This week we chose Yogi Berra’s famous quote, “It feels like deja vu all over again” to describe one aspect of the current market climate. This is in contrast to what many talking heads are saying about China in recent days (also a famous Yogi quote), “the future ain’t what it used to be!” Continue reading “The Yogi Berra “Deja Vu” Stock Market (and Sentiment Results)…”

Tag: StockMarket

Unusual Options Activity – Exxon Mobil Corporation (XOM)

Data Source: barchart

Today some institution/fund purchased 45,100 contracts of Jan 2023 $30 strike calls (or the right to buy 4,510,000 shares of Exxon Mobil Corporation (XOM) at $39). The open interest was just 5,615 prior to this purchase. Continue reading “Unusual Options Activity – Exxon Mobil Corporation (XOM)”

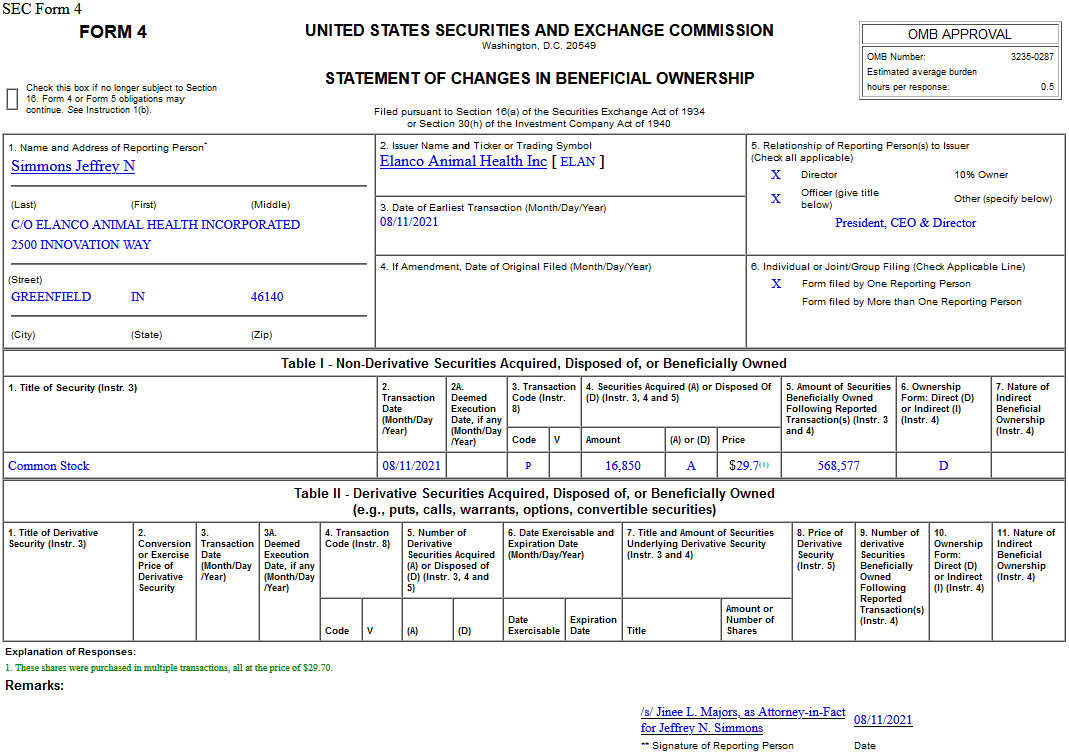

Insider Buying in Elanco Animal Health Incorporated (ELAN)

On Aug 11, 2021, Jeffrey Simmons – President, CEO & Director of Elanco Animal Health Incorporated (ELAN) – purchased 16,850 shares of ELAN at $29.70. His out of pocket cost was $500,455.

Where is money flowing today?

Data Source: Finviz

Be in the know. 20 key reads for Wednesday…

- Splunk upgraded to Buy from Neutral at UBS (TheFly)

- Boeing Max Takes to China’s Skies in Test to End Flight Ban (Bloomberg)

- This Turning Point for Markets Merits a Hard Look (Bloomberg)

- 9 Industrial Stocks With 30% Upside (Barron’s)

- George Foreman Grills, Kwikset Locks—Spectrum Brands’ Sales Are Growing. And the Stock Is Inexpensive. (Barron’s)

- These 7 Warren Buffett quotes can help you stay sane in today’s manic market (Yahoo! Finance)

- SoftBank CEO to Take Stake in Vision Fund 2 (Barron’s)

