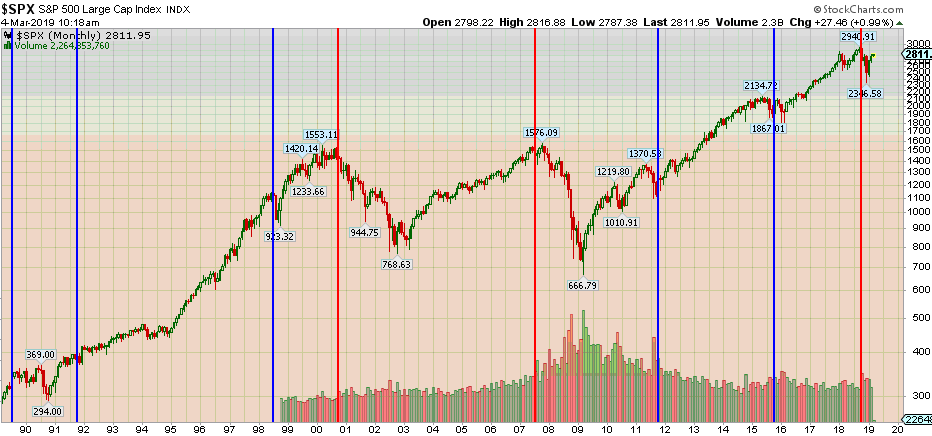

- Tim Knight takes a technical view with “Downtrend Intact” (Slope of Hope)

- Hedge Fund and Insider Trading News: Bodenholm Capital, Regal Funds Management, Nexstar Media Group Inc (NXST), Denbury Resources Inc. (DNR), and More (Insider Monkey)

- Boeing Will Recover (Bloomberg)

- Exclusive: China makes unprecedented proposals on tech, trade talks progress – U.S. officials (Reuters)

- Bond yields on the canvas, Turkey’s lira on the ropes (StreetInsider)

- Why Pfizer May Soon Make Up Lost Ground in Underperforming Against Merck (24/7 Wall St.)

- Mystery Trader Bets Huge That Market Is Wrong On Fed Rate-Cuts (ZeroHedge)

- Pimco and BlackRock Have a Contrarian Bet on Inflation (Bloomberg)

- 19th-Century ‘Humiliation’ Haunts China-U.S. Trade Talks (New York Times)

- U.S. LNG Tipped To Go Global On Abundant Supplies (Forbes)

If you found this post helpful, please consider visiting a few of our sponsors who have offers that may be relevant to you.