Data Source: Bank of America

Each month, Bank of America conducts its survey of Global Fund Managers. This month’s survey was held between December 6-12 and solicited responses from 247 money managers representing $745 Billion AUM.

Here are the key results:

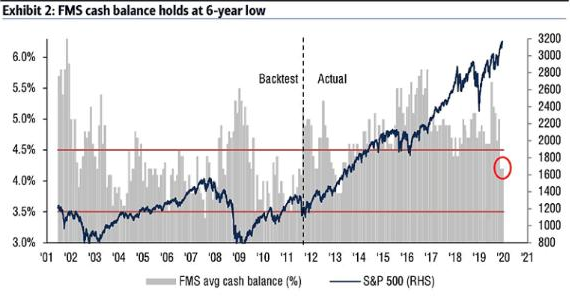

CASH: Allocation fell to 4.2% – which is the lowest since March 2013.

EQUITIES: Managers were 31% overweight – which is the highest level in a year. However, despite the 10% month-on-month gain, this level is just above the long term average – implying that sentiment is not yet fully overheated.

POSITIONING:

-Managers selling bonds and buying stocks and commodities.

-Managers shifting a bit from U.S. equities to Emerging Markets, Japan and U.K.

-Increased allocations to Banks and Tech. Decreased from defensives like Utilities and Staples.

-More interest in Industrials, Healthcare, Energy and Materials.

SENTIMENT:

-BofA’s “Bull and Bear” reading is the most bullish since April 2018.

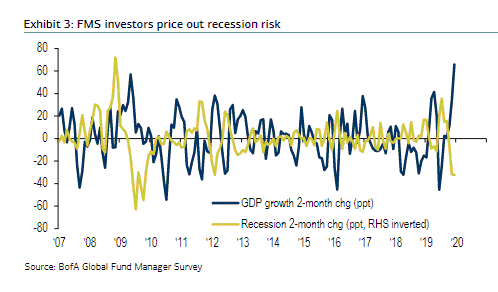

-BofA’s June Survey was the most bearish since the Great Financial Crisis – with 50% of investors having expected global growth to weaken. This contrasts to December when 68% are saying a recession is now unlikely next year.

-29% of managers now believe that global growth will improve in 2020 (this is a 22% jump in one month).

-20% of managers think the global economy will experience above-trend (>2%) growth in 2020 – and below trend inflation (i.e. Goldilocks).

MOST CROWDED TRADES:

- Long U.S. Technology and Growth Stocks

- Long U.S. Treasuries

- Long Investment Grade Corporate Bonds

BASIS FOR OPTIMISM:

-U.S. Employment data beat expectations over the last 2 months.

-Fed will remain accommodative (through 2021).

-China PMI has had 4 consecutive months of increases (Aug-Nov).

-Optimism over trade deal.

SUMMARY:

- Managers buying equities generally, banks, energy stocks, and commodities.

- Cash levels at 6 year low. Rally continued last time cash was at this level in 2013.

- Huge 2 month jump in profit expectations (last matched in May 2009 – or the beginning of the post-crisis bull market).

- Record two month jump in global growth expectations.

So while optimism is pouring back in, we are just above the long term average – not showing “extreme” levels yet…