- Ray Dalio Called This Wall Street Journal Story ‘Wrong.’ Dow Jones Stands by It. (Institutional Investor)

- Tesla’s Cybertruck Is a Killer Deal and Nobody Is Talking About It (Futurism)

- It May Finally Be Hedge Funds’ Time to Shine (Institutional Investor)

- Move Over Viagra Ads, Here Come the Financial Advisers ()

- CNBC’s full interview with Liberty Media Chairman John Malone (CNBC)

- Amazon files suit protesting Microsoft’s JEDI cloud contract with Pentagon (CNBC)

- ‘Wizard of Oz’ Greg Coffey’s hedge fund has reportedly surged 29% this year, demolishing the broader market (Business Insider)

- Pfizer’s New Strategy Makes It Worth Another Look (Barron’s)

- Why the 1,973-HP, All-Electric Lotus Evija Is Among the World’s Most Anticipated Hypercars (Maxim)

- I rode inside Tesla’s polarizing Cybertruck (engadget)

- America’s Top 50 Givers (Forbes)

- ECRI Weekly Leading Index Update (Advisor Perspectives)

HFT VideoCast – Stock Market Commentary and Weekly Recap – Episode 4

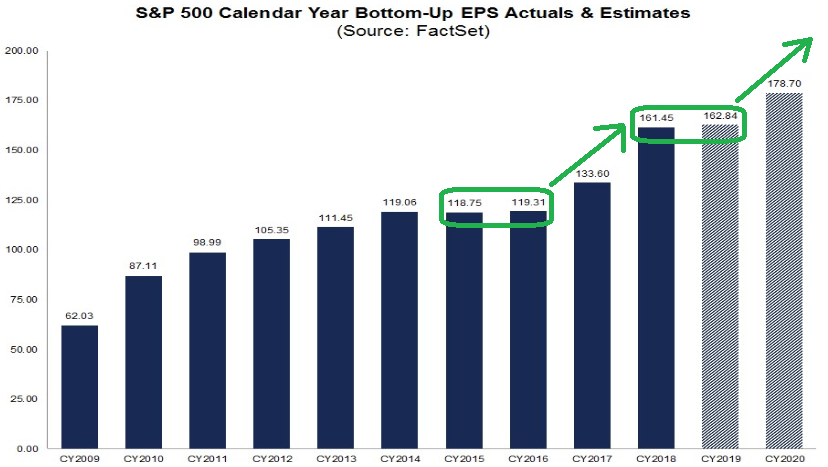

2020 Earnings Estimates Holding Strong

Data Source: Factset

While 2020 Earnings estimates for the S&P 500 held steady at $178.70 this week, the growth rate actually improved to 9.9% from 9.7% – due to a modest take down in 2019 results. Continue reading “2020 Earnings Estimates Holding Strong”

