- U.S.-traded Chinese stocks clinch best week since at least March as reopening hopes help spark rebound (marketwatch)

- China Watchers See Shift to Growth at Politburo Meeting (bloomberg)

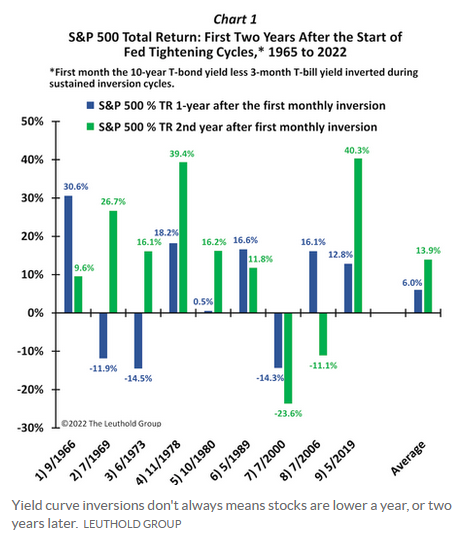

- Why stocks might not be doomed even with a key recession signal flashing warnings (marketwatch)

- The Big Read. The humbling of Xi Jinping (ft)

- Xi Sees Covid in China as Now Less Lethal, EU Official Says (bloomberg)

- The 10 Best Companies to Invest in Now (morningstar)

- Beijing, Shenzhen loosen more Covid curbs as China easing gathers pace (cnbc)

- Wall Street Isn’t Fond of T. Rowe Price, but Maybe You Should Be (barrons)

- Boeing Stock Is Surging. A Big United Airlines Order May Be Coming. (barrons)

- This part of stock market signals economy won’t soon collapse under Fed’s ‘weight’ as investors brace for oil risks, inflation data (marketwatch)

- Latin American Stocks Are Rising. Time to Buy. (barrons)

- Boeing Races to Win Congressional Reprieve for New 737 MAX Models (wsj)

- Lack of Wind Pushes Europe’s Power Prices Higher, Just as Cold Sets In (wsj)

- Not your average plane Pentagon debuts first new US bomber aircraft in 30 years (nypost)

- Four Chinese tell why they’re protesting Xi: ‘Give me liberty or give me death!’ (nypost)

- Dollar sinks as investors increase bets on slower Fed rate rises (ft)

- One Massive Trade Likely Fueled $1.5 Billion Flood Into Bond ETF (bloomberg)

- Protests Put Xi Jinping in Unfamiliar Territory (bloomberg)

- Here is how the so-called price cap on Russian oil will work. (nytimes)

- The spread of P/E multiples is 40% wider than normal, says Oakmark’s Nygren (youtube)

Be in the know. 20 key reads for Saturday…