In 1997, Jack Nicholson co-starred with Helen Hunt in a movie called, “As Good As it Gets.” When it comes to markets, you want to be a SELLER when things are “As Good As it Gets.” However, it pays to be a BUYER when things are “As Bad As it Gets.”

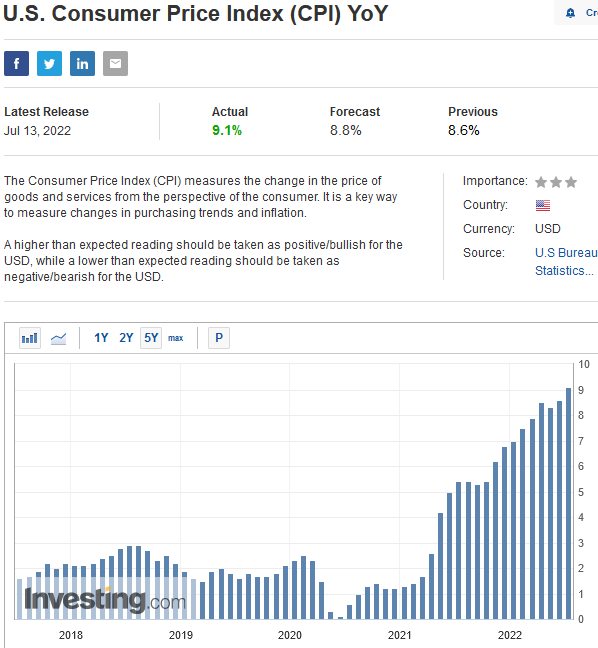

The market is a discounting mechanism and is forward looking. Yesterday’s CPI prints may finally be “As Bad As It Gets” and the weakness going in (and shortly after) may very well be an instance of “sell the rumor, buy the news…” To be determined as earnings reports/guidance in coming weeks are key…

Fox Business

On Monday, I joined Lauren Simonetti on Fox Business – The Claman Countdown – to discuss inflation and the Fed. Thanks to Finley Walker, Lauren and Liz Claman for having me on:

Watch in HD directly on Fox Business

Here were some key points ahead of the segment:

–U of M Consumer Sentiment at 50. Since 1980, last 3x it dropped below 58, it marked the lows in sentiment and peak in inflation. Avg S&P gains 12 months later were +20.87%.

-Fed does want to “reduce demand” but they don’t want to DESTROY the economy. They promised $47.5B in Quantitative Tightening in June. They only did $7.5B (and were net buyers of Treasuries).

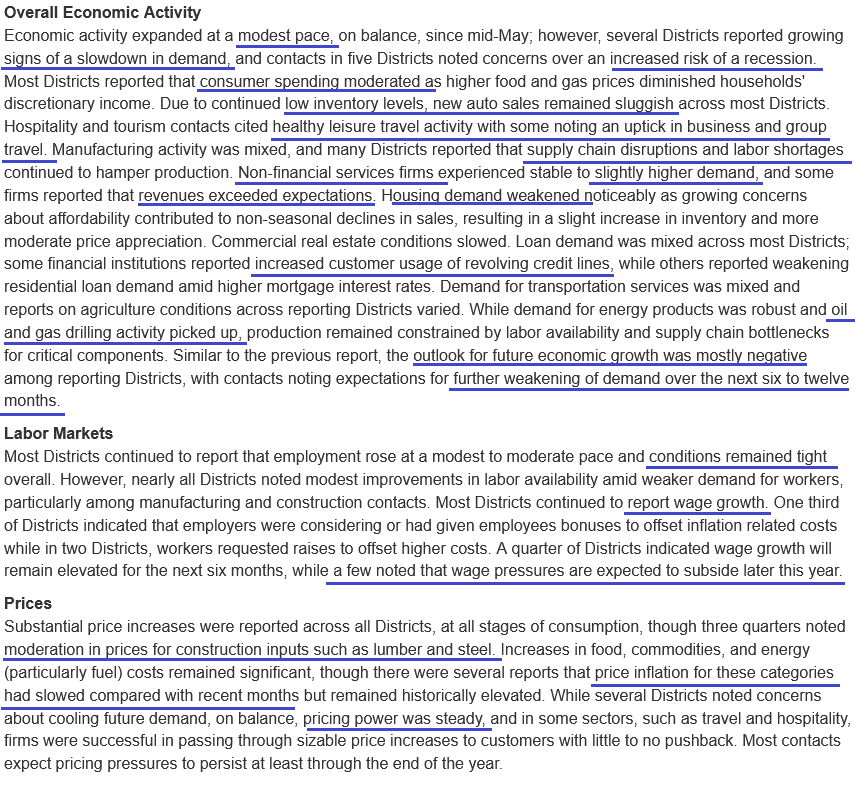

Beige Book

We found out yesterday – with the Fed’s Beige Book – WHY the Fed is remaining accomodative in the background (not being aggressive with Quantitative Tightening – $7.5B vs. $47.5B scheduled for June).

We expect the Fed to balance “inflation fighting” (rate hikes) with “economy stabilizing” (weaker QT than advertised) actions in an attempt to “soft land” the economy. Whether they will succeed or not depends on how quickly recently weakened commodity prices will show up in Consumer Prices.

Bad News, Good News?

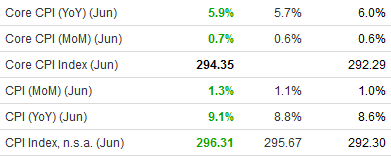

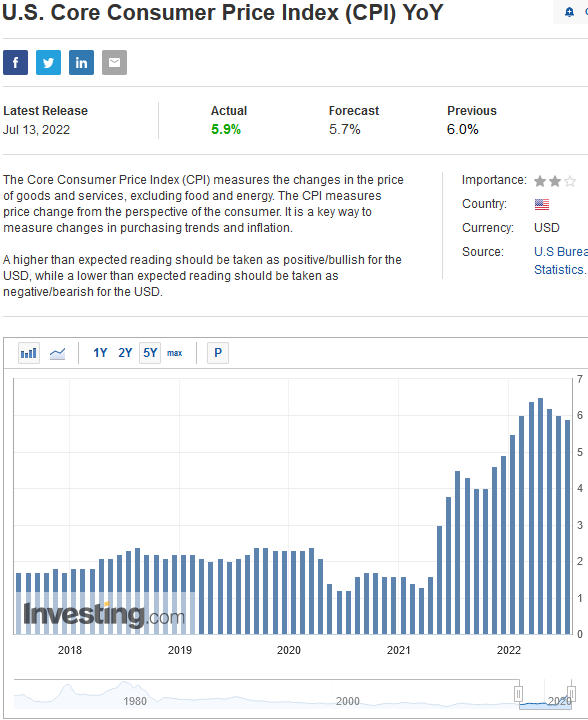

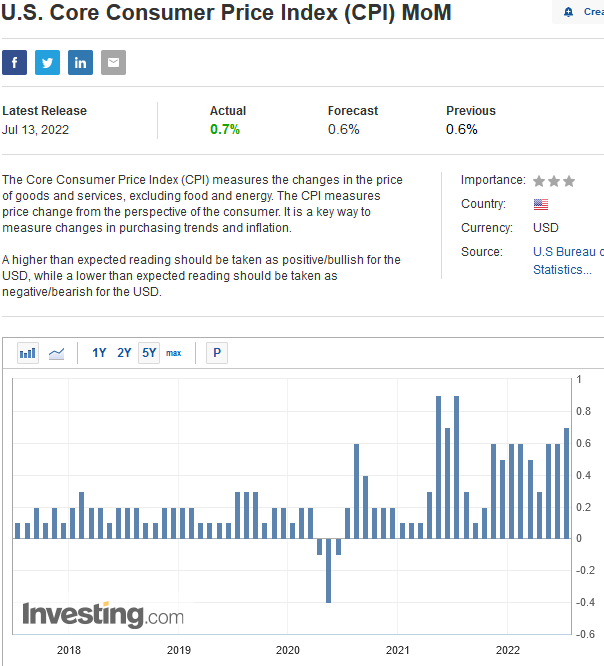

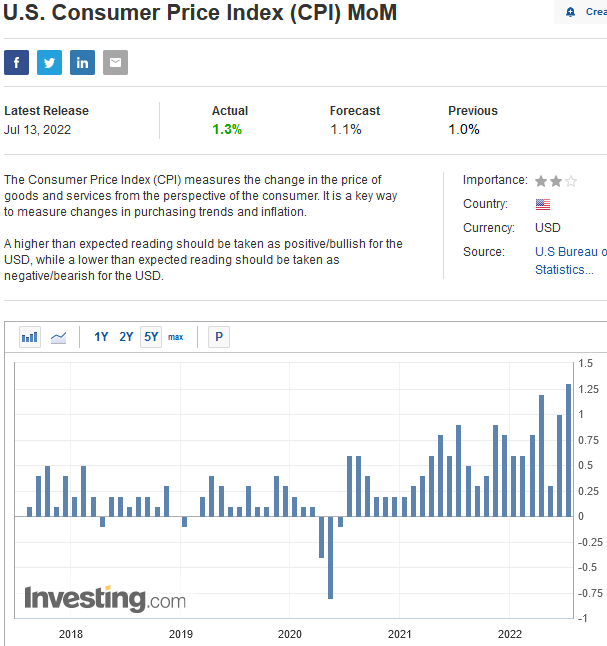

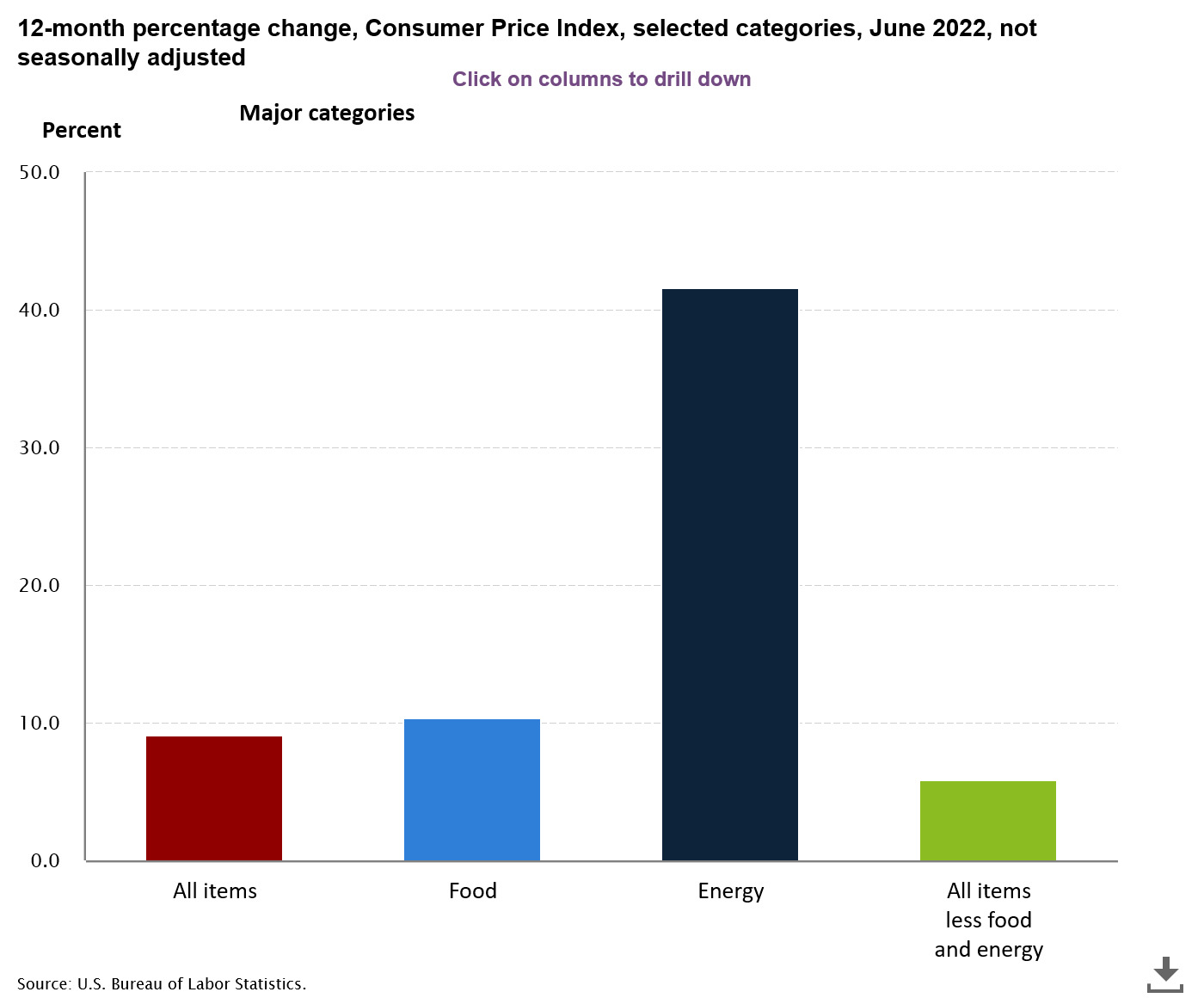

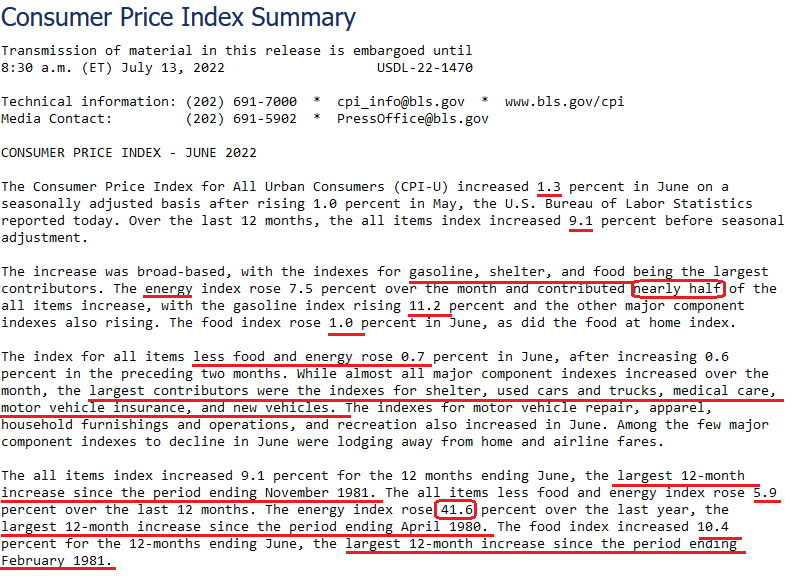

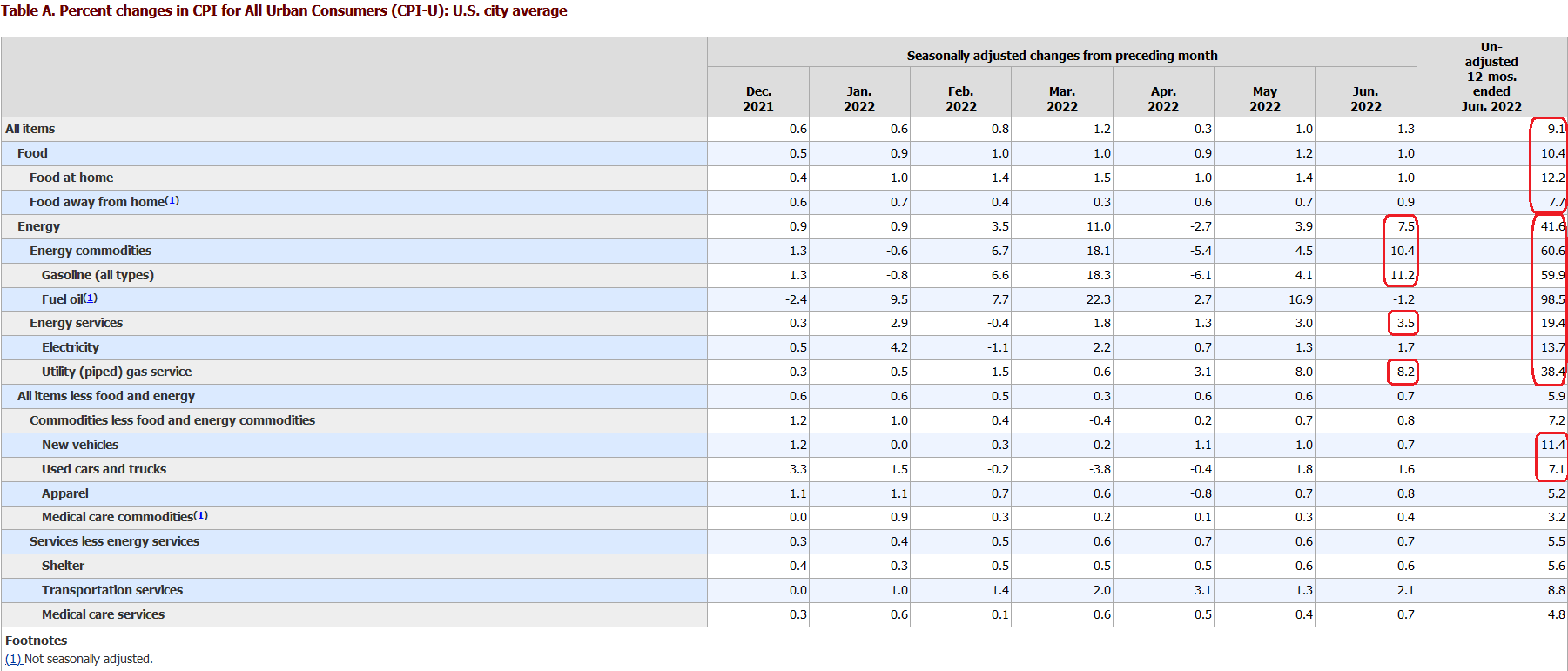

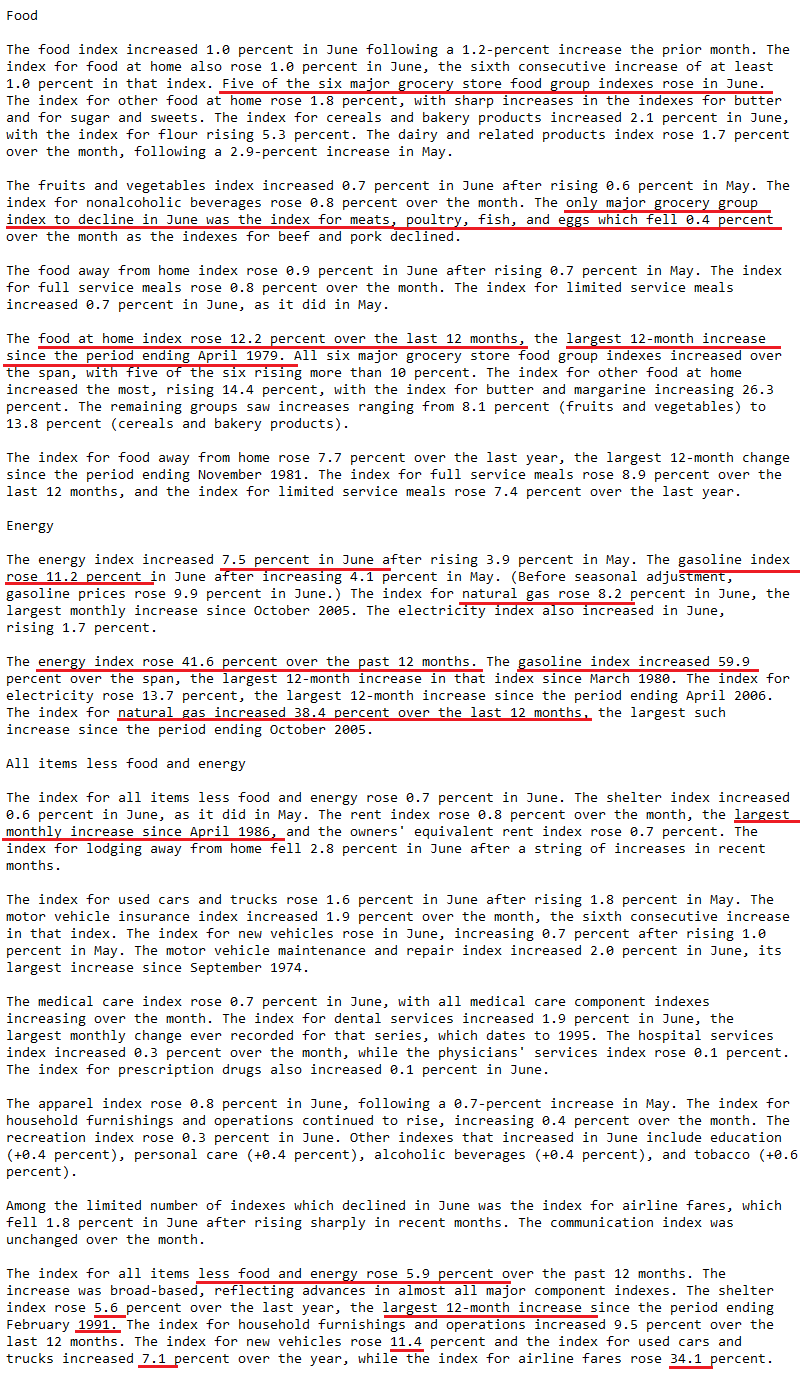

Now that the rear-view mirror (backward looking) terrible CPI news is out, here’s what you need to know:

Now that the rear-view mirror (backward looking) terrible CPI news is out, here’s what you need to know:

![]()

But that’s backward looking. What is not yet filtering in that will be soon?

So You’re Telling Me There’s a Chance?

So You’re Telling Me There’s a Chance?

On Monday I joined Alicia Nieves on Cheddar TV to discuss GameStop and Fed Policy. Thanks to Ally Thompson, Alicia and Rachel Mayman for having me on. Enjoy the “Dumb and Dumber” reference – as it relates to GameStop’s prospects:

On Monday I joined Alicia Nieves on Cheddar TV to discuss GameStop and Fed Policy. Thanks to Ally Thompson, Alicia and Rachel Mayman for having me on. Enjoy the “Dumb and Dumber” reference – as it relates to GameStop’s prospects:

Watch in HD directly on Cheddar

While we have no position in GameStop long or short, here’s an interesting anecdote:

A couple of weekends ago I took my daughters to Cold Stone for ice cream. Next door in the strip mall is “meme stock” GameStop with a hand written sign on the door in the middle of a Saturday afternoon “back in one hour.” I saw one guy (potential customer) came and left. The business is run like a bodega, not a public company:

Public

On Friday I joined Ann Berry on Public.com to discuss Recession, Facebook, Market Outlook and why our second largest position – Biotech – is now up ~33% off its May lows. We also discuss our latest outlook on China and Alibaba (our largest position). Thanks to Mike Teich and Ann for having me on. For the latest, listen here:

Now onto the shorter term view for the General Market:

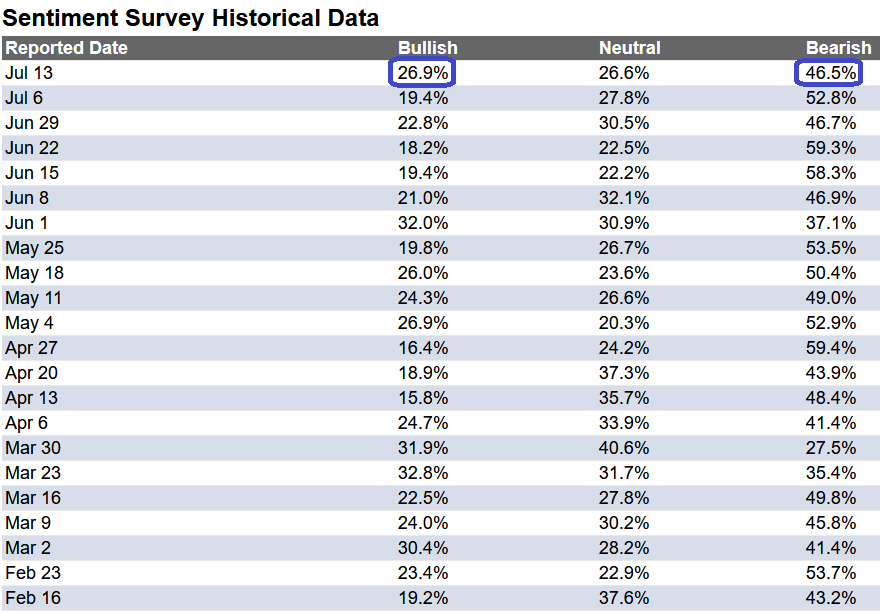

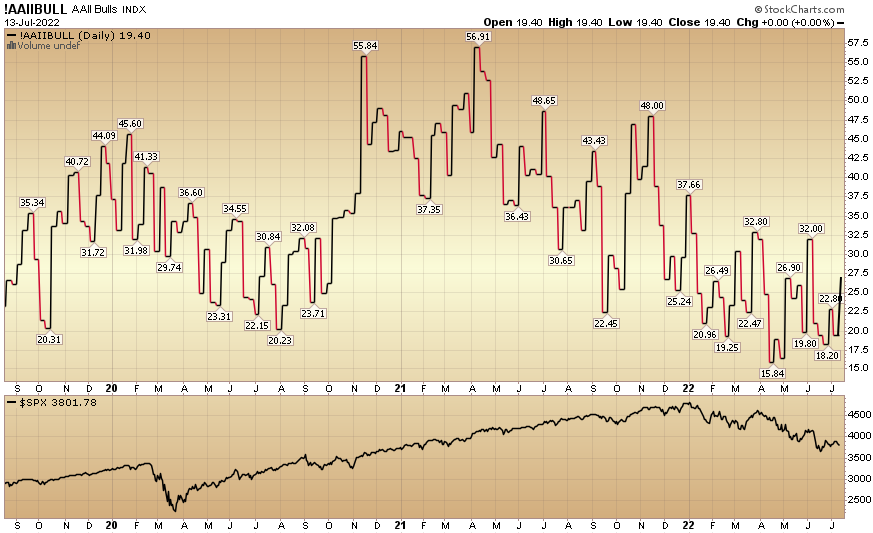

In this week’s AAII Sentiment Survey result, Bullish Percent (Video Explanation) jumped to 26.9% this week from 19.4% last week. Bearish Percent dropped to 46.5% from 52.8%. Retail investors are still fearful, but starting to thaw.

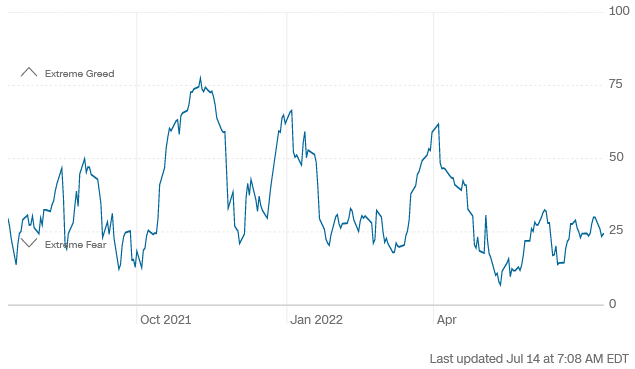

The CNN “Fear and Greed” flat lined from 24 last week to 24 this week. This still shows extreme fear. You can learn how this indicator is calculated and how it works here: (Video Explanation)

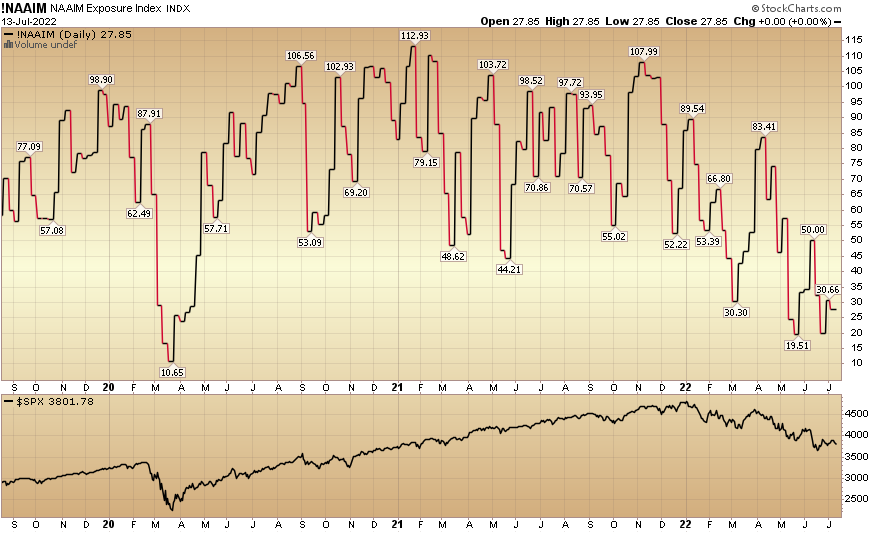

And finally, the NAAIM (National Association of Active Investment Managers Index) (Video Explanation) ticked down to 27.85% this week from 30.66% equity exposure last week. Active managers are underweight. Any unexpected positive news will force them back into the market aggressively.

Our podcast|videocast will be out today. Each week, we have a segment called “Ask Me Anything (AMA)” where we answer questions sent in by our audience. If you have a question for this week’s episode, please send it in at the contact form here.