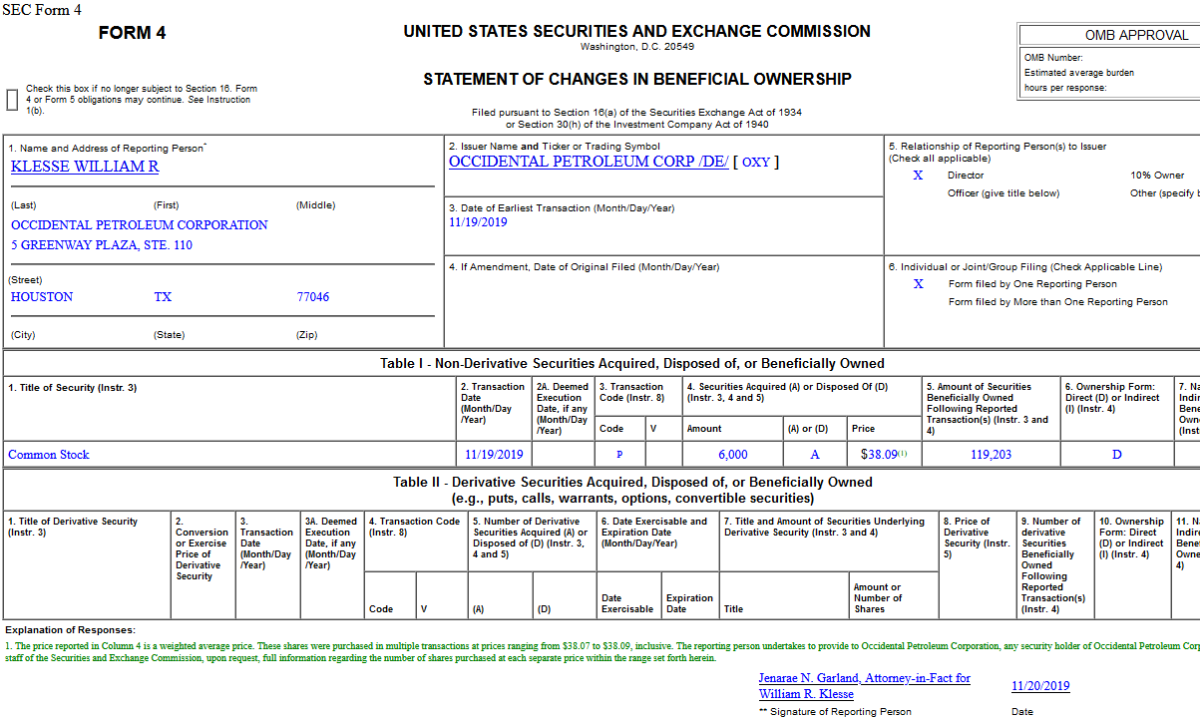

Unusual Options Activity – Occidental Petroleum Corporation (OXY)

Data Source: barchart

Today some institution/fund purchased 1,180 contracts of Dec 27 $43 strike calls (or the right to buy 118,000 shares of Occidental Petroleum Corporation (OXY) at $43). The open interest was just 366 prior to this purchase. Continue reading “Unusual Options Activity – Occidental Petroleum Corporation (OXY)”

Where is money flowing today?

Be in the know. 9 key reads for Friday…

- Tesla Revealed Its ‘Cyberpunk’ Pickup Truck. What You Need to Know. (MarketWatch)

- Bridgewater Associates bets over $1 billion on market drop: WSJ (Reuters)

- ECB chief Christine Lagarde pushes EU Leaders for Fiscal Stimulus (CNBC)

- How the Discount Window Became a Pain in the Repo Market (Wall Street Journal)

- The TikTok “Git Up” Stock Market (and Sentiment Results) (Hedge Fund Tips)

- Hennessy Funds Founder Says Bull Market Won’t End Anytime Soon (Bloomberg)

- Hedgies Take Sides in the Icahn-Buffett-Occidental Battle (Institutional Investor)

- Match.com for Hedge Funds or Low-Rent Telemarketing Service? Cold-Calling Firm Murano Connect Has Many Fans, but Just as Many Detractors. (Institutional Investor)

- Trump: US, China ‘very close’ to trade deal (Fox Business)

Unusual Options Activity – Western Digital Corporation (WDC)

Data Source: barchart

Today some institution/fund purchased 541 contracts of April $52.5 strike calls (or the right to buy 54,100 shares of Western Digital Corporation (WDC) at $52.5). The open interest was just 189 prior to this purchase. Continue reading “Unusual Options Activity – Western Digital Corporation (WDC)”

Where is money flowing today?

Insider Buying in Occidental Petroleum Corporation (OXY)

Be in the know. 12 key reads for Thursday…

- Bearish Oil-Drilling Indicator Is Full of Holes (Wall Street Journal)

- China says it will strive to reach ‘phase one’ trade deal with U.S (Reuters)

- How to Play Media Stocks for the Coming ‘Streaming Wars’ (Barron’s)

- Charles Schwab is in talks to buy TD Ameritrade, source says (CNBC)

- A legendary trader who made billions betting on wars, other macro events is reportedly closing fund (CNBC)

- How a Top Stock Fund Finds Winning Picks Across the Globe (Barron’s)

- Nobel Laureate Robert Shiller on Trade Wars and the U.S. Economy (Barron’s)

- Shinzo Abe’s Record and the Continuing Revolution in Japanese Stocks (Wall Street Journal)

- Oil rises on reports that OPEC might extend cuts, U.S.-China talks to continue (StreetInsider.com)

- Impeachment Is Just Noise to Wall Street Inured to Trump Drama (Bloomberg)

- The TikTok “Git Up” Stock Market (and Sentiment Results) (ZeroHedge)

- How Trading Stocks Gave This CEO His $10 Billion Idea (Investor’s Business Daily)