This week we chose Dinah Washington’s legendary hit, “What a Difference a Day Makes” to capture the turn in sentiment that took place between Monday and Tuesday of this week:

What a difference a day makes

24 little hours

Brought the sun and the flowers

Where there used to be rain…

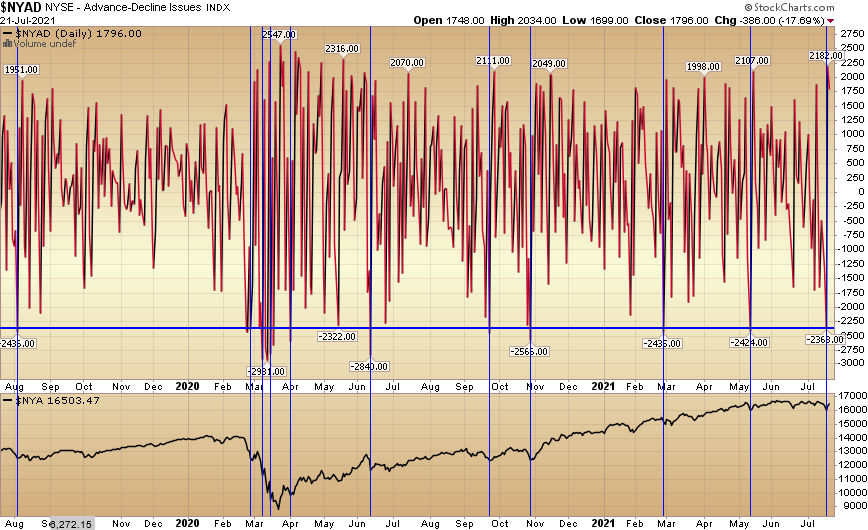

On Monday, the NYSE Advance/Decline Issues Indicator dropped below -2350 (it was even lower mid-day) which has routinely been a reversal point in normal conditions. It was not a useful tool during March of 2020 – which was a once in 100 year event.

What’s on Sale?

I was called on Monday morning by Ally Thompson at 10:20am (with the Dow down ~800 points) and asked to come on Cheddar at 10:40am to discuss the market’s meltdown. I finished up a couple of buy orders and jumped on with Brad Smith to deliver this calming message. Thanks to Ally and Brad for having me on:

Click Here to Watch HD Version Directly on Cheddar

We talked about initiating/adding INTC and BABA on the weakness that day. We also talked about the difficulty of getting too bearish with the Fed’s Balance Sheet at an all time high (as of Friday’s close), and commodities’ recent cooling clearing the way for a continued accommodation. Furthermore, I expected 2022 EPS guidance to continue strong and take estimates from $213 to ~$225+ in coming months.

I anticipated some buying into the close (after 2:30pm margin calls) and made a statement that Brad seemed to latch onto and enjoy quite a bit:

“Wall Street is the only place that when they hold a clearance sale, no one shows up!” That was certainly the case on Monday morning, but they jumped back in on Tuesday.

Alibaba

On Tuesday evening I joined Shery Ahn & Haidi Stroud-Watts on Bloomberg TV. Thanks to Jung Soo Maeng, Sheri and Haidi for having me on.

An hour later I joined Kathleen Hays & Douglas Krizner on Bloomberg Radio. Thanks to Yang Yang, Jung Soo, Kathleen and Doug for having me on.

Click Here To Watch HD Version Directly on Bloomberg – (starting point 2:50 minutes in)

Listen Directly on Bloomberg (shorter commercial free version)

Here are a few of the Subjects we covered over the two different interviews (Show Notes):

– Top 3 investment strategies (top stock picks in China & US, any changes in the past month)?

PICK 1 (China)

- We’ve spent the last few weeks adding to Alibaba holdings between $199-210. Our basis is now ~$209. It is our largest position.

- Our bet is that the Chinese Government will not destroy $2.1T of liquidity/market cap that has been raised for ~248 Chinese companies listed in the US. Doing so would destroy job creation and innovation in their own country. Furthermore, if they discourage FUTURE IPO listings, the existing/legacy Chinese growth companies will benefit from lack of new supply. Institutional managers may not be as quick to invest in the Hong Kong shares either as the business environment has become more tenuous – so any impairment of US capital market access would severely impact capital formation for Chinese companies globally.

- 33 China Tech giants signed a voluntary anti-trust ‘self-discipline’ pledge at the China Internet Conference last week.

- China stocks largely bottomed on July 8 and have since bounced after Tencent’s deal to buy search engine Sogou was approved. This showed that regulators were being reasonable and reviewing each situation on a deal by deal basis – versus saying no to everything.

- BABA trading at 17.5x next year’s earnings compared to historic multiple of 28x. Buy at same price in July 2021 as in July 2018. Difference? You get double earnings per share, double cash flow per share, and double revenue per share today.

