- Morgan Stanley Highlights Boeing (BA) Shares As Attractive After the 13% Pullback (StreetInsider)

- Was Intel’s (INTC) Second Quarter a Speedbump or Inflection? (StreetInsider)

- Earnings season so far has been great with profit margins holding up

- Biden’s order could make it easier for Americans to borrow (Yahoo! Finance)

- Airbnb Stock Has Been Under Pressure. The Case for Investing Now. (Barron’s)

- ‘Black Widow’ Enters a Gray Area (Wall Street Journal)

- Pfizer and BioNTech to supply U.S. govt with additional 200 million doses of COVID-19 vaccine (MarketWatch)

- Airline Earnings Show Signs of Life. But New Challenges Are Emerging. (Barron’s)

- Las Vegas Sands Is Falling Amid Concern Over Covid and Asian Operations (Barron’s)

- How Options Trading Is Driving Up Stocks—and Driving Them Down (Barron’s)

- Here’s what a Bank of America strategist says investors should do next as market rotation enters round four (MarketWatch)

- Eurozone business activity expands at fastest pace for 21 years (Financial Times)

- Thermal coal prices soar as demand for electricity rebounds (Financial Times)

- Intel chief says more consolidation needed in chip industry (Financial Times)

- Energy expert warns of ‘serious oil crisis’ within next five years (Fox Business)

- Intel beats, but guides to lower margins for Q3 (CNBC)

- China Considers Turning Tutoring Companies Into Non-Profits (Bloomberg)

- Fed Ramps Up Debate Over Taper Timing, Pace (Wall Street Journal)

- Palm Beach Real Estate Is So Hot, at Least 22 Homes Sold for $40M-Plus Since Covid (Wall Street Journal)

- EV Batteries: The Next Victim of High Commodity Prices? (Wall Street Journal)

Tag: StockMarket

Where is money flowing today?

Data Source: Finviz

Be in the know. 23 key reads for Thursday…

- AT&T Stock Rises As Q2 Earnings Top Expectations (Investor’s Business Daily)

- China Trade Booms as If Virus, Tariffs Never Happened (Bloomberg)

- United Wholesale Mortgage CEO on mortgage rates (Yahoo! Finance)

- 4 Top Aerospace and Defense Stocks to Buy Now Before Q2 Earnings (24/7 Wall Street)

- Two Big Carriers Report Narrowing Losses, Positive Cash Flow (Invetor’s Business Daily)

- ECB Hints at Looser Policy for Longer (Barron’s)

- Intel Reports Earnings Today. Expectations Are High. (Barron’s)

- Natural Gas Prices Are Soaring, but the Stocks Aren’t. Here’s Why. (Barron’s)

- Apple’s Privacy Move Has Scrambled Social-Media Advertising. We’ll Know the Real Impact Soon. (Barron’s)

- Fed Chief Powell Enjoys Support for Reappointment, but He’s Not a Lock (Wall Street Journal)

- Coca-Cola Boosts Outlook as Sales Rebound (Wall Street Journal)

- ‘Call Her Daddy’ Host Alex Cooper Wants to Have the Biggest Podcast in the World (Wall Street Journal)

- 2M workers remain on jobless benefits as weekly claims jump to 419K (New York Post)

- How Nations Are Learning to ‘Let It Go’ and Live With Covid (New York Times)

- The Saudi Prince of Oil Prices Vows to Drill ‘Every Last Molecule’ (Bloomberg)

- China Offers Oil Reserves in Unprecedented Move to Cool Rally (Bloomberg)

- Oil Holds Biggest Gain in Three Months on Demand Recovery (Bloomberg)

- Johnson & Johnson Posts Higher Profit as Healthcare Demand Returns (Wall Street Journal)

- Wild Superyacht Secrets I Learned When I Became a Deckhand (Bloomberg)

- Delta Dawn. The Energy Report 07/22/2021 (Phil Flynn)

- Biden confident $1tn infrastructure deal within reach despite vote setback (Financial Times)

