Data Source: FactSet

A few notes on earnings this week…

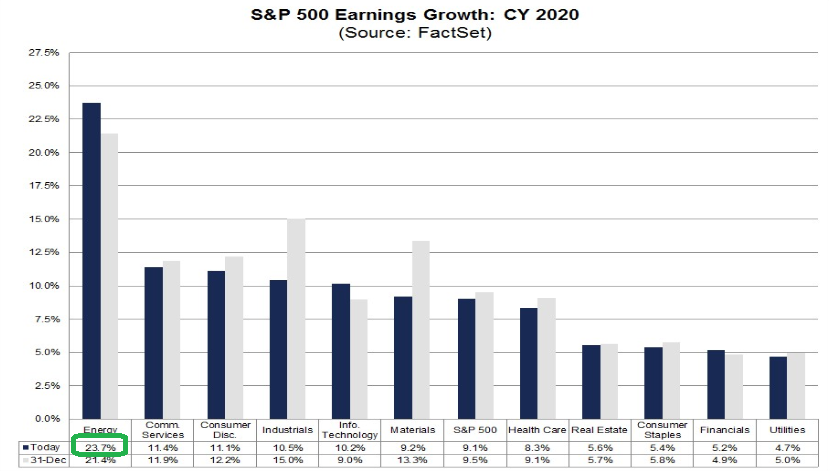

2020 S&P 500 Earnings:

-Up $.10 from last week ($177.41 to $177.50)

-Growth rate down from 9.5% to 9.1% due to Q4 2019 EPS coming in better than expected (improvement in both 2019 and 2020 EPS this week).

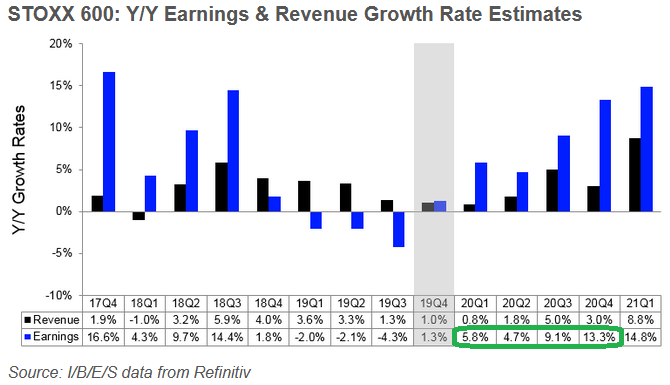

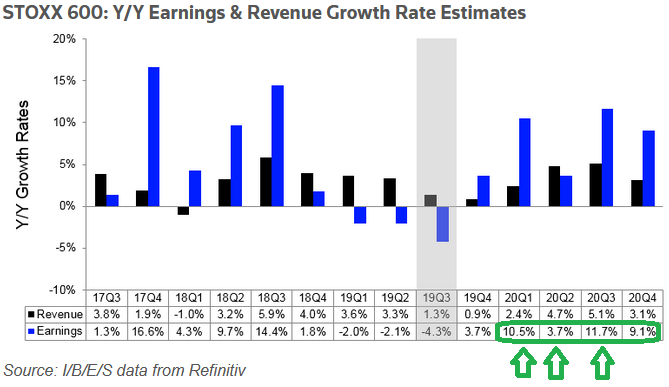

2020 Euro Stoxx 600 Earnings:

The Data above (from 1/29/2020) is still strong – avg. 8.22% EPS growth for the 4 quarters of 2020. This compares to avg. 8.75% EPS growth for the 4 quarters of 2020 at the beginning of January 2020:

Q4 Industrials Results (Impact of Boeing):

-Boeing is the largest contributor to the yoy earnings decline for the Industrials sector.

-Boeing reported EPS of -$2.33 for Q4, compared to year-ago EPS of $5.48. If Boeing was excluded, the blended growth rate for the sector would improve to 2.4% from -10.6%.

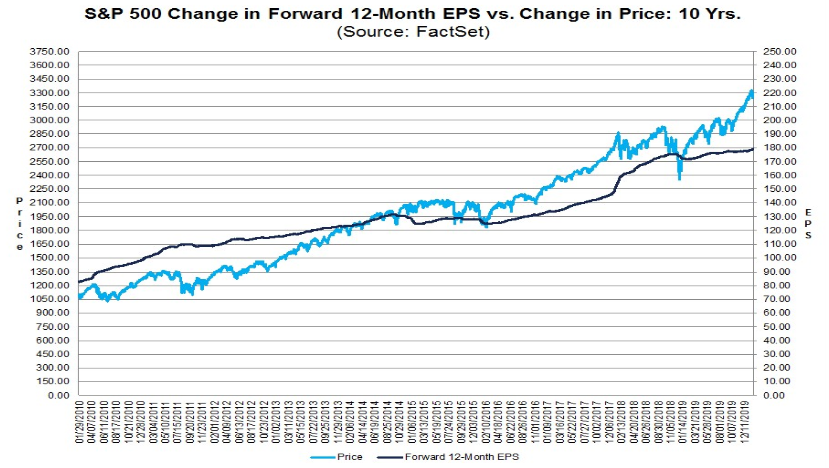

S&P 500 Target Price:

-The bottom-up target price for the S&P 500 is 3602.30, which is 11.68% above the closing price of 3225.52.

-The Energy (+23.0%) sector is expected to see the largest price increase, as this sector has the largest upside difference between the bottom-up target price and the closing price. This is consistent with the sector having the highest expected earnings growth for 2020: