- How Media Mogul John C. Malone Quietly Became America’s Largest Landowner (Maxim)

- Share Buybacks Surge in China (Wall Street Journal)

- Dividend Increases Are Expected From Oreo Maker Mondelez and 3 Others (Barron’s)

- The Big Obstacle on the Road to Electric Vehicles (Wall Street Journal)

- Toys R Us turns to tech to revive defunct chain (Financial Times)

- When Good Intentions Go Bad: My Interview with Social Psychologist Jonathan Haidt [The Knowledge Project Ep. #61] (Farnam Street)

- There Was Another Concert in 1969 That Changed Pop Music (Bloomberg)

- Ten Juicy Secrets About Restaurants I Learned Working as Nobu’s Maitre D’ (Bloomberg)

- Josh Brown: Sometimes the best returns come from CEOs you’ve never heard of (CNBC)

- ‘Top Gun 2’: Everything we know about ‘Maverick’ after Tom Cruise drops first trailer (USA Today)

- Buzz Aldrin and Neil Armstrong put a flag on the moon. Here’s what you can and can’t see in the iconic photo (USA Today)

- How Attorney General Bill Barr Built A $40 Million Fortune (Forbes)

- Hedge Fund Investor Letters 2019 Q2 (Insider Monkey)

- Hedge Fund and Insider Trading News: Anthony Scaramucci, Oaktree Capital Management, ICF International Inc (ICFI), Unit Corporation (UNT), Central Garden & Pet Co (CENT), and More (Insider Monkey)

- Allison Schrager Discusses Monetary Policy (Podcast) (Bloomberg)

- Does Human Behavior Move the Markets? (Goldman Sachs Exchanges)

- 100 Best Adventures in America on Public Lands (Men’s Journal)

- WeWork CEO Adam Neumann has reportedly cashed out of over $700 million ahead of its IPO (TechCrunch)

- A Design Lover’s Guide to Montreal (Architectural Digest)

Be in the know. 10 key reads for Friday…

- U.S.-China officials discuss trade; Mnuchin eyes possible in-person talks (Reuters)

- Low Prices Boost Hopes for Natural Gas (Barron’s)

- China will ease policy further, but saving big ammunition for potential shocks: sources (Reuters)

- Fed’s wisest strategy is to cut interest rates at first sign of economic distress, Williams says (MarketWatch)

- Boeing (BA) will record charge of $4.9 billion in connection with potential concessions to customers for disruptions related to 737 MAX grounding (StreetInsider)

- Distressed Debt Traders Have Tons of Cash and Nothing to Buy (Bloomberg)

- Ron Insana: Digitize the dollar faster and end the frenzy for fake money (CNBC)

- The new 2020 Corvette Stingray revealed. Guns for Ferrari with Chevy’s first mid-engine design (CNBC)

- The Fed’s $3.8 Trillion Balance Sheet Is Unlikely to Shrink More (Bloomberg)

- Trump Administration, Congress Have Agreed on ‘Top-Line’ Spending Levels, Mnuchin Says (Wall Street Journal)

Where is money flowing today?

Unusual Options Activity – YY Inc. (YY)

Today some institution/fund purchased 500 contracts of January $60 strike calls (or the right to buy 50,000 shares of YY Inc. (YY) at $60). The open interest was just 114 prior to this purchase. Continue reading “Unusual Options Activity – YY Inc. (YY)”

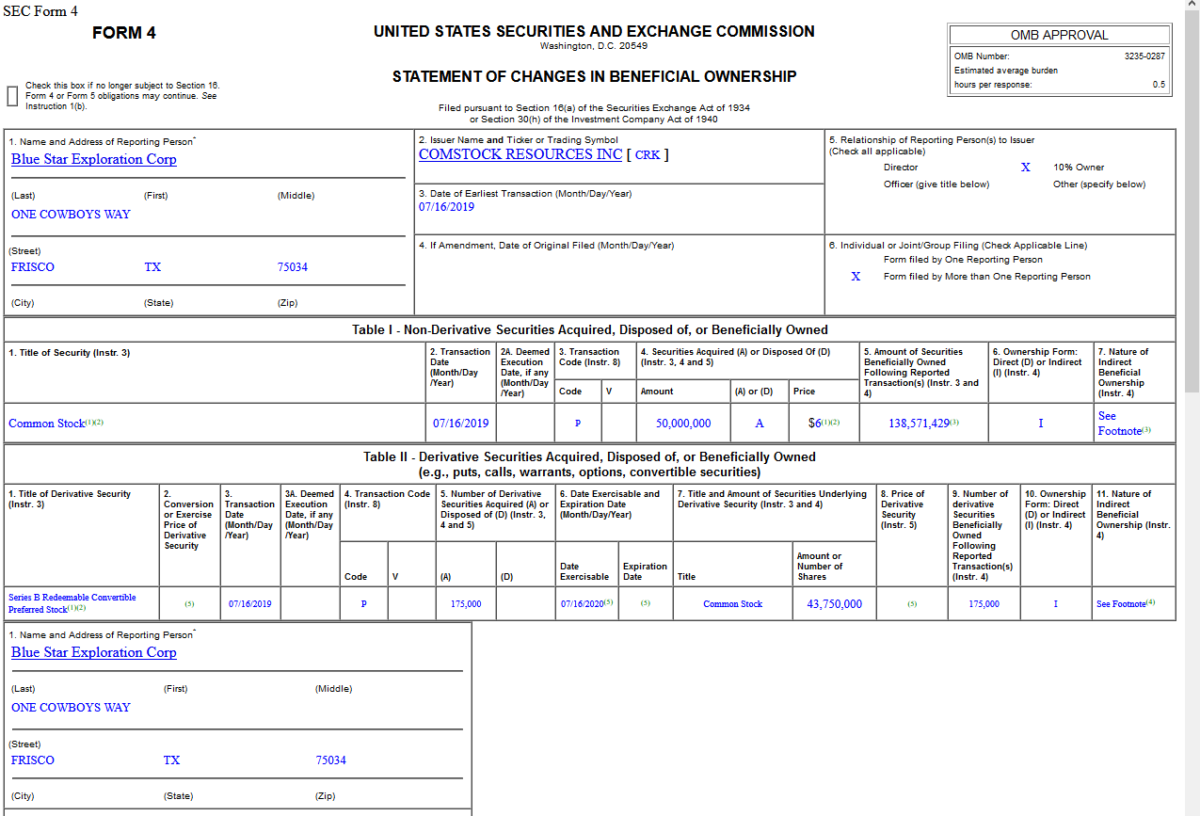

Insider Buying in Comstock Resources, Inc. (CRK)

Jerry Jones – Owner of the Dallas Cowboys – (Blue Star Exploration Corp) put up $475M of his own money to do a deal in the Natural Gas Space with Comstock Resources (CRK) (2 articles explain the deal): Continue reading “Insider Buying in Comstock Resources, Inc. (CRK)”

Hedge Fund Trade Tip (PIN) – Position Idea Notification

Be in the know. 15 key reads for Thursday…

- Energy shares could double by 2020, so buy now, says contrarian investor (MartketWatch)

- Raymond James upgrades Apple on ‘increased conviction in a 5G iPhone’ (CNBC)

- Paradigm Shifts by Ray Dalio (LinkedIn)

- UnitedHealth lifts 2019 profit forecast after topping second-quarter estimates (MarketWatch)

- More Solid Bank Results: Morgan Stanley beats profit estimates as rising stocks benefit wealth management and fund business (CNBC)

- Mnuchin: Phone call on trade with China counterparts set for Thursday, ‘complicated issues’ remain (CNBC)

- Mnuchin says progress being made on debt limit deal (CNBC)

- There’s light at the end of the tunnel for small caps, analysts say (MarketWatch)

- Hedge Fund Beating S&P 500 on Stodgy Bets Goes All-In on Stocks (Bloomberg)

- Airline Profits Are Flying but Investors Don’t Care (Wall Street Journal)

- Frontier Markets Are on Sale — but It Could Be a Wild Ride (Barron’s)

- Here’s how the new Corvette Stingray could morph into a ‘fire-breathing monster’ (USA Today)

- Netflix Loses U.S. Subscribers as Price Increases Take a Toll (New York Times)

- Buy Luckin Coffee Stock Because Its Growth Story Is Still Going, Analyst Says (Barron’s)

- Texas Showdown Flares Up Over Natural-Gas Waste (Wall Street Journal)

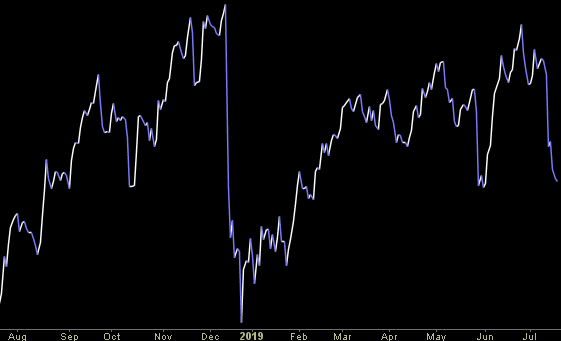

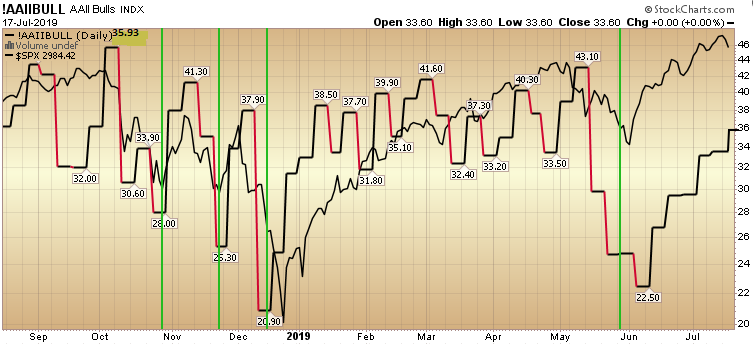

AAII Sentiment Survey Results: Slowly Climbing the Wall of Worry

Data Source: AAII

While the market indices all made new highs this week, sentiment did not. This is a hated rally because most institutions were caught offsides in May/June and raised too much cash. Continue reading “AAII Sentiment Survey Results: Slowly Climbing the Wall of Worry”

Unusual Options Activity – Freeport-McMoRan Inc. (FCX)

Today some institution/fund purchased 28,235 contracts of Nov $12 strike calls (or the right to buy 2,823,500 shares of Freeport-McMoRan Inc. (FCX) at $12). The open interest was just 5,673 prior to this purchase. Continue reading “Unusual Options Activity – Freeport-McMoRan Inc. (FCX)”