- The FDA may not fully approve a COVID-19 vaccine until January. Here’s why (MarketWatch)

- CSX profit more than doubled as railroad hauled 27% more (FoxBusiness)

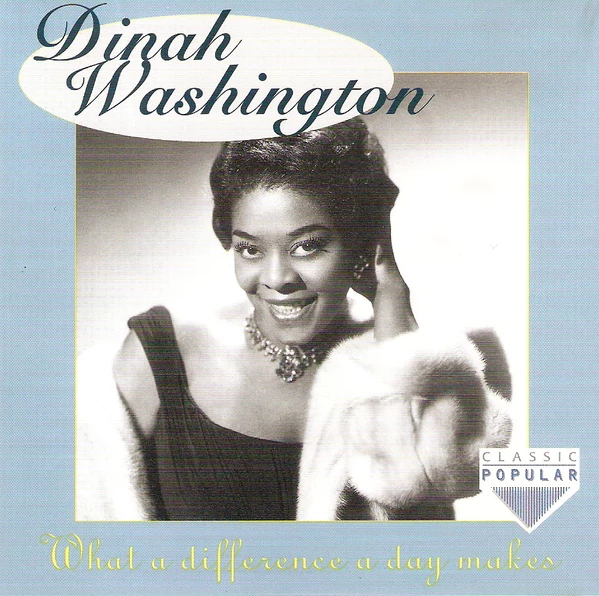

The Dinah Washington, “What a Difference a Day Makes” Stock Market (and Sentiment Results)…

This week we chose Dinah Washington’s legendary hit, “What a Difference a Day Makes” to capture the turn in sentiment that took place between Monday and Tuesday of this week: Continue reading “The Dinah Washington, “What a Difference a Day Makes” Stock Market (and Sentiment Results)…”

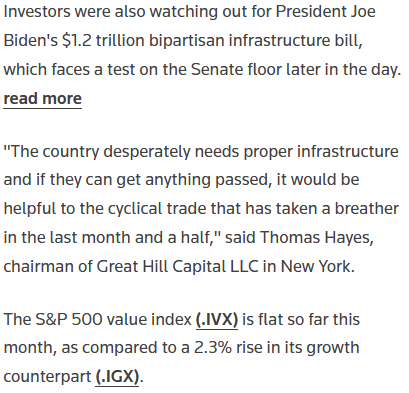

Tom Hayes – Quoted in Reuters article – 7/21/2021

Thanks to Devik Jain and Shreyashi Sanyal for including me in their article on Reuters today. You can find it here:

Click Here to View The Full Article on Reuters

Unusual Options Activity – Alibaba Group Holding Limited (BABA)

Data Source: barchart

Today some institution/fund purchased 2,222 contracts of Jan 2023 $285 strike calls (or the right to buy 222,200 shares of Alibaba Group Holding Limited (BABA) at $285). The open interest was just 959 prior to this purchase. Continue reading “Unusual Options Activity – Alibaba Group Holding Limited (BABA)”

Where is money flowing today?

Data Source: Finviz

Be in the know. 30 key reads for Wednesday…

- Futures Mixed With Earnings in Focus; Dollar Gains: Markets Wrap (Bloomberg)

- US official to visit China as diplomatic stand-off resolved (Financial Times)

- Novartis Sales Rise As Clients Restock Post-lockdown (Barron’s)

- Intel Can Do Self-Driving Cars, Too. Don’t Write Off Mobileye. (Barron’s)

- Novartis aims to beat rivals to novel $10bn cancer treatment market (Yahoo! Finance)

- Airbnb’s Brian Chesky Sees a ‘Travel Rebound of the Century’ (Barron’s)

- Oil Could Hit $80 by Year End, JPMorgan Says. Here’s Why. (Barron’s)

- SAP Boosts Guidance as It Gains Ground in Shifting to the Cloud (Barron’s)

