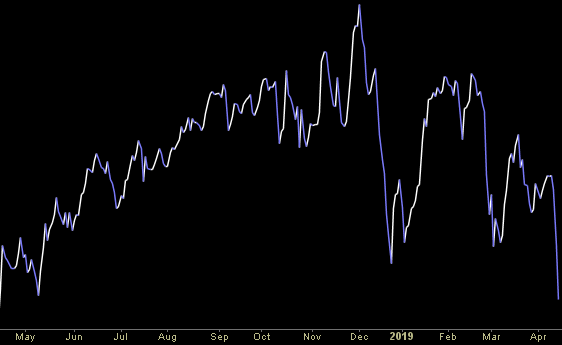

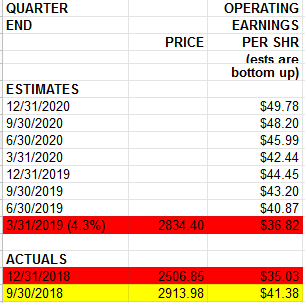

Q1 earnings estimates bumped up 10bps from -4.2% last week to -4.1% this week.

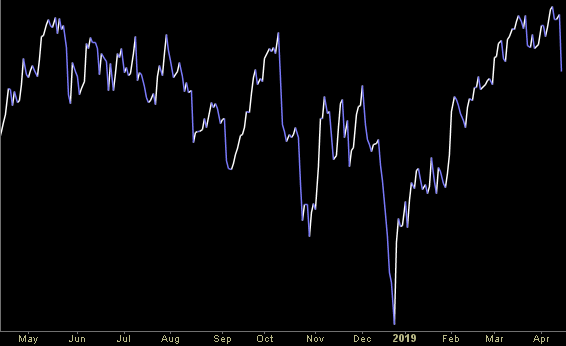

As we stated last week, the bar is now so low that companies don’t even have to jump to get over it. They can stumble over like a drunken frat boy and still win. That’s the good news.

The bad news is that with estimates down to -4.1% for Q1 versus -3.9% two weeks ago and +2.8% on December 31, it is unlikely that earnings will be flat for Q1 – even after they beat. They will most likely be negative year on year.

Smart folks will say, “that’s priced in – it’s all about guidance.” I agree, to an extent. Where I’m cautious is if we get another sequential drop (Q4 2018 vs. Q1 2019) in OPERATING earnings (versus ‘as reported’).

Data Source (below): Howard Silverblatt – S&P Global

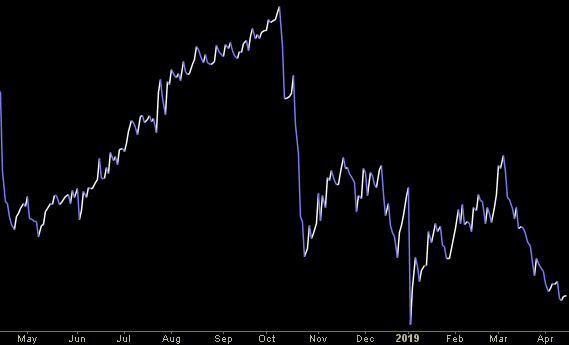

The significance of this is that it would signal a deterioration in the underlying economy last seen only in late 2007 and 2000. As you can see, we have a $1.79 “margin of safety” against this happening on Operating Earnings (difference between Q4 2018 final – $35.03 and Q1 2019 est – $36.82).

The difference is that while “as reported” earnings tend to beat by ~3%, “operating earnings” have recently DROPPED as the reporting period progressed. For example, operating earnings estimates for Q4 2018 were estimated at $38.82 with just four weeks left of reporting in early March and they finished out $3.79 LOWER by the end of the Q1 reporting season last week (for a 15.34% sequential drop from Q3 2018-Q4 2018).

So while it is not our base case that we will get a second sequential drop, it is now within the realm of possibility. Whether that yields an outcome similar to 2007/2000 periods when this last happened is to be determined, but I would err toward unlikely as the pressure will be on for the fed to ease.

Furthermore, the 2/10 part of the curve has not even inverted yet (stock market peaks are usually ~1.5yrs AFTER 2/10 inversion, so the countdown clock has not even started). The 2/10 had been inverted for almost 2 years prior to the double sequential operating earnings drops in 2007 and 2000.

I covered these subjects extensively in this recent article:

UPDATE (newest data): Bull vs. Bear Death Match: Why Q1 Operating Earnings are “Make or Break”