Opinion, Not Investment Advice. See Terms Above. Disclosure: We own a meaningful amount of CPS stock.

On June 7, 2022 we broke our Cooper Standard (CPS) thesis publicly on Fox Business for the first time:

We elaborated on the thesis – at a more granular level – on our VideoCast – Episode 138 on June 9, 2022:

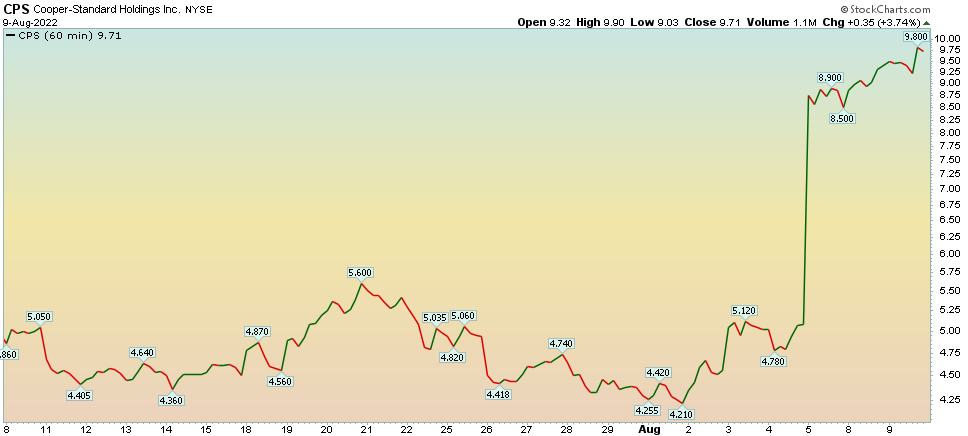

The stock is now up 83.41% since reporting earnings last Thursday:

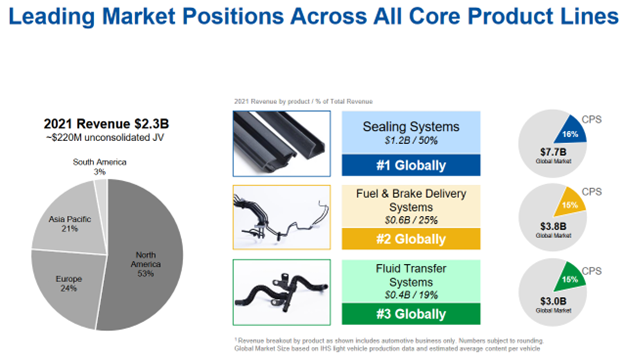

Cooper Standard (CPS) – Leveraged Play on Auto-Semi recovery and High Yield Credit Markets Re-Opening

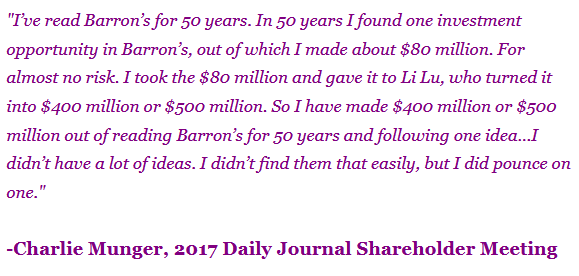

The idea emanated from Charlie Munger’s purchase of Tenneco during 2001 -2003 recession:

“Tenneco was a major supplier of aftermarket auto parts. Its well-known brands include Monroe shock absorbers, Walker mufflers, and DynoMax exhaust products.

At the time of Charlie Munger’s “cigar butt” investment, Tenneco — which had ~40m shares outstanding — had a market cap of ~$80m and enterprise value of ~$1.6 billion, as well as a total debt load of ~$1.52b.

He bought the stock (which was trading at ~$1.50-$2/share), as well as the bonds (11.375% notes yielding 35% to maturity).

Within a few years, the stock went up to $15, at which point he sold. The bonds went back up to par value and were called in by the company in conjunction with a refinancing.” (macro-ops)

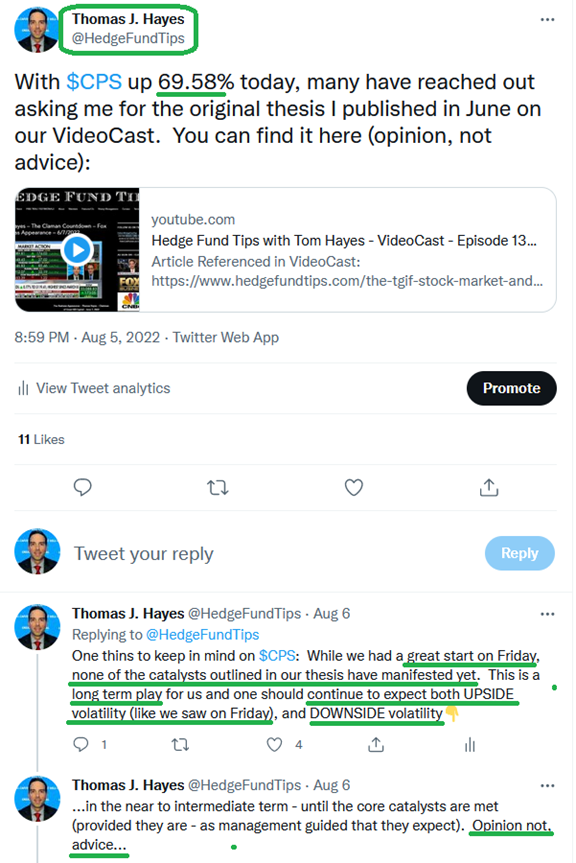

Friday, CPS was up 69.58% on Q2 Earnings Report and Guidance (up ~14% more since). We said this:

Overview:

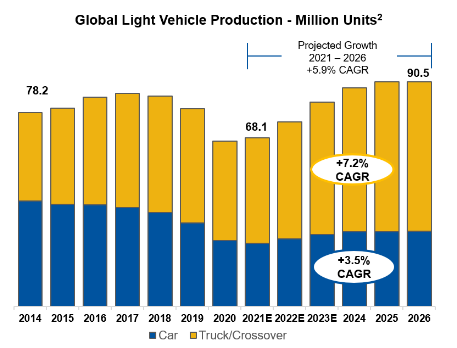

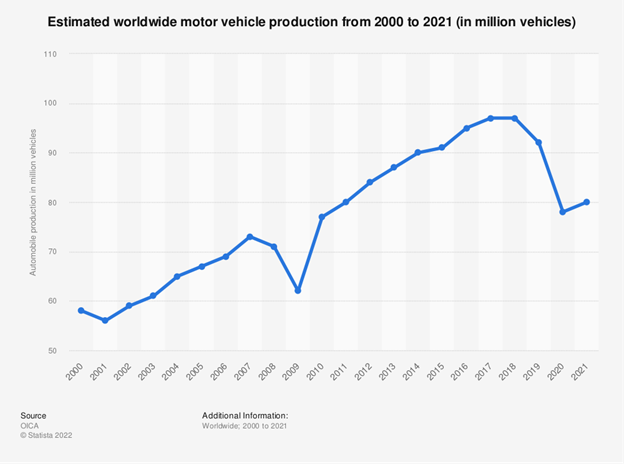

The Auto Industry is finally moving past the worst of a costly semiconductor shortage that has reportedly cut 13 million vehicles from global production since the start of 2021 (AutoForecast Solutions (AFS)).

Over-ordering of chips (for consumer products) is finally catching up with reduced demand (electronics/PCs). Excess capacity is being re-allocated to auto/industrial chips.

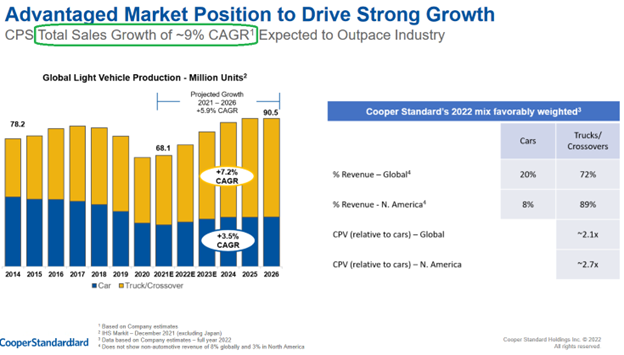

CPS is a Special Situation auto supplier. Its existence depends on the number of cars the OEMs produce – with its two largest clients being Ford and GM. We have received very good news on this front in a mosaic of recent earnings reports – indicating the tide has shifted as it relates to auto chip supply (improving). This was a core tenet in our investment thesis – which is now starting to manifest.

Taiwan Semiconductor: Auto Chip business up 14% yoy in Q2

NXPI Semiconductor: Auto Chip business up 36% yoy in Q2

Texas Instruments: Beat and Raised on strength in Industrial and Auto Chips. Auto chips rose 20% yoy.

