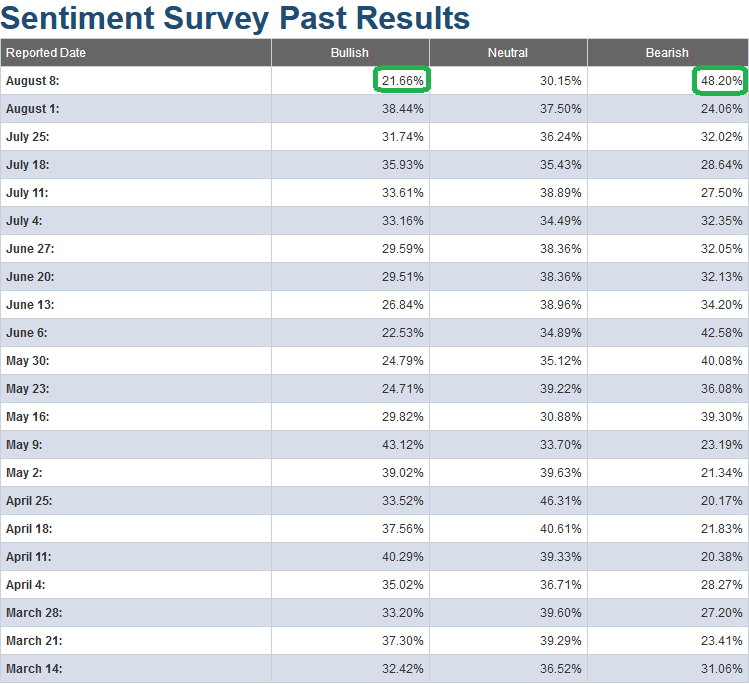

Source: AAII

Last week we had hit full complacency levels on the Bearish Percent which had plummeted down to 24.06%. We did not however get to euphoric levels of bullishness – coming in a couple of percent shy at 38.44%. What a difference a week makes:

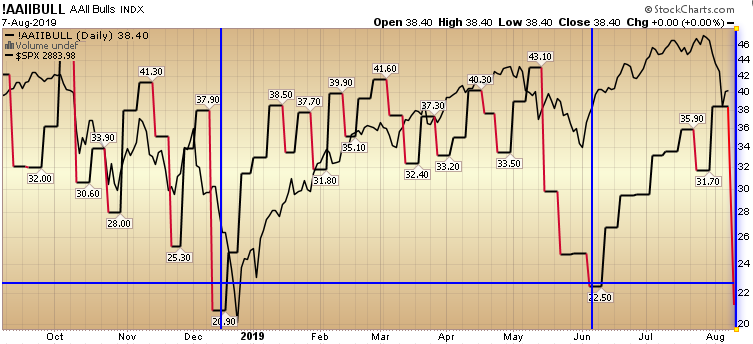

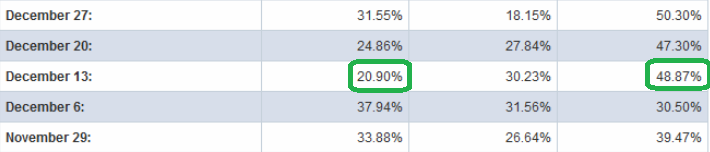

These are the most bearish reads we have seen since the middle of December 2018 (one week before the major bottom):

Although you would have been handsomely rewarded – buying this extreme signal in December (in the intermediate term), you would have taken some pain in the short term due to the Fed meeting debacle that came a week later. But ultimately it paid to buy the extreme (fear) in sentiment:

While we still have headline/tweet risk in coming weeks, the risk/reward is historically favorable buying when there is blood in the streets and people are panicking – as is the case with this week’s sentiment read.

Just as no one could have predicted the Powell debacle in late December, no one could have predicted the Trump tweet on Thursday afternoon of last week (although to his credit – Jim Cramer had been intimating such an action might be possible). The market was making new highs just before President Trump hit “send.” Understandably, if you are going to take on China and risk your re-election for the longer term benefit of the country – when would be a good time to do it (new highs – from a position of strength – and some cushion for volatility)?

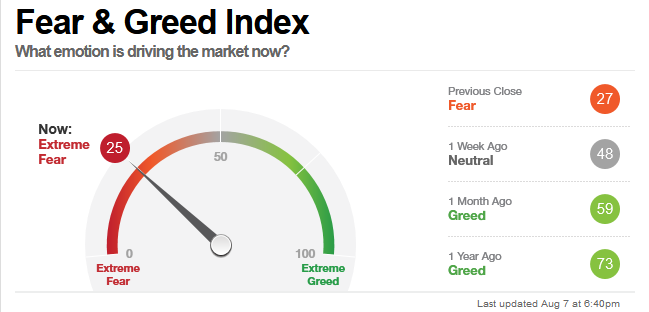

Another indicator that we use as a short term barometer to assess risk/reward is also in a favorable buy range (CNN Fear and Greed Index).

While both of these indicators can stay pinned for an extra week or so and bring additional short term damage, it has historically paid to buy this level of fear in the market – over the intermediate term. You can always find exceptions, but as a barometer – the risk/reward favors stepping in when everyone else is puking out their stock in a panic.