- GE Had a Surprise Profit. Cash Flow Was Great. (Barron’s)

- Greenlight Capital’s David Einhorn just called the top in stocks, and gave 10 reasons why tech is in a bubble (Business Insider)

- The Oil Industry Trend That Could Pump Stock Prices Higher (Barron’s)

- Wells Fargo Hits Lowest Since 2009 as Investors Await Strategy (Bloomberg)

- JPMorgan Asks “What If Trump Wins?” (ZeroHedge)

- Microsoft dips on weak revenue guidance (CNBC)

- Why Ray Dalio hates cash and bonds, and says the election won’t change his view on the economy (MarketWatch)

- Gundlach: Trump Will Win Next Week, And By 2027 “There Will Be Some Sort Of Revolution” (ZeroHedge)

- Battered Up. The Energy Report 10/28/2020 (Phil Flynn)

- Inventories Appear to Have Stopped Falling. That’s a Good Sign for Manufacturers and Jobs. (Barron’s)

- Alphabet’s ‘Legal Woes’ Overshadow Earnings (Barron’s)

- The ‘Recovery Has Been Faster Than Expected,’ Says an Industrial Components CEO (Barron’s)

- Microsoft Earnings Top Expectations, Driven By Cloud Computing (Barron’s)

- Stocks With Solid Balance Sheets Have Been 2020 Winners. They Will Be Again in 2021. (Barron’s)

- JPMorgan Says Trump Win Could Spur U.S. Stocks, Dent Asia Assets (Bloomberg)

- GE Jumps on Surprise Profit as CEO Larry Culp Sees Turnaround Accelerating (Bloomberg)

- The New Bugatti Bolide Is a Study in Speed Set for the Track (Bloomberg)

- Microsoft’s Search Revenue Downtrend Signals Trouble For Google Too (Benzinga)

- These Allocators Say They Are Sticking With Value Managers (Institutional Investor)

- Factories Hum to Keep Up With Auto, Housing Demand (Wall Street Journal)

- Apple develops alternative to Google search (Financial Times)

- Odds favor a post-election rally in stocks, even if the election is contested, Fundstrat’s Tom Lee says (Business Insider)

- Microsoft (MSFT) Shares Dip as Q1 Beats But Guidance Misses on Volatile Personal Computing Segment; Goldman, Others Raise Targets (StreetInsider)

- Economic data continues to beat expectations: Morning Brief (Yahoo! Finance)

- Why ExxonMobil is sticking with oil as rivals look to a greener future (Financial Times)

- The Fed has done nearly all it can do — and it’s now up to Congress to further aid the economy, ex-New York Fed president says (Business Insider)

- Investors should rotate away from tech stocks and into these 4 sectors before 2021 brings market relief from turmoil, a Wall Street investment chief says (Business Insider)

- Trump Weighs Executive Order to Show Support for Fracking (Wall Street Journal)

- Dodd-Frank Undermines the Fight Against Covid (Wall Street Journal)

- Raytheon Shrinks to Fit Jet Downturn (Wall Street Journal)

Hedge Fund Trade Tip (PIN) – Position Idea Notification

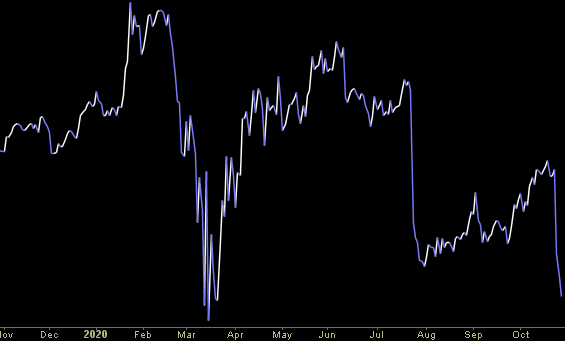

Unusual Options Activity – BP p.l.c. (BP)

Data Source: barchart

Today some institution/fund purchased 12,129 contracts of Dec $15 strike calls (or the right to buy 1,212,900 shares of BP p.l.c. (BP) at $39). The open interest was just 432 prior to this purchase. Continue reading “Unusual Options Activity – BP p.l.c. (BP)”

Where is money flowing today?

