Ol’ blue eyes recorded the song “The Best is Yet to Come” in 1964. What is interesting about both the song and the year – is that the expansion had been going for 11 years at that point (from 1953). How much further could it run? Answer: It ran another 4 years. In July, we wrote about the 3 historical periods – in the last 100 years – that had periods of extended expansions after periods of prolonged consolidations. You can read this historic account here:

As for Frank and his magical lyrics (composed by Cy Coleman years earlier in 1959):

You came along and everything started’in to hum

Still it’s a real good bet

The best is yet to come…

Who came along? Well, your rich Uncle Jerome (Powell) came along:

He’s back from a two year vacation. The “vacation” was extended when he got lost last December on a Thomas Cook travel vacation tour (Reference For non-Brits)! After months in the wilderness, he’s found his way home and he feels so bad that he’s bearing unlimited gifts to the tune of $200B in balance sheet expansion in the past 5 weeks (and up to $75B/day until November 4). He’s finally doing the right thing (which I’m certain was always his intent – but now is reflected in his execution)…

We wrote about this on Monday (before his speech on Tuesday), when he whispered these additional sweet nothings into our ear, “the time is now upon us to expand the balance sheet.”

How does this line up with earnings and estimates?

CY2020 estimates for the S&P 500 are still at +10.5% and double digits for the Euro Stoxx 600 as well. If we get half of that, the renewed earnings growth plus lowered discount rate = multiple expansion. We wrote about this on Friday and will follow up with any earnings updates tomorrow:

So where does that leave us today?

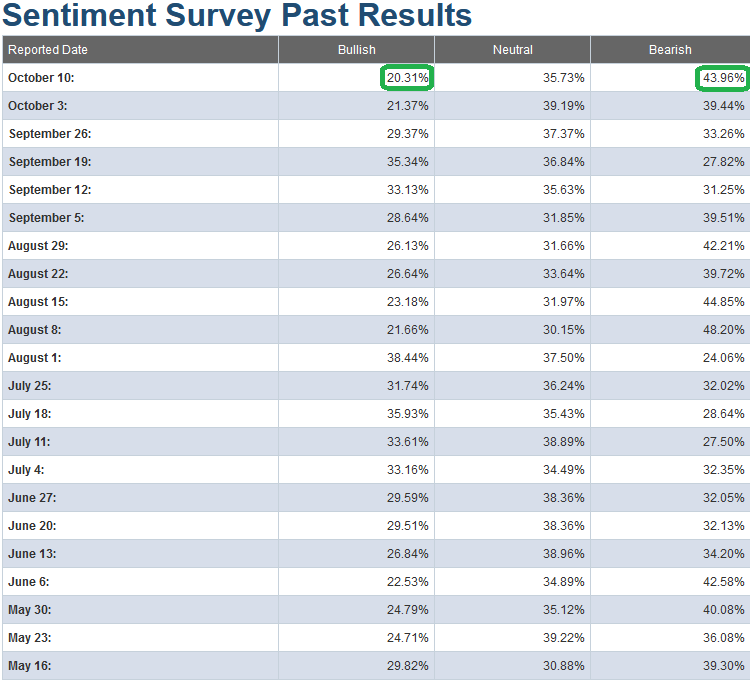

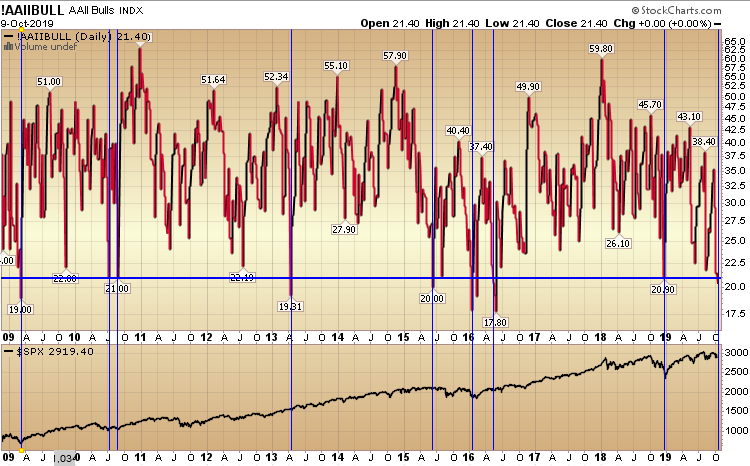

Last week the AAII Sentiment Survey results showed a complete washout. Bullish percent plummeted to 21.37% (a level historically associated with selling exhaustion and market reversals). Bearish Sentiment rocketed to 39.44% – which is historically high but not as extreme as the drop in Bullish percent.

This week, Bullish Sentiment weakened further to 20.31% and Bearish Sentiment finally got up to an extreme level of 43.96% – which usually precedes reversals (see blue vertical lines below marking those instances when bullish sentiment dropped below 21% and what happened to the S&P 500 at the bottom).

