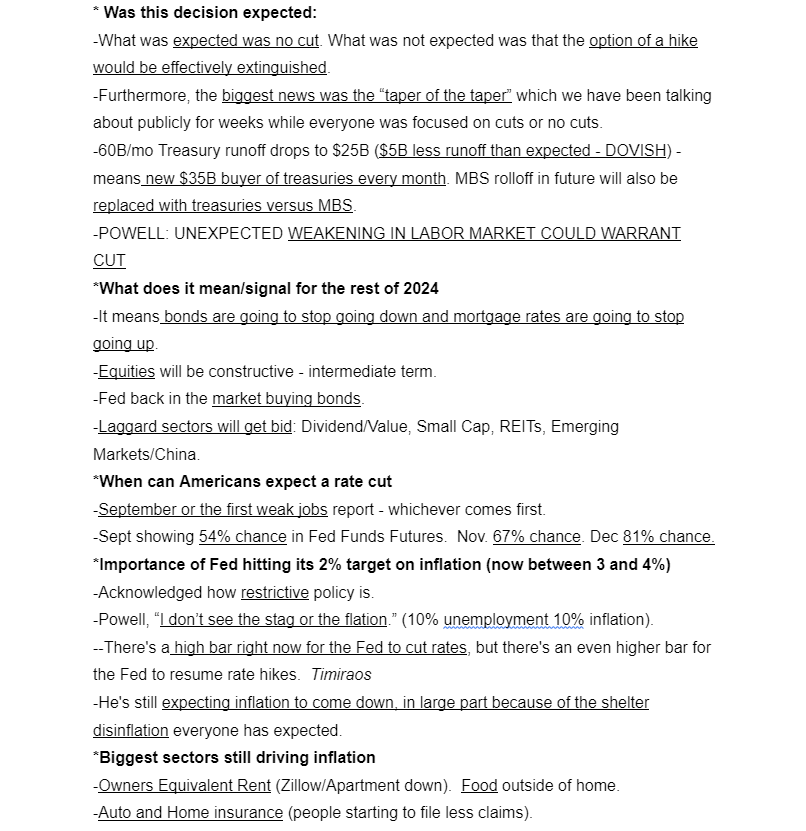

Hot off the plane – I joined Sean Callebs on CGTN – to discuss the implications of Chairman Powell’s actions on Wednesday. Thanks to Sean and Nancy Said Ali for having me on:

Here were my notes ahead of the segment:

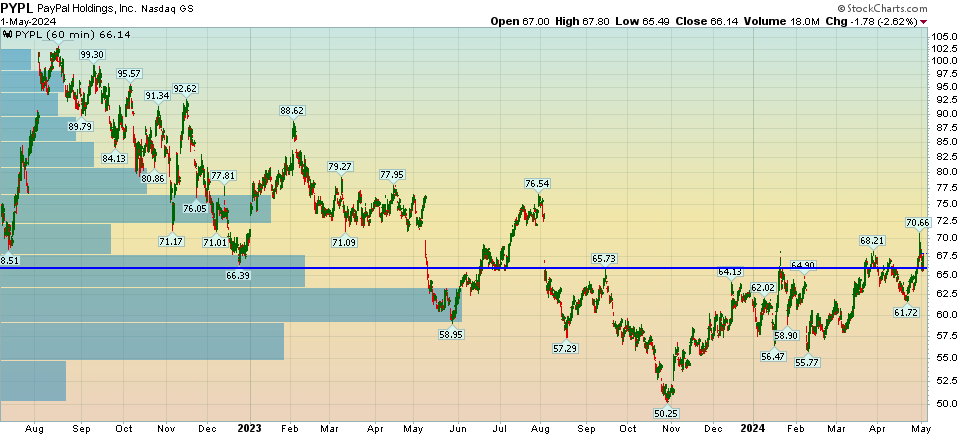

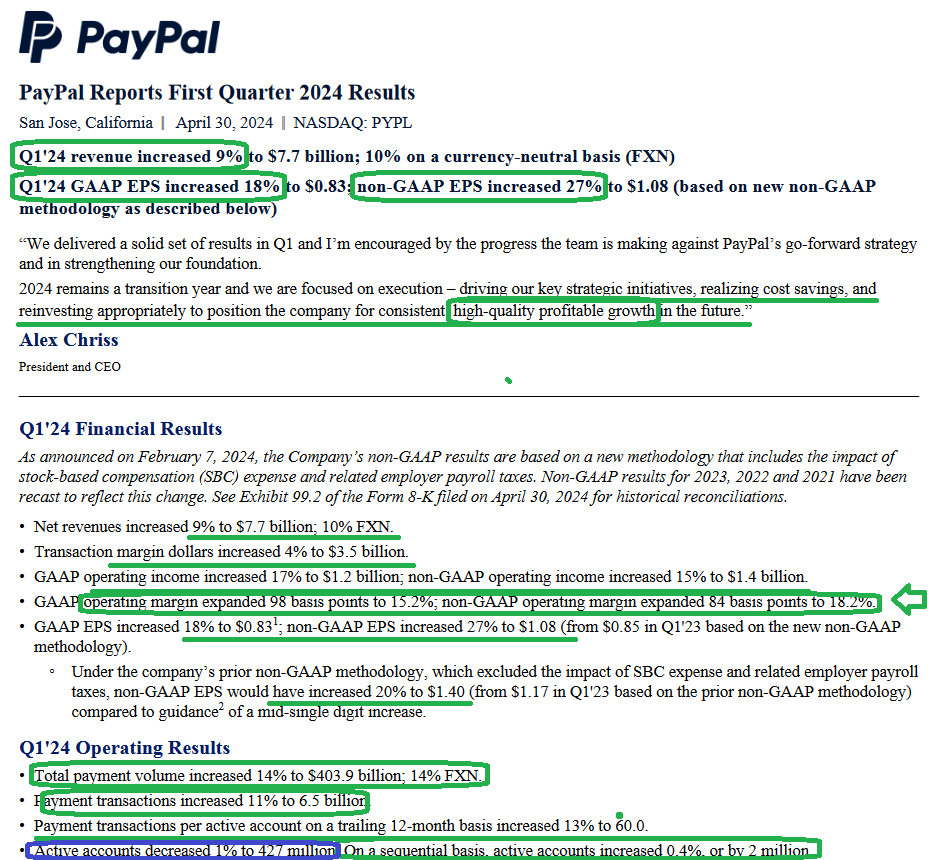

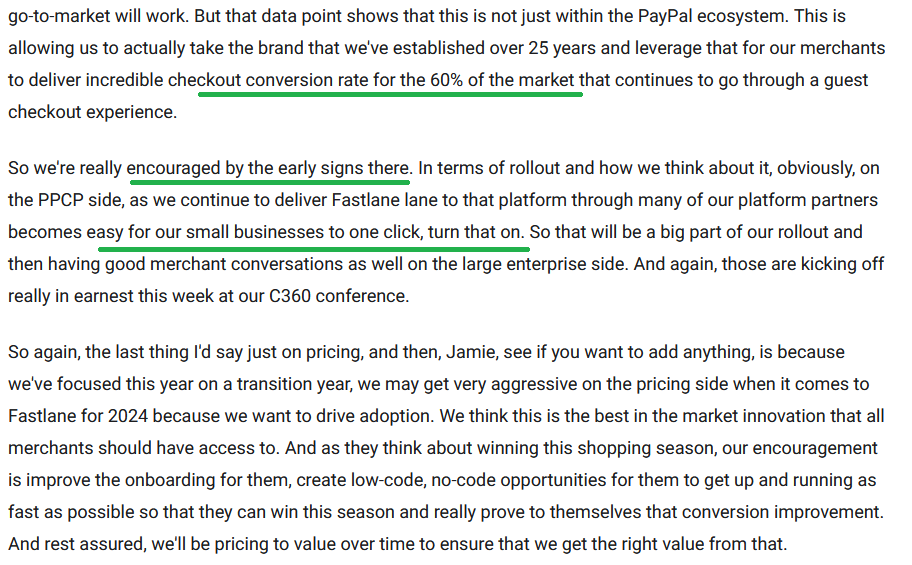

PayPal is my Pal

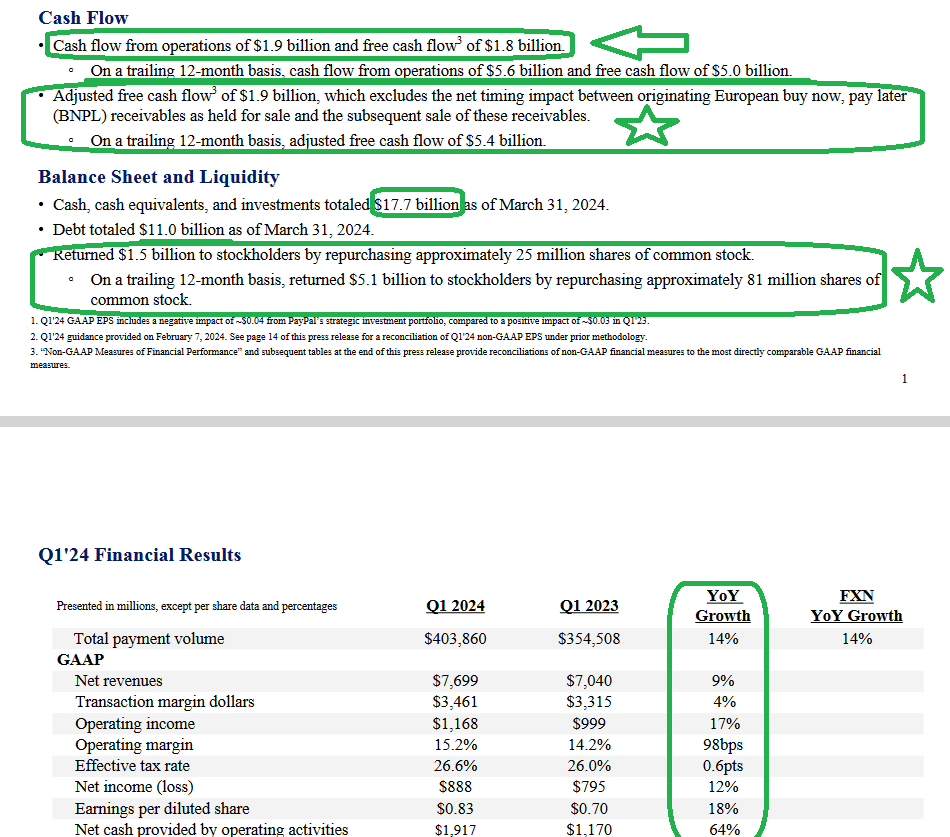

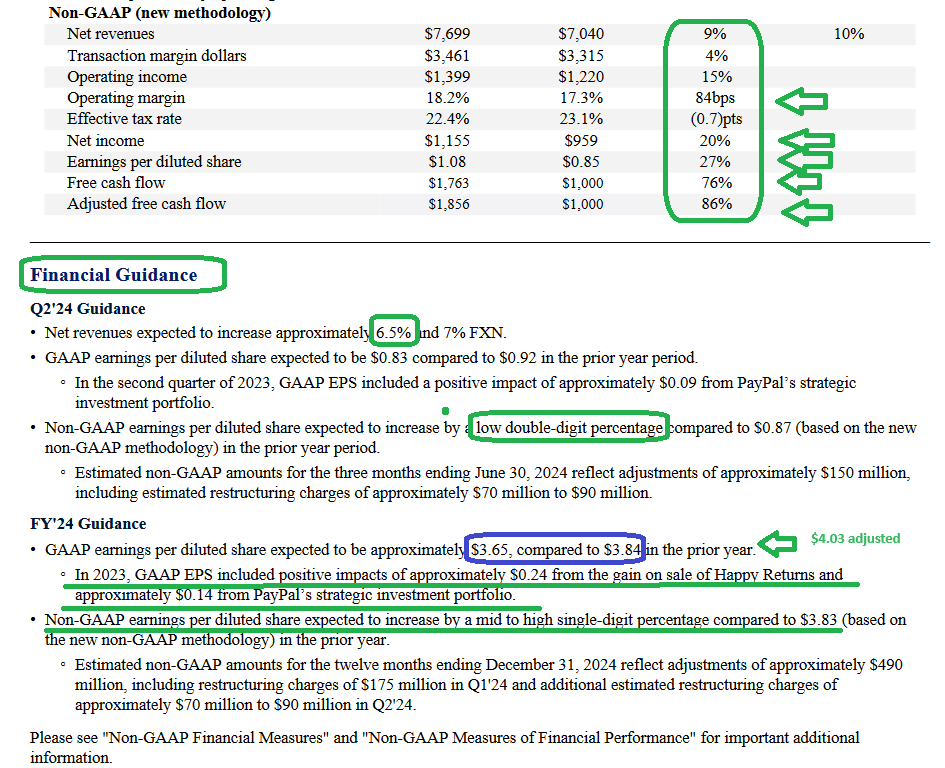

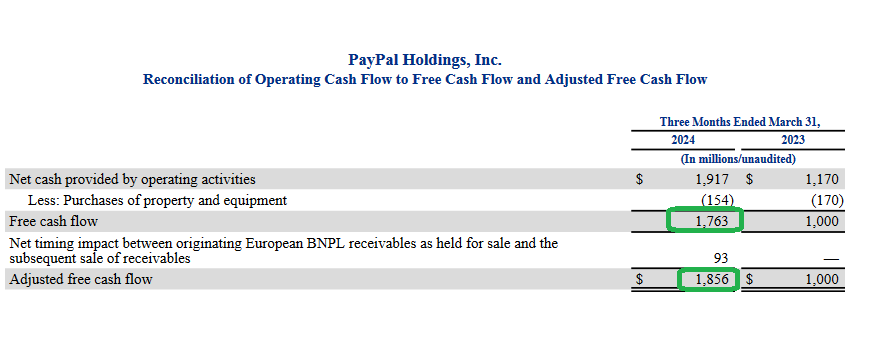

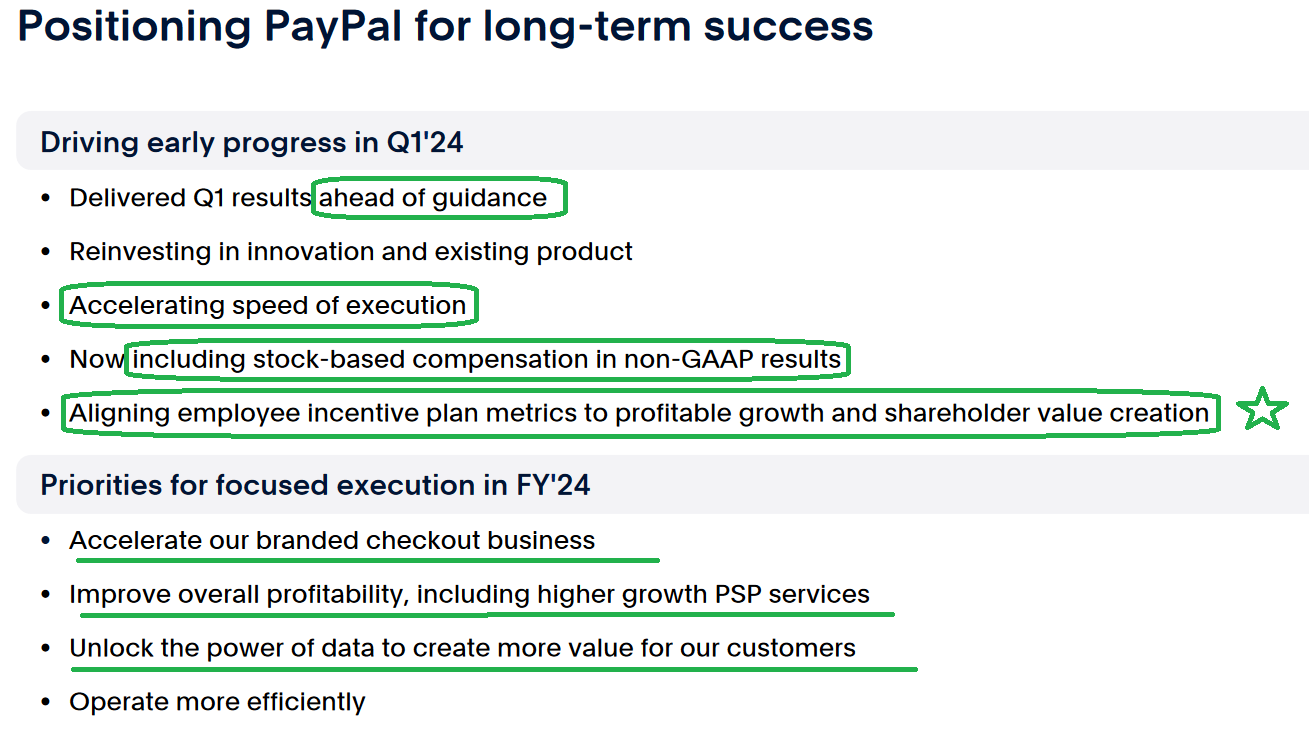

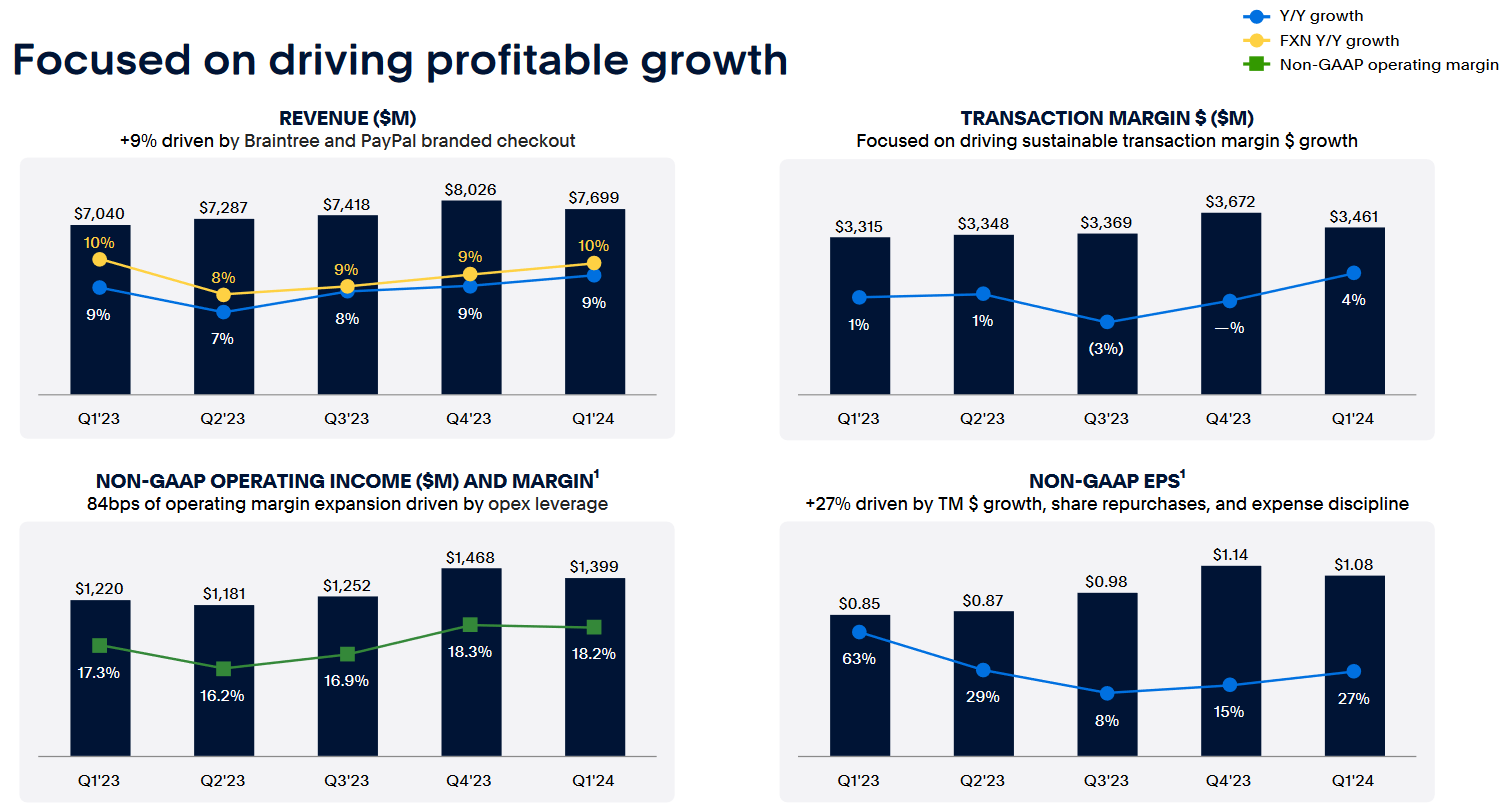

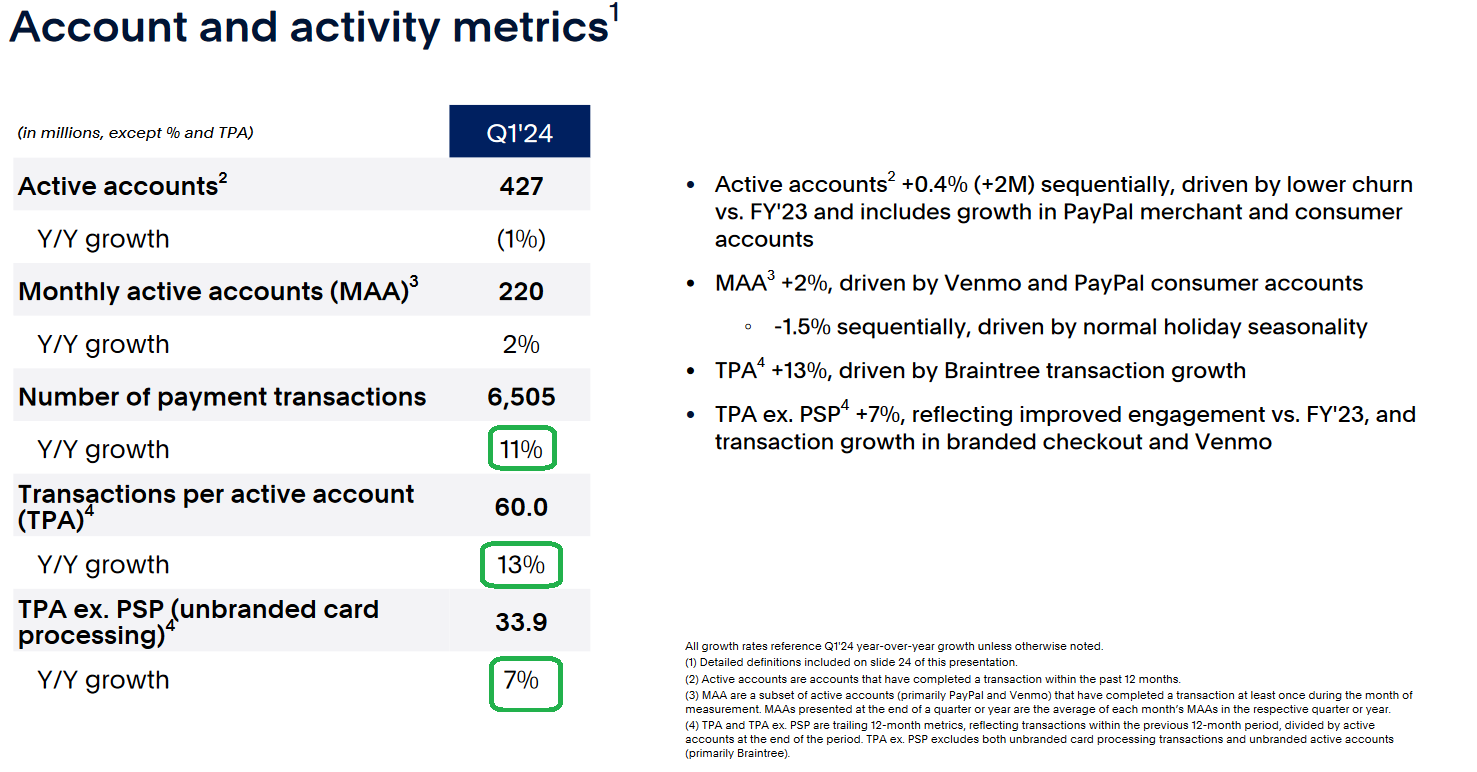

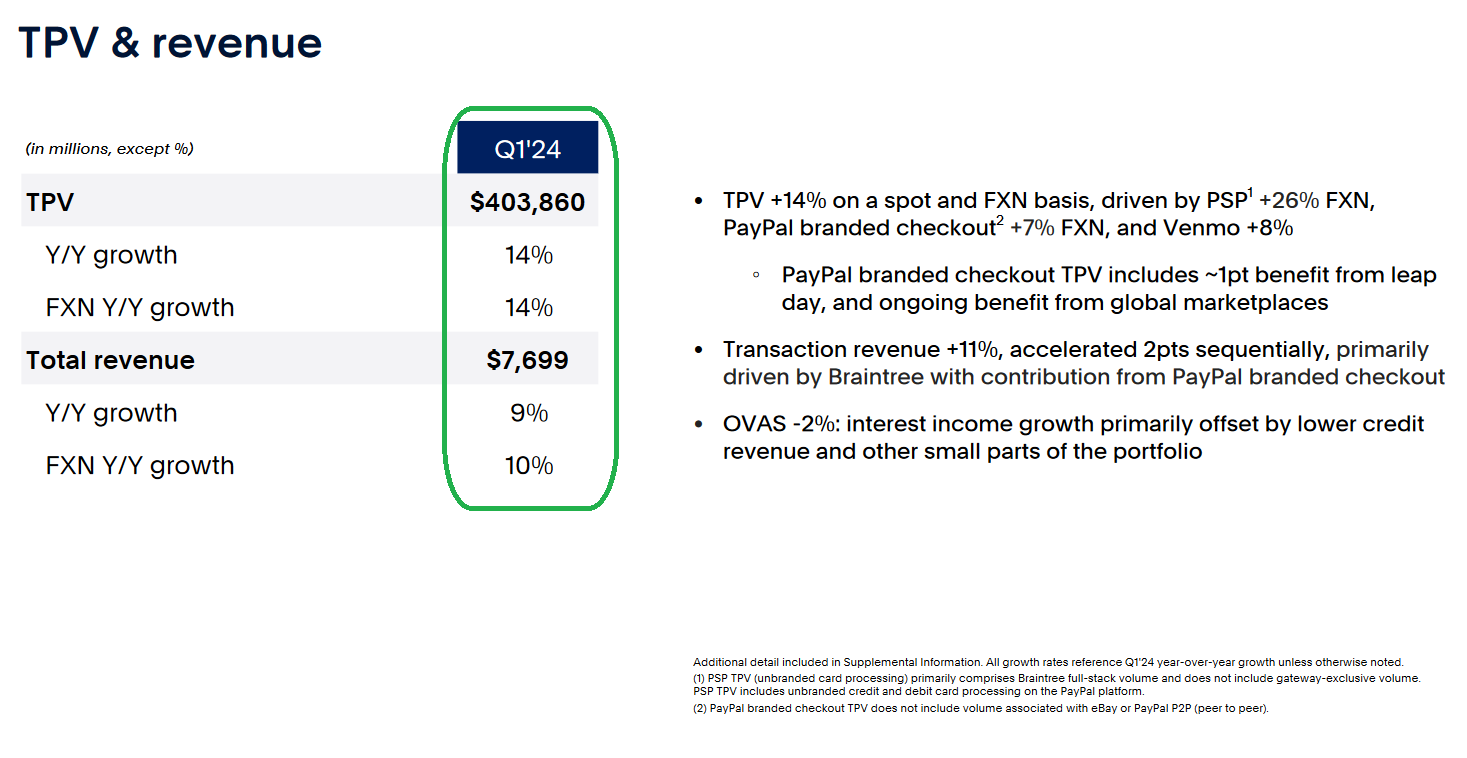

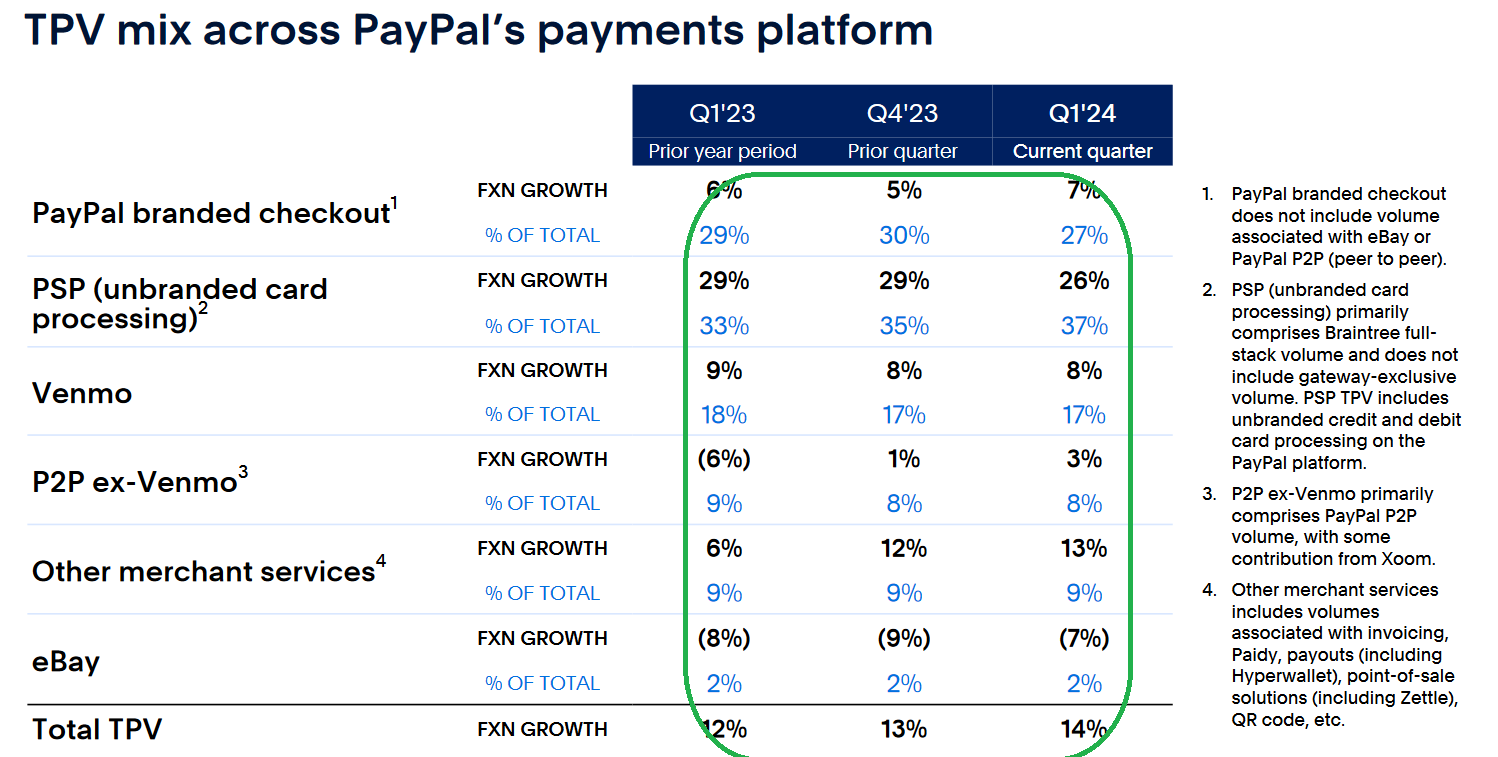

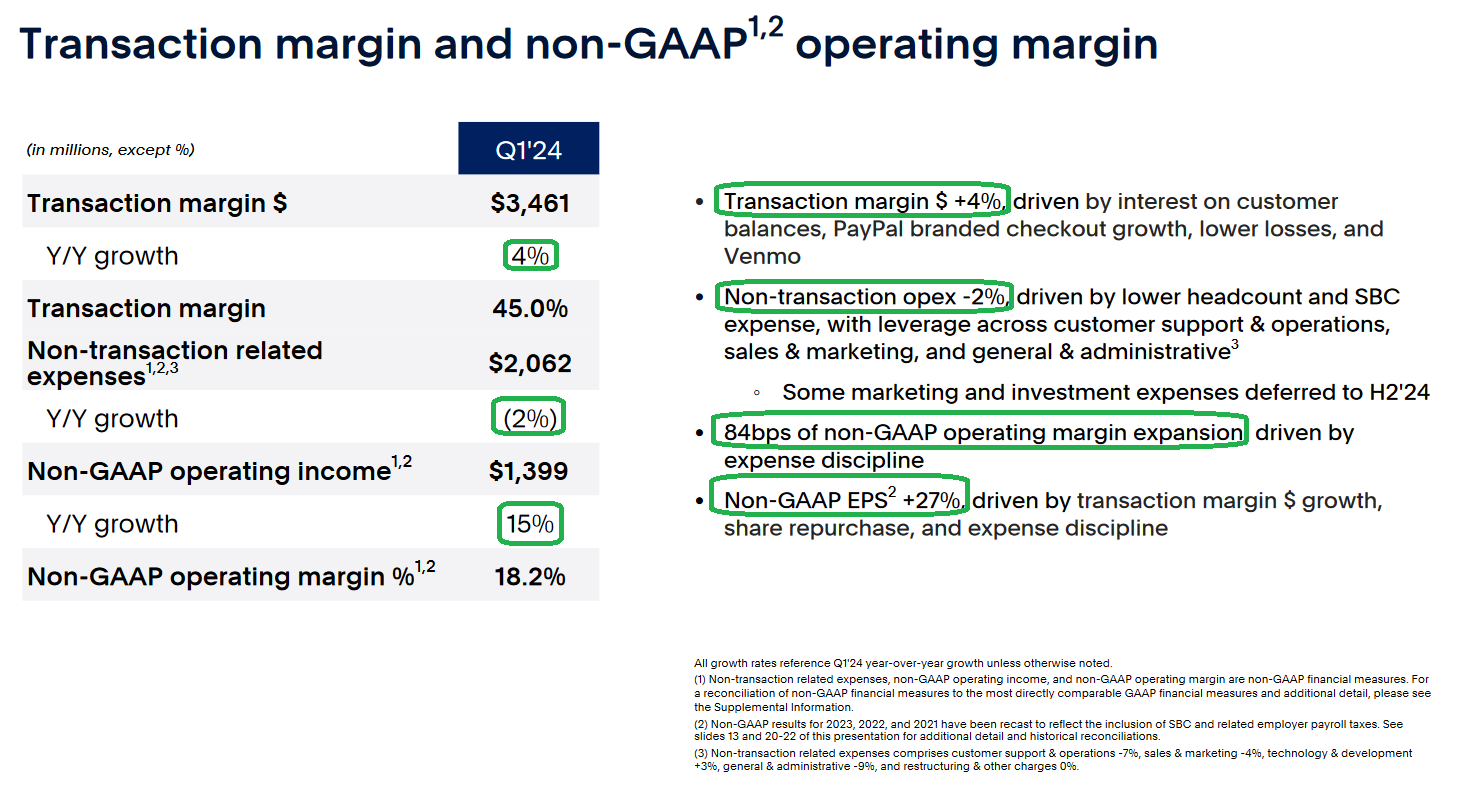

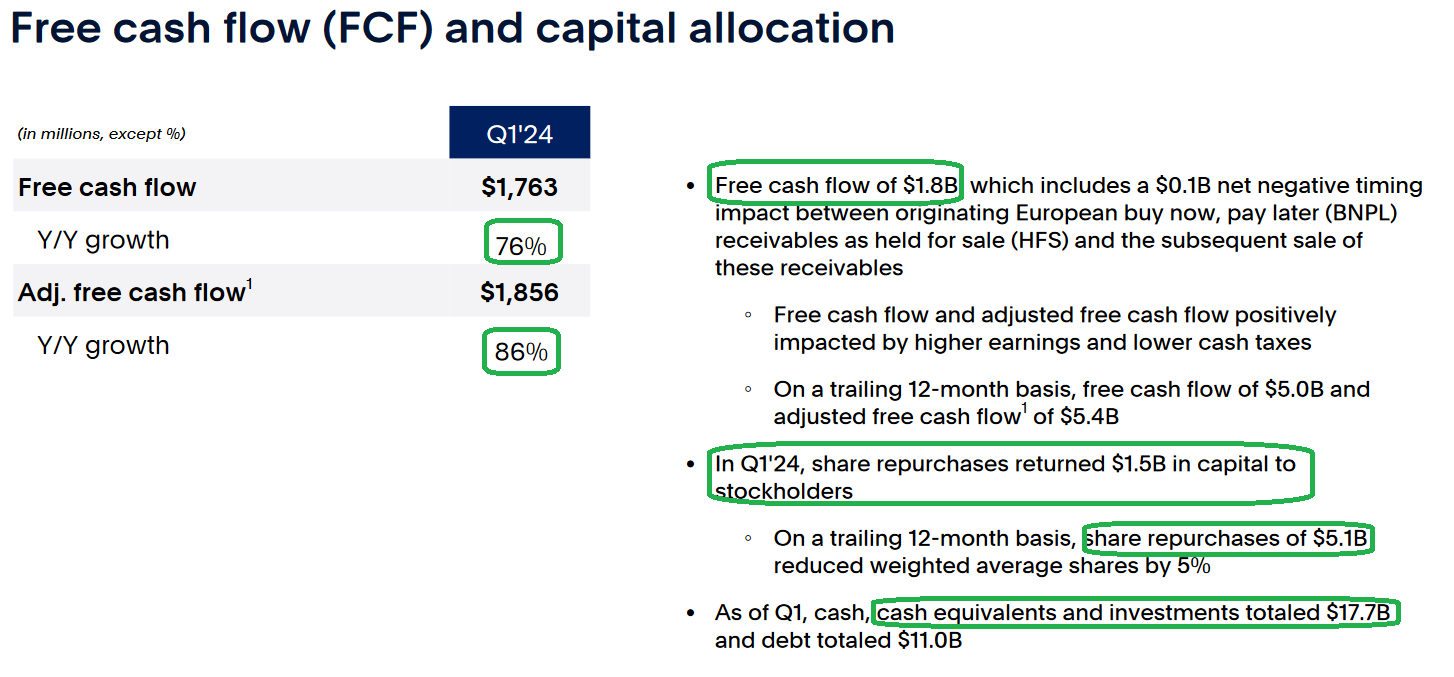

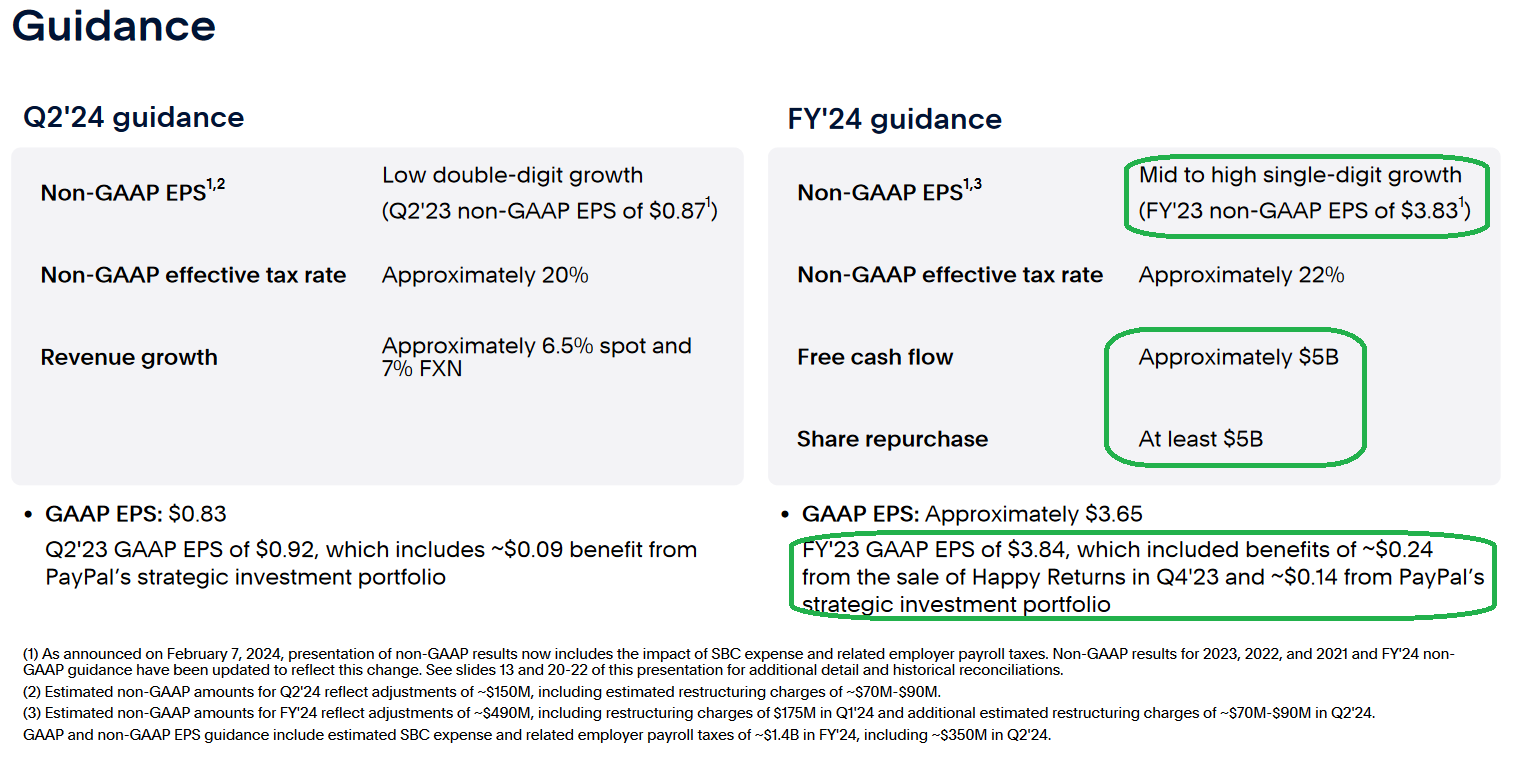

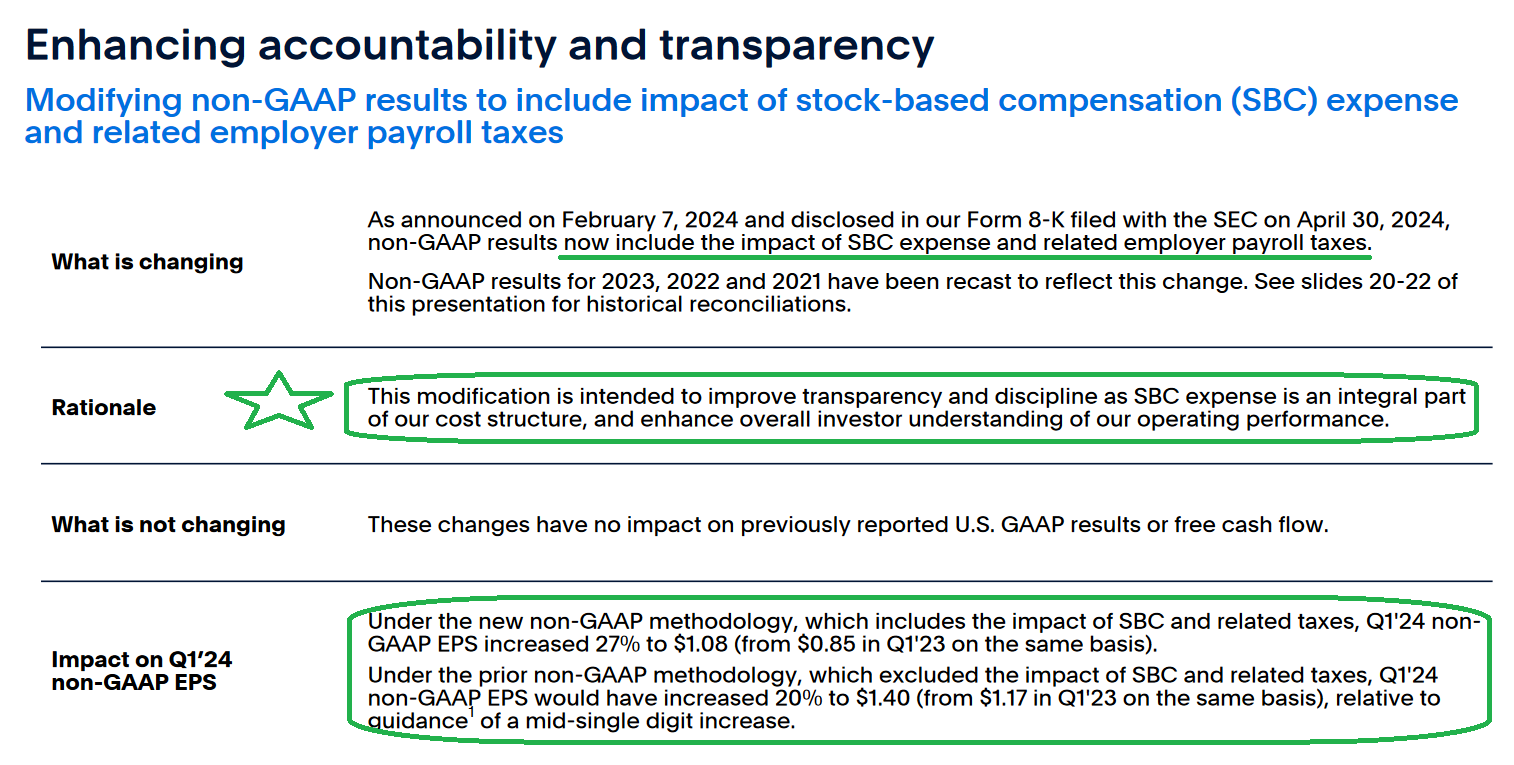

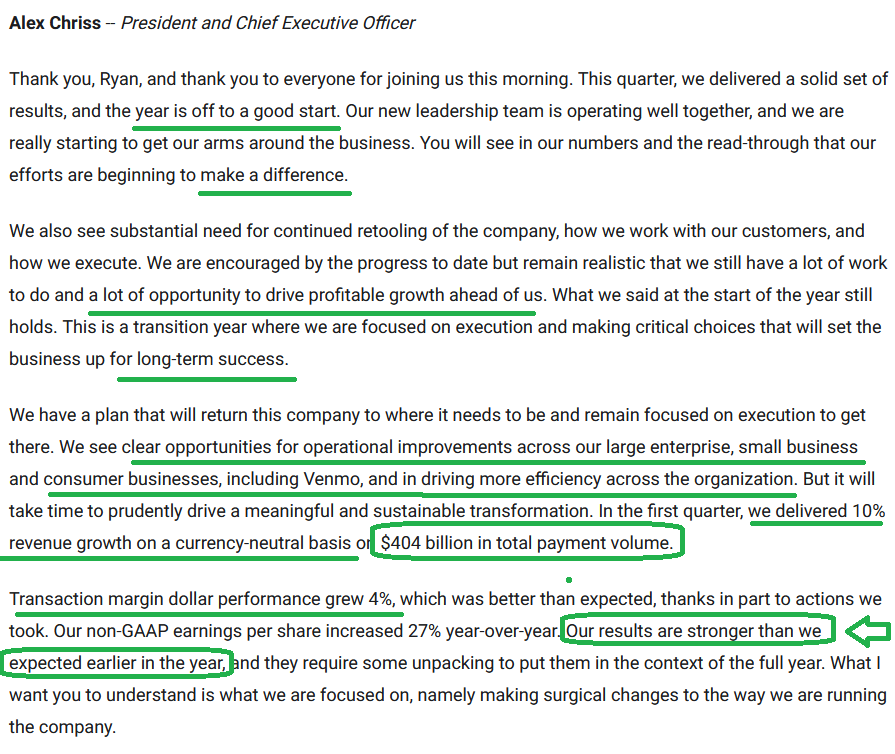

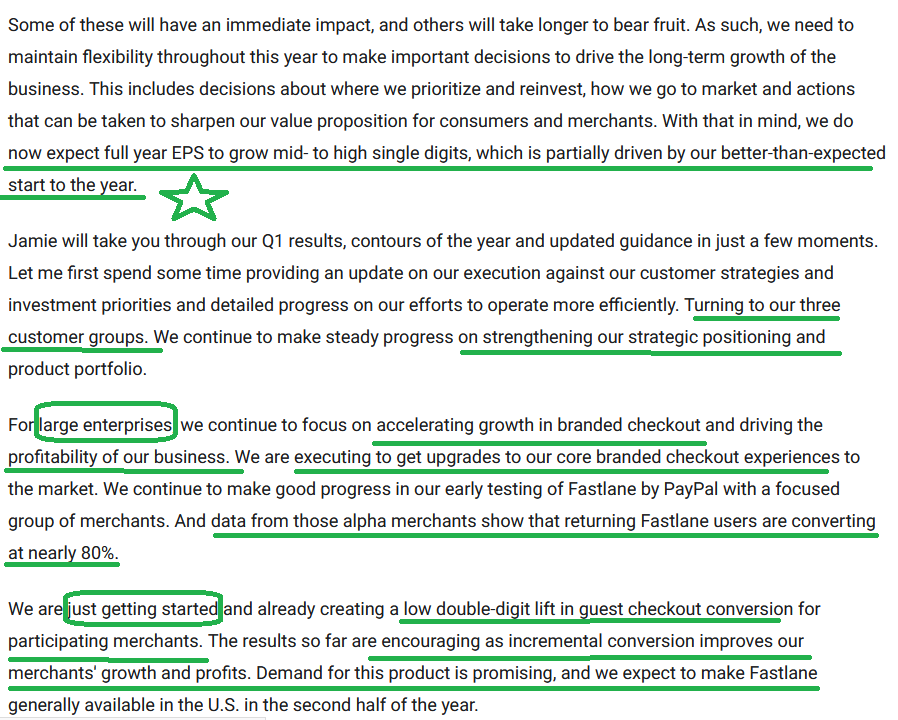

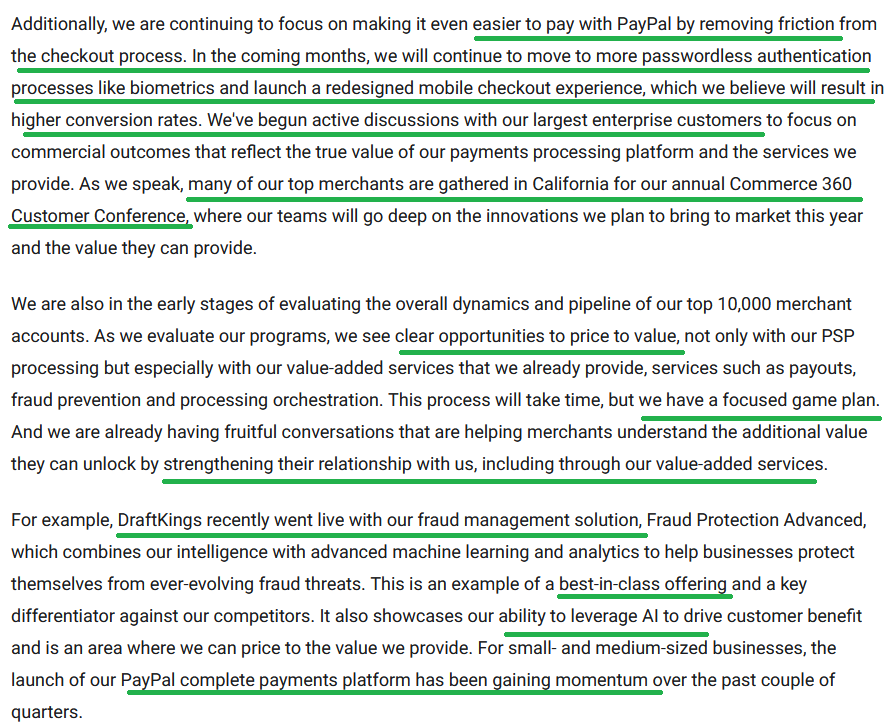

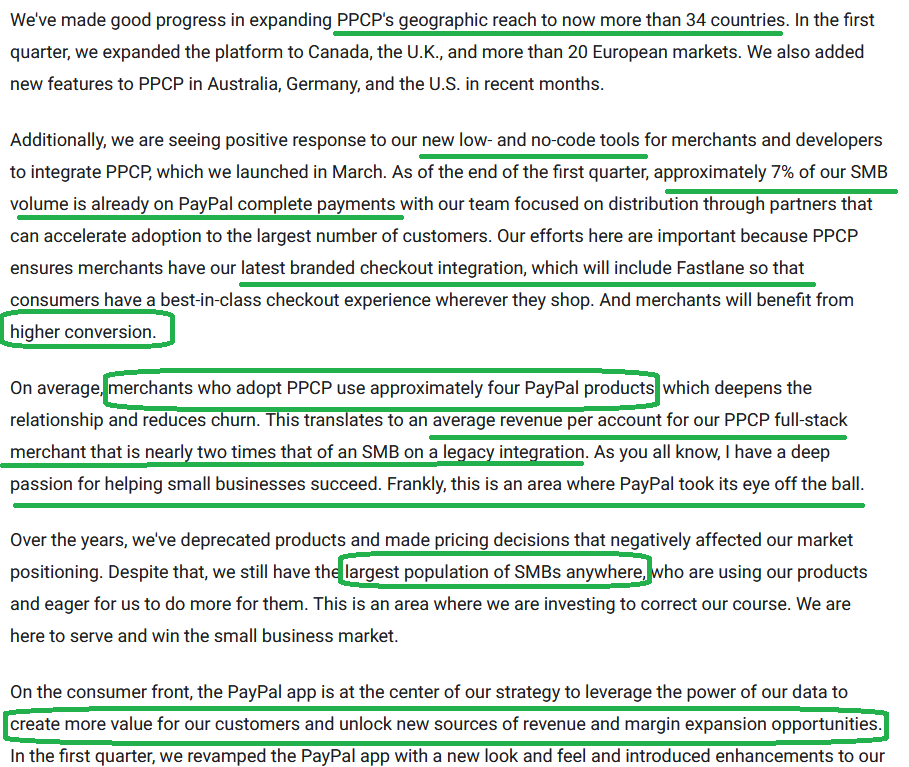

Each week we try to cover the earnings of one or more companies that we have discussed in previous podcast|videocast(s). PayPal reported earnings on Tuesday – and they were very good. New CEO Alex Chriss is executing on his