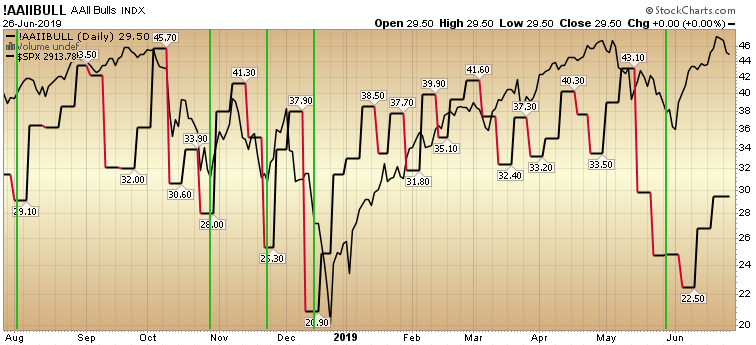

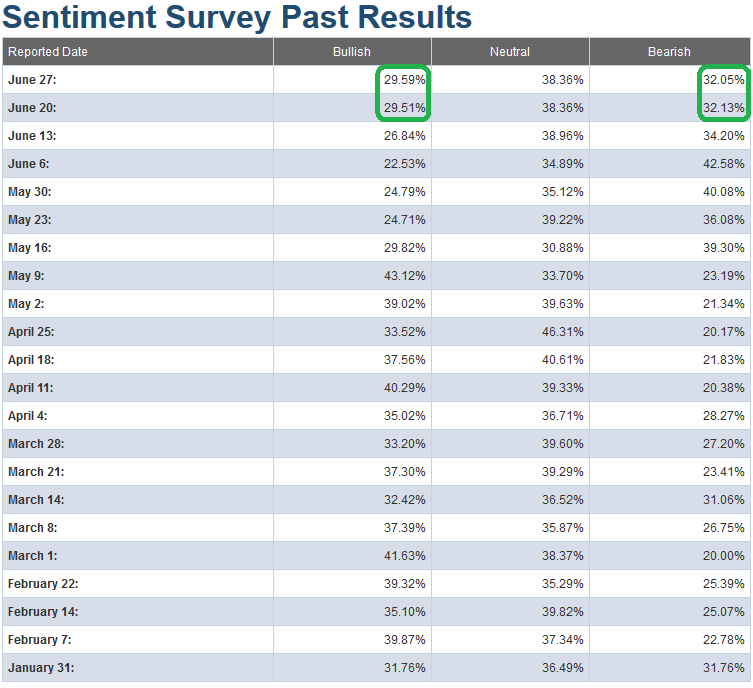

Waking up today I had fully expected the “bullish percent” to move well above 30 and the “bearish percent” to drop since last week. This would have caused us to look for places to lighten up, and if there was a euphoric read, start to look for a few shorts…

Nothing of the sort happened! Instead, the read came in exactly as last week – which means we are still in the mid stages of the bounce. So long as this persistent pessimism and skepticism remains (coupled with off-sides positioning by institutions who have been overweight in cash during this record month), the “PAIN TRADE” remains up.

Every tick we climb higher will force that mis-allocated cash back into the market in a fomo (fear of missing out) panic – until everyone is back in the boat, cash levels are low, and then the trap door can open to take a bit of steam out of the bounce.

Until then – barring any colossal failure at the Trump/Xi meeting this weekend – the likely course in coming week(s) is more upside and new highs in the major indices. Although, even with a colossal failure over the weekend, it would be more likely than not we would see a parade of Fed members out making the rounds to assure they had the markets’ back – which may in fact be the best move for Trump’s re-election prospects. Muddle/Delay the deal, get the cuts – THEN close some kind of deal (soybeans, nat gas and a photo opp) and coast into re-election.

The risk with this strategy is that the economy has weakened, and if the Fed is not quick enough to react (which so far they have been backward looking and have not shown any understanding of the 6-9 month lag in impact of 9 sequential raises in a row and persistent quantitative tightening), it may be too little, too late. My observation is that Trump likes to play out on the skinny branches (a true brinksman). So far, it has served him well, but this time could be too risky. If this weekend results in “new tariffs” and the Fed doesn’t call off the quantitative tightening (within days) – or virtually assure a 25-50bps cut at the July meeting – all bets are off and the Democrats will be dancing in the streets at Trump’s self inflicted death blow.

That said, he played out on the skinny branches with Mexico, Canada, Tax Cuts, etc. – and in all instances came out on top. Grab the popcorn because the next few days will be paramount for the markets and for Trump’s re-election prospects (especially with OH and PA so tight – no Nat Gas deal = low odds of beating Biden in those critical electoral states). One outlier outcome that few people are looking for may be an agreement by China to revalue (strengthen the yuan) as a way to “even trade” without giving in on Trump’s other demands. They are in a good position to give this concession as they have been weakening their currency since the “trade war” began 18 months ago. A revaluation would give Trump a “win” and net cost China nothing (i.e. they’re back to where they started – which may have been part of their plan all along).

Here are this week’s AAII numbers:

Here are the last few weeks’ commentary so you can follow along as to what we were saying at each AAII data point:

AAII Sentiment: Pessimism Thawing, but Skeptics Still Abound

As with all indicators, they are to be used as a barometer – not a crystal ball. Furthermore, they should not be used in isolation. You are best served using a mosaic of data, both fundamental and technical to skew the odds in your favor and manage your risk appropriately. No matter how good the odds line up, you can simply be wrong and must manage risk accordingly.