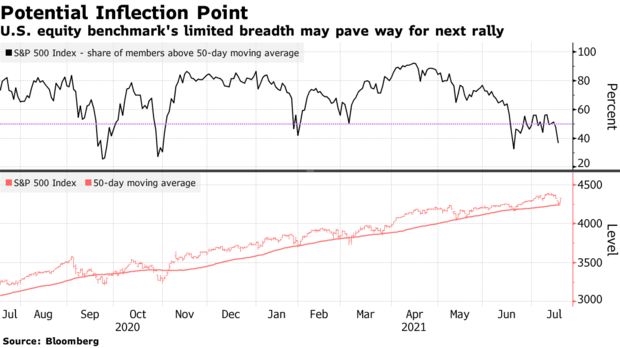

- This technical support shows the strength of the buy-the-dip force in markets (MarketWatch)

- United Airlines Expects to Turn Profitable This Fall (Barron’s)

- J&J Stock Rises on Earnings. (Barron’s)

- Don’t Give Up on Value Stocks. 10 That Can Beat the Market. (Barron’s)

- JPMorgan Raised Its S&P 500 Price Target — Before Tuesday’s Rally. Here’s Why. (Barron’s)

- John Kerry Urges China to Help Break Climate ‘Suicide Pact’ (Bloomberg)

- Raytheon CEO Sees Hypersonic-Weapons Era: ‘Speed Trumps Stealth’ (Bloomberg)

- China’s Births May Drop Again This Year From 2020’s Low (Bloomberg)

- Netflix Promises Growth Ahead After Languid Start to Year (Bloomberg)

- Netflix Signals No Acquisition Plans as It Adds 1.5 Million Subscribers (Wall Street Journal)

- S. Investors Seek Bargains in U.K. Home-Building Industry (Wall Street Journal)

- An ‘Airbnb for Pools’ Is Making a Splash This Summer (Wall Street Journal)

- Coca-Cola quarterly revenue tops 2019 levels; company raises full-year forecast (CNBC)

- Johnson & Johnson expects $2.5 billion in global sales from Covid vaccine this year (CNBC)

- JPMorgan says the S&P 500 will rally another 8% this year as fears of slower growth are overblown (Business Insider)

- JPMorgan gives Jamie Dimon ‘special award’ worth millions to stick around as CEO (MarketWatch)

- Home Building Booms, but Not Enough (Wall Street Journal)

- Goldman Sachs Upgrades Halliburton (HAL) to Buy, Sees Dividend Raise (StreetInsider)

- 5 Highest Yielding Dividend Aristocrat Stocks to Buy Now as Interest Rates Continue to Plunge (24/7 Wall Street)

- China says it will continue to open up financial sector (Reuters)

- Netflix To Begin Video-Gaming Foray With Free Mobile Offerings For Subscribers: What You Need To Know (Benzinga)

- Verizon Beats On Q2 Earnings, Issues Robust FY21 Outlook (Benzinga)

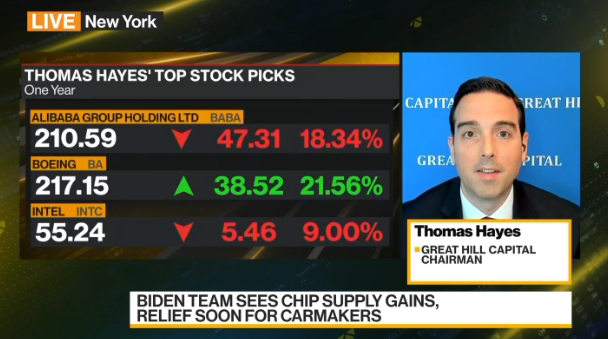

Tom Hayes – Bloomberg TV Appearance – 7/20/2021

Bloomberg TV Appearance – Thomas Hayes – Chairman of Great Hill Capital – July 20, 2021

Click Here To Watch Directly on Bloomberg – (starting point 2:50 minutes in)

Tom Hayes – Bloomberg Radio Appearance – 7/20/2021

Bloomberg Radio Appearance – Thomas Hayes – Chairman of Great Hill Capital – July 20, 2021