- Northrop and Lockheed win missile defense contracts valued at up to $7.6 billion (StreetInsider)

- Pfizer Will Test a Pill to Kill the Covid-19 Virus (Barron’s)

- Pfizer Goes It Alone to Expand Vaccine Business Beyond Covid-19 Pandemic (Wall Street Journal)

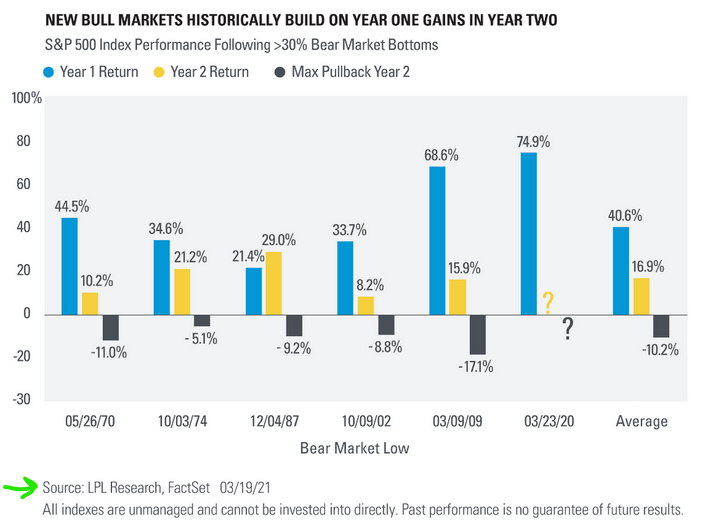

- The new S&P 500 bull market is about to enter its second year. Now what? (MarketWatch)

- Powell and Yellen’s game plan is evocative of the World War II playbook. Here’s what happened then. (MarketWatch)

- Convertible Bonds Are Booming. Here’s What You Need to Know. (Barron’s)

- Regeneron Stock Climbs on Positive Covid-19 Antibody Data (Barron’s)

- Citigroup and 5 More Lenders Poised for Gains in ‘Bank Renaissance’ (Barron’s)

- 5 Beaten-Down Renewable Energy Stocks That May Be Worth a Look (Barron’s)

- Intel’s New CEO Is Spending $20 Billion to Double Down on Chip Manufacturing (Barron’s)

- Powell Says Stimulus Package Isn’t Likely to Fuel Unwelcome Inflation (Wall Street Journal)

- New York Business Leaders Urge State Lawmakers to Not Raise Taxes (Wall Street Journal)

- Fed’s Bullard won’t forecast any interest-rate hikes until he sees proof of strong economy (MarketWatch)

- Bostic expects Fed to lift rates in 2023 – WSJ (Reuters)

- Hawaii gets tourism surge as coronavirus rules loosen up (Fox Business)

- Coronavirus latest: Merkel reverses course on Easter lockdown in Germany (Financial Times)

- BofA Raises Price Targets for US Banks on Faster-Than-Expected Recovery (StreetInsider)

- Banks stand firm on calls for oil ‘supercycle’ even as price drops (Financial Times)

Be in the know. 18 key reads for Wednesday…