Click Here To Read Our Previous Articles On Sentiment

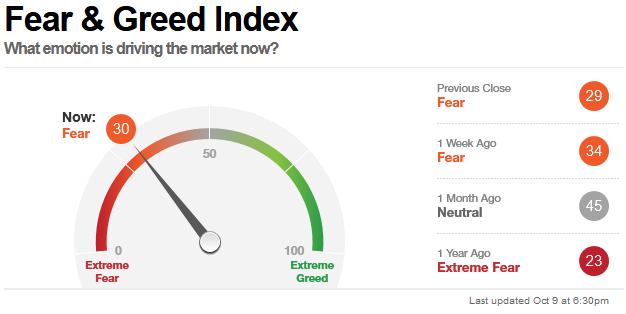

The CNN Fear & Greed Index is down 4 points week on week (3o this week versus 34 last week) confirming the continued fear and skepticism:

The fear and greed index is a compilation of 7 technical indicators that measure extremes in sentiment and positioning. It confirms the fear and pessimism in the market that often precedes reversals (Video Explanation Here).

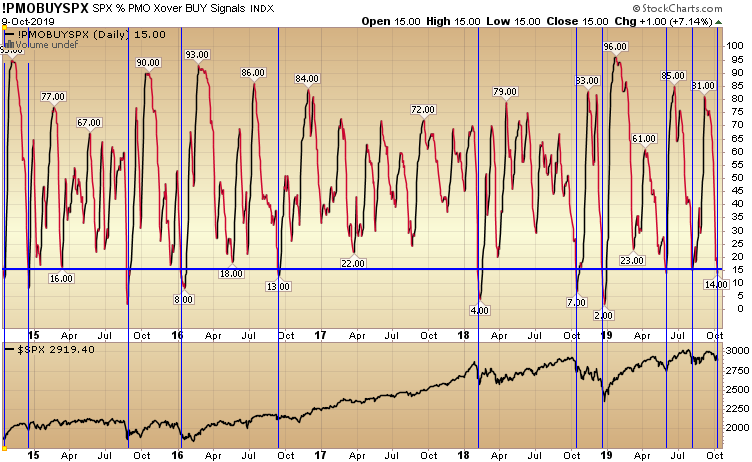

Also confirming the favorable odds of being a buyer versus a seller of equities at these levels is an indicator we covered in our “Indicator of the Day” video on August 6 (PMO Buy SPX Explained). As you can see in the chart below, in the past 10 out of 11 times (exception last October), it has paid to be a buyer of stocks when this indicator dropped to 15%:

We cover this and other indicators in our daily “Indicator of the Day” videos – which you can view here:

Applied Market Indicator of the Day Video Library

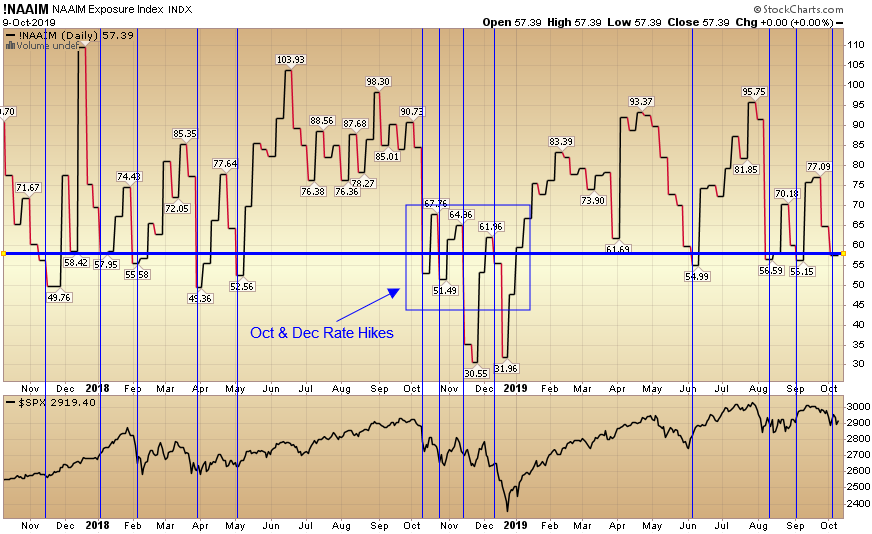

Finally, we have the National Association of Active Investment Managers (NAAIM) Equity Exposure Index (Video Explanation Here). Managers are historically underweight equities as of this week (below 60%).

With the exception of last October-December when the Fed was tightening aggressively into slowing growth, it has paid to take the other side of the trade when active managers are off-sides and underweight equities.

This means if there is any constructive outcome to China talks, the “catch up” play into year end could be violent to the upside as managers chase and lever up to catch their benchmarks.

Here is the irony we face today: Last December, Chair Powell was blamed for lurching the markets into the abyss. He quickly realized the error of his ways and reversed course – learning from a mistake. It is the sign of a very skilled, intelligent and experienced practitioner. Mistakes are fine, digging your heels in is not.

Now the ball is in the Administration’s court. Chair Powell has done his part to reverse course and provide the liquidity required to extend the expansion – in spite of global headwinds. Will the Administration create another December 2018 (by holding out for a BIG all-encompassing deal right now), OR have a constructive conclusion to this week’s talks (resulting in a delay until after the election, or a short term “mini-deal”) that leads to a possible melt UP into year end?

Chair Powell has now done his part to set the table (and will likely finish off with a final 25bps cut before year-end to match market expectations). It’s up to the Administration now, and everyone knows it. We’re rooting for you…

We may have some short term turbulence to overcome, but just as Ol’ Blue eyes was right in 1964 (there was some more gas in the tank), Chair Powell and The Administration have the opportunity to realize the same outcome: The Best is Yet to Come…