On Wednesday morning I joined Alicia Nieves on Cheddar’s “Opening Bell.” Thanks to Alicia, Ally Thompson and Jovan Collins for having me on:

I started the segment by saying, “It never pays to bet on the end of the world because even if you’re right you can’t collect!”

I went on to elaborate that the “biggest risk in the Stock Market right now is to the UPSIDE, not the downside.”

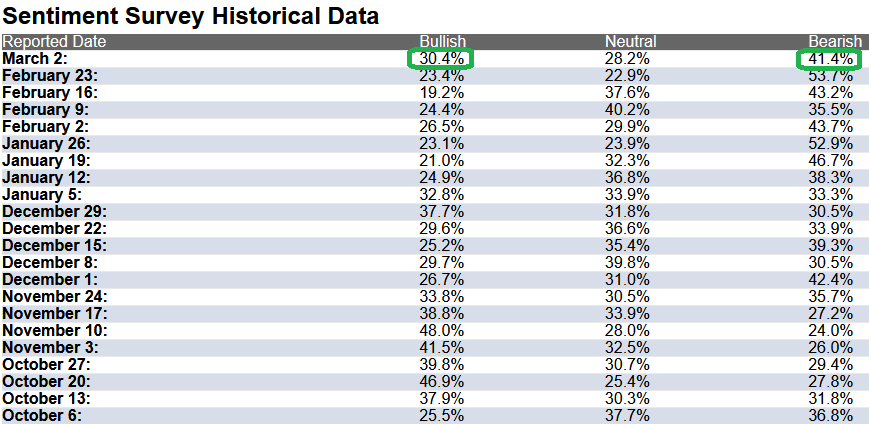

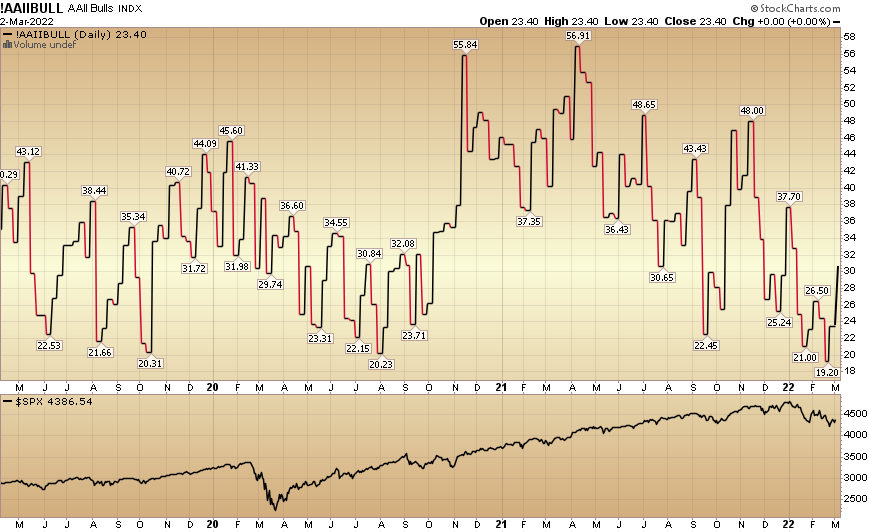

It’s a RISK because no one is positioned for it. SENTIMENT IS WASHED OUT. Here’s some data:

- AAII Sentiment Survey: Retail Bullish Percent down to 23.40 last week – historically found near lows.

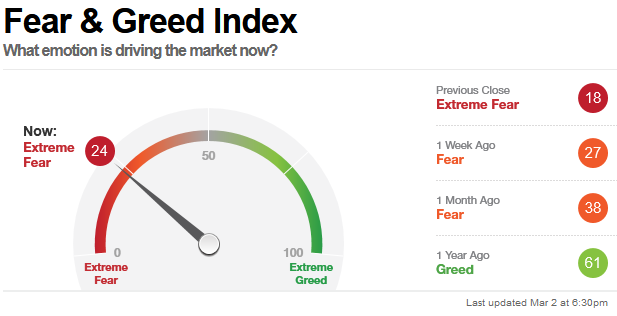

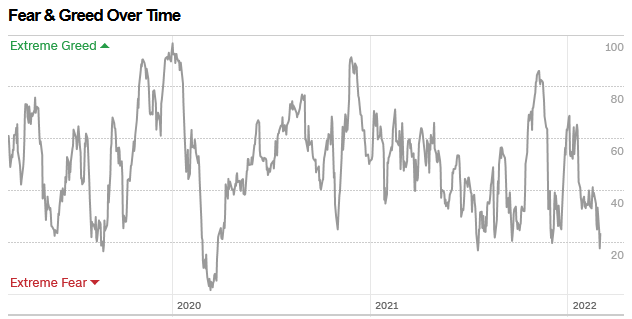

- CNN Fear & Greed Index: 17 = Fear Approaching 2020 Covid Lows.