Hedge Fund Trade Tip (PIN) – Position Idea Notification

Tom Hayes – Quoted in Reuters article – 10/27/2020

Thanks to Medha Singh and Shivani Kumaresan for including me in their article on Reuters today. You can find it here:

Hedge Fund Trade Tip (PCN) – Position Completion Notification

Be in the know. 30 key reads for Tuesday…

- Opinion: Most investors now expect the U.S. stock market to crash like it did in October 1987 — why that’s good news (MarketWatch)

- The S&P 500 could jump 14% to 3,900 if Trump wins the election, JPMorgan says (Business Insider)

- Kazakhstan, Reversing Itself, Embraces ‘Borat’ as Very Nice (New York Times)

- Odeon’s Dick Bove Cites 3 Reasons for Bank Stock Rally, Which Should Continue (Street Insider)

- Chairman Plattner buys nearly $300 million in SAP stock (Street Insider)

- Covid condemns value investing to worst run in two centuries (Financial Times)

- SAP Casts a Cloud Over Software (Wall Street Journal)

- Cummins stock surges toward a record after profit and revenue beats, upbeat outlook (MarketWatch)

- Biogen (BIIB) Shares Looking ‘Interesting’ Into Big Week Ahead – Mizuho (Street Insider)

- Are the Polls Wrong Again? (LPL Financial)

- ‘Orderly’ Trump win most favorable outcome for equities, JPMorgan says (Reuters)

- Wells Fargo Considers Sale Of Corporate-Trust Unit, Student-Loan Portfolio: Report (Benzinga)

- All About Ant Group, the Next Big Tech I.P.O. (New York Times)

- 9 Promising Stocks From Emerging Markets (Barron’s)

- 10 High-Yielding Stocks That Should Please Investors Looking for Income (Barron’s)

- 3M’s Earnings Were a Positive Surprise. Investors Should Be Relieved. (Barron’s)

- BP Returns to Profit as Oil Demand and Prices Recover. (Barron’s)

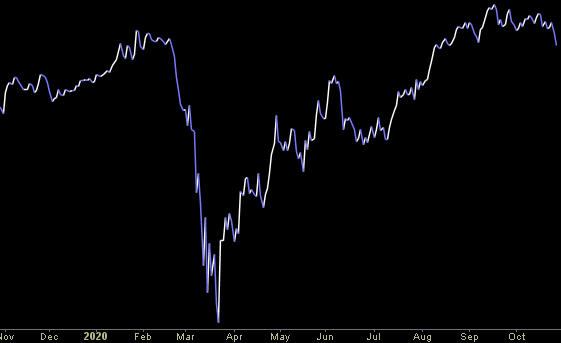

- Stimulus Hope On Hold Until After Election as Senate Leaves (Bloomberg)

- The Land Rover Defender Returns With a Nod to Silicon Valley (Bloomberg)

- The Market Is Betting Trump Will Lose the Election. Here’s the Playbook if It’s Wrong. (Barron’s)

- Why Amazon, Tesla, and other ‘Elite Eight’ mega-cap titans look to be in a bubble despite strong profit growth, according to one research firm (Business Insider)

- Stocks historically win in this election scenario (Fox Business)

- Early voting surge points to huge turnout in US election (Financial Times)

- The US shale industry’s top priority: win back Wall Street (Financial Times)

- Pfizer earnings report touts COVID vaccine progress in clinical trial (FoxBusiness)

- Pandemic Fatigue Is Real—And It’s Spreading (Wall Street Journal)

- Oxford, AstraZeneca Vaccine Shows Promising Immune Response in Older Adults (Wall Street Journal)

- American International Group to Divest Life-Insurance Business (Wall Street Journal)

- Corporate Defaults Slow, Lifting Debt Market (Wall Street Journal)

- 40 perfect Christmas gift ideas for men (USA Today)