Qualcomm: Automotive chips grew 38% on an annual basis – an all-time-high for Qualcomm.

GM: Maintained full year guidance and production despite a setback in early Q2 due to China lockdowns.

Ford: Maintained full year guidance and production despite a setback in early Q2 due to China lockdowns.

In a research report recently published, RBC analyst Joseph Spak wrote that some auto suppliers he follows have seen supply chain situations improve. What’s more, forecasting firm IHS kept its prediction of about 80 million global car sales for the full year 2022 earlier this month, despite volume slipping out of the second quarter because of problems in China.

GM and FORD are key: They can only book revenue when they send the car to dealers. They can only send the car to dealers when they have the auto chips. The color is now that the tide has changed in the latter part of Q2 and the chips are flowing again. This is critical for auto-suppliers as they get paid when OEMs are shipping cars, and OEMs can only ship cars if they have chips. The machine is now unclogging and two years of unfulfilled backlog can now start to be filled. The operating leverage will be enormous.

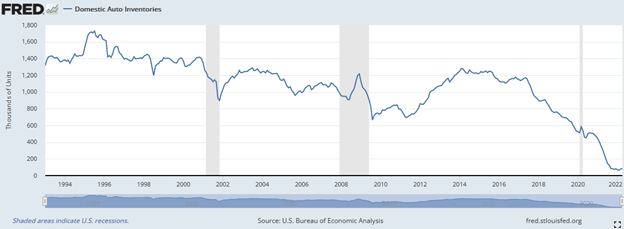

Dealer lot inventories are still at 10-15% of where they need to be. This is not for lack of DEMAND. It is due to lack of supply of chips. This is finally changing. Yesterday’s shortage will be tomorrow’s glut!

-Adam Jonas of Morgan Stanley came out with a note this month which indicates that the long-lasting global auto chip shortage is edging closer to resolution.

CEO Jeff Edwards 8/5/2022:

“We began to see some improvement in global market conditions and production levels in the final four weeks of the quarter,” said Jeffrey Edwards, chairman and CEO, Cooper Standard. “With China production coming back on line, European markets and operations beginning to stabilize from Ukraine war-related disruptions, and increasing inflation recoveries from our customers, we saw adjusted EBITDA margins and cash flow turn positive in June. With further improvements in global production volume expected in the remainder of the year, combined with continuing cost reduction initiatives and anticipated incremental positive impact from our enhanced commercial agreements, we continue to expect to deliver full year adjusted EBITDA in line with our original guidance.”

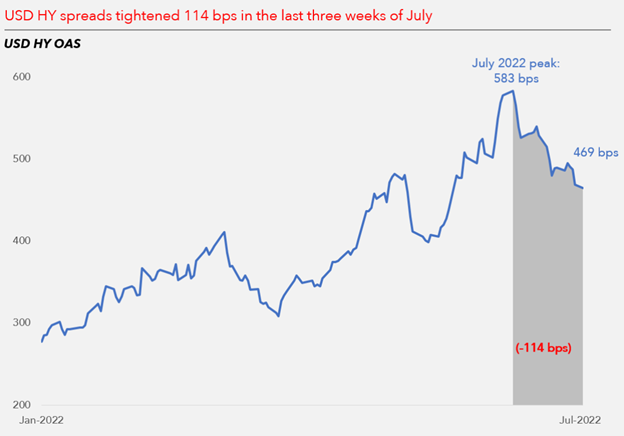

This is THE MOST IMPORTANT CHART to watch moving forward. Expect deals and financing to return this Fall:

Source: MUFG

Debt:

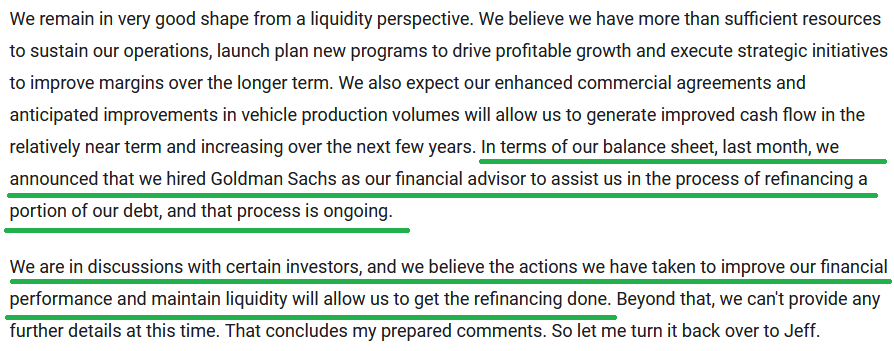

CEO Jeff Edwards 8/5/2022:

| Description | Maturity Date | Terms | Amount Outstanding | Trading |

| Term Loan | November 2, 2023 | Eurodollar + 275 | $320,605 | na |

| Senior Secured Notes | June 1, 2024 | 13% | $242,310 | $106.80 |

| Senior Unsecured Notes | November 15, 2026 | 5.625% | $396,723 (210,739) | $53.12 |

| Local Bank Lines | Due within 1 year | NA | $49,071 | na |

| Total: | $1,008,709 (822,725) |

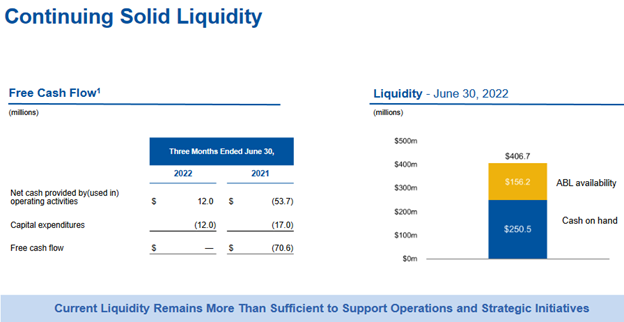

Cash and Liquidity

As of June 30, 2022, Cooper Standard had cash and cash equivalents totaling $250.5 million. Total liquidity, including availability under the Company’s amended senior asset-based revolving credit facility, was $406.7 million at the end of the second quarter.

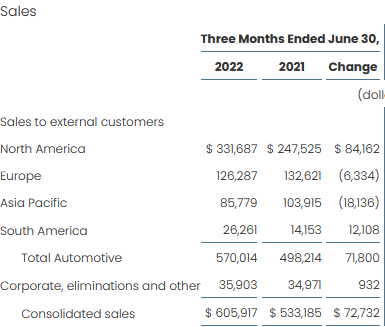

Sales:

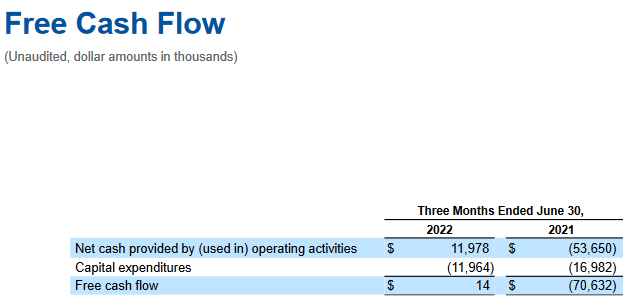

Free Cash Flow:

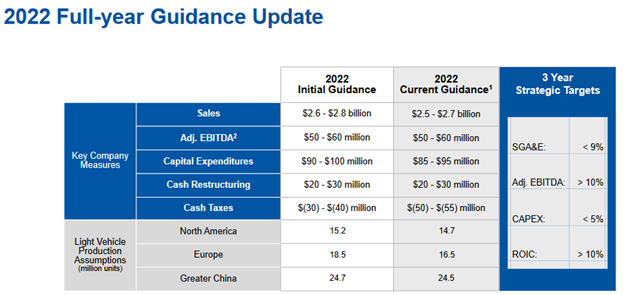

Guidance:

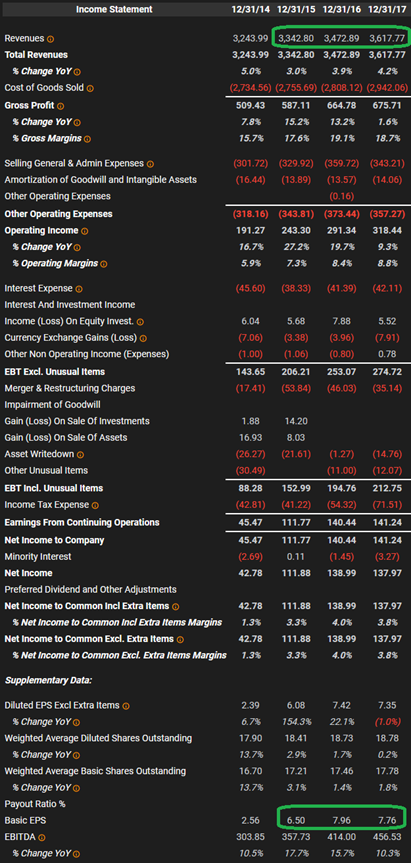

*Implies: ~$3.4B Revenue for 2025 at “double digit” ~10%+ EBITDA margin = $340M++ EBITDA ~$8-9/share EPS – 10-20x multiple.

