- JPMorgan Analysts Behind ‘Uninvestable’ Call Upgrade China Tech (bloomberg)

- Shanghai heads towards June 1 end of lockdown as Covid-19 cases dip (scmp)

- China’s Weight To Increase in MSCI EM (chinalastnight)

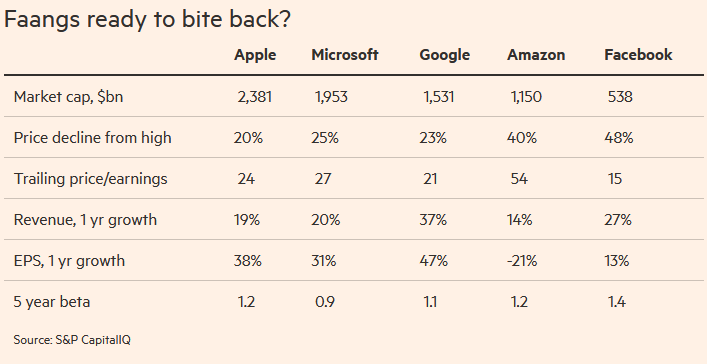

- The Faangs will be back (ft)

- China Rate Cut in Focus as Economy Counts Cost of Covid Zero (bloomberg)

- Collapse Of China Credit Growth Opens Door For Rate Cuts (zerohedge)

- Walmart’s Earnings Will Set the Tone for Other Retailers (barrons)

- SPACs Have a Bad Rap. Why That Isn’t Fair. (barrons)

- Under Armour Stock Could Climb 50% From Here (barrons)

- Shanghai Lays Out Covid-19 Reopening Plan as China Cancels 2023 Soccer Tournament (wsj)

- Individual Investors Step Back From Options Bets (wsj)

- Investors Stay Put, Because They Can’t Think of Better Options (wsj)

- Warren Buffett Spends Big as Stock Market Sells Off (wsj)

- China’s Economic Activity Collapses Under Xi’s Covid Zero Policy (bloomberg)

- Bernanke says the Fed’s slow response to inflation ‘was a mistake’ (cnbc)

- Boeing management needs a reboot after losing its way, Ryanair CEO says (cnbc)

- Will the stock market recover? Bank of America and UBS strategists share 4 reasons why Wall Street should have hope — and 4 reasons why there may be more pain ahead (businessinsider)

- Gloomy Goldman offers 20 ‘safety’ stocks with valuations below the previous 2 bear markets (marketwatch)

- Zero Hour. The Energy Report 05/16/2022 (Phil Flynn)

- Sweden Makes Formal Decision to Apply for NATO Membership (bloomberg)