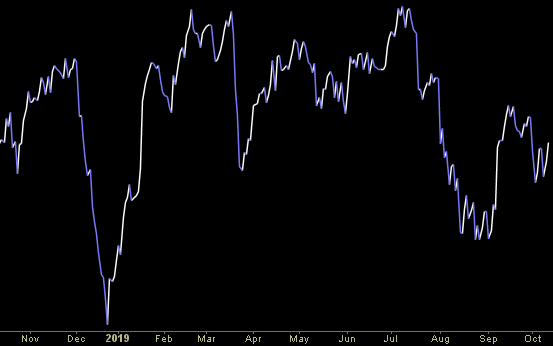

Data Source: Finviz

Hedge Fund Trade Tip (PMN) – Position Management Notification

Hedge Fund Trade Tip (PCN) – Position Completion Notification

Be in the know. 10 key reads for Friday…

- Opinion: These battered biotech stocks are now buying opportunities as Elizabeth Warren climbs in the polls (MarketWatch)

- What May Have Driven David Tepper’s Big Decision (Institutional Investor)

- Hedge Fund and Insider Trading News: Kyle Bass, Warren Buffett, Silver Point Capital, Kraft Heinz Co (KHC), and More (Insider Monkey)

- Jeff Bezos’s Master Plan (The Atlantic)

- SAP Stock Jumps After Strong Earnings Pre-Announcement, CEO Succession (Barron’s)

- Aussie dollar up on hopes of U.S.-China trade deal, sterling surges on Brexit deal hopes (Street Insider)

- For hedge funds, software-as-a-service stocks are the new FAANG (MarketWatch)

- 5 Raymond James Analyst Favorite Picks With Huge Implied Upside (24/7 Wall Street)

- Here’s how the Fed’s balance sheet expansion that’s got the market excited is going to work (CNBC)

- Trump just joined Amazon’s video game streaming site Twitch, even though he has major beef with Jeff Bezos (Business Insider)

Unusual Options Activity – Schlumberger Limited (SLB)

Today some institution/fund purchased 6,005 contracts of June $37.50 strike calls (or the right to buy 600,500 shares of Schlumberger Limited (SLB) at $37.5). The open interest was just 615 prior to this purchase. Continue reading “Unusual Options Activity – Schlumberger Limited (SLB)”

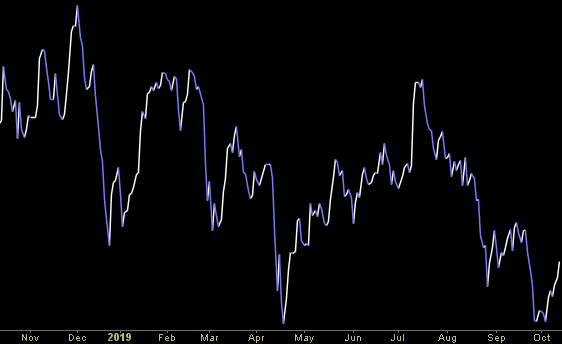

Where is money flowing today?

Hedge Fund Trade Tip (PCN) – Position Completion Notification

Be in the know. 10 key reads for Thursday…

- U.S. Weighs Currency Pact With China as Part of Partial Deal (Bloomberg)

- Fed’s Kaplan has ‘open mind’ on rate cuts, watching U.S. yield curve (Reuters)

- Hedge Fund and Insider Trading News: Boaz Weinstein, Eddie Lampert, Ray Dalio, AQR Capital Management, Monolithic Power Systems, Inc. (MPWR), Catalent Inc (CTLT), and More (Insider Monkey)

- No Inflation: US consumer prices were unchanged in September, the weakest reading since January (CNBC)

- How people vote in 2020 will come down to the economy (New York Post)

- The Fed chose ‘ounce of prevention’ with rate cut. Expect more. (Barron’s)

- Fed Officials Voice Concern About Slowdown’s Effect on Hiring (New York Times)

- Stock Traders Pay Biggest Premium to Shun Volatility in 41 Years (Bloomberg)

- From summer janitor to CEO of Disney: What fueled Bob Iger’s rise to the top (CNBC)

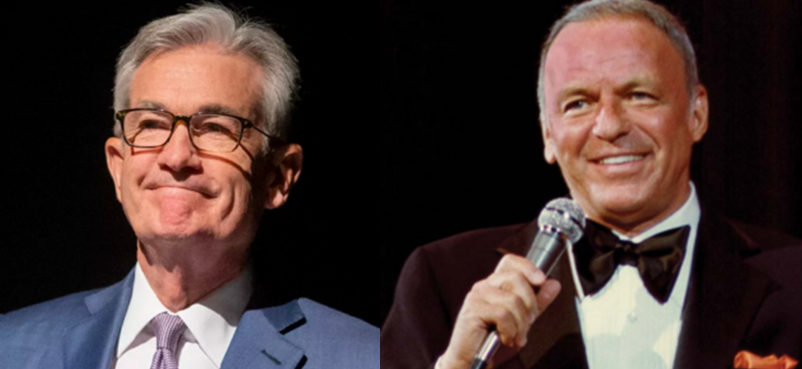

- Frank & Jerome (The Chairmen) agree: The Best is Yet to Come (AAII Sentiment Results) (Hedge Fund Tips)

Frank & Jerome (The Chairmen) agree: The Best is Yet to Come (AAII Sentiment Results)

Ol’ blue eyes recorded the song “The Best is Yet to Come” in 1964. What is interesting about both the song and the year – is that the expansion had been going for 11 years at that point (from 1953). How much further could it run? Continue reading “Frank & Jerome (The Chairmen) agree: The Best is Yet to Come (AAII Sentiment Results)”

Unusual Options Activity – 3M Company (MMM)

Today some institution/fund purchased 1,105 contracts of January $160 strike calls (or the right to buy 110,500 shares of 3M Company (MMM) at $160). The open interest was 655 prior to this purchase. Continue reading “Unusual Options Activity – 3M Company (MMM)”