Today some institution/fund purchased 1,307 contracts of Jan 2021 $23 strike calls (or the right to buy 130,700 shares of The Williams Companies, Inc. (WMB) at $23). The open interest was just 152 prior to this purchase. Continue reading “Unusual Options Activity – The Williams Companies, Inc. (WMB)”

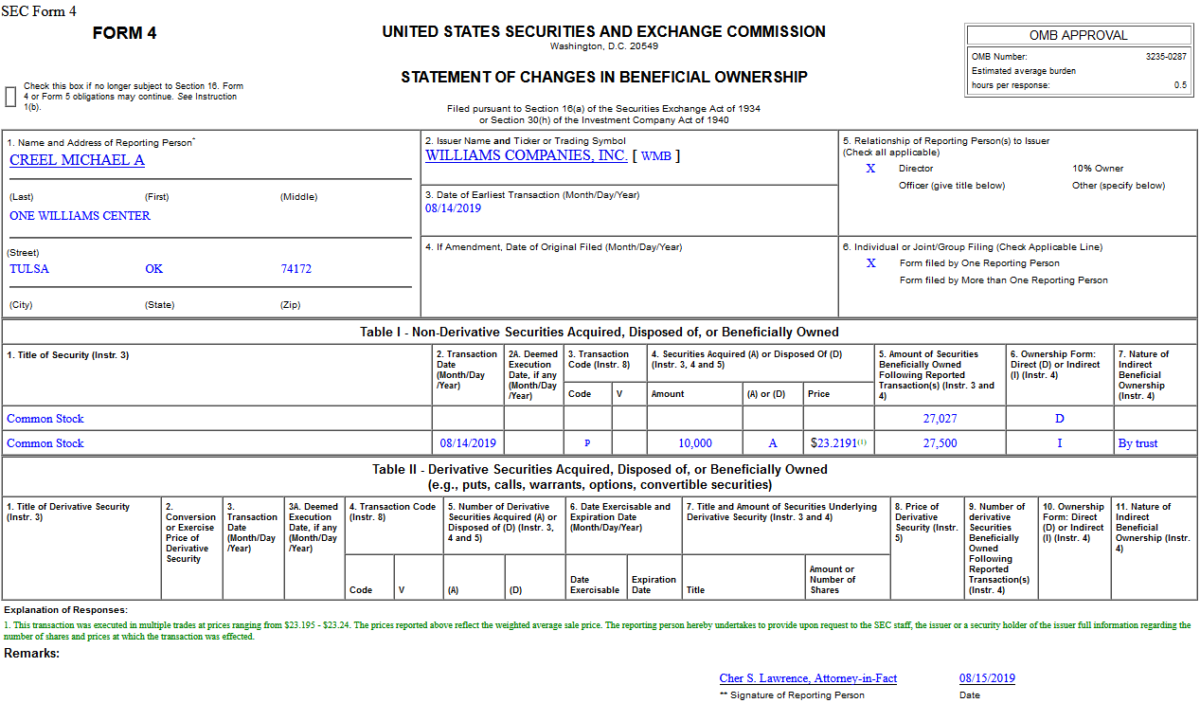

Insider Buying in The Williams Companies, Inc. (WMB)

