Be in the know. 12 key reads for Tuesday…

- iPhone sales in China reportedly tanked 20 percent last quarter (New York Post)

- A Government Shutdown May Have Been Avoided, but Investors Shouldn’t Relax Just Yet (Barron’s)

- How Millennials Could Restore American Prosperity (Barron’s)

- Latest Warning Sign for Markets: A Possible ‘Earnings Recession’ (New York Times)

- Can the middle-class revival under Trump last? (USA Today)

- Traders With $515 Billion Boycott Stocks for Cash Despite Rally (Bloomberg)

- Opinion: Proof that you can outperform with the right actively managed stock fund (Market Watch)

- Here’s why hedge-fund manager Kyle Bass thinks U.S. stocks will be lower by end 2019 (Market Watch)

- Why Canaccord Genuity Sees Tesla Rising Nearly 50% (24/7 Wall Street)

- Wall Street analysts slash Nvidia price target, say recent guidance cut is ‘a splash of cold water’ (NDVA) (Business Insider)

- Anadarko selloff brings ‘compelling entry point,’ says JPMorgan (The Fly)

- GDP Now upgrades to 2.7% (from 2.5%) (Atlanta Fed)

If you found this post helpful, please consider visiting a few of our sponsors who have offers that may be relevant to you.

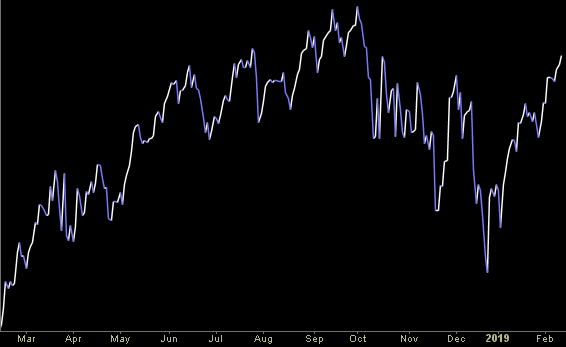

NASDAQ (top 30 weights) Earnings Estimates/Revisions

In the spreadsheet above I have tracked the earnings estimates for the top 30 weighted Nasdaq stocks. I have columns for what the 2019 and 2020 estimates (if available) were: 12/23/18, 1/23/19 and today 2/11/2019. The Continue reading “NASDAQ (top 30 weights) Earnings Estimates/Revisions”

Hedge Fund Trade Tip – Position Idea Notification (PIN)

Unusual Options Activity

Today some institution/fund purchased 27,268 contracts of June 82.5 strike calls (or the right to buy 2,726,800 shares of Merck & Co. MRK at $82.5). The open interest was just 1,483 prior to this purchase. Continue reading “Unusual Options Activity”

Insider Buying

Be in the know. 8 key reads for Monday…

- Talks Over Border Security Break Down, Imperiling Effort to Prevent Shutdown (New York Times)

- Latest Round Of Trade Talks Begins In Beijing With Deal In Doubt (Zero Hedge)

- The Next Wave of ‘Unicorn’ Start-Ups (New York Times)

- Two Large Chinese Borrowers Miss Bond Payments, Sources Say (Bloomberg)

- AI Stocks To Watch: 42 Top Funds Just Invested $1.1 Billion In Splunk Stock (Investor’s Business Daily)

- High-Rollers Cool Their Bets as Chinese Economy Slows (Wall Street Journal)

- Growing economic anxiety hits Main Street as small-business confidence drops: Survey (CNBC)

- Every NFL Team’s Biggest Hole to Fill in 2019 Offseason (CNN)

If you found this post helpful, please consider visiting a few of our sponsors who have offers that may be relevant to you.

Be in the know. 5 key reads for Saturday…

- This Global Money Manager Sat on Cash and Gold for 2 Years. Now He’s Snapping Up Stocks. (Barron’s)

- Lawmakers Close In on Deal in Talks on Border Funding (Wall Street Journal)

- Stock Market Outlook: Wall Street Braves Political Risks As 2020 Election Looms (Investor’s Business Daily)

- Female CLO Managers Tend to Outperform Men (Wall Street Journal)

- The Invention of Ice Hockey (Wall Street Journal)

If you found this post helpful, please consider visiting a few of our sponsors who have offers that may be relevant to you.

Unusual Options Activity

Today some institution/fund purchased 25,075 contracts of August 17 strike calls (or the right to buy 2,507,500 shares of Freeport McMoRan FCX at $17). The open interest was just 175 prior to this purchase. Continue reading “Unusual Options Activity”

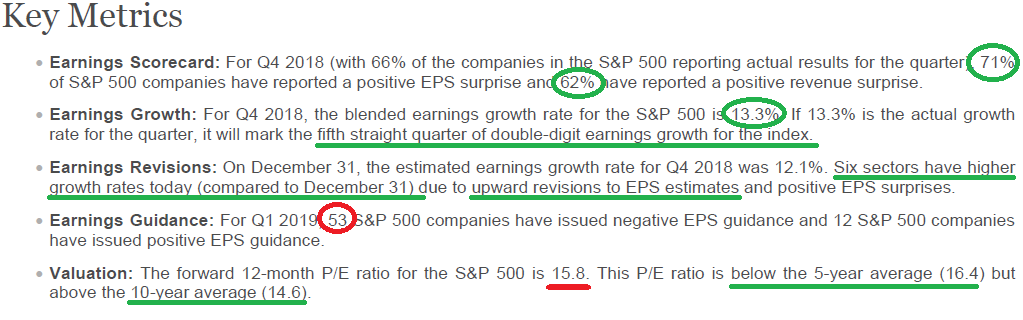

Earnings Update

Per Factset:

EPS and revenues continue to beat by 71% and 62% respectively (after 66% of S&P 500 companies have reported). The earnings growth rate has increased to 13.3% for Q4 2018 from 12.4% last week (and 12.1% on 12/31). Continue reading “Earnings Update”