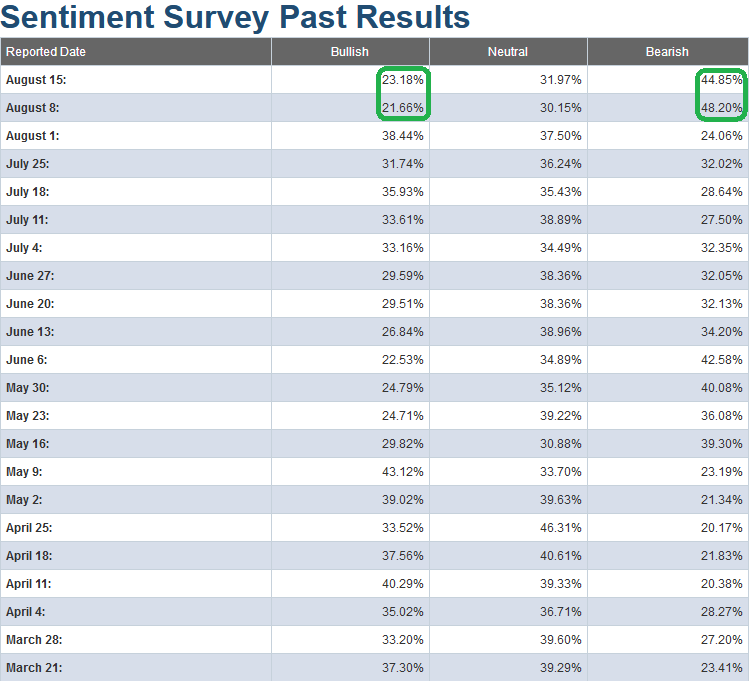

Last week we laid out the case that the AAII Sentiment Survey results were as stretched to the downside as they were a week or so before the bottom in December – and that while there could be some residual market/headline risk in the coming week – the bottom in sentiment was in (i.e. it was about as bearish as you could get – and a good environment to start to buy the fear even if you would take a bit of short term pain for intermediate term gain).

AAII Sentiment Survey Results: What a Difference a Week Makes…

So far that thesis has held up as sentiment started to improve modestly in the past week – just as it had in the days before the bottom in late December.

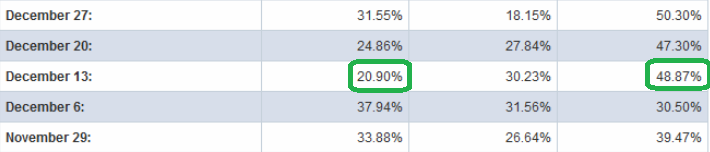

As you can see in the featured chart above and the table below, sentiment bottomed on December 13, got its first improving reading on December 20, and the market finally bottomed on December 24 (the Christmas Eve Massacre).

These are the scenarios where the market tests your meddle. Everyone knows that you make money “buying when there’s blood in the streets,” and yet, you see one after another example of people dumping their holdings – as evidenced by etf flows in the past week. If you have a five day view, who knows if it’s the right move to buy today – but if you have a five week to several month view – history would support that this is a positive risk/reward to step in (even if it goes a bit lower in coming days – although it may not).

We have been putting out “Indicator of the Day (in 60 seconds or less)” videos for the past few weeks and if you pull up/run most of them this morning, they are confirming the same extreme levels (where it had historically paid to step into the chaos and buy).

https://www.hedgefundtips.com/category/market-indicators/

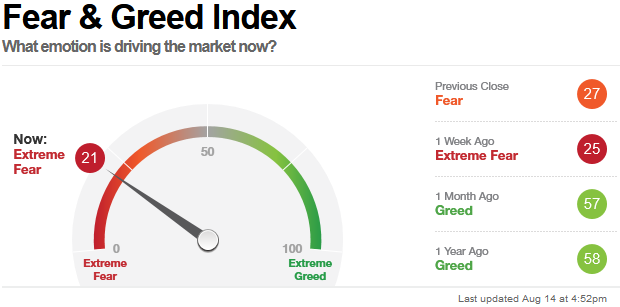

The CNN Fear and Greed gauge is even more stretched than it was last week and firmly in the realm of a range that it has historically paid to be a buyer while everyone else was selling.