- It is also noteworthy that between 2014 and 2021 revenue has grown at a CAGR of 41.4%, EBITDA has grown at a CAGR of 23.4% while the enterprise value of Alibaba has only expanded at a CAGR 13.9% (and the market cap at 14.7%). This indicates that price is trailing intrinsic value by a large margin. We believe fair value is >$300/share and will normalize over the next 12-24 months.

PICK 2 (US) Boeing (NEW)

- Never ending problems with 737 Max, now 787, BUT it’s still a duopoly!

- Booked 219 orders in June (200 737 Max from UAL).

- Key catalyst will be approval in China (737 Max is fastest selling in China). It’s up to relations between Beijing and Washington at this point.

PICK 3 (US) Intel (NEW)

- Holds the lion’s share of the PC and server processor markets. Server processor sales will be the main driver of growth in the near future.

- Trades at 11.7x next year’s earnings. Consistent dividend grower with 2.53% current yield.

– 2Q earnings outlook

- 2022 estimates at $213.59. We think this climbs to ~$225-230 over next 2 months with strong guidance.

- So far Q2 85% beat rate (bottom line), 90% beat rate (top line).

- Q2 EPS growth estimated +63% yoy, Actual +70% so far.

– US-China trade tensions; have markets priced the risks in?

- For the big established players with business moats like BABA, BIDU, TCEHY, PDD, etc. we think most of the regulatory and listing risk is priced in at this point.

– Have you priced in for further China tech crackdown? Do you see Chinese tech stocks selling off further? Thoughts on valuations US tech vs China tech.

- Biggest fines are in the rearview mirror for the big players. New IPOs will be aggressively scrutinized and possibly rejected moving forward. As we move farther away from the 100yr anniversary of the communist party, policies should begin to normalize.

– Contrarian views and anything else you’d like to add

- We are one year into the new business cycle. While we will not grow at 70% yoy moving forward “peak growth,” but we will continue to grow above trend. Dips in quality/fairly valued names are to be bought, not sold.

- Defensives should continue to get bid over the next month or so (Staples, Utilities, Healthcare). Cyclical/Re-opening trade will come roaring back before year-end.

– Virus resurgence on the delta variant- does it still make sense for an economic re-opening trade? Have investors begun the unwind of the reflation trade?

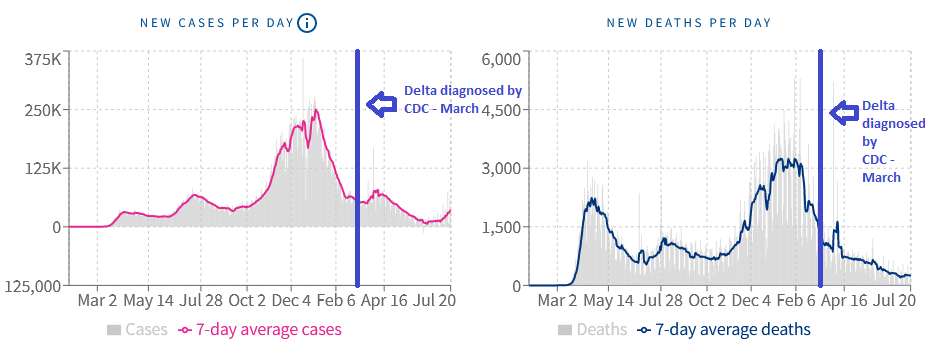

- Cases driven by the Delta variant are rising, but compared to very low levels, as you can see in the chart below (usafacts.org):

- While the re-opening/cyclical trade has taken some pain in recent weeks, we think it will take some time to work through the “Delta Variant” story.

- Now approaching a 70% vaccination rate for Adults in the U.S., any proliferation of COVID cases among the non-vaccinated will drive us closer to herd-immunity.

- The market will figure this out in coming weeks and it will be the time to add/build back re-opening/cyclical exposure into year-end as taper talk returns and yields start to move higher once again.

- In the mean time, defensives (utilities, staples, pharma)/dividend payers should benefit from compressed yields.

