This week we chose Dua Lipa’s billboard hit (featuring DaBaby), “Levitating” to capture the current status of the stock market. She describes it well with her lyrics:

Woo-hoo

I’m levitating (woo)

Come on, come on, come on, dance with me

I’m levitating

(Come on, let me take you for a ride)

I’m levitating (woo)

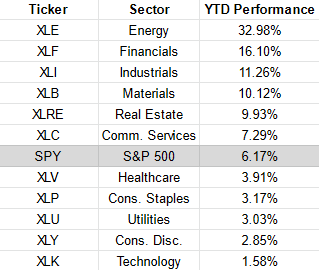

While it may feel like the market is “Levitating”, when we look at performance by sector – it shows what has run and where there still may be opportunity:

The good news – for those of you who have followed me for some time – is that we were dramatically overweight banks and energy since before the election.

The bad news is – we may have to wait some time for the next leg higher. We are holders at this level, not buyers – and would not be surprised to see these Q1 winners take a rest. We are not sellers because we believe this rest will support a move to new highs before year-end and beyond.

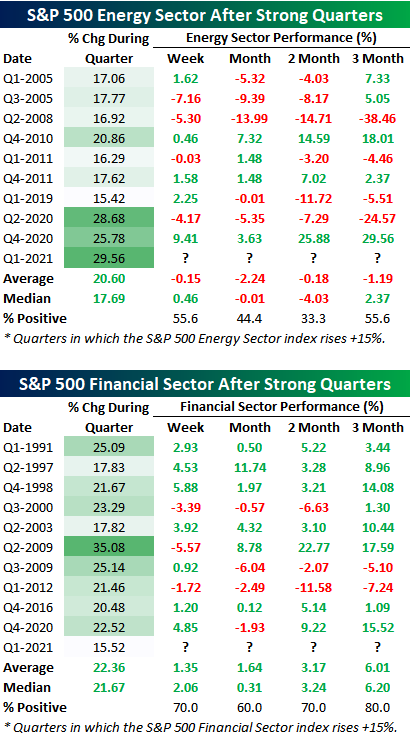

@BespokeInvest put out these two tables which show the inclination of Energy and Financials to rest for a few months after a 20%+ quarter:

It would not surprise us if past is prologue, and our winners from Q1 do not help us much in Q2. If that proves to be the case, where will we look to keep our equity curve moving up?

On Feb 25 and Mar 4 we emphasized that we were loading up on Utilities, Cons. Staples and Big Pharma. All had one thing in common at the time we wrote the notes – they were negative for the year. That has changed quickly in four weeks:

If you notice from the sector performance table at the top of the article, while they are all now positive for the year, they are still below the S&P 500 performance. The other “under the line” sector (which is the worst performer for the year) is Technology.

For the S&P 500 to move meaningfully higher we will need some participation from this laggard sector – and with the rate of change in yield appreciation slowing – we may start to see certain pockets of tech perk up in coming weeks. This is one group where selectivity will be paramount as many names continue to deflate – due to multiple contraction/re-rating.

We will not be aggressive in Tech as we have been in Utilities, Staples and Pharma (where there is still selective opportunity on weakness), we will take advantage of selective opportunities as they present themselves.

AAPL will not be one of those opportunities – yet. We do not see any near term catalysts to reverse this weakness (as they are coming up on tough comps), however we do think a long term “load-the-boat” opportunity should present itself at some point later this year if it gets sold off enough.

It’s going to take some major initiatives to move the needle on a $2T stock that experienced significant multiple expansion into the “sell the news” 5G roll out. We do not believe those catalysts are imminent, and therefore would not be surprised by further drift.

We are however starting to look at a few SAAS companies that are down 30-40% off their recent highs. Nothing aggressive for tech in general (as their year on year comps will be very tough in Q1/Q2), but there are selective opportunities starting to emerge.

Infrastructure

On Tuesday, I was on Fox Business – the Claman Countdown – with Liz Claman discussing some ideas ahead of the infrastructure bill announcement. Thanks to Liz and Ellie Terrett for having me on:

The good news is we’re going to finally get some infrastructure spending. The bad news is it’s going to cost $3-4T.

Many of the industrial, materials, and clean energy stocks have risen materially since the election – in anticipation of this announcement, so a lot of this “good news” is already priced in. It’s not the time to chase.

*This $3-4T is going to be raised through new taxes and deficit spending. In order to comply with new taxes and rules, people and businesses are going to increasingly turn to professionals.

1) (Source: Barron’s – Carleton English) Last year, H&R Block launched a new strategy focused on continuing to provide tax preparation to individuals and small businesses while expanding into financial products such as debit and savings accounts and year-round payroll and tax services for small businesses. Small business invoices, payroll, and payments needs sales grew 32% in the last quarter from a year ago. H&R Block’s Emerald prepaid debit card, which accounts for roughly 3% of sales, allows tax refunds to be deposited straight to the card, which is also compatible with Apple and Android wallets, allowing H&R Block to become a player in mobile payments. 1/3 of leases are expiring and they will continue to invest in their digital offerings. Revenues are projected to hit $3.5B for this fiscal year (which ends next month), up from $2.6B the prior year. It pays almost 5% dividend yield and trades at 8x next year’s earnings. The five year average p/e is 11x which implies we could see a ~40-50% move in the next 12 months.

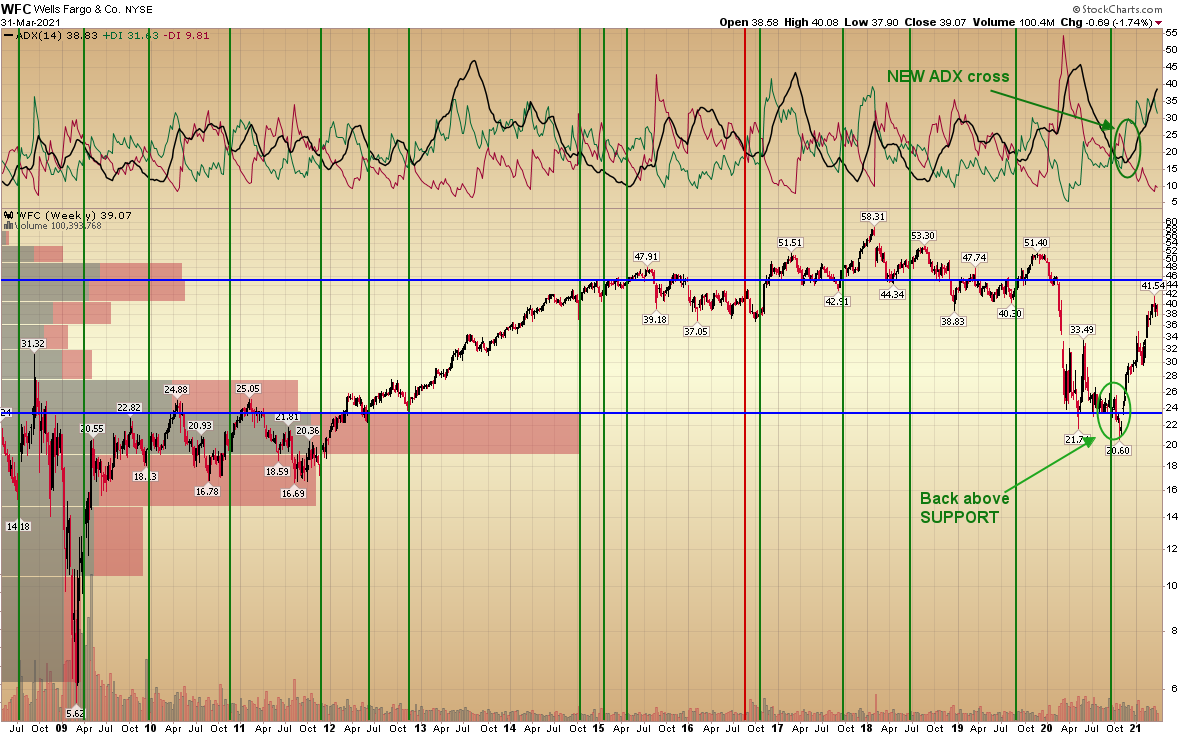

2) What’s not raised in Taxes will be borrowed in treasury issuance – which will cause yields on Treasuries to creep up over time. This will continue to help banks’ net interest margin and profitability over time – which will specifically accrue to banks with large lending businesses like Wells Fargo. While we suggested WFC last year in the mid-20’s on the show, we believe there is significant room to run over the next year+ as NIM profits improve, credit reserves are released and lending accelerates. Another catalyst will be when the asset cap is finally lifted by the regulators. Here’s the updated chart from when we originally put it out last summer:

To the Victor Go the Spoils

President Biden laid out the first part of his Infrastructure/Green New Deal plan on Wednesday evening. As was the case in the last $1.9T bill, he suggested a willingness to “work across the aisle” and then jammed it through with reconciliation (circumventing the ordinarily required 60 votes to pass a bill). This time will be no different. That is not a criticism, it is the reality of the situation. To the victor go the spoils…

Here’s what’s coming (NYPost):

Taxes:

-28% corporate tax rate (up from 21%).

-Minimum tax on profits U.S. corporations earn overseas, increasing the rate to 21% from roughly 13%.

-White House Press Secretary Jen Psaki recently clarified the hike would apply to families earning a total of $400,000 per year — meaning two adults who make $200,000.

-Biden also reportedly is planning to push for a higher rate for capital gains taxes on investments like stocks and real estate, to treat them like ordinary income rather than the current highest 20 percent tax rate.

Spending (1st $2.25T NOW. $1T+ in a few weeks):

-Home care for seniors, disabled: $400 billion

-Electric vehicles: $174 billion

-Roads and bridges: $115 billion

-Modernize water systems: $111 billion

-School construction: $100 billion

-Public transit: $85 billion

-Amtrak repairs: $80 billion

-Broadband internet: $100 billion

-Infrastructure resilience: $50 billion

-Public housing: $40 billion

-Weatherize buildings: $27 billion

-‘Transformative’ and ‘ambitious’ projects: $25 billion

-Upgrade child care facilities: $25 billion

-Airport construction: $25 billion

-Bike lanes and pedestrian safety: $20 billion

-Connect disadvantaged neighborhoods: $20 billion

-Ports and ferries: $17 billion

-Cap oil wells and old mines: $16 billion

-Community colleges: $12 billion

-Civilian Climate Corps: $10 billion

-Redevelop industrial sites: $5 billion

Some of these line items are overdue and will be beneficial to productivity in years to come. Many are unrelated to Infrastructure investment and will not provide any long term benefit to growth.

But one thing is clear, with $5.3T of spending completed in the past 12 months – and this additional $3-4T on the way – inflation is coming. Chairman Powell will get his wish, but it will not be transitory…

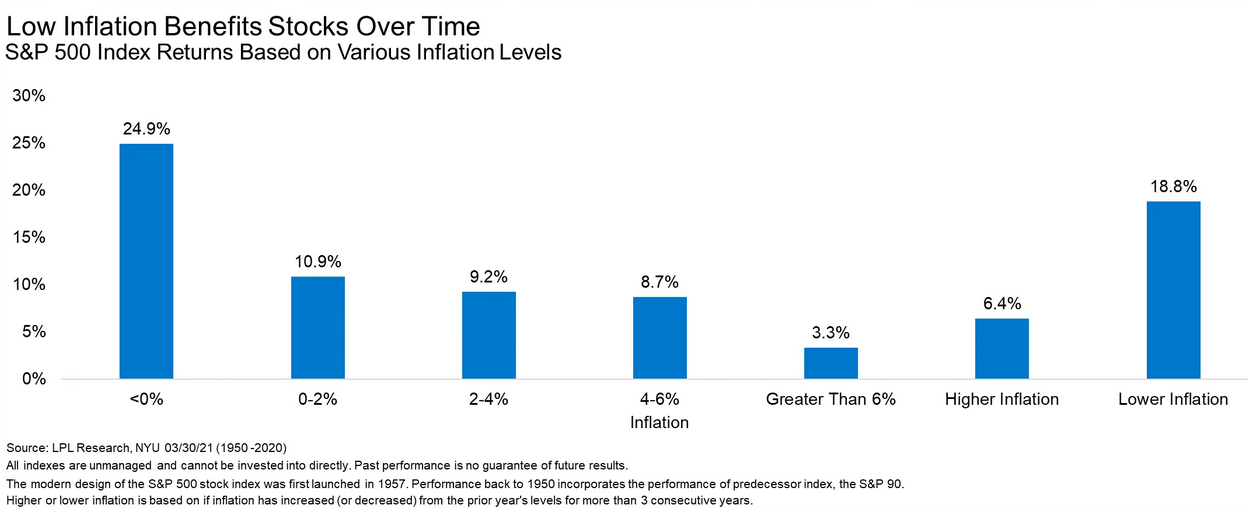

Here’s how stocks historically react in inflationary environments (source: Ryan Detrick LPL):

The bad news is inflation is not great for stocks (general indices) – especially when it exceeds 2%. The good news is, it does help value, cyclicals, banks and commodity based stocks outperform on a relative basis to Tech and Growth. This (along with higher taxes) will start to be of greater concern in 2H.

Now onto the shorter term view for the General Market:

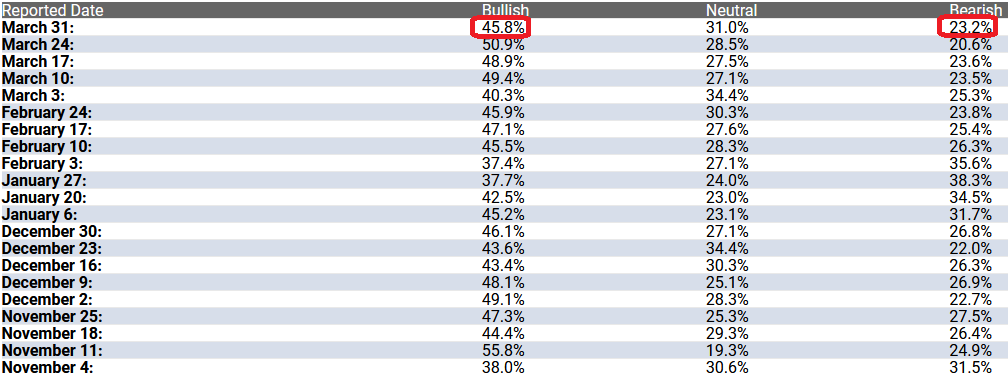

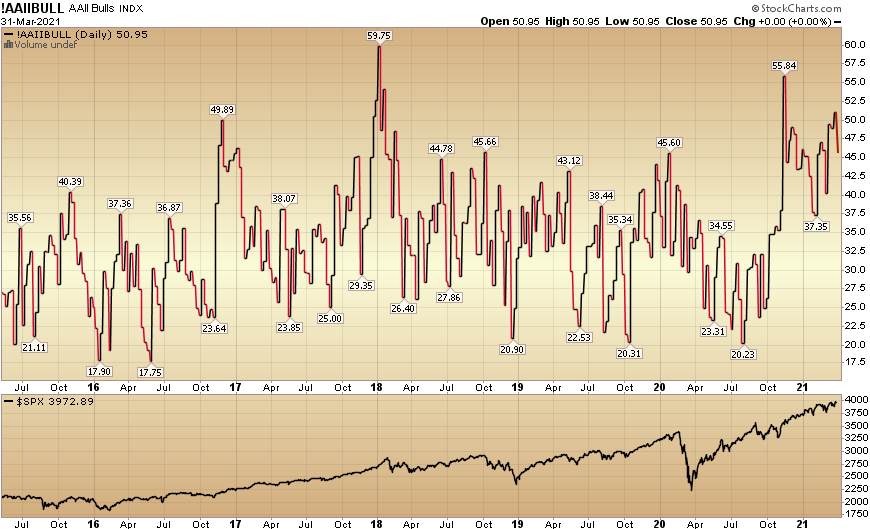

In this week’s AAII Sentiment Survey result, Bullish Percent (Video Explanation) declined modestly to 45.8% from 50.9% last week. Bearish Percent rose to 23.2% from 20.6% last week. Retail exuberance is persisting and still extreme at these levels.

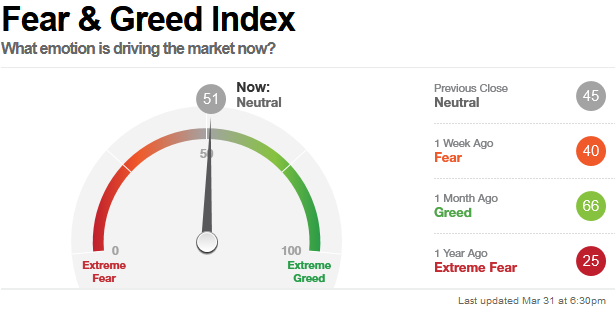

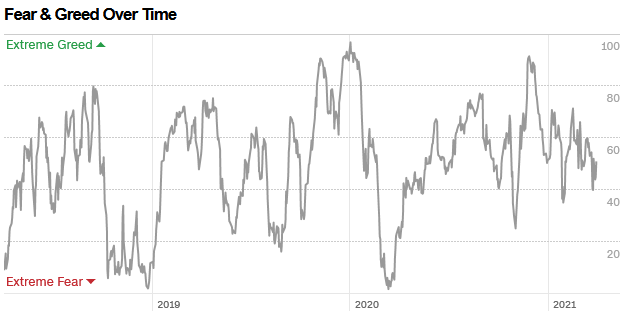

The CNN “Fear and Greed” Index rose from 40 last week to 51 this week. This is a neutral reading. You can learn how this indicator is calculated and how it works here: (Video Explanation)

And finally, this week the NAAIM (National Association of Active Investment Managers Index) (Video Explanation) fell to 57.52% this week from 78.55% equity exposure last week.

Our message for this week:

Despite the feeling that the market is “levitating” we believe there are still great opportunities if you know how to look under the hood.

We built up selective positions in Utilities, Consumer Staples, and Big Pharma since we first mentioned it at the end of last month. We think the rebound in this group should continue in coming months (even if we have a few fits and starts – after a very big jump in the past four weeks).

We continue to hold our banks, energy and defense/aerospace stocks from much lower levels last year and would not be surprised if they continue to take a breather – before resuming their uptrend later this year.

We will look for very selective opportunities in Tech/SAAS – particularly in stocks that have fallen 20-40% in the past few weeks – and will be less impacted by tough comps for Q1 and Q2. This is NOT a wholesale call on tech – as we believe certain pockets will continue to face headwinds.

Reminder: Pay less attention to the general indices – as there are many crosswinds at present – and more attention to take advantage of the “rallies under the surface” through sector rotation.