plan to “shock the world” (over time) – just like he did at Intuit.

Now onto the shorter term view for the General Market:

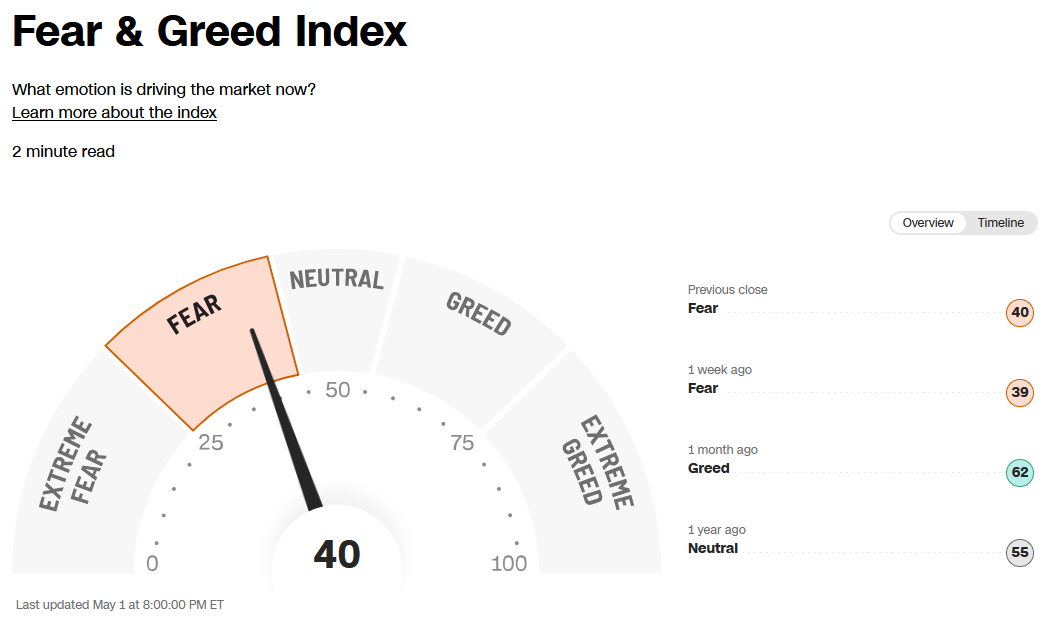

The CNN “Fear and Greed” flat-lined from 41 last week to 40 this week. You can learn how this indicator is calculated and how it works here: (Video Explanation)

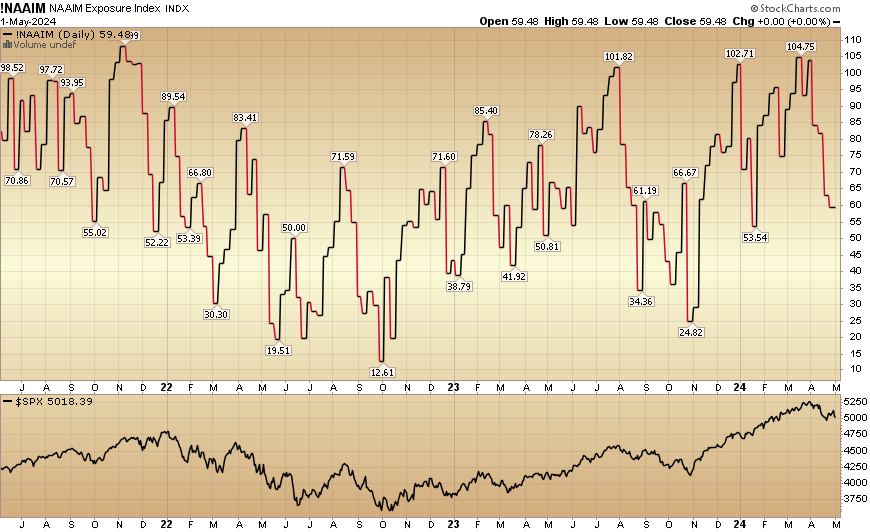

The NAAIM (National Association of Active Investment Managers Index) (Video Explanation) dropped down to 59.48% this week from 62.98% equity exposure last week.

Our podcast|videocast will be out later today. Each week, we have a segment called “Ask Me Anything (AMA)” where we answer questions sent in by our audience. If you have a question for this week’s episode, please send it in at the contact form here.