- A Trader Spent $50 Million on Options Betting on S&P 500 Rally (Bloomberg)

- Imminent China Evergrande deal will see CCP take control (Asia Markets)

- It’s Just Evergrande. The Energy Report 09/23/2021 (Phil Flynn)

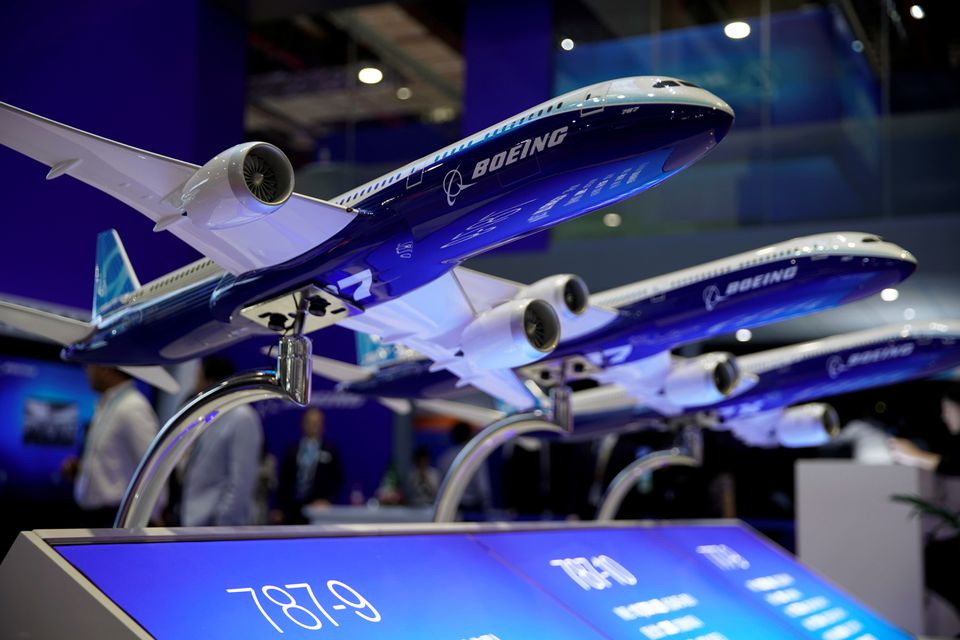

- Boeing lifts China jet demand estimate over two decades to $1.47 trln (Reuters)

- US jobless claim rise 351,000 in surprise jump (Fox Business)

- The Beginning of Tapering Is in Sight. What It Means for Markets. (Barron’s)

- Rates May Rise Sooner Than Expected, Fed Indicates (Barron’s)

- How the dean of valuation prices loss-making tech stocks — and his views on Amazon, Netflix and Airbnb (MarketWatch)

- China Will Need More Planes, Boeing Says. (Barron’s)

- Evergrande Is in Crisis, but a Risky China Still Beckons to Investors (Wall Street Journal)

- General Mills Shows Food Is Still Glorious (Wall Street Journal)

- Beyond Evergrande’s Troubles, a Slowing Chinese Economy (New York Times)

- China Pumps $17 Billion Into System Amid Evergrande Concerns (Bloomberg)

- China Tells Evergrande to Avoid Default on Near-Term Dollar Bonds (Bloomberg)

- BlackRock Targets China Tech Billions After ETF Loses Top Spot (Bloomberg)

- Big Pharma Isn’t Done Rolling Out Covid Treatments (Wall Street Journal)

- Carnival to have over half of its cruise ships sailing again by the end of October (MarketWatch)

- Oil Is Back Over $70 and 4 Stocks That Pay Massive Dividends Are Cheap (247wallst)

- ‘It’s really easy to navigate’ this stock market, says a BofA star strategist. Here’s what she says to do (marketwatch)

- The Fed prepares to tighten: five takeaways from its latest meeting (Financial Times)

Be in the know. 20 key reads for Thursday…