- JP Morgan quant who called summer rebound in stocks says rally could continue even if corporate profits decline (marketwatch)

- Chinese stocks get cheaper for money managers who don’t want to be late for economy reopening party (scmp)

- China’s Alibaba teams up with Tesla rival Xpeng on tech for driverless cars (cnbc)

- Slow Days. The Energy Report 08/02/2022 (Phil Flynn)

- PayPal Stock Has Taken a Beating. Why They’re Worth a Look Before Earnings. (barrons)

- OPEC Meets This Week. Can It Still Swing the Market? (barrons)

- The Liberty Times, a large newspaper in Taiwan, said Pelosi would be landing in Taiwan around 10:20 p.m. local time. (barrons)

- Uber Is Cash Flow Positive for First Time. The Stock Soars. (barrons)

- The dollar will weaken and these stocks could outperform, says Evercore (marketwatch)

- Renters Finally See Market Starting to Cool After Record Growth (wsj)

- JPMorgan’s Kolanovic Stands Apart in Saying Stocks Will Rebound (bloomberg)

- JPMorgan’s China Calls Show Market Timing Is Tough (bloomberg)

- Climate Bill Could be a ‘Significant Tailwind’ for Tesla, GM, and Ford – Goldman (streetinsider)

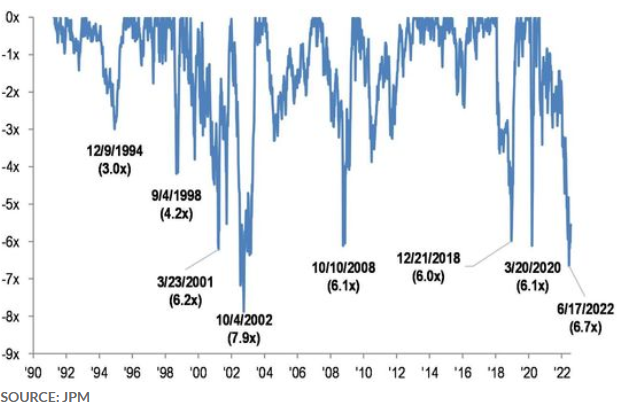

- Potential for Short Squeeze is Increasing – Citi (streetinsider)

- Hints of 1982 have one strategist saying the bear market is over: Morning Brief (yahoo)

- US Audit Watchdog Insists on Full Access in China-Delisting Case (yahoo)

- Crunch looms in China-US wrangle over delistings (ft)

- European imports of Russian diesel jump, highlighting challenge to EU plans for ban (ft)

- Yen rises to two-month high as investors slash short bets (ft)

- Ant Group restructuring continues with top management change at Alipay (scmp)

- China unveils system for filing antitrust reviews as tech crackdown eases (scmp)

- China in Longest Streak of Liquidity Withdrawals Since February (bloomberg)

Be in the know. 22 key reads for Tuesday…