- Wall Street Is Buying Treasuries Again in Bet Worst Is Over (bloomberg)

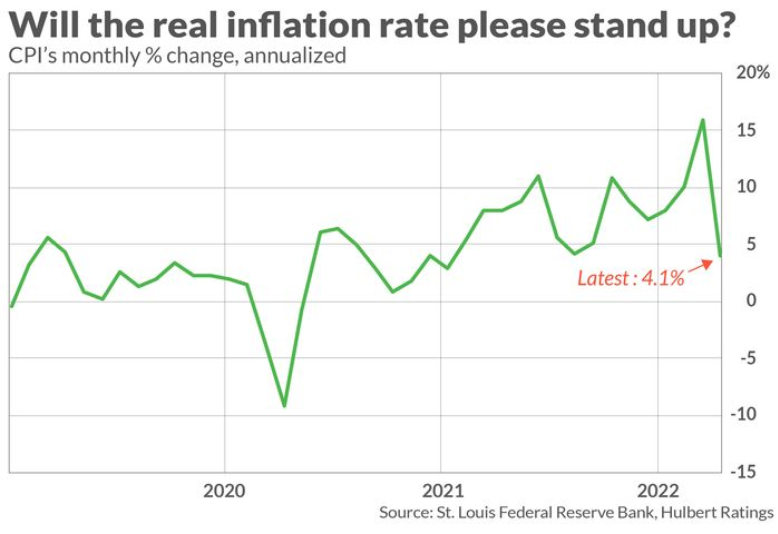

- Inflation may be a lot lower than anyone thinks — even the Fed (marketwatch)

- China Faces Growing Pressure to Iron Out Audit Deal With the U.S. (wsj)

- Insiders Seem More Positive. But Mostly About Smaller Stocks. (barrons)

- Starbucks’ CEO Bought $10 Million of the Beaten-Down Stock (barrons)

- Intel Execs Took Advantage of the Dip (barrons)

- Schwab Stock Has Almost Wiped Out a Year of Gains. The CEO Scooped Up Stock. (barrons)

- The 10 Cheapest S&P 500 Stocks Include 3 Home Builders (barrons)

- AutoZone Stock Rises as Same-Store Sales Beat Estimates (barrons)

- $250 billion in ‘rebalancing’ inflows could rescue stocks by the end of June, JPMorgan says (marketwatch)

- Bank of America CEO says Americans still haven’t spent all their stimulus money (marketwatch)

- Fed will succeed in bringing inflation down over next couple of years, Bernanke says (marketwatch)

- Opinion: The U.S. isn’t headed for recession. Nor will it be consumed by inflationary fires. (marketwatch)

- In a ‘baby with the bathwater’ market, here are a dozen unfairly punished stocks, ripe for a bounce (marketwatch)

- Alibaba earnings preview: COVID-19 lockdowns could ‘amplify’ challenges (marketwatch)

- S Births Increase for First Time Since 2014 (wsj)

- Boeing Stock Might Be Near Its Low. What to Watch Now. (barrons)

- Bridgewater’s Greg Jensen on Why Markets Have Further to Fall (bloomberg)

- RBC says these 10 beaten-down internet stocks have the most upside in the sector, and names 4 top favorites — as well as the ones most vulnerable in a consumer-led slowdown (businessinsider)

- Bank of America Clients are Buying the Tech Pullback (streetinsider)

- China slashes tax to spur sales, in aid for world’s No. 1 auto market (scmp)

Be in the know. 21 key reads for Tuesday…