- Top Analyst Says Software Stocks Are Expensive Now: 5 High-Value Conviction Buys (24/7 Wall Street)

- Spac boom fuels strongest start for global M&A since 1980 (Financial Times)

- Long-term US government bonds endure worst quarterly fall since 1980 (Financial Times)

- Archegos debacle reveals hidden risk of lucrative swaps (Financial Times)

- 5 Weirdest Corporate April’s Fool Pranks Of All Time: Voltswagen, Tesla Model W And More (Benzinga)

- The Wrong Guy. The Energy Report 04/01/2021 (Phil Flynn)

- Biden’s Push for Electric Cars: $174 Billion, 10 Years and a Bit of Luck (New York Times)

- 3 Underperforming IPO Stocks Worth a Second Look (Barron’s)

- It’s a Great Time to Own Financial Stocks. Here’s Why. (Barron’s)

- Optimistic Forecasts on Economy Might Still Be Too Dismal (Wall Street Journal)

- Biden’s $2.3 Trillion Infrastructure Plan Takes Broad Aim (Wall Street Journal)

- What’s in Biden’s $2 Trillion Corporate Tax Plan (Wall Street Journal)

- Shoppers Start to See Effect of Higher Commodity Costs (Wall Street Journal)

- How Japanese Investors Accelerated the Treasury Selloff (Wall Street Journal)

- Walgreens Reports Stronger Profit as Covid-19 Vaccine Rollout Ramps Up (Wall Street Journal)

- Pfizer says COVID-19 vaccine lasts 6 months, protects against variants (New York Post)

- Goldman Sachs Sees “Significant Downside Risk” to Apple (AAPL) Services Growth (Street Insider)

- US home prices are rising at their fastest in 15 years – and Goldman says they’ll surge another 7% this year (Business Insider)

- S&P 500 clears 4,000 milestone as data show U.S. factories booming (MarketWatch)

- Japan and South Korea reported unexpectedly strong economic data, as Asian stocks rise (MarketWatch)

Tag: StockMarket

The Dua Lipa “Levitating” Stock Market (and Sentiment Results)…

This week we chose Dua Lipa’s billboard hit (featuring DaBaby), “Levitating” to capture the current status of the stock market. She describes it well with her lyrics: Continue reading “The Dua Lipa “Levitating” Stock Market (and Sentiment Results)…”

Where is money flowing today?

Data Source: Finviz

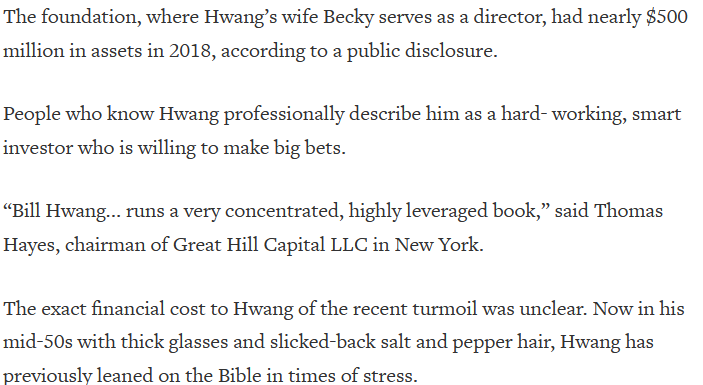

Tom Hayes – Quoted in Reuters article – 3/29/2021

Thanks to Lawrence Delevingne for including me in his article on Reuters this afternoon. You can find it here:

Tom Hayes – Quoted in Al Jazeera article – 3/30/2021

Be in the know. 15 key reads for Wednesday…

- What’s in Biden’s $2.25 Trillion Infrastructure and Tax Proposal (Bloomberg)

- Pfizer’s Vaccine Is 100% Effective in Adolescents, Company Says (Barron’s)

- H&R Block Wants to Do More Than Your Taxes. Why Its Stock Is a Buy. (Barron’s)

- Tesla Could Be One of the Big Winners in Biden’s $2 Trillion Infrastructure Plan (Barron’s)

- OPEC cuts, vaccines to sustain oil’s recovery: Reuters poll (Reuters)

- Biden to unveil $2tn infrastructure plan and big corporate tax rise (Financial Times)

- Boeing Gets More 737 MAX Orders From Alaska Airlines Over December Commitment (Benzinga)

- Wall Street is pricing in $4 trillion of infrastructure spending. Here are the stocks that could benefit, according to Bank of America. (MarketWatch)

- These are the stocks for playing Biden’s infrastructure push, analysts say (MarketWatch)

- Biden kicks off effort to reshape U.S. economy with infrastructure package (Reuters)

- Energy Mixer. The Energy Report 03/31/2021 (Phil Flynn)

- U.S. Companies Add Most Jobs Since September, ADP Data Show (Bloomberg)

- Kimberly-Clark (KMB) Announces Price Increases for North American Consumer Products Business (Street Insider)

- U.S. Home Prices Rise at Fastest Pace in 15 Years (Wall Street Journal)

- What Is a Total Return Swap and How Did Archegos Capital Use It? (Wall Street Journal)

Where is money flowing today?

Data Source: Finviz

Be in the know. 20 key reads for Tuesday…

- Institutional investors have been net sellers of stocks since December but that’s actually a bullish signal for equities, according to Fundstrat (Business Insider)

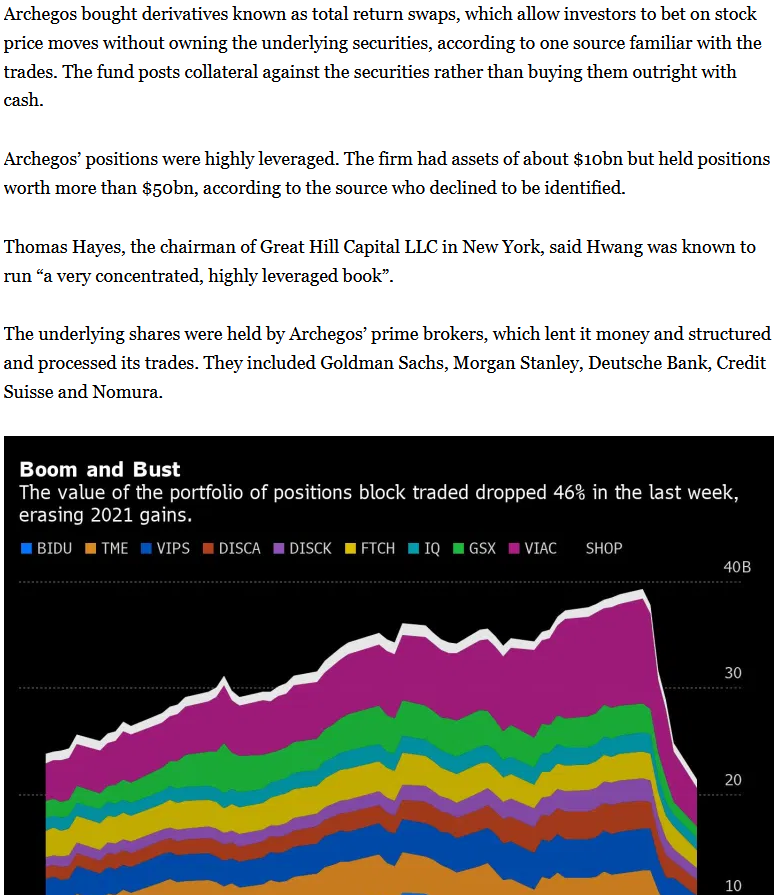

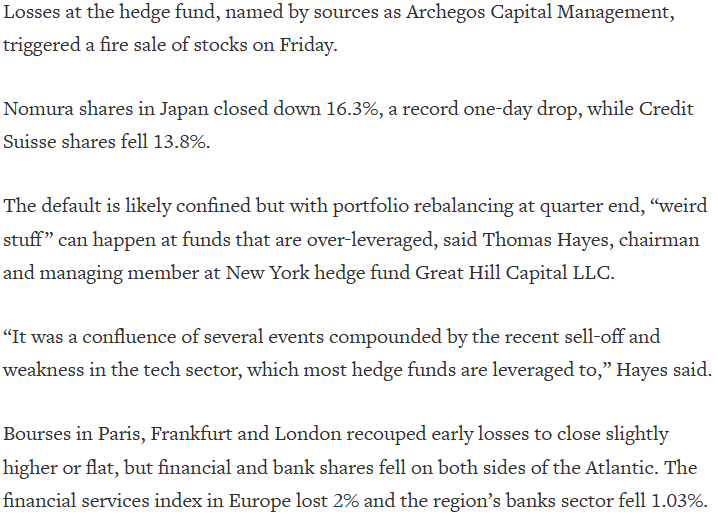

- Here are the complex bets at the heart of ‘unprecedented’ Archegos-linked $30 billion margin call (MarketWatch)

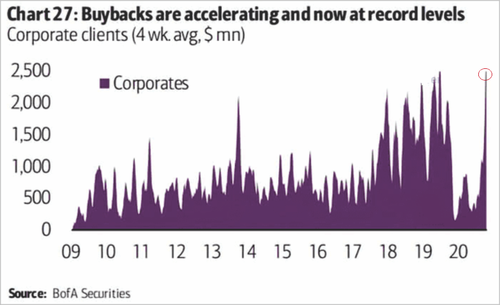

- This past week, share buybacks hit a new record. (zerohedge)

- Real Estate Investors Desperate to Spend $250 Billion Hoard (Bloomberg)

- Splunk Fell Behind in the Cloud Era. Now It’s Catching Up and the Stock Could Soar. (Barron’s)

- The Fed May Allow Bank Dividend Hikes. How to Play It. (Barron’s)

- Investors See Poor Large-Cap Stock Gains This Year. Here’s Where There’s Opportunity. (Barron’s)

- Boeing Stock Is Jumping, With 3 Pieces of Good News (Barron’s)

- Billions in Secret Derivatives at Center of Archegos Blowup (Bloomberg)

- Here’s why Wall Street and investors aren’t giddy enough, says top strategist (MarketWatch)

- China, Long a Source of Deflation, Starts Raising Prices for the World (Wall Street Journal)

- SPACs Are the Stock Market’s Hottest Trend. Here’s How They Work. (Wall Street Journal)

- Treasury Yields Rise With Biden Spending in Focus: Markets Wrap (Bloomberg)

- How the U.S. Is Vaccinating Its Way Out of the Pandemic (Bloomberg)

- Value Quants Take Wall Street by Storm With Best Run Since 2000 (Bloomberg)

- Big Oil’s Secret World of Trading (Bloomberg)

- Bank and cyclical stocks should be bought on the dip, Jim Cramer says (CNBC)

- Oil drops as Suez opens, focus turns to OPEC+ output cuts (Street Insider)

- Oil Choppy Ahead of OPEC Plus. The Energy Report 03/30/2021 (Phil Flynn)

- ‘Biggest Risk’ Facing Apple, Tesla, Other Nasdaq Stocks? US-China ‘Cold Tech War,’ Says Analyst (Benzinga)

Unusual Options Activity – Wells Fargo & Company (WFC)

Data Source: barchart

Today some institution/fund purchased 29,442 contracts of May $45 strike calls (or the right to buy 2,944,200 shares of Wells Fargo & Company (WFC) at $45). The open interest was 15,410 prior to this purchase. Continue reading “Unusual Options Activity – Wells Fargo & Company (WFC)”

Tom Hayes – Quoted in Reuters article – 3/29/2021

Thanks to Herb Lash for including me in his article on Reuters this afternoon. You can find it here: