With several conflicting messages (regarding tapering) from the Fed and Treasury this week, the best song to capture current sentiment is, “Should I Stay or Should I go” by The Clash.

On Monday, Fed Chair Jerome Powell spoke about reducing inequality through Fed policy. The implicit message was that he will run the economy as hot as needed to get everyone who wants a job – hired. On Tuesday, Treasury Secretary Yellen sent the market on an intraday swoon when she said that President Biden’s $4.5T infrastructure and social spending package could cause the Fed to have to raise rates.

After the close, she quickly reversed her statement with the WSJ saying, “I don’t anticipate inflation is going to be a problem.” Phew, for a minute there I was worried that when spending starts to approach 50% of GDP – in a 12-18 month period – my purchasing power might be diminished. I’m glad she cleared that up.

On Wednesday, they paraded out Fed Vice Chair Clarida who said, “the Fed is a long way from our goals.” Translation, what’s hot is about to get a lot hotter. For good measure Fed’s Rosengren came out to assure the market that Yellen’s accidental worry was unfounded, and “higher inflation will be as temporary as last year’s toilet-paper shortage.” It’s always worrisome when a Fed official uses toilet paper as an analogy related to inflation and currency.

Thou doth protest too much, methinks…

But for the Fed, the question for 2H will be:

Should I stay or should I go now?

Should I stay or should I go now?

If I go, there will be trouble

And if I stay it will be double

So come on and let me know…

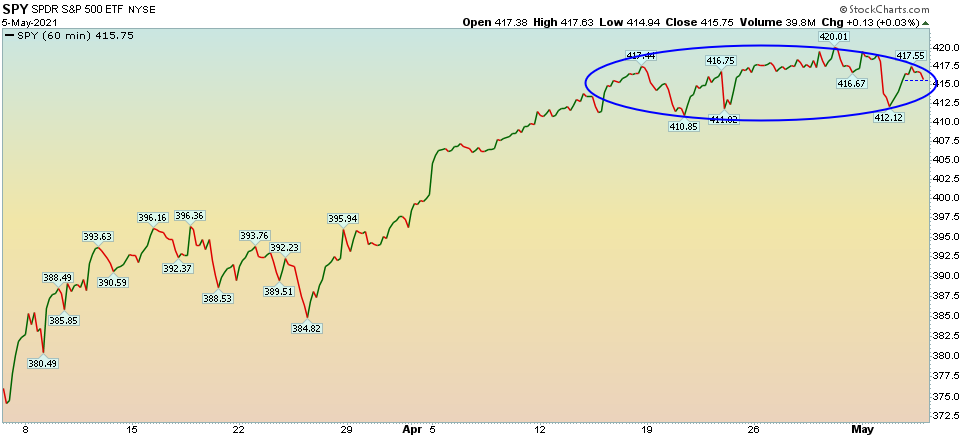

Despite all of the conflicted chatter, the market stayed in its “No Particular Place to Go” range that we discussed last week.

That’s okay with us as it is this exact environment we have discussed since the beginning of the year when we said to, “ignore the general indices and look for the ‘rallies under the surface.'”

Last year we were pounding the table long on Banks, Energy and Defense/Aerospace (for new readers you can review all of our notes here). No one wanted them and most ridiculed the “out of touch” value investors. Now everyone’s excited about banks and people are reluctantly coming around on energy. The fact is, as we emphasized on a weekly basis last year, cyclicals outperform in the early part (first 8-12 quarters) of a new business cycle (when GDP is growing at its fastest off of a low base).

With most banks and and energy stocks now up over 100% the question becomes, “when do I sell them?” The good news is, while you may have to trim some on the way up as you become too overweight from internal profits, both banks and energy have years to go (despite their triple digit moves so far).

Several weeks ago we discussed that the time to get completely out of banks is AFTER the yield curve inverts again. That is years away – as we only inverted in the summer of 2019 – and are now at our steepest ratio since 2011:

If you are a new reader, the red line is the ratio of the 10yr Treasury Yield : 2yr Treasury Yield. When this drops below 1, the curve has inverted (represented 2019, 2007, and early 2000 below – when the red line is at the bottom). That does not mean we will not have 10-20% sector and market pullbacks before the next inversion, but it does mean there is plenty of upside in coming years for the patient investor.

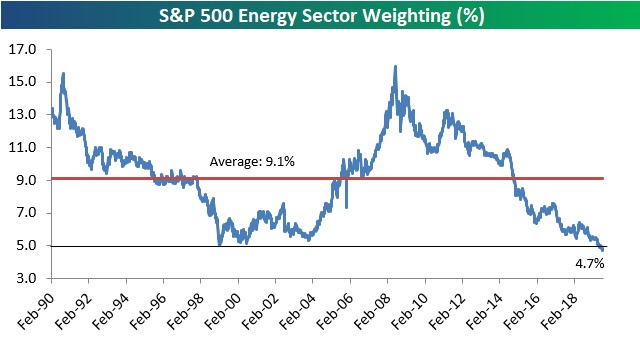

What about energy? The best metric I can think of for energy is to envision its sector weighting in the S&P 500. In Fall of last year it hit its lowest weighting in the index <2%.

Here’s the headline from Barron’s (October 30, 2020):

Here’s a longer term chart from Bespoke Group that puts it in perspective. You can visualize where 2% is:

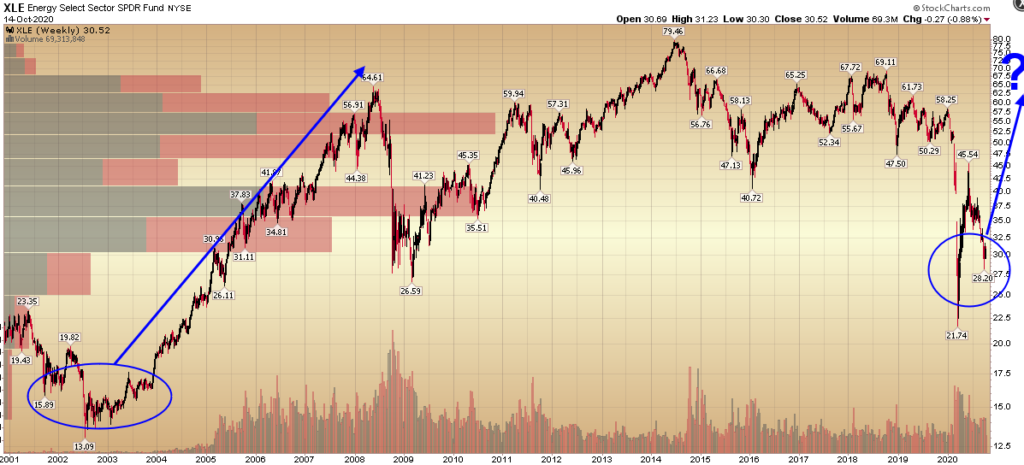

The long term average weighting is 9.1% and each cycle usually peaks ABOVE the average. As we overshot the lower bound last year, it is possible we will exceed the longer term average weighting for Energy by the time this cycle peaks. We are nowhere near that point at present – despite the big move off the lows. In making our case for energy last year, we put out this chart on October 15:

The long term average weighting is 9.1% and each cycle usually peaks ABOVE the average. As we overshot the lower bound last year, it is possible we will exceed the longer term average weighting for Energy by the time this cycle peaks. We are nowhere near that point at present – despite the big move off the lows. In making our case for energy last year, we put out this chart on October 15:

The group has come a long way in a short amount of time:

But where would we get bearish? When the sector weight approaches high single digits – which again – is years away. Will there be 10-20%+ sector corrections along the way? Yes, but for the patient investor it will be worth the wait. We’ll trim some on the way up as the internal profits make us too overweight one stock or sector, but the intermediate term outlook is strong this early in the new cycle.

We are “diamond hand hodlers” of both groups and shave positions (take profits) over time (on strength) as a company or sector becomes too overweight in the portfolio (from internal profits), but we have significant time (years) until this cycle peaks out for good.

Now onto the shorter term view for the General Market:

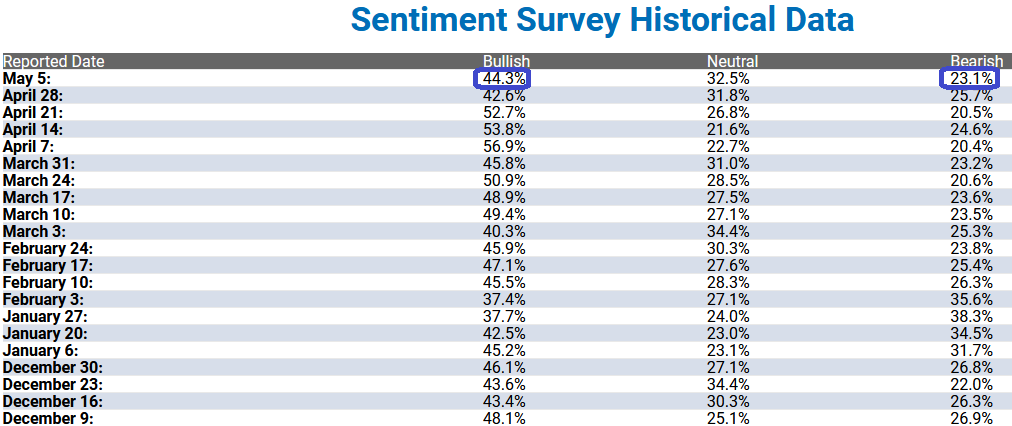

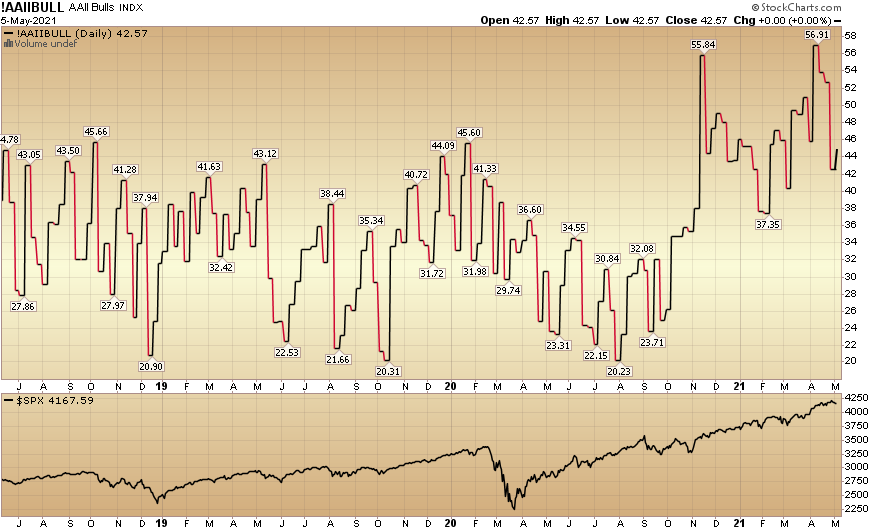

In this week’s AAII Sentiment Survey result, Bullish Percent (Video Explanation) rose to 44.3% from 42.6% last week. Bearish Percent dropped to 23.1% from 25.7% last week. Retail investors’ enthusiasm ticked back up this week.

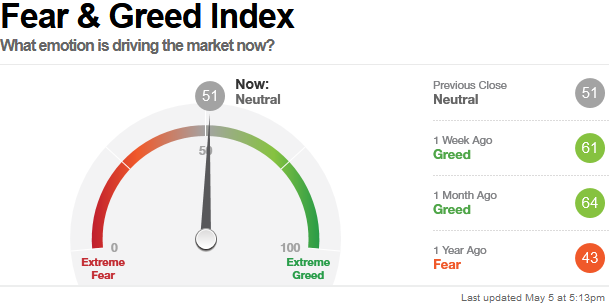

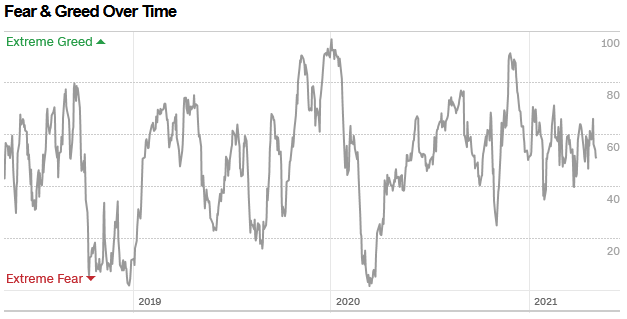

The CNN “Fear and Greed” Index fell from 61 last week to 51 this week. This is a neutral read. You can learn how this indicator is calculated and how it works here: (Video Explanation

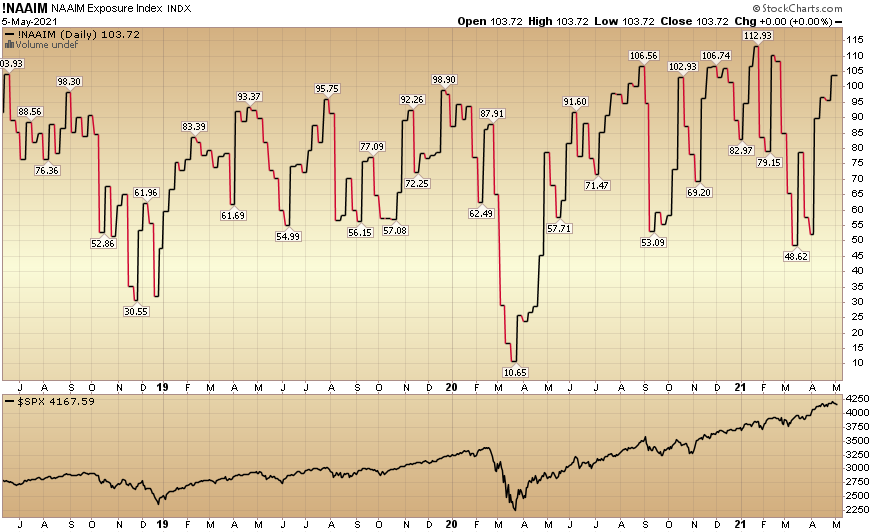

And finally, this week the NAAIM (National Association of Active Investment Managers Index) (Video Explanation) ticked up to 103.72% this week from 95.6% equity exposure last week.

Our message for this week:

In the last couple of weeks we hinted at adding a basket of high quality Chinese stocks on weakness, and “busted SPAC” warrants (mostly SPACs that have announced a deal and have since rolled over after the initial euphoria – awaiting earnings data). The most important part of SPACs is betting on a basket of the right jockeys (when they’re down) and taking a long-term view. We selectively added to both baskets this week.

Our most aggressive add this week was to our Novartis (NVS) position. We continue to like our Utilities, Staples and Big Pharma stocks – that we put on in the last week of February and first week of March. However, most of them have had big moves since that time. Novartis is the laggard from the group, and we used the opportunity to lean into it this week. We think it will be a nice performer through year-end from these levels.

As for the Fed “Staying or Going,” the consensus already knows what they are pretending to hide: Tapering will likely begin in Q4 of this year – even if they don’t raise rates until late 2022/early 2023. With a GDP print approaching ~9% by the time we’re done with 2021, the market will be able to handle it just fine…