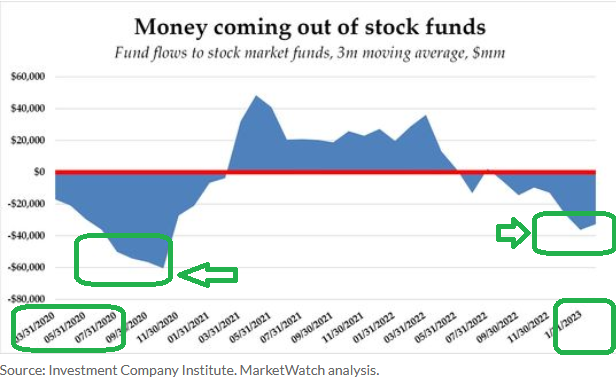

- Opinion: Stocks have been rising over the past 5 months — why aren’t investors convinced? (marketwatch)

- Investors piled $354 bln into cash since Ukraine war – BofA (reuters)

- Bonds record longest inflow streak since November 2021 – BofA (streetinsider)

- Markets are overrun with bearish sentiment that ignores the resilient economy, strategist says; ‘Earnings can hang in there’ (businessinsider)

- What recession? Consumer sentiment hits 13-month high in February (marketwatch)

- Buy Micron Stock Because Memory Chip Demand Will Rebound, Says J.P. Morgan (barrons)

- Bank of America’s CEO, on Inflation, Recession, and the Fed (barrons)

- Inflation Comes in Higher in Troubling Sign for Fed (barrons)

- The War in Ukraine Has Boosted Defense Stocks. There Are More Gains to Come. (barrons)

- S. to Expand Troop Presence in Taiwan for Training Against China Threat (wsj)

- China Urges End to Ukraine War, Calls for Peace Talks (wsj)

- Chip Makers Turn Cutthroat in Fight for Share of Federal Money (nytimes)

- Fed’s Mester says she has hope that inflation can be brought down without a recession (cnbc)

- The next bull market in stocks won’t kick off until the Fed is forced to bail out the US government, Bank of America says (businessinsider)

- Nobel economist Paul Krugman warns of nagging inflation – but he sees only a 25% chance of a US recession (businessinsider)

- Janet Yellen now sees a chance the US economy will avoid a recession as inflation is coming down (businessinsider)

- Warren Buffett’s must-read annual letter arrives Saturday. Here’s what to expect from the investing legend (cnbc)

- US Dollar Strength & Political Rhetoric Weigh on Markets, Week in Review (chinalastnight)

Be in the know. 18 key reads for Friday…