- Ridgefield, Conn.: Arts, Culture and Open Space (New York Times)

- China’s Credit Expands at Slowest Pace Since February 2020 (Bloomberg)

- SEC’s Gensler Seeks Warren Help in Crypto Exchange Crackdown (Bloomberg)

- Consumer Prices in U.S. Increase at a More Moderate Pace (Bloomberg)

- Chinese giant NetEase targets major overseas growth with new battle royale game (CNBC)

- Billionaire investor Dan Loeb trumpeted his bets on Buffett-backed RH, crypto, and private companies in his Q2 letter (Business Insider)

- Warren Buffett’s pandemic-hit businesses came roaring back last quarter. Here are his 7 big winners. (Business Insider)

- Democrats push through $3.5 trillion budget resoluton to assist families and fight climate change (MarketWatch)

- ‘From unreasonable to ridiculous’: Here’s why Moderna is set to fall 76%, according to Bank of America (Business Insider)

- S. mortgage applications rise as rates remain below 3% -MBA (Reuters)

- Manchin concerned about “grave consequences” of U.S. Senate’s $3.5 trln spending plan (Reuters)

- Cathie Wood Keeps ‘Open Mind’ on China Shares After Dumping Them (Yahoo! Finance)

- China’s Strict Covid-19 Strategy Risks Slowing Economic Recovery as Delta Variant Hits (Wall Street Journal)

Where is money flowing today?

Data Source: Finviz

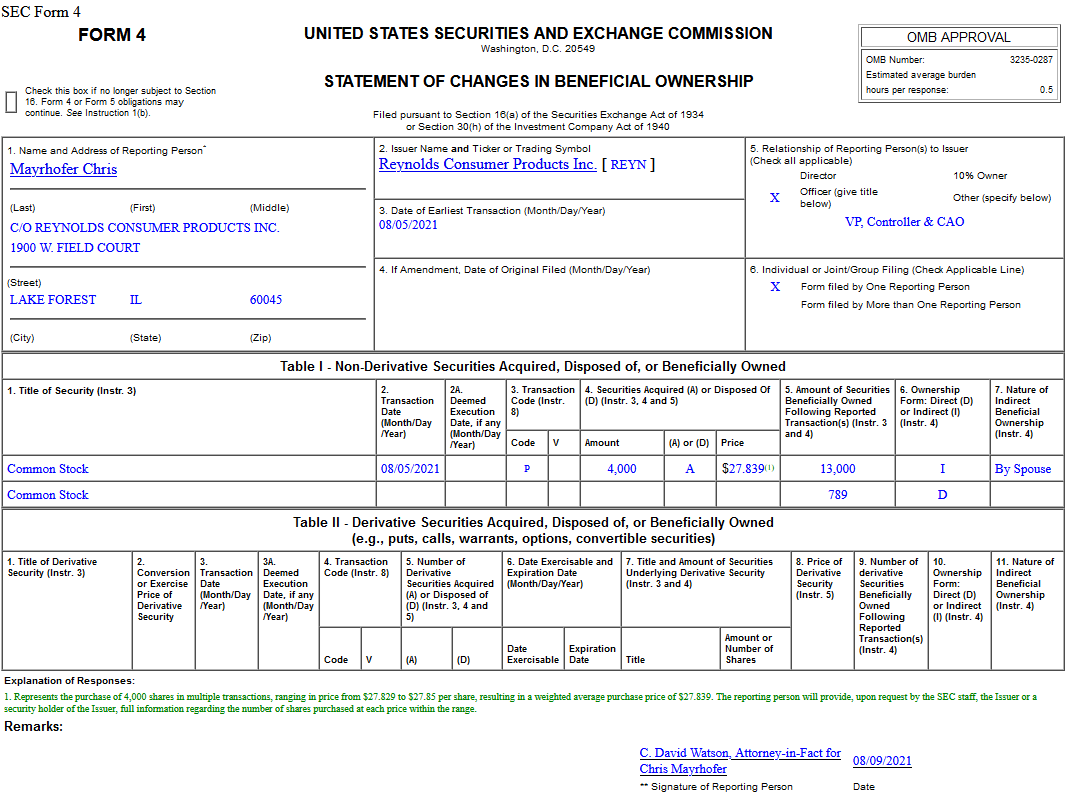

Insider Buying in Reynolds Consumer Products Inc. (REYN)

On August 5, 2021, Chris Mayrhofer – VP, Controller & CAO of Reynolds Consumer Products Inc. (REYN) – purchased 4,000 shares of REYN at $27.83 (through his spouse). The out of pocket cost was $111,356.

Be in the know. 10 key reads for Tuesday…

- China Tech Stocks Rise as Analysts Turn Positive After Selloff (Bloomberg)

- Delta Done. The Energy Report 08/10/2021 (Phil Flynn)

- 11 Undervalued Stocks That Analysts Love (Barron’s)

- Earnings Slump at Softbank but It Shrugs Off the Chinese Crackdown–for Now (Barron’s)

- Infrastructure Is Almost a Done Deal. Now the Focus Turns to the $3.5 Trillion Budget. (Barron’s)

- Tyson Foods Says Labor, Grain Costs Boosting Meat Prices (Wall Street Journal)

- Citigroup Reaches First Deal of Jane Fraser’s Refresh, Selling Australian Consumer Bank (Wall Street Journal)

- The Sage of Omaha’s Berkshire Hathaway bet on China’s BYD looks like it’s paying off. It’s all about the technology. (Bloomberg)

- Odds Are Sports Betting Will Bring Trouble (Bloomberg)

- Fed’s Bostic: U.S. needs to be “beyond the crisis” before rate hike (Street Insider)

Unusual Options Activity – Intel Corporation (INTC)

Data Source: barchart

Today some institution/fund purchased 6,001 contracts of June 2022 $75 strike calls (or the right to buy 600,100 shares of Intel Corporation (INTC) at $375). The open interest was 4,588 prior to this purchase. Continue reading “Unusual Options Activity – Intel Corporation (INTC)”

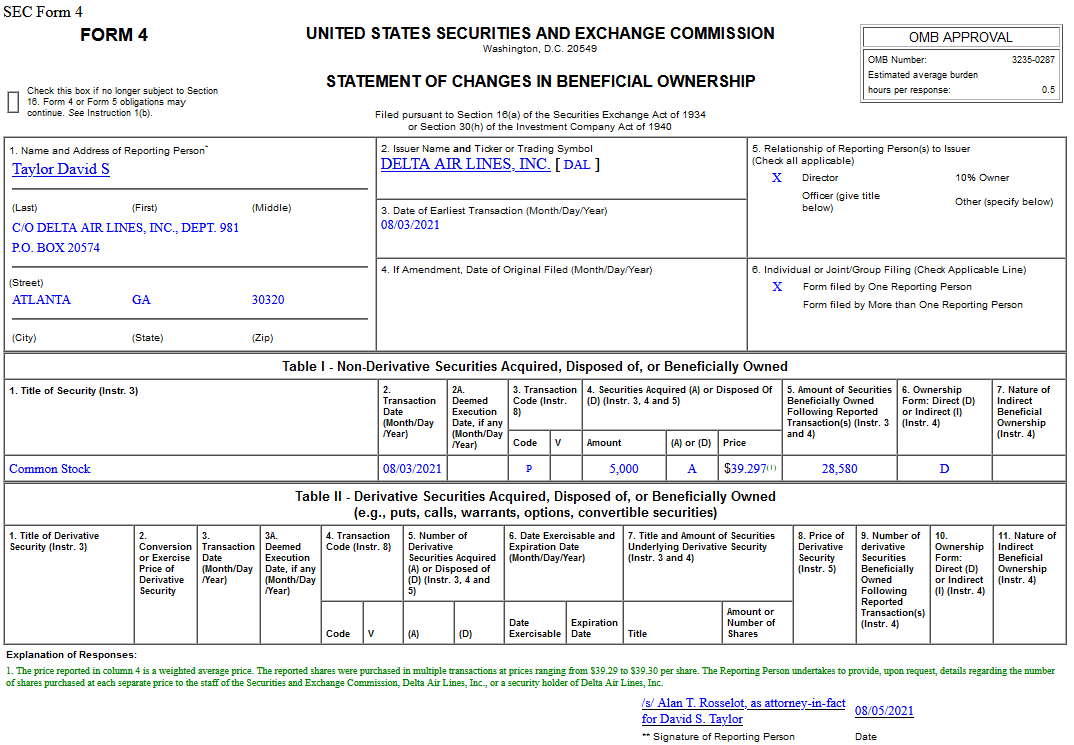

Insider Buying in Delta Air Lines, Inc. (DAL)

On August 3, 2021, David Taylor – Director of Delta Air Lines, Inc. (DAL) – purchased 5,000 shares of DAL at $39.30. His out of pocket cost was $196,485.