- China Weighs More Stimulus With $139 Billion of Special Bonds (bloomberg)

- A new dawn NASA, Lockheed Martin debut quiet supersonic ‘son of Concorde’ plane — capable of flying NYC to London in 3.5 hours (nypost)

- Pfizer CEO Bourla Bets His Pension on Company Stock (barrons)

- Goldman Sachs Equity-Trading Surge Drives Jump in Profit (bloomberg)

- Goldman Client Survey Shows Geopolitics Is Biggest Risk in 2024 (bloomberg)

- Trump is a ‘transactional president’ but may not rock the boat on China, Standard Chartered CEO says (cnbc)

- Li Qiang says China’s economy grew an ‘estimated’ 5.2% in 2023 (ft)

- Beijing tells some investors not to sell as Chinese stock rout resumes (ft)

- G Sachs Adjusts TPs on BABA-SW (09988.HK)/ JD-SW (09618.HK)/ TENCENT (00700.HK)/ PDD (PDD.US); Ratings Buy (aastocks)

- Citi says Baidu (BIDU) stock selloff overdone (streetinsider)

- Investors are now ‘very optimistic’, BofA’s monthly fund manager survey shows (streetinsider)

- Another Wall Street bank has boosted its S&P 500 target. Here’s why. (marketwatch)

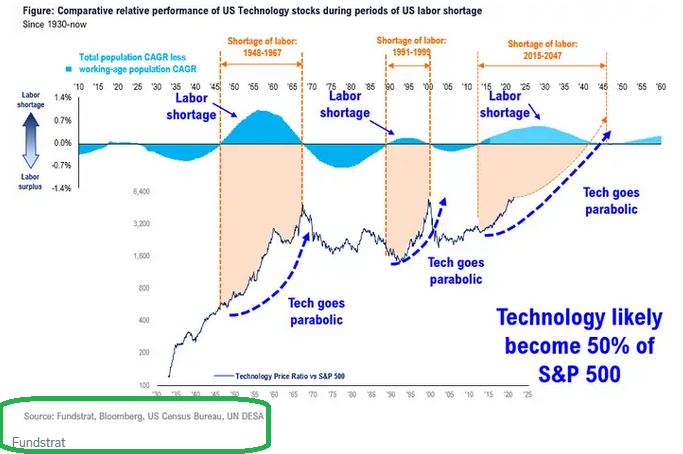

- CHART OF THE DAY: Technology stocks will grow to 50% of the S&P 500 amid a growing labor shortage, Fundstrat says (businessinsider)

- Chinese Premier Makes Surprise Economic Growth Reveal (wsj)

- Goldman Sachs lists 10 reasons it’s more confident than others about the U.S. economy (marketwatch)

- China Sees Record Nine Billion Trips Over This Lunar New Year (bloomberg)

- Chinese Splurging on ‘Revenge Travel’ Is Pressuring the Yuan (bloomberg)

Be in the know. 17 key reads for Tuesday…