Now onto the shorter term view for the General Market:

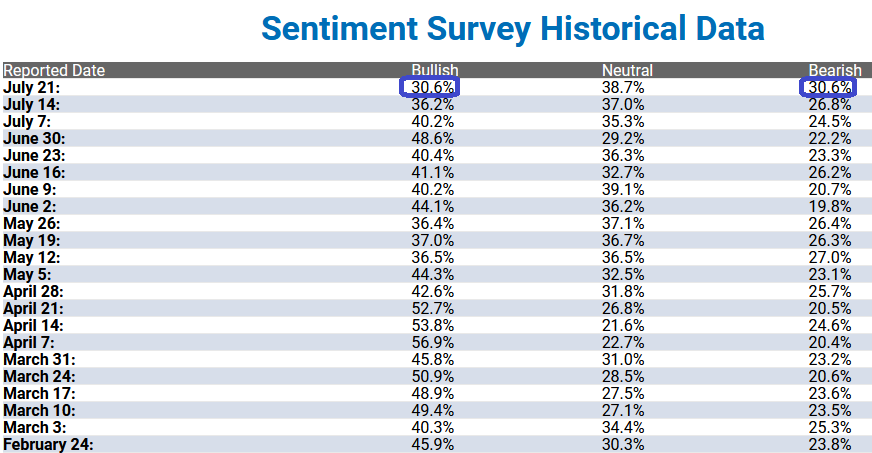

In this week’s AAII Sentiment Survey result, Bullish Percent (Video Explanation) dropped to 30.6% from 36.2% last week. Bearish Percent increased to 30.6% from 26.8% last week. Retail traders/investors are now showing fear.

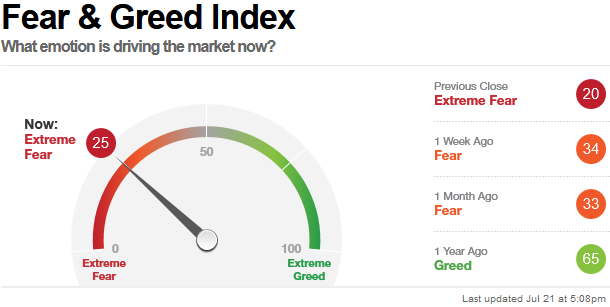

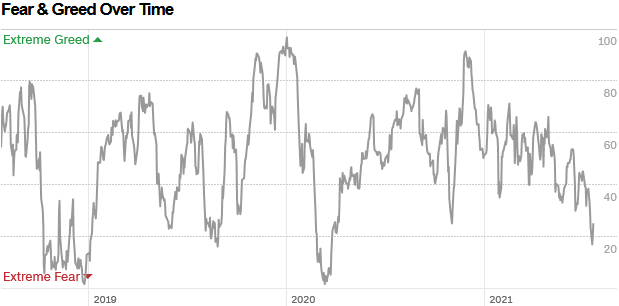

The CNN “Fear and Greed” Index dropped from 34 last week to 25 this week. Fear is present in the market. You can learn how this indicator is calculated and how it works here:(Video Explanation)

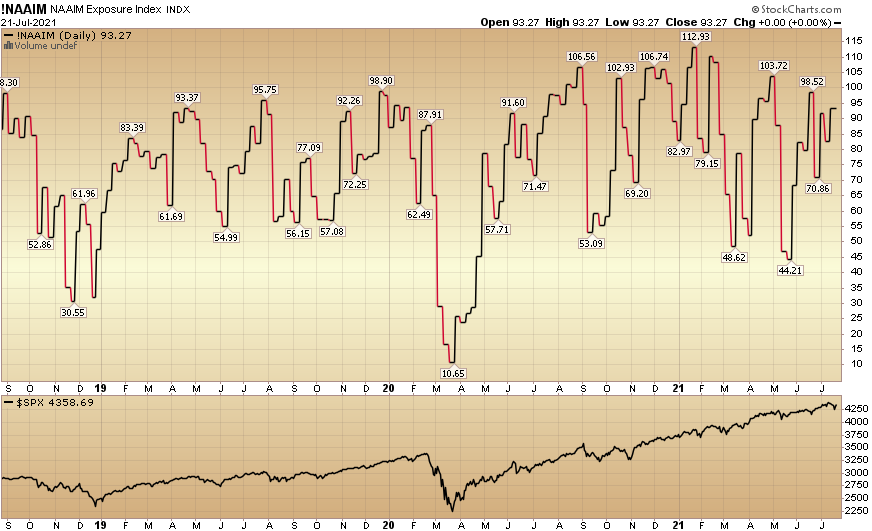

And finally, this week the NAAIM (National Association of Active Investment Managers Index) (Video Explanation) rose to 93.27% this week from 82.54% equity exposure last week.

And finally, this week the NAAIM (National Association of Active Investment Managers Index) (Video Explanation) rose to 93.27% this week from 82.54% equity exposure last week.

Our message for this week:

We mentioned a few new long term picks in our recent media spots (that we bought on weakness this week). INTC and BA are longer term holds. We added – at the margins – to energy on Monday’s flush. We think there will be more opportunity to gain additional exposure.

Nothing has changed in our outlook on Defensives (staples, utilities, big pharma). This (next few months) is the time of year you are generally rewarded for holding these groups. As for BABA, there’s nothing more to add beyond what I covered in the three segments above. “I like the stock!”

We will go into further detail this week on FRIDAY’s podcast/videocast.