- How Private Sector Balance Sheets Changed Recessions (Podcast) (Bloomberg)

- Theodore Roosevelt: A Timeline of the 26th President’s Life (Mental Floss)

- How Biotech and Big Pharma Have Upside Heading Into Earnings ()

- Stocks ‘no brainer’ over bonds (Fox Business)

- How Non-Profit Hospitals Are Driving Up The Cost Of Health Care (NPR Planet Money)

- How His Obscure Tax Break Became a $60B Venture Fund for Low-Income America (OZY)

- ConocoPhillips Stock Looks Cheap After a Selloff (Barron’s)

- What’s Next After the U.K. Parliament’s Non-Vote on Brexit (Barron’s)

- Can ‘Modicare’ Save Sick Indians From Poverty? (OZY)

- The Downside of Reusable Bags More People Need to Be Thinking About (Reader’s Digest)

Be in the know. 20 key reads for Saturday…

- Hedge Fund and Insider Trading News: James Dondero, Eddie Lampert, Chris Rokos, ExodusPoint Capital, SkyBridge Capital, Nektar Therapeutics Inc. (NKTR), Oshkosh Corp (OSK), and More (Insider Monkey)

- Wealth Taxes Don’t Work. Here’s Why. (Barron’s)

- How to pretend to understand the Brexit deal (Barron’s)

- Meet the Buffett bot: quant fund tries to crack the ‘value’ code (Financial Times)

- China’s GDP growth grinds to near 30-year low as tariffs hit production (New York Post)

- Why Popular Investments Are Doomed to Underperform (Institutional Investor)

- Howard Marks Latest Memo – Mysterious (OakTree)

- Invest like Warren Buffett — Is this value’s time to finally shine? (CNN)

- Wall Street’s top hedge fund managers reveal their best ideas (CNBC)

- ‘Feel the Force’: Gut Instinct, Not Data, Is the Thing (Wall Street Journal)

- Bill Miller 3Q 2019 Market Letter (Miller Value)

- Buy in October, and Get Yourself Sober (Almanac Trader)

- Google affiliate begins drone deliveries in Virginia town (AP)

- Mark Zuckerberg Takes Hard Stance Against China And Censorship In Georgetown University Speech (Forbes)

- Trump hopes U.S.-China trade deal will be signed by middle of November (Reuters)

- Empire State Manufacturing Survey: Slight Growth in October (Advisor Perspectives)

- Norway Is a Green Leader. It’s Also Drilling More Oil Wells Than Ever (Fortune)

- Lavender Fields, Bouillabaisse, and Calanques: The 4-Day Weekend in Marseille (Men’s Journal)

- List Of Top 10 Best Beaches In The World (ValueWalk)

- Here They Are: The 20 Best Places To Visit In 2020 (Forbes)

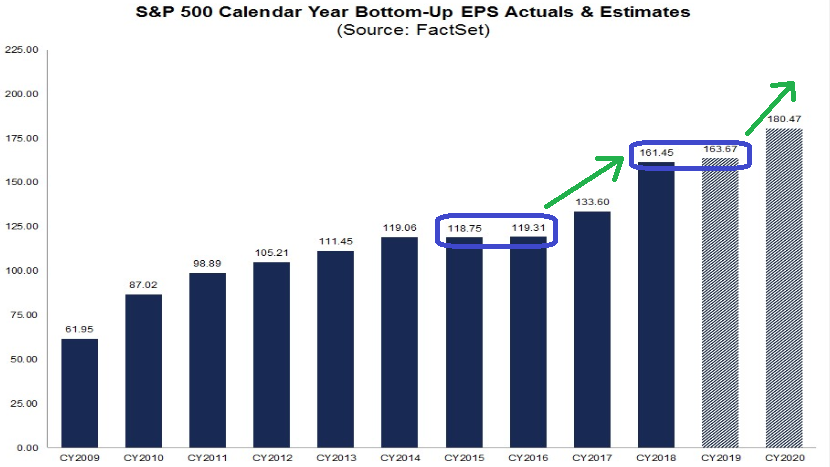

Earnings: Better Than Expected…

2020 S&P 500 Earnings Estimates are still holding strong at $180.47 – or a jump of 10.4% over 2019. This will be our first jump in Earnings growth since the 2016-2017 period. Continue reading “Earnings: Better Than Expected…”

Unusual Options Activity – International Business Machines Corporation (IBM)

Data Source: barchart

Today some institution/fund purchased 1,246 contracts of April $135 strike calls (or the right to buy 124,600 shares of International Business Machines Corporation (IBM) at $135). The open interest was just 113 prior to this purchase. Continue reading “Unusual Options Activity – International Business Machines Corporation (IBM)”

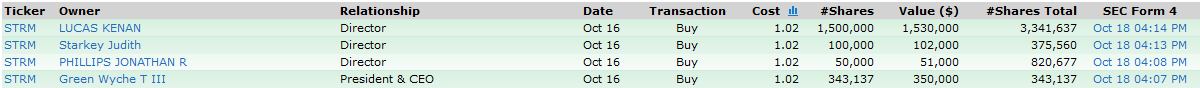

Insider Buying in Streamline Health Solutions, Inc. (STRM)

Hedge Fund Trade Tip (PCN) – Position Completion Notification

Hedge Fund Trade Tip (PCN) – Position Completion Notification

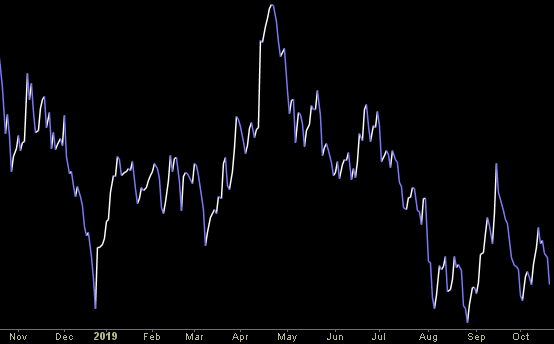

Where is money flowing today?

Hedge Fund Trade Tip (PIN) – Position Idea Notification

Be in the know. 9 key reads for Friday…

- Why Mega-Cap Dividend Energy Stocks May Be the Best 2020 Bet (24/7 Wall Street)

- 4 Biotech Stocks That Are Set to Rally, Analyst Says (Barron’s)

- Hedge Fund and Insider Trading News: Ken Fisher, D.E. Shaw, Dalton Investments, Safehold Inc (SAFE), ResMed Inc. (RMD), and More (Insider Monkey)

- A Fed recession indicator has lit up. It’s not the only one to watch. (Barron’s)

- Saudi Aramco Delays Launch of World’s Largest IPO (Wall Street Journal)

- With Advice Like This, Gilead Can’t Go Wrong (Wall Street Journal)

- Schlumberger profit beats as international gains offset weak North America (Reuters)

- This Robotic Surgery Giant Just Crushed Third-Quarter Earnings Forecasts (Investors)

- The Taylor Swift, “Shake It Off” Market…(AAII Sentiment Survey) (ZeroHedge)