Back to the Future:

Stocks don’t revert to the mean. Just as they overshoot in despondency on the downside ($3.66 in 2022), the overshoot in euphoria on the upside ($146 in 2018).

So if it’s so great, why doesn’t everyone see it yet? The risk is credit markets stay closed and they cannot refinance the debt over the next 15 months. We believe that even in this unlikely scenario, the company could pay off the first tranche from existing cash, credit, free cash flow (from improving production/operations) and balance sheet maximization actions (sale leasebacks, etc).

In today’s podcast|videocast we will go into more color on the above detail.

Now onto the shorter term view for the General Market:

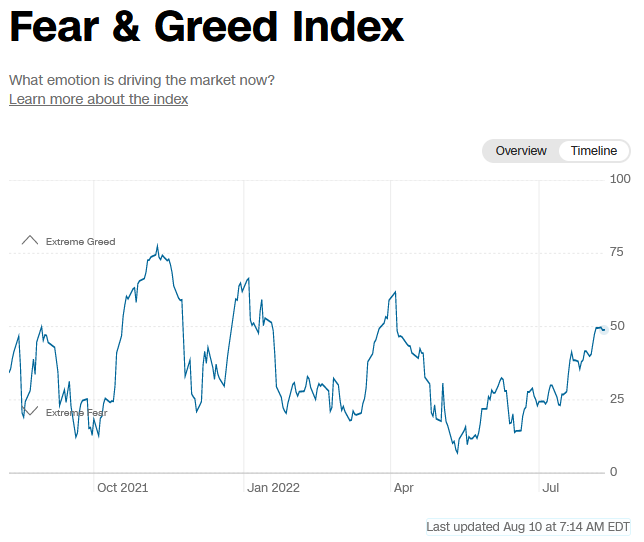

The CNN “Fear and Greed” ticked up from 46 last week to 49 this week. Fear is easing. You can learn how this indicator is calculated and how it works here: (Video Explanation)

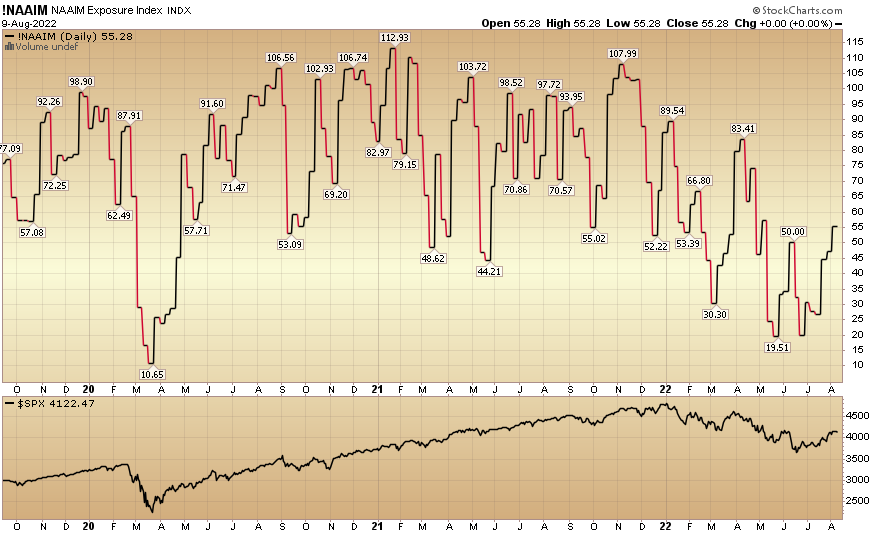

And finally, the NAAIM (National Association of Active Investment Managers Index) (Video Explanation) rose to 55.28% this week from 47.21% equity exposure last week. Active managers are still underweight equities. Any unexpected further positive news will continue to force them back into the market aggressively.

Our podcast|videocast will be out today or tomorrow. Each week, we have a segment called “Ask Me Anything (AMA)” where we answer questions sent in by our audience. If you have a question for this week’s episode, please send it in at the contact form here.