- Banks Borrow $164.8 Billion From Fed in Rush to Backstop Liquidity (bloomberg)

- Alibaba forges cooperation with Chongqing on connected cars, digital infrastructure as e-commerce giant bolsters ties with more local governments (scmp)

- FedEx jumps after lifting profit view amid pressure on e-commerce parcel volume (reuters)

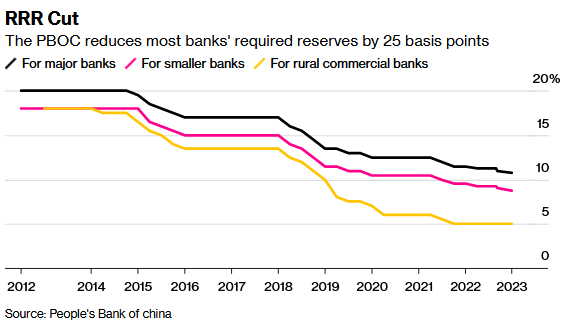

- China Cuts Reserve Requirement Ratio To Boost Economy (bloomberg)

- First Republic Set to Get $30 Billion of Deposits in Rescue (bloomberg)

- The Yield Curve Inversion Is Shrinking (barrons)

- China cuts banks’ reserve ratio for first time in 2023 to aid recovery (reuters)

- Intel’s stock nabs an upgrade: ‘Things are moving enough in the right direction.’ (marketwatch)

- The Fed Gets a Dose of Its Own Medicine. Rate Hikes Have Dried Up Its Income Stream. (barrons)

- Companies Ponder Moving Cash to Big Banks After Silicon Valley Bank Failure (barrons)

- Quantitative Easing Left the Banking System Vulnerable (barrons)

- Charles Schwab Insiders Loaded Up on Shares (barrons)

- Why the Return of Chinese Shoppers Could Help Nike More Than Adidas (barrons)

- Barney Frank defends role at Signature Bank: ‘I need to make money’ (ft)

- China Unexpectedly Cuts Reserve Ratio For Banks, Injecting $73BN To Stimulate Economy (zerohedge)

- This Week in China: Chinese Bank Stocks Are World’s Best as US, Europe Crack (bloomberg)

- While Rising to Pop Stardom, Taylor Swift Built a Real-Estate Empire Worth North of $150 Million (wsj)

- Don’t Count Out the Consumer Yet (wsj)

- Stock Trader’s Almanac says investors should remain calm and is calling for stock gains of 10-15% this year (streetinsider)

- Michael R. Bloomberg: New York’s Legal Marijuana Policies Endanger Kids (bloomberg)

- UK backs Rolls-Royce project to build a nuclear reactor on the moon (cnbc)

Be in the know. 21 key reads for Friday…