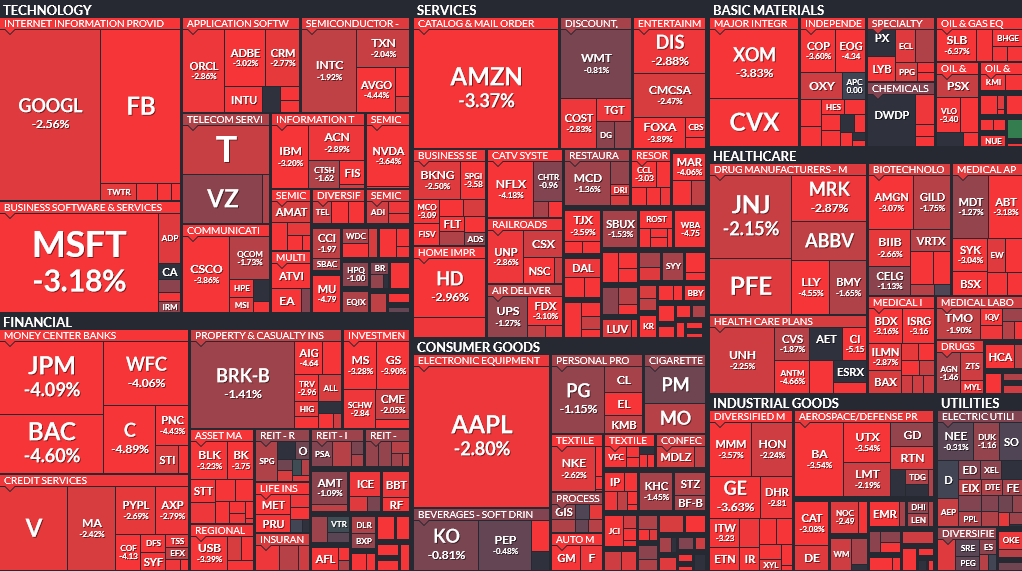

Where is money flowing today?

Hedge Fund Trade Tip (PIN) – Position Idea Notification

Be in the know. 10 key reads for Thursday…

- Someone’s Betting Big on an S&P 500 Rebound as Sell-Off Worsens (Bloomberg)

- Worried? History Says Don’t Be — Yet (Barron’s)

- Bill Ackman Is Betting Big on Berkshire Hathaway (Barron’s)

- The case for higher oil prices (Barron’s)

- President Donald Trump tweeted on Wednesday that his Chinese counterpart Xi Jinping was a “great leader” and posed setting up a “personal meeting” to solve escalating protests in Hong Kong. (Business Insider)

- After the yield curve inverts — here’s how the stock market tends to perform since 1978 (MarketWatch)

- Lumber Liquidators: Get in on the Ground Floor (Wall Street Journal)

- U.S. retail sales surge in July in boost to economy (Reuters)

- Stocks set for strong open after China says it hopes to meet halfway on trade issues (CNBC)

- Warren Buffett Is a Huge Backer of U.S. Banks (Wall Street Journal)

AAII Sentiment Survey Results: As Good As It Gets…

Last week we laid out the case that the AAII Sentiment Survey results were as stretched to the downside as they were a week or so before the bottom in December – and that while there could be some residual market/headline risk in the coming week – the bottom in sentiment was in (i.e. it was about as bearish as you could get – and a good environment to start to buy the fear even if you would take a bit of short term pain for intermediate term gain). Continue reading “AAII Sentiment Survey Results: As Good As It Gets…”

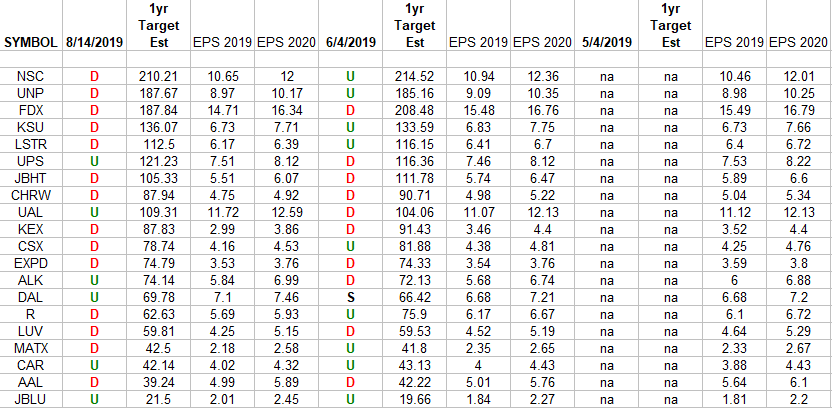

Transports Earnings Estimates/Revisions

In the spreadsheet above I have tracked the earnings estimates for the Transportation Sector ETF (IYT) holdings. Continue reading “Transports Earnings Estimates/Revisions”

Unusual Options Activity – Cisco Systems, Inc. (CSCO)

Today some institution/fund purchased 1,701 contracts of Mar 2020 $52.5 strike calls (or the right to buy 170,100 shares of Cisco Systems, Inc. (CSCO) at $52.5). The open interest was just 466 prior to this purchase. Continue reading “Unusual Options Activity – Cisco Systems, Inc. (CSCO)”