- Hedge Fund and Insider Trading News: Ken Griffin, Keith Meister, Bodenholm Capital, AQR Capital, Anworth Mortgage Asset Corp. (ANH), Oasis Petroleum Inc. (OAS), and More (Insider Monkey)

- Weekly mortgage refinances spike 39% after huge rate drop (CNBC)

- Private payrolls add 129K in March vs. 173K est.: ADP/Moody’s Analytics (CNBC)

- Deutsche Bank downgrades Caterpillar ahead of negative backlog growth (TheFly)

- US Auto Sales Wrap Up Weak First Quarter (ZeroHedge)

- Boeing Keeps Leaving Trash In New Air Force Tankers; Deliveries Halted Again (Investor’s Business Daily)

- Bitcoin Rises 16%, Touching $5,000 in Asia ()

- If Trump closes Mexican border, avocados could cost more and auto factories could shut (USA Today)

Cocoa Update: up 7.5% sans leverage

Chart from: FinViz

Since our post on March 19, Cocoa is up 7.5% (underlying) excluding leverage. Could it have gone the other way? Of course, but the odds were in our favor – look at the data: Continue reading “Cocoa Update: up 7.5% sans leverage”

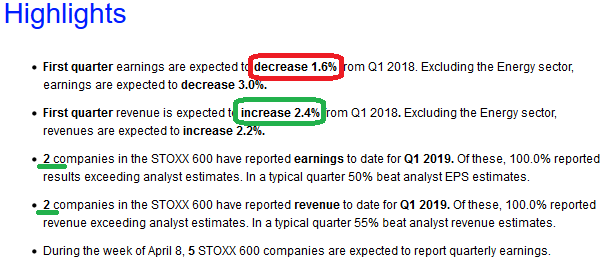

European (Stoxx 600) Earnings Estimates Q1

Data Source: Thomson Reuters

Despite mass pessimism on Europe, earnings estimates are more sanguine for the Stoxx 600 than the S&P 500 in the US. Q1 estimates for the Stoxx 600 are -1.6% year on year compared the the S&P 500 at -3.9% year on Continue reading “European (Stoxx 600) Earnings Estimates Q1”

Unusual Options Activity – Deutsche Bank Aktiengesellschaft (DB)

Today some institution/fund purchased 13,954 contracts of January 2020 $8 strike calls (or the right to buy 1,395,400 shares of Deutsche Bank Aktiengesellschaft (DB) at $8). The open interest was 7068 prior to this Continue reading “Unusual Options Activity – Deutsche Bank Aktiengesellschaft (DB)”

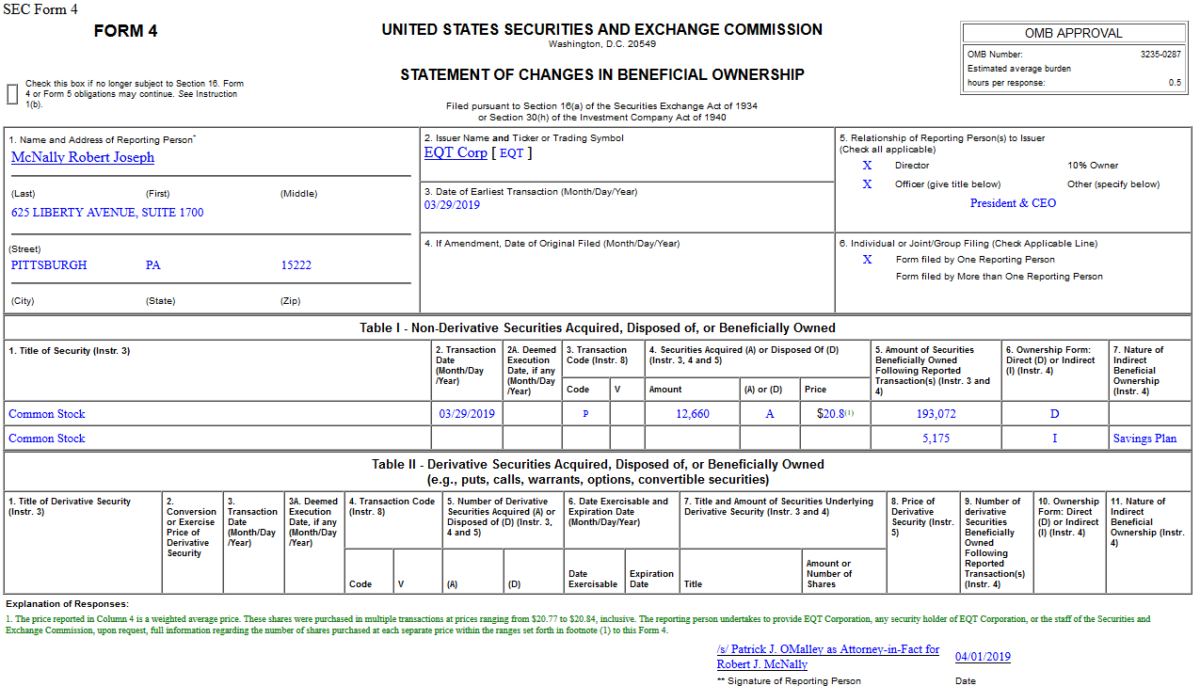

Insider Buying in EQT Corporation (EQT)

Hedge Fund Tips (PCN) – Position Completion Notification

Be in the know. 6 key reads for Tuesday…

- Analysts expect China to cut bank reserve ratios soon (Reuters)

- Four solid stocks whose recent hard times mean they’re potential bargains (MarketWatch)

- Walgreens shares slide as drugstore chain misses earnings estimates, lowers 2019 forecast (CNBC)

- DealBook Briefing: Lyft Crashes Back to Reality (New York Times)

- U.S. and Chinese Manufacturing Stabilize, While Europe Lags Behind (Wall Street Journal)

- 50 Cent Sells Massive Connecticut Compound for 84% Less (i.e. 16 Cent) (Wall Street Journal)

If you found this post helpful, please consider visiting a few of our sponsors who have offers that may be relevant to you.

Unusual Options Activity – UBS Group AG (UBS)

Today some institution/fund purchased 9,482 contracts of August $12.50 strike calls (or the right to buy 948,200 shares of UBS Group AG (UBS) at $12.50). The open interest was just 1,191 prior to this purchase. Continue reading “Unusual Options Activity – UBS Group AG (UBS)”

Hedge Fund Trade Tip (PIN) – Position Idea Notification

Be in the know. 10 key reads for Monday…

- Hold Tight to Value Stocks. They May Be Set to Rise Soon. (Barron’s)

- U.S. Retail Sales Unexpectedly Fall; Prior Reading Revised Up (Bloomberg)

- 6 things successful people like Bill Gates and Jeff Bezos do on weekends to make their Mondays more productive (CNBC)

- China Purchases Could Undercut Trump’s Larger Trade Goal (New York Times)

- Things are suddenly looking a lot brighter for China’s manufacturing sector (Business Insider)

- ‘Fear of Missing Out’ Pushes Investors Toward Stocks (Wall Street Journal)

- Tesla, SpaceX CEO Elon Musk releases rap song: ‘RIP Harambe’ (USA Today)

- Costco Stock Is Trading Near a Record, and One Director Has Been Selling (Barron’s)

- The 5G Network Rollout And The 4th Industrial Revolution (Investor’s Business Daily)

- Private equity tricks mask mounting debt: ‘I’m 5 foot 8 inches, but I change the scale and make myself 6 foot 2 inches on a pro forma basis’ (Business Insider)

If you found this post helpful, please consider visiting a few of our sponsors who have offers that may be relevant to you.