Data Source: Finviz

Tag: Energy

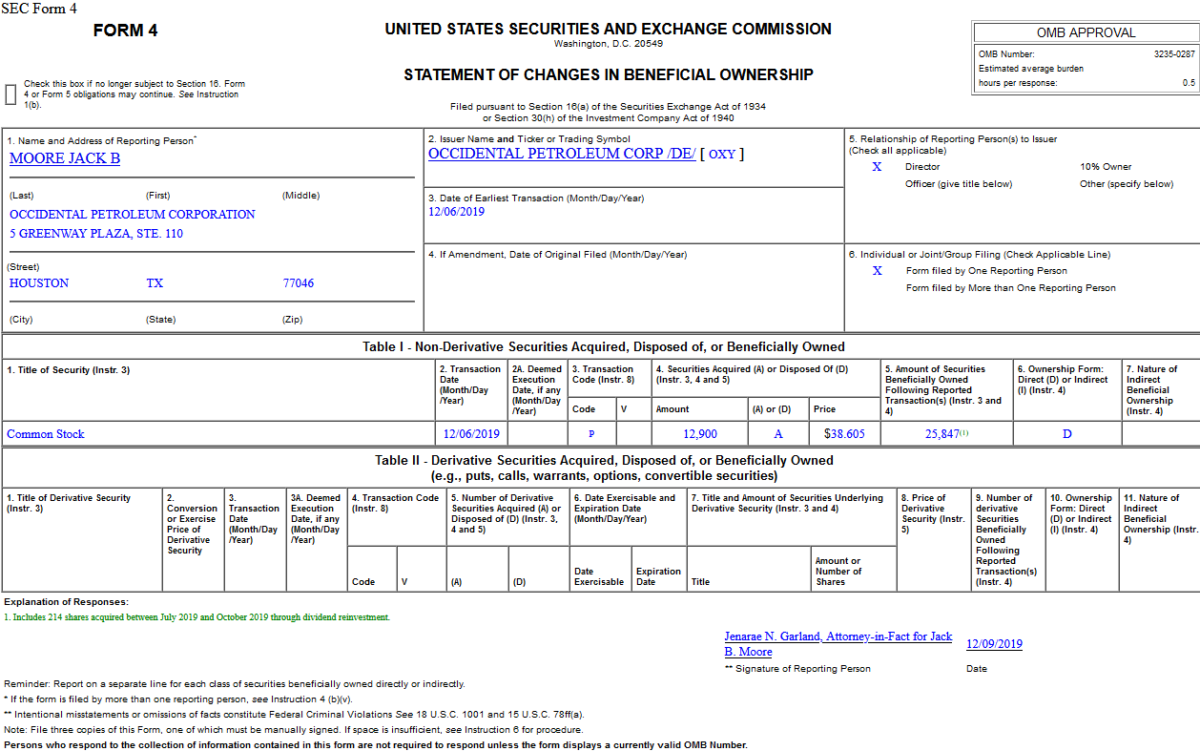

Insider Buying in Occidental Petroleum Corporation (OXY)

On December 6, 2019, Jack Moore – Director of Occidental Petroleum Corporation (OXY) – purchased 12,900 shares of OXY at $38.61. His out of pocket cost was $498,005. Continue reading “Insider Buying in Occidental Petroleum Corporation (OXY)”

Where is money flowing today?

Data Source: Finviz

Be in the know. 12 key reads for Tuesday…

- 6 Strong Buy Oil and Gas Stocks Called to Surge in 2020 (24/7 Wall Street)

- Here’s What It’s Like To Drive a $210,000 McLaren (Barron’s)

- The Time to Buy Home Depot Stock Is Now, Analysts Say (Barron’s)

- JP Morgan is bullish on Vietnamese banks, says sector offers high growth and profitability (CNBC)

- The Federal Reserve’s Meeting Starts Today. Here’s What You Need to Know. (Barron’s)

- The Fed will stay in hibernation until at least summer: CNBC survey (CNBC)

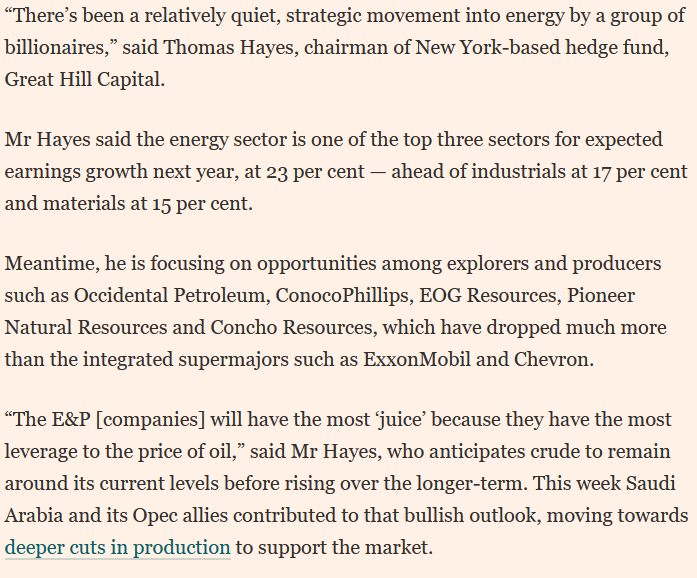

- Big-name US investors take aim at beaten-up energy sector (Financial Times)

- Democrats and the Trump administration near a tentative North American trade deal (CNBC)

- There’s no better place to put your money than the U.S., says hedge-fund manager Kyle Bass (MarketWatch)

- Ross: US close to largest trade deal in history of the world, 170,000 jobs (Fox Business)

- US and Chinese trade negotiators planning for delay of December tariff Fox Business)

- Next Oil Rally May Be Made in Texas, Not Vienna (Wall Street Journal)

Unusual Options Activity in Chesapeake Energy Corporation (CHK)

Data Source: barchart

Today some institution/fund purchased 1,505 contracts of July $1 strike calls (or the right to buy 150,500 shares of Chesapeake Energy Corporation (CHK) at $1). The open interest was 1,065 prior to this purchase.

