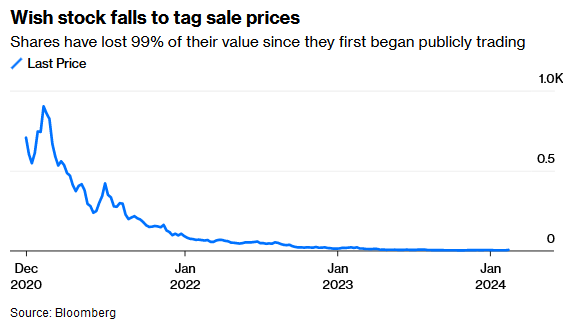

- Temu Is ‘Shopping Like a Billionaire’ for Ads. What Could Go Wrong? A lot. The recent relatively cheap sale of Wish, which also spared no expense when it came to marketing, proves it. (bloomberg)

- Improved Cash Flow Highlights Cooper Standard’s Fourth Quarter and Full Year 2023 Results (cooperstandard)

- Chinese New Year travel and consumption data continues to come in strong, with a strong increase in hotel bookings of +60% year-over-year, according to the Ministry of Commerce. Meanwhile, Meituan reported a +36% YoY increase and +155% versus 2019 in “daily consumption growth.” E-Commerce spending appears to be coming in strong, though Hainan Island, China’s Hawaii, does not have enough planes to get people home. Macau and Hong Kong visitor numbers look strong too. (chinalastnight)

- Overseas Chinese tourists back as Alipay transactions up 7 per cent from 2019 (scmp)

- ‘The Big Short’s’ Michael Burry Doubled Down on Alibaba Stock and JD.com. Should You? (barrons)

- China steps up ‘whitelist’ mechanism for property sector – media (reuters)

- UK shoppers pick up their spending, signaling quick end to recession (reuters)

- China Holiday Travel Surge Hints at Consumer Spending Pickup (bloomberg)

- Banks Are Piling Back Into Everything From Mortgage Debt to CLOs (bloomberg)

- Macau Sees Record Lunar New Year Visitors in Boost for Casinos (bloomberg)

- UK Energy Bills Set to Drop 15% in Boon for Taming Inflation (bloomberg)

- Goldman Strategists See Stronger US Consumers Boosting Luxury Stocks (bloomberg)

- Coca-Cola Boosts Its Dividend Again (barrons)

- What the Top Hedge Funds Are Buying: an Inside Peek (barrons)

- CN Govt Plans to Buy Distressed Private Property Projects, then Sell or Rent them Out after Conversion – Report (aastocks)

Be in the know. 15 key reads for Friday…