If you found this post helpful, please consider visiting a few of our sponsors who have offers that may be relevant to you.

Be in the know. 7 key reads for Friday…

- Lyft, Inc. (LYFT) Prices 32.5M Share IPO at $72/Sh (Street Insider)

- U.S., China hold ‘constructive’ trade talks in Beijing (Reuters)

- Buffett on the economy: ‘It looks like things have slowed down’ (CNBC)

- The 5G Network Rollout And The 4th Industrial Revolution (Investor’s Business Daily)

- Buy Disney Stock Before Its Investor Day, Says Analyst (Barron’s)

- U.S. Consumer Spending Misses Forecasts as Inflation Eases (Bloomberg)

- The 4% Mortgage Is Back (Wall Street Journal)

If you found this post helpful, please consider visiting a few of our sponsors who have offers that may be relevant to you.

Unusual Options Activity – Knight-Swift Transportation Holdings Inc. (KNX)

Today some institution/fund purchased 25,065 contracts of August $35 strike calls (or the right to buy 2,506,500 shares of Knight-Swift Transportation Holdings Inc. (KNX) at $35). The open interest was just 679 prior to this purchase. Continue reading “Unusual Options Activity – Knight-Swift Transportation Holdings Inc. (KNX)”

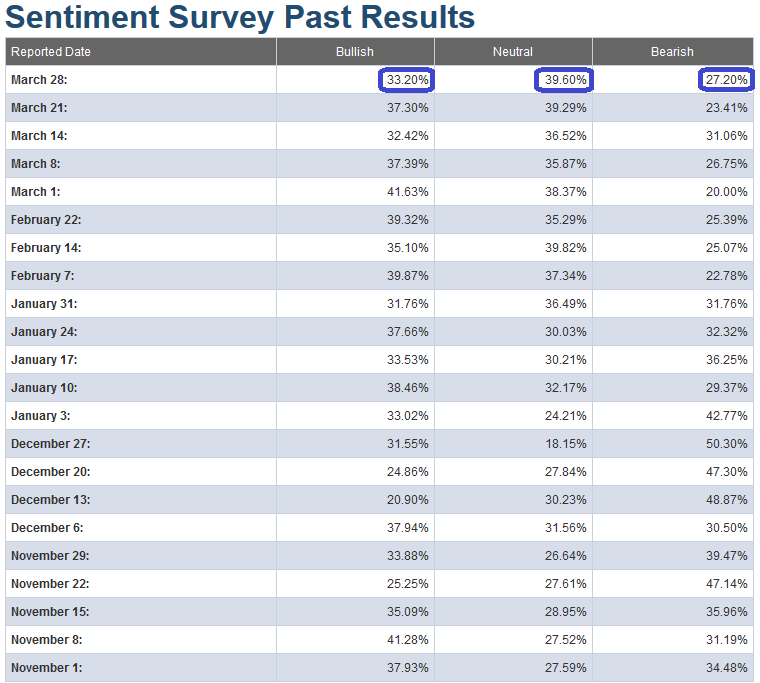

AAII Sentiment Results: NO MAN’S LAND – Part Trois!

I focus on the AAII sentiment indicator when it is at true extremes. This week, the bullish sentiment moved back down to 33% from 37%. This is a neutral rating (not optimistic or excessively pessimistic). The Bearish Percent creeped up to 27% from 23% which is still pretty complacent until we see a move to the high 30s/low 40s. So while there is no euphoria on the side of the bulls, there is also very little fear and still a decent amount of complacency- hence NO MAN’S land part Trois!

The past 3 weeks of “No Man’s Land Parts un-trois” are also reflected in the indices which have basically gone nowhere in the month of March:

Here are the last two editions of “No Man’s Land:”

If you found this post helpful, please consider visiting a few of our sponsors who have offers that may be relevant to you.

Be in the know. 10 key reads for Thursday…

- Tim Knight takes a technical view with “Downtrend Intact” (Slope of Hope)

- Hedge Fund and Insider Trading News: Bodenholm Capital, Regal Funds Management, Nexstar Media Group Inc (NXST), Denbury Resources Inc. (DNR), and More (Insider Monkey)

- Boeing Will Recover (Bloomberg)

- Exclusive: China makes unprecedented proposals on tech, trade talks progress – U.S. officials (Reuters)

- Bond yields on the canvas, Turkey’s lira on the ropes (StreetInsider)

- Why Pfizer May Soon Make Up Lost Ground in Underperforming Against Merck (24/7 Wall St.)

- Mystery Trader Bets Huge That Market Is Wrong On Fed Rate-Cuts (ZeroHedge)

- Pimco and BlackRock Have a Contrarian Bet on Inflation (Bloomberg)

- 19th-Century ‘Humiliation’ Haunts China-U.S. Trade Talks (New York Times)

- U.S. LNG Tipped To Go Global On Abundant Supplies (Forbes)

If you found this post helpful, please consider visiting a few of our sponsors who have offers that may be relevant to you.

Unusual Options Activity – Cronos Group Inc. (CRON)

Today some institution/fund paid up to purchase 8,495 contracts of July $18 strike puts (or the right to sell short 849,500 shares of Cronos Group Inc. (CRON) at $18). The open interest was just 465 prior to this purchase. Continue reading “Unusual Options Activity – Cronos Group Inc. (CRON)”

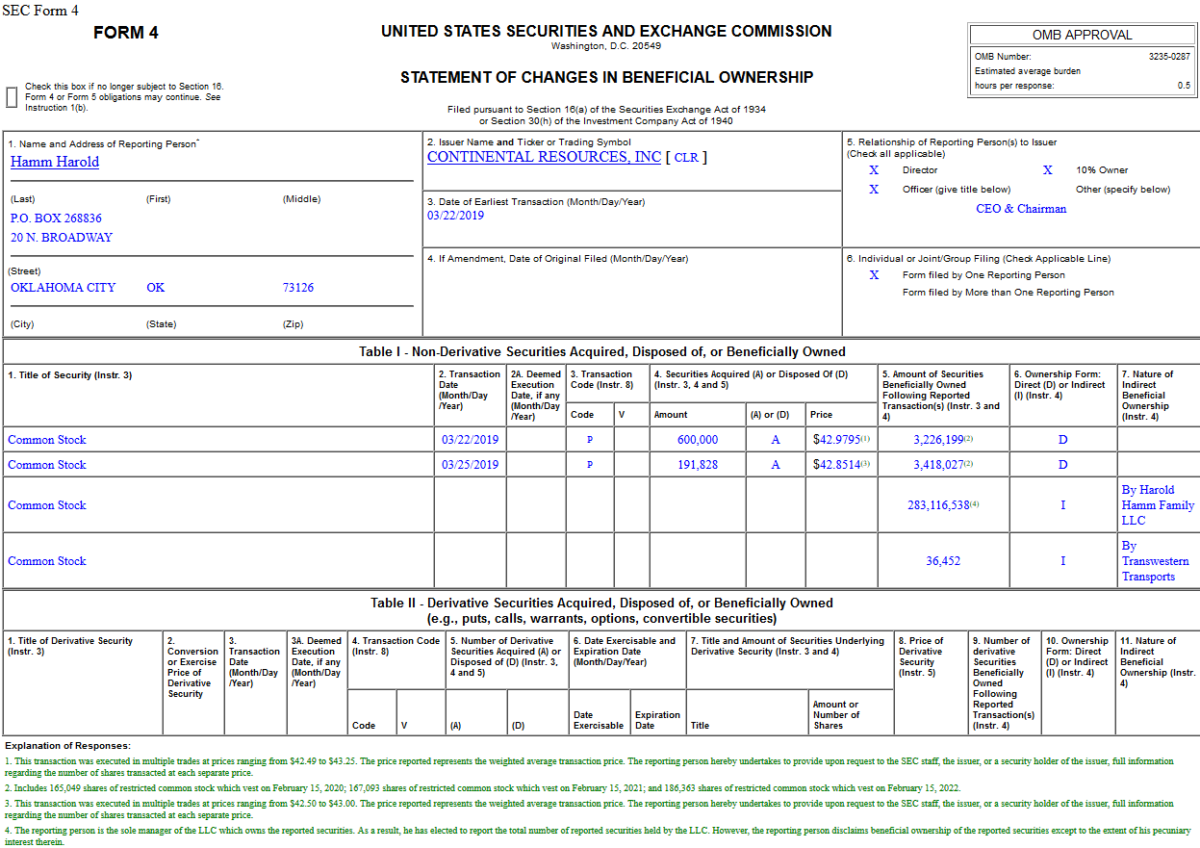

Insider Buying in Continental Resources, Inc. (CLR)

Hedge Fund Trade Tip (PIN) – Position Idea Notification

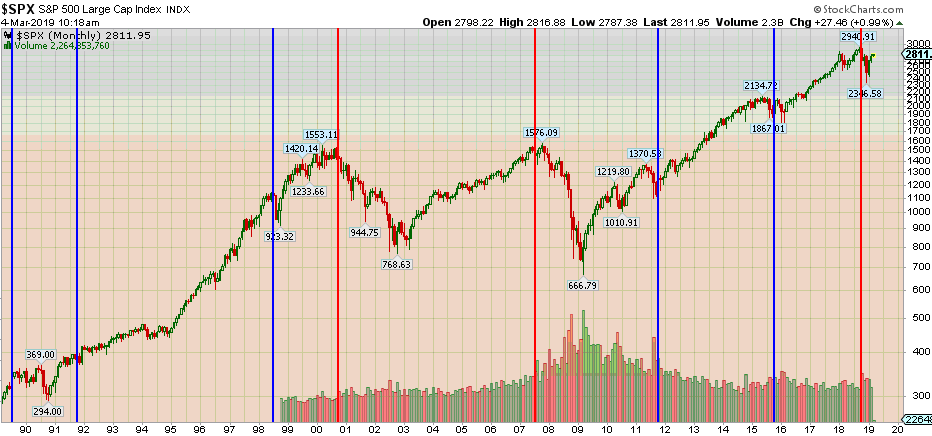

UPDATE (newest data): Bull vs. Bear Death Match: Why Q1 Operating Earnings are “Make or Break”

Historical Data Source: S&P Global – Howard Silverblatt

In the past 30 years, we have had 7 instances of sequential S&P operating earnings drops of 6% or greater (data table below highlights sequential Continue reading “UPDATE (newest data): Bull vs. Bear Death Match: Why Q1 Operating Earnings are “Make or Break””

Be in the know. 8 key reads for Wednesday

- Likely Fed nominee Stephen Moore thinks rates should be cut by half a percentage point (CNBC)

- Turkey On Verge Of Collapse As Overnight Swaps Hit 700%, CDS Soar (ZeroHedge)

- One Way Stocks Go Up Is if Wall Street Sets the Earnings Bar Really, Really Low (Barron’s)

- Here’s Why U.S. Bond Yields Plunged So Much Over the Past Week (Bloomberg)

- US efforts to cut trade deficit show biggest win in almost a year (CNBC)

- Lennar, KB Home Earnings Boosted by Falling Mortgage Rates (Bloomberg)

- Top Analyst Upgrades and Downgrades: Alcoa, Apple, Autodesk, BB&T, Bed Bath & Beyond, Camping World, Nvidia, Vertex, Voya and More (24/7 Wall Street)

- Neiman Marcus, in Debt Talks, Makes It Easier to Bet It Will Fail (Wall Street Journal)

If you found this post helpful, please consider visiting a few of our sponsors who have offers that may be relevant to you.