![]()

Continue reading “Unusual Options Activity in Chesapeake Energy Corporation (CHK)”

Be in the know. 15 key reads for Monday…

1. Hedge funds key in exacerbating repo market turmoil, says BIS (Financial Times)

2. RPT-U.S. banks’ reluctance to lend cash may have caused repo shock – BIS (Yahoo! Finance)

3. Now Repo Distortions Are Emerging in Europe’s $9 Trillion Market (Bloomberg)

4. Will sterling hold its gains through the UK general election? (Financial Times)

5. UK property investors pull cash at fastest rate this year (Financial Times)

6. Top DoubleLine investor sees opportunity in Brazil amid tariff threat (Yahoo! Finance)

7. Jeffrey Gundlach extended interview with Yahoo Finance [TRANSCRIPT] ()

8. The Taylor Swift “Bad Blood†Energy Market (and Sentiment Results) (ZeroHedge)

9. Big-name US investors take aim at beaten-up energy sector (Financial Times)

10. JPMorgan Sees $410 Billion Bump to Stocks’ Demand-Supply Balance (Bloomberg)

11. Japan’s economy expanded at a much faster-than-initially-reported pace in the third quarter. (Business Insider)

12. China says hopes it can reach trade agreement with US as soon as possible. (Business Insider)

13. Here’s the hard-money call for why the boom in the economy and stock market will continue (MarketWatch)

14. Not the sign of a Top: Investors Bail on Stock Market Rally, Fleeing Funds at Record Pace (Wall Street Journal)

15. Pound Rally Gets Nod From Signal That’s Been Right for a Decade (Bloomberg)

Be in the know. 10 key reads for Sunday…

- Big-name US investors take aim at beaten-up energy sector (Financial Times)

- The Taylor Swift “Bad Blood” Energy Market (and Sentiment Results) (ZeroHedge)

- Sweet Success: WhIsBe Is Bringing His $60,000 Vandal Gummy Bears To Art Week Miami (Forbes)

- ECRI Weekly Leading Index Update (Advisor Perspectives)

- Politics Aside, what could happen to markets in the event of impeachment in the House? (Almanac Trader)

- Episode 773: Slot Flaw Scofflaws (NPR Planet Money)

- Making Sense of the Genome, at Last (Nautilus)

- Fed Adds $72.8 Billion to Markets, Balance Sheet Moves to $4.07 Trillion (Wall Street Journal)

- This wealth manager picked a home-run stock in 2019. Here’s what he likes for 2020 (MarketWatch)

- S&P 500 Melt-Up Is So Hot It’s Making Cheerleaders Into Skeptics (Bloomberg)

HFT VideoCast – Stock Market Commentary and Weekly Recap – Episode 6

Articles referenced in VideoCast above:

The Taylor Swift “Bad Blood” Energy Market (and Sentiment Results)

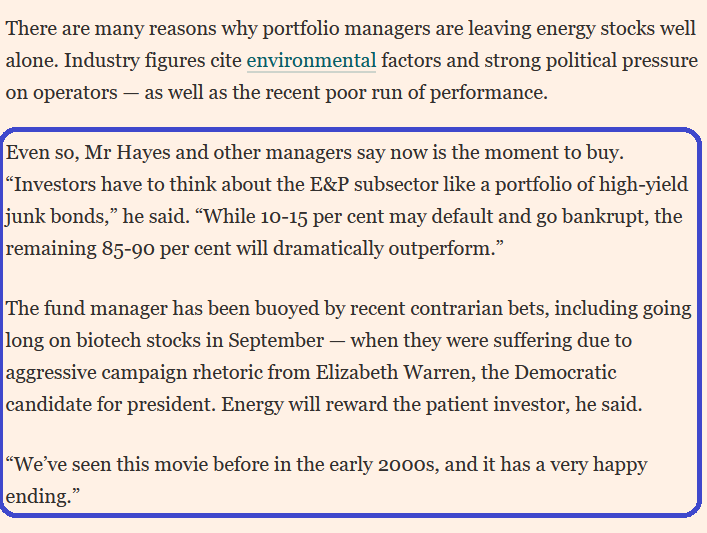

My quotes in the Financial Times today:

Source: Financial Times 12/7/2019 Weekend Edition (link below)

I was quoted in the Financial Times today. Thank you Jennifer! Please check out Jennifer Ablan’s (U.S. Markets Editor) full article, “Big-name US investors take aim at beaten-up energy sector” here:

The Taylor Swift “Bad Blood” Energy Market (and Sentiment Results)

In previous weeks we discussed being bullish on the general market over the intermediate term, while recognizing and respecting a short term “overbought” condition that could either be worked off in time (grind sideways) or price (short term pullback) to shake out the “late money” that missed the rally from Aug/Sept lows.

Continue reading “The Taylor Swift “Bad Blood” Energy Market (and Sentiment Results)”