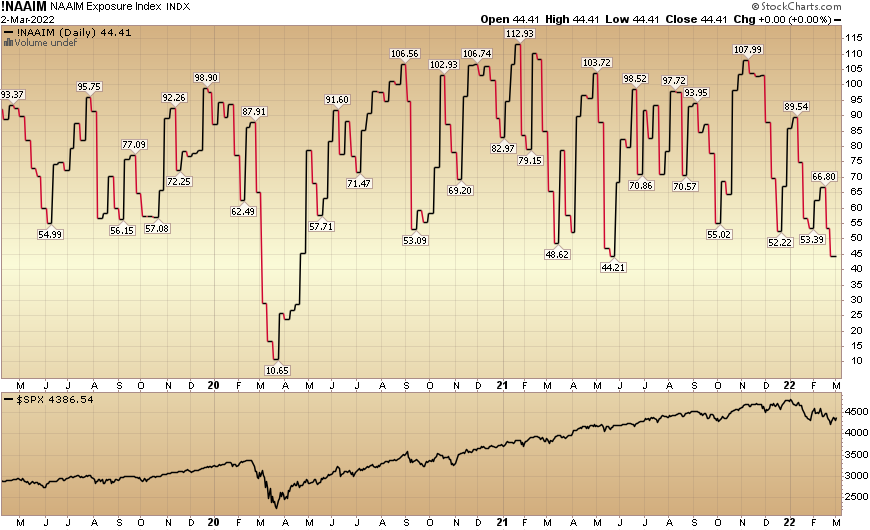

- National Association of Active Investment Managers: Equity exposure at just 44.41% found near bounces and bottoms.

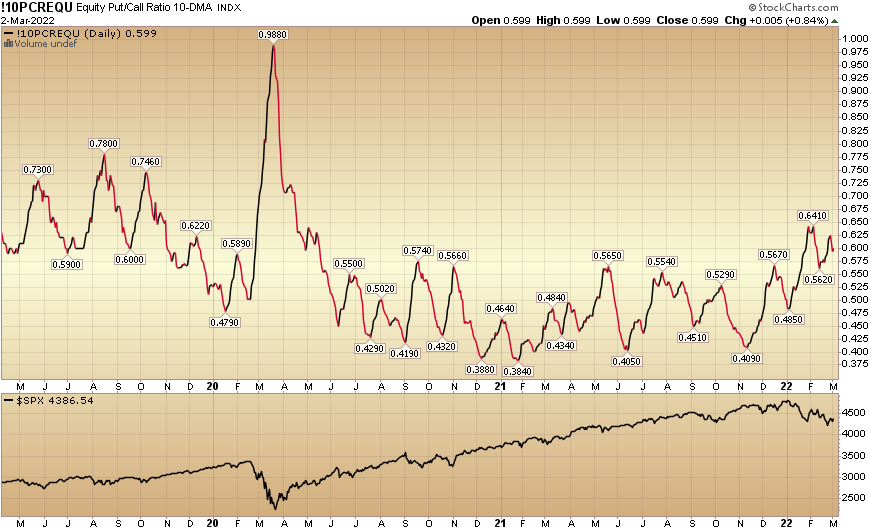

- 10 Day Moving Average Equity Put/Call Ratio at .625 (highest level since 2020). The time to buy insurance (puts) is BEFORE the fire!

We also covered the following bullets they sent over just before the segment:

- Reaction to geopolitical risks/positioning portfolio for downtrending market.

- Companies with overseas exposure/exiting Russia.

- Outlook on airlines/oil prices in the near term.

- Fed’s approach to inflation.

- Take on tech profitability.

- Sectors with the most growth potential.

OUR UNDERPINNINGS FOR OPTIMISM:

- BUYBACKS: $1.234T authorized for 2022 so far.

- M2 GROWTH: Up 12.5% yoy.

- EARNINGS are still RISING: $225.42 2022 est. $248.07 2023 est. 8.5% growth for 2022.

- CITI (positive) Economic Surprise Index jumped above 40 in in its most recent read. Highest Level in almost a year.

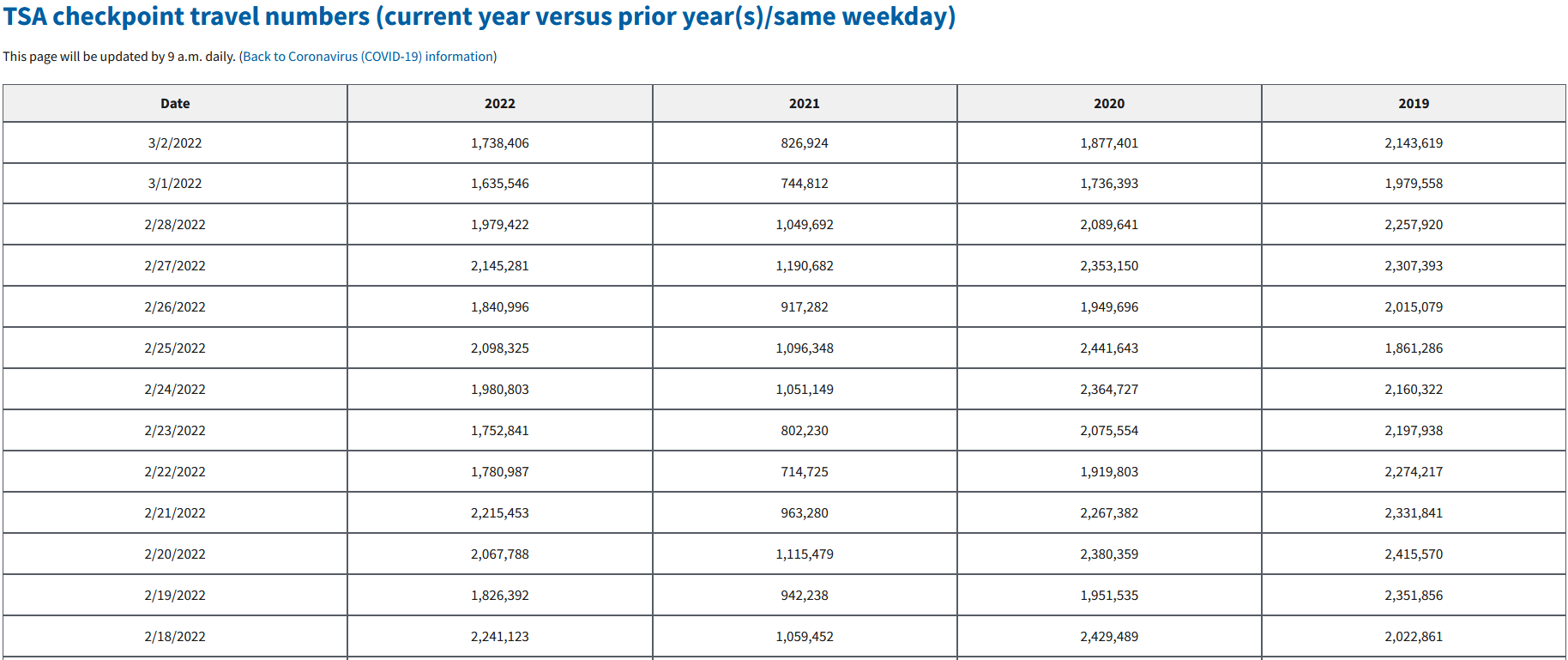

- TRAVEL has bounced back! TSA Passthrough numbers approaching 2019 levels:

- IMMUNITY rates are now high due to omicron. Anticipate a roaring recovery into the summer season coupled with a hard shift from “demand for goods” to “demand for services/travel/leisure.” This will go a long way to alleviate pressure on the supply chain – and in turn – inflation.

- To get a BEAR MARKET correction ~20%, you need a recession. To get a recession, you first need a yield curve inversion. While the yield curve is flattening, it is not yet near inverting (38bps spread).

_________________________________________

Last week I joined Phil Muscatello on his podcast “Stocks For Beginners.” We were introduced through a mutual friend and covered a broad array of topics:

Listen or Read Transcript Directly on Stocks For Beginners (The Podcast)

- Shorting Soybeans with Cornwall Capital.

- Managing risk/non-correlated assets.

- What investors should read first.

- What investors should read second.

- What investors should read daily.

- Autos, Semiconductors, Intel.

- Why we avoid newly IPO’d companies.

- Biotech Thesis.

- China Tech (Alibaba Thesis).

- Secular versus Cyclical.

- The most important Metric. How to calculate.

- Opinion follows trend…

- Beware of the “Story Stock.”

- Why high Price/Sales stocks are plummeting (historic context).

Next week I will be on the Money Show. You can get a free pass to watch (here):

In this segment I will cover some key trades/investments we did over the past decade or so. You will see the reasoning behind why we put the positions on, how we think about entering positions, how we managed risk and dealt with short term moves against us. Among the coverage:

In this segment I will cover some key trades/investments we did over the past decade or so. You will see the reasoning behind why we put the positions on, how we think about entering positions, how we managed risk and dealt with short term moves against us. Among the coverage:

- Case 1 – A Financial Company Long – April 2009. Thesis, Execution, Management, Result.

- Case 2 – A Commodity Short – July 2012. Thesis, Execution, Management, Result.

- Case 3 – An Energy Company Long – July 2012. Thesis, Execution, Management, Result.

- Case 4 – A Financial Company Long – Summer/Fall 2020. Thesis, Execution, Management, Result.

- Case 5 – A Sector/Company Long – Summer/Fall 2020. Thesis, Execution, Management, Result.

- 2 Big Ideas for 2022.

________________________________________

While people are concerned with geopolitical headwinds, we continue to look under the surface to see what’s actually happening. One of the disciplines we have is to consistently pull the earnings estimates of the top 30 weights of 2 new sectors each week – starting with the general indices at the beginning of the quarter. We publish some of these studies on the site. In the last few weeks we did SPY, DIA, QQQ, XLB (Materials), and FFTY (IBD 50). Here’s what we found:

- SPY: The cumulative 2022 earnings power of these 30 stocks was revised UP by 4.01% in the past 60 days.

- DIA: The cumulative 2022 earnings power of these 30 stocks was revised down by -0.45% in the past 60 days.

- QQQ: The cumulative 2022 earnings power of these 30 stocks was revised DOWN by -0.42% in the past 60 days.

- XLB: The cumulative 2022 earnings power of the group increased 5.45% in the last 60 days.

- FFTY: The cumulative 2022 earnings power of these 30 stocks increased by +12.17% in the past 60 days.

On Wednesday, Fed Chair Jay Powell gave some clarity on the plan moving forward – and the market liked it. 25bps hike in March (not 50bps), and start to look at balance sheet reduction. I am a proponent of using the balance sheet roll-off to re-steepen the yield curve and going slowly with the hikes (as I mentioned on Cheddar).

They should start (selling) with longer duration Treasuries versus MBS (as they have alluded to in recent Fed Minutes). The goal is to avoid an inversion/recession by keeping credit flowing. Right now odds are on a 1994 “close call” (almost inversion and pull back from the brink just in time to extend the cycle). We’ll see if they can pull it off:

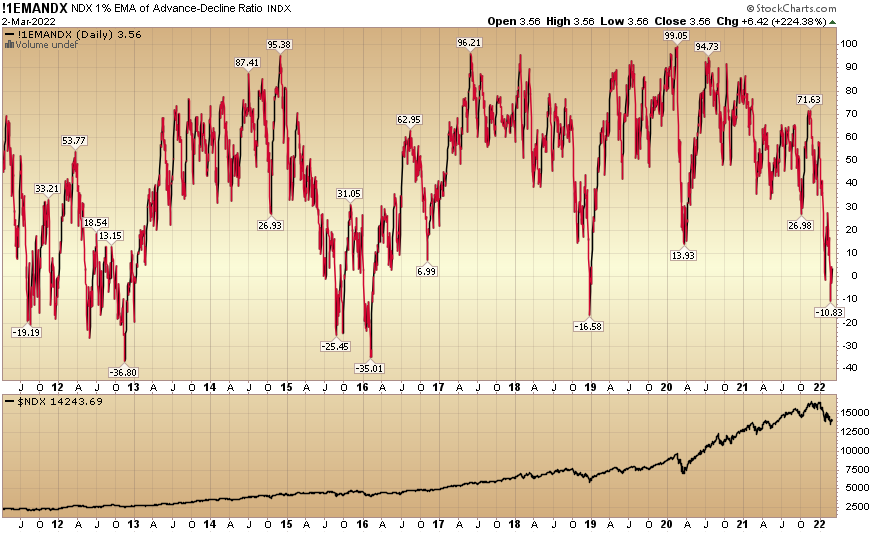

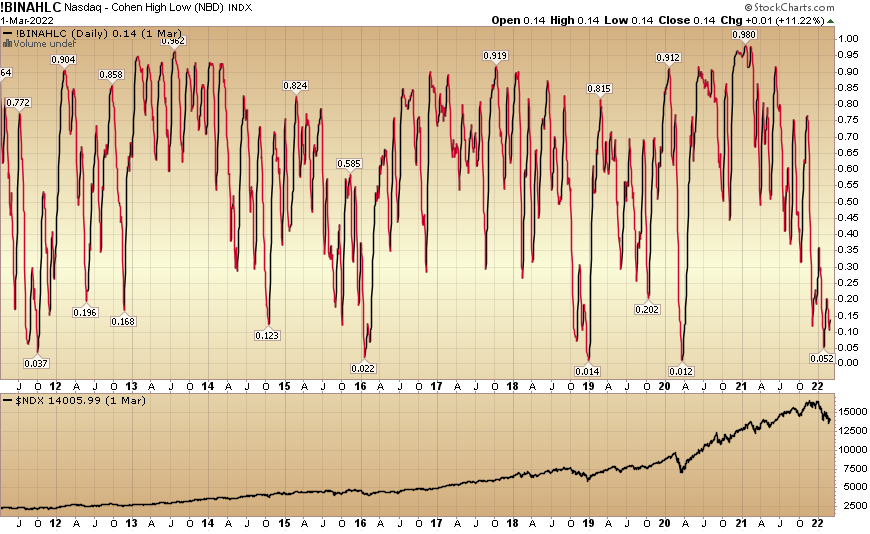

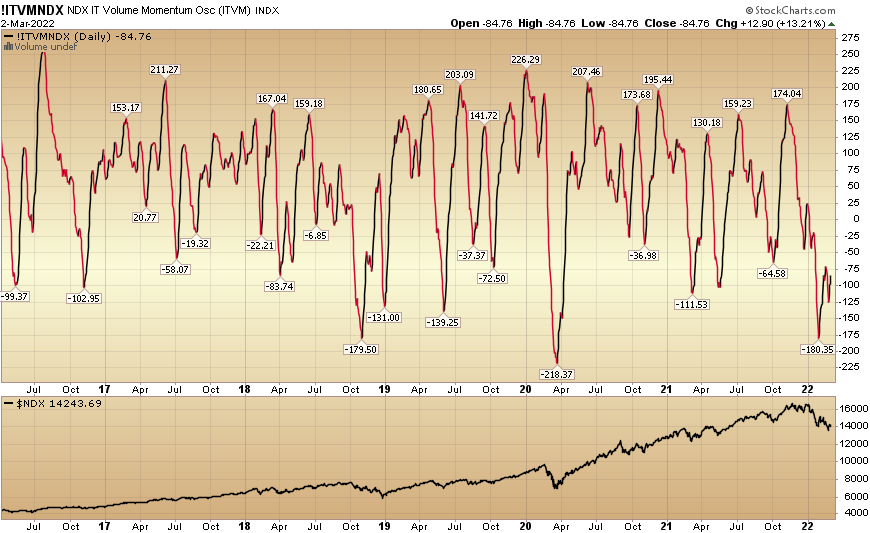

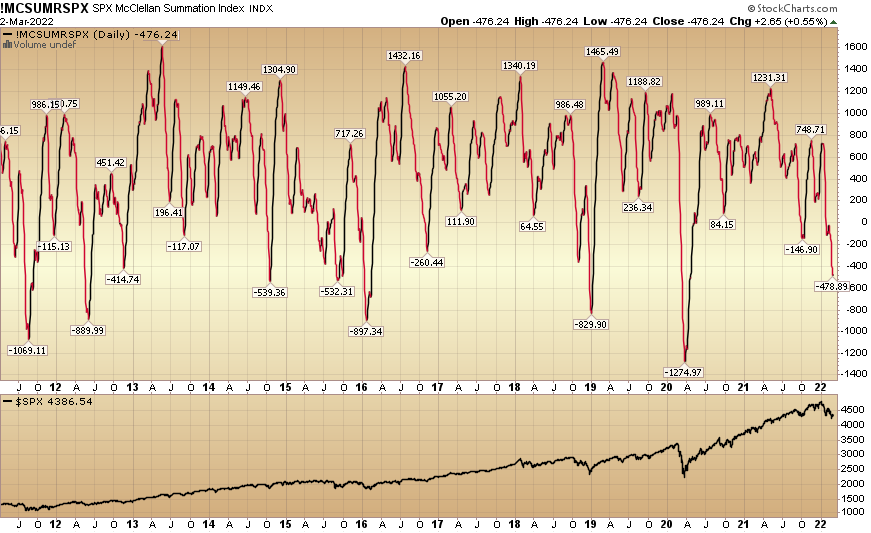

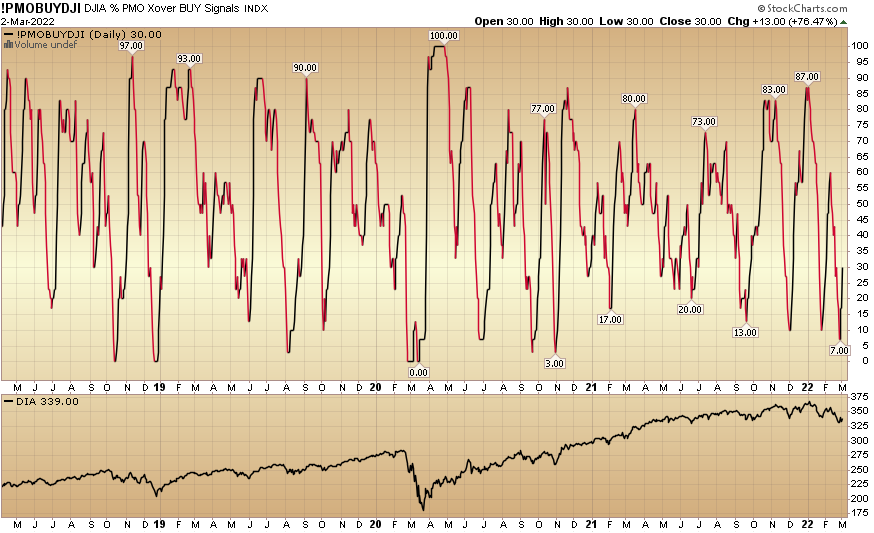

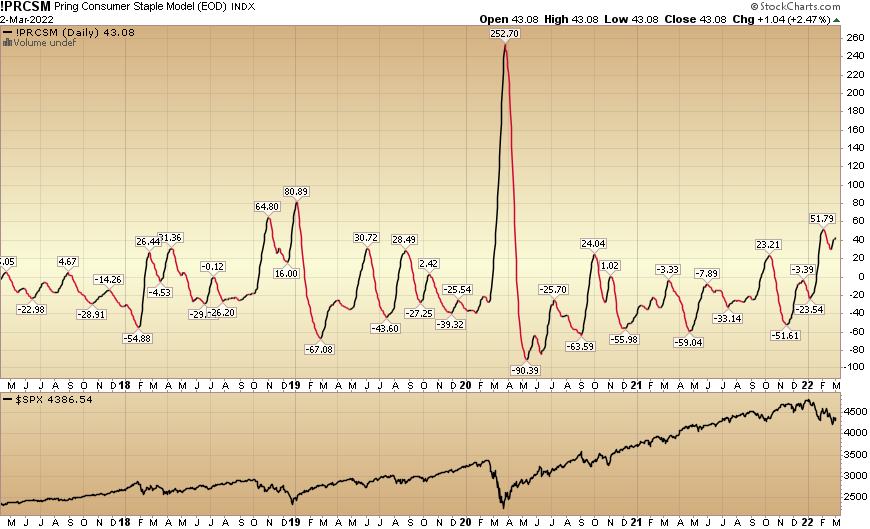

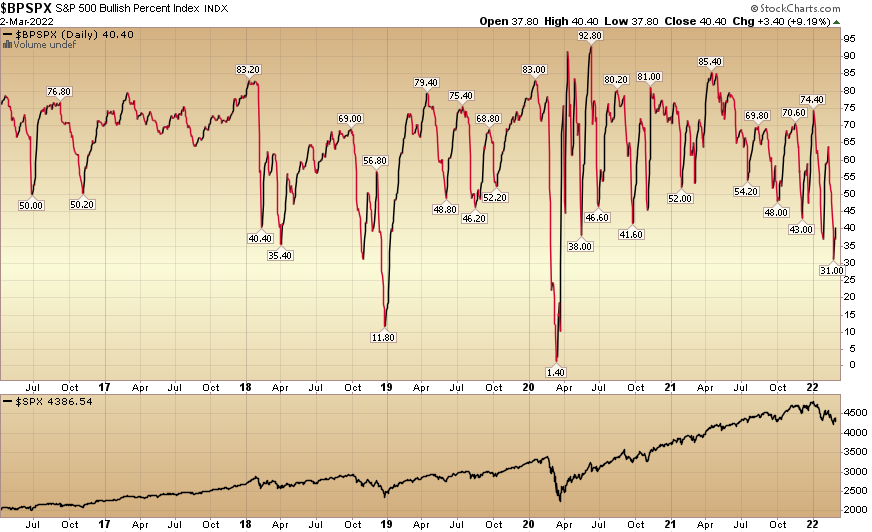

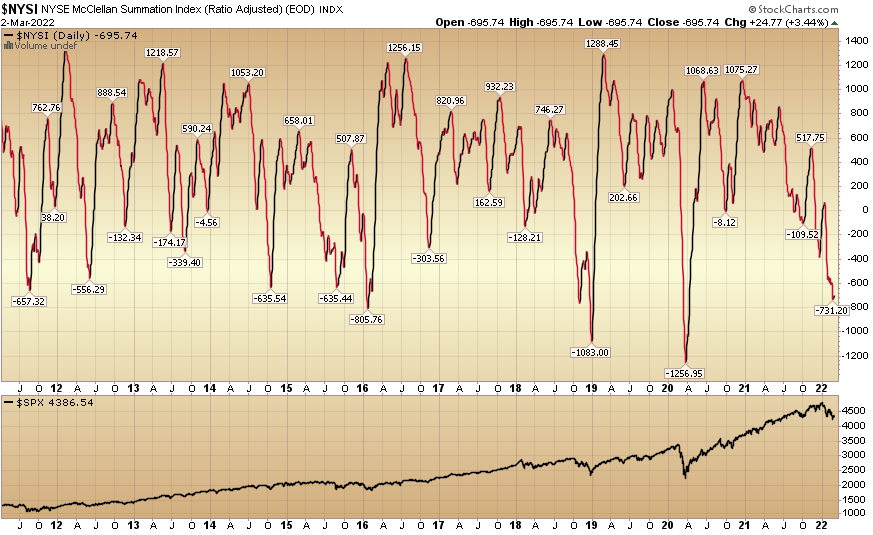

Here are several additional indicators we are looking at which support our thesis – that the risk in the market right now – is to the UPSIDE. These are all at/near levels found at inflections:

Now onto the shorter term view for the General Market:

In this week’s AAII Sentiment Survey result, Bullish Percent (Video Explanation) moved up to 30.4% this week from 23.4% last week. Bearish Percent fell to 41.4% from 53.7%. Retail trader/investor fear is starting to thaw.

The CNN “Fear and Greed” Index ticked down from 26 last week to 24 this week. There is still fear in the market. You can learn how this indicator is calculated and how it works here: (Video Explanation)

And finally, this week the NAAIM (National Association of Active Investment Managers Index) (Video Explanation) dropped to 44.41% this week from 53.48% equity exposure last week. Managers will have to chase any strength in coming weeks.

Our podcast podcast|videocast will be out tonight or tomorrow. Each week, we have a segment called “Ask Me Anything (AMA)” where we answer questions sent in by our audience. If you have a question for this week’s episode, please send it in at the contact form here.