- US inspectors arrive in PwC, KPMG offices in Hong Kong to review Chinese companies’ audit records, sources say (scmp)

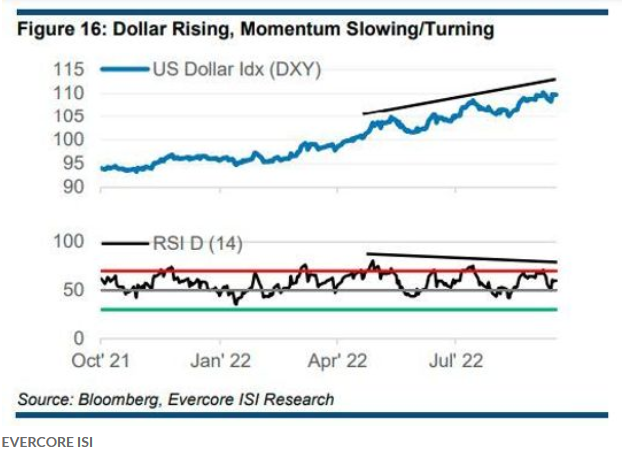

- The mighty dollar may be about to crack, says this strategist, who offers stocks to watch on either side. (marketwatch)

- China central bank cuts 14-day reverse repo rate, steps up cash injections (cnbc)

- Goldman Sachs Prefers the US Stock Market. Why Alibaba Is an Exception. (barrons)

- Bluebird Bio Stock Soars on FDA Approval of Gene Therapy for Rare Neurological Disease (barrons)

- AutoZone Stock Rises After Posting Strong Profits (barrons)

- Will GE HealthCare Stock Find a Home With Investors? (barrons)

- Back-to-work barometer falls short of measuring up to reality as offices fill up (nypost)

- Ralph Lauren Sees Faster Growth on Higher Prices, New Customers (bloomberg)

- China’s Factories Accelerate Robotics Push as Workforce Shrinks (wsj)

- Do Wages Drive Prices, or Vice Versa? The Answer Matters for Interest Rates (wsj)

- Economy Week Ahead: Federal Reserve and Other Central Banks in Focus (wsj)

- Are Biotech IPOs Coming Back? Some Investors Think So (wsj)

- Rising Bond Yields Change the Calculus for Stocks (wsj)

- Homebuilder sentiment tumbles for ninth consecutive month (foxbusiness)

- Xi and Modi ‘not standing with Putin’ over war in Ukraine, analysts say (ft)

- China Vanke spin-off seeks $780mn in Hong Kong’s biggest IPO this year (ft)

- Stanley Druckenmiller says the Fed is like a ‘reformed smoker,’ while Jeff Gundlach warns it’s driving the US into a dumpster. 6 market experts talk straight about rate hikes. (businessinsider)

- Alibaba sets up AI labs with two prestigious Chinese universities (scmp)

- Goldman unsure if Chinese stocks can rally before Communist Party congress (scmp)

Be in the